Research News and Market Data on HUSIF

October 15, 2025 9:00 AM EDT | Source: Nicola Mining Inc.

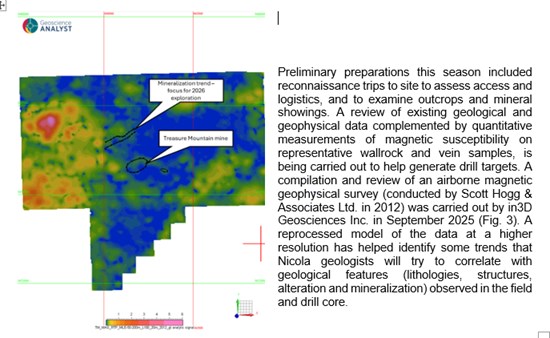

Vancouver, British Columbia–(Newsfile Corp. – October 15, 2025) – Nicola Mining Inc. (TSXV: NIM) (OTCQB: HUSIF) (FSE: HLIA) (the “Company” or “Nicola“) is pleased to provide an update on preparation work conducted during 2025 on the Treasure Mountain Silver Project (“Treasure Mountain“) and its plan for 2026 exploration drilling program (“2026 TM Program“). The 2026 TM Program is the culmination of an airborne magnetic geophysical survey (conducted by Scott Hogg & Associates Ltd. in 2012), extensive soil sampling programs over multiple years, and 2025 field reconnaissance. Treasure Mountain is a permitted silver mine located 30 km northeast of Hope and about a 3-hour drive from Vancouver, British Columbia. Treasure Mountain was an operating mine but was put into care and maintenance in 2013[1], due to depressed silver prices and has always been a core asset to Nicola, which has been strategically waiting for higher silver prices.

As previously announced in the Company’s June 9, 2025 news release, Nicola received a multi-year area-based exploration permit (the “MYAB Permit“), allowing the Company to conduct diamond drilling and trenching at Treasure Mountain. In addition to receipt of MYAB Permit, the Company received a ten year mine lease extension (through April 26, 2032; announced on August 30, 2024), further bolstering the attractiveness of re-opening Treasure Mountain.

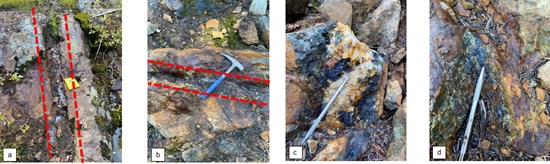

The area of exploration interest is northwest of the currently suspended mine (Fig. 1) and consists of several northeast-southwest trending and steeply dipping sulphide-rich veins (Fig. 2). Photos exhibited in Figure 2 are associated with 2025 field reconnaissance focused on establishing the 2026 TM Program drill targets.

Figure 1. Geological map of Treasure Mountain showing trend of mineralized veins northeast of the mine.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4873/270388_de6ad025542159aa_001full.jpg

Initial interest in this area was driven by Coeur Mining’s (“Coeur“)[2] (NYSE: CDE) (TSX: CDM) 2012 investment into the Company giving it a 12.7% ownership at time of investment. Coeur purchased shares at a price of $1.08 ($20.6 when considering subsequent rollbacks)[3].

Previous exploration work along this trend is limited to six percussion holes totaling 274m in 1994 and 14 “backpack drill” holes totaling 25m in 2020. Widespread soil sampling was also conducted in 2019 and 2020. Limited rock samples were collected in 2020 and 2021. The most recent exploration along this trend (sampling conducted by Nicola in 2021) is described in Assessment Report #39721 (available on ARIS[4]). Results from these programs are encouraging and demonstrate the presence of vein-hosted silver, copper, lead, zinc and gold. This provides support for initial diamond drilling to establish the width of the trend and mineralization at depth. Currently mineralization is present on surface and open in all directions.

Figure 2. 2025 Field Reconnaissance Photos: (a) and (b) 10-20 cm wide quartz-sulphide veins steeply dipping and trending northeast-southwest. Close-ups of quartz veins show (c) mainly sphalerite with pyrite and chalcopyrite and (d) pyrite, chalcopyrite and sphalerite.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4873/270388_de6ad025542159aa_002full.jpg

Figure 3. 3D magnetic MVI inversion at 200m depth below topography.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4873/270388_f8d245b9a405d91e_001full.jpg

Peter Espig, Chief Executive Officer, commented, “Recently we have garnered accelerated interest from both investors and strategics that have become increasingly excited about Treasure Mountain. At Nicola, we have always been aware of its significant potential, as highlighted by Coeur’s investment in the Company at a time prior to Nicola securing ownership of New Craigmont Copper Project and commencing gold production and pre-investment in Dominion Gold Project. In addition to these other projects, for the past decade we have continued to review, maintain and explore Treasure Mountain, which is more than an exploration project but is a fully permitted mine that can be reopened. We continue to review all possibilities and are excited for the 2026 TM Program.”

Qualified Person

The scientific and technical disclosures included in this news release have been reviewed and approved by Will Whitty, P.Geo., who is the Qualified Person as defined by NI 43-101. Mr. Whitty is Vice President of Exploration for the Company.

About Nicola Mining

Nicola Mining Inc. is a junior mining company listed on the TSX.V Exchange and Frankfurt Exchange that maintains a 100% owned mill and tailings facility, located near Merritt, British Columbia It has signed Mining and Milling Profit Share Agreements with high grade gold projects. Nicola’s fully permitted mill can process both gold and silver mill feed via gravity and flotation processes.

The Company owns 100% of the New Craigmont Project, a high-grade copper property, which covers an area of over 10,800 hectares along the southern end of the Guichon Batholith and is adjacent to Highland Valley Copper, Canada’s largest copper mine. The Company also owns 100% of the Treasure Mountain Property, which includes 30 mineral claims and a mineral lease, spanning an area exceeding 2,200 hectares.

On behalf of the Board of Directors

“Peter Espig“

Peter Espig

CEO & Director

For additional information

Contact: Peter Espig

Phone: (778) 385-1213

Email: info@nicolamining.com

URL: www.nicolamining.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] Silver prices dropped below US$20 in 2013 and reached a low of US$13.80 in December of 2015. Link

[2] At the time of investment Coeur Mining was called Coeur d’Alene Mines Corporation

[3] July 17, 2014 (2 for 1), June 1, 2015, (5 for 1) and November 17, 2023 (2 for 1). The first 2 rollbacks were related to a successful CCAA process.

[4] British Columbia Geological Survey’s (BCGS) Assessment Report Indexing System

SOURCE: Nicola Mining Inc.