Research News and Market Data on LUCK

02/05/2025

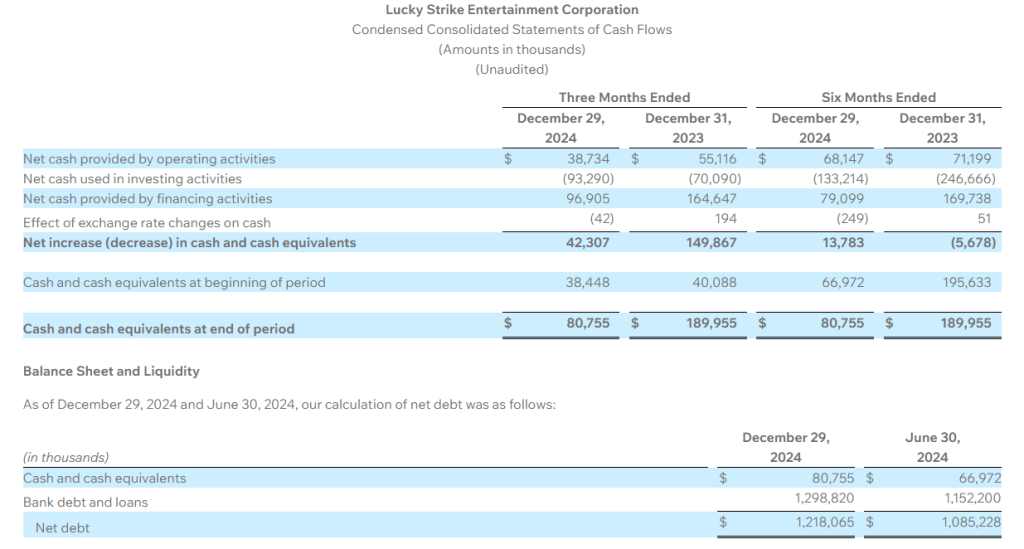

RICHMOND, Va.–(BUSINESS WIRE)– Lucky Strike Entertainment (NYSE: LUCK), one of the world’s premier operators of location-based entertainment, today provided financial results for the second quarter of the 2025 Fiscal Year, which ended on December 29, 2024.

Quarter Highlights:

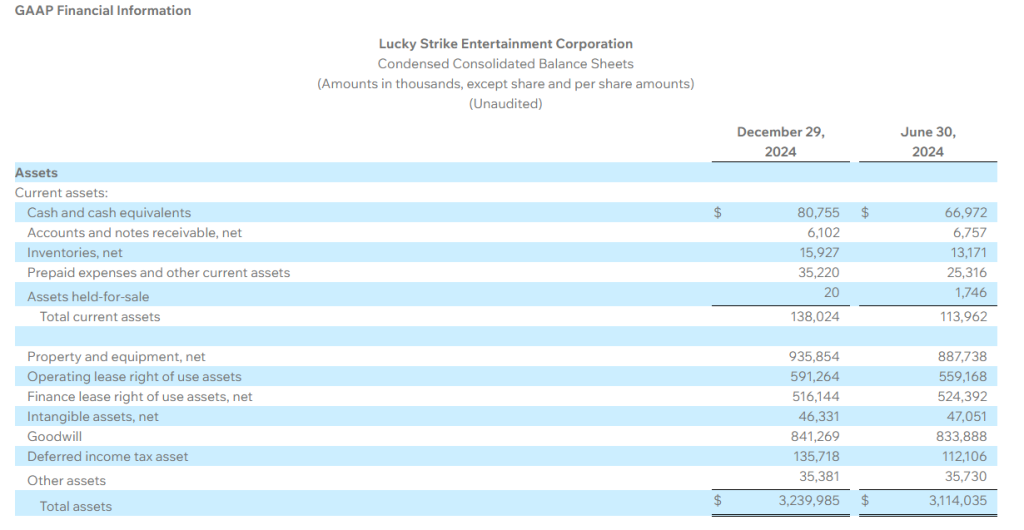

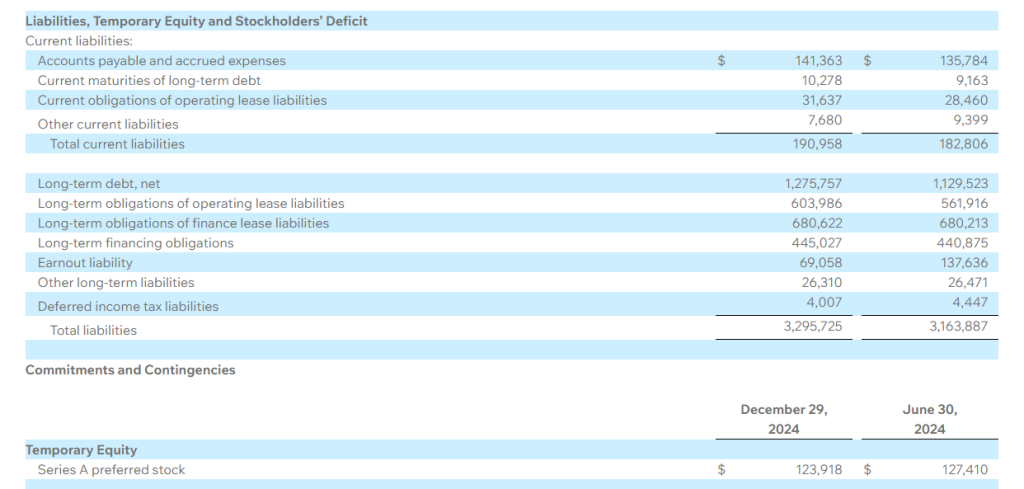

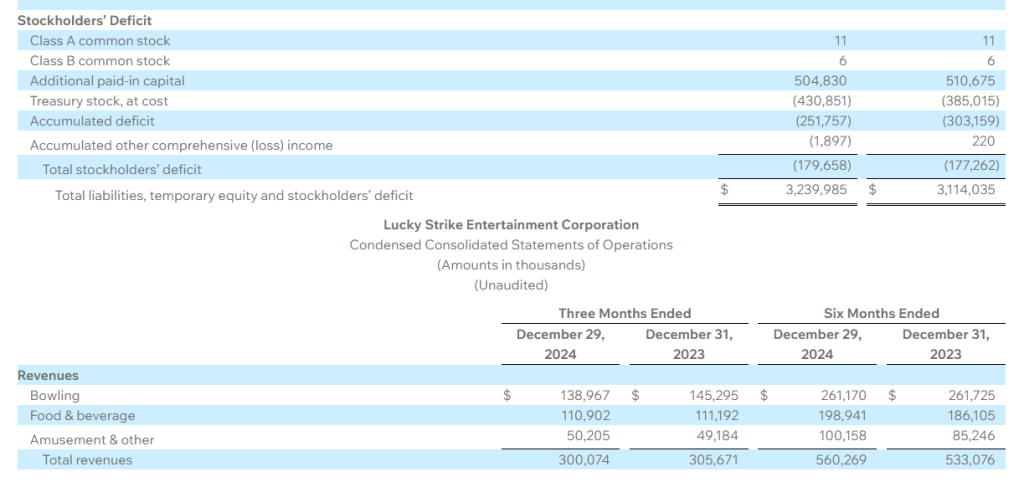

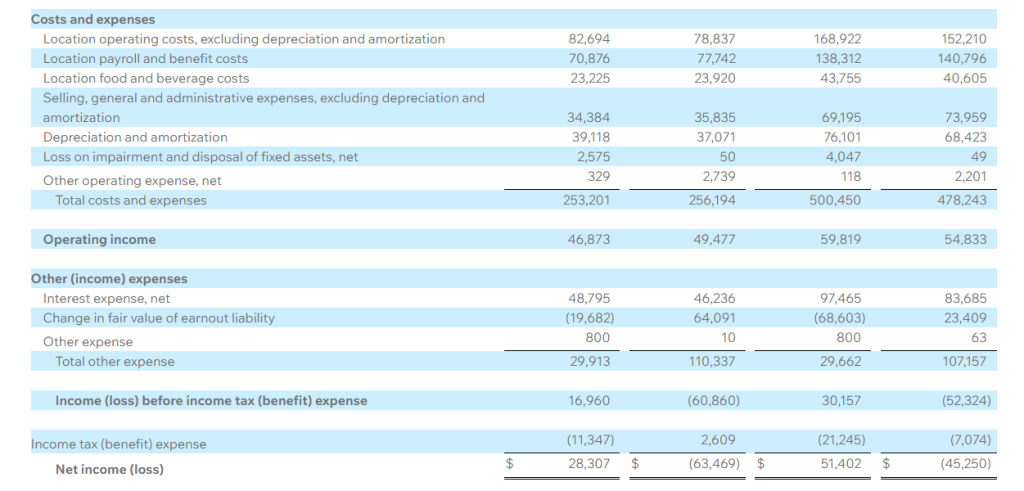

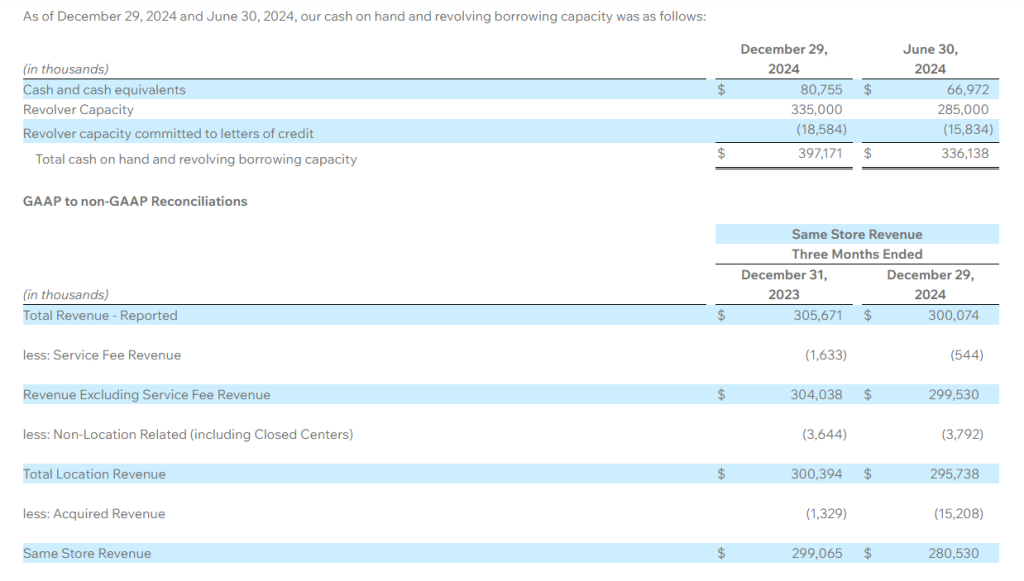

- Revenue decreased 1.8% to $300.1 million from $305.7 million in the previous year

- Same Store Revenue decreased 6.2% versus the prior year

- Net income of $28.3 million versus prior year loss of $63.5 million

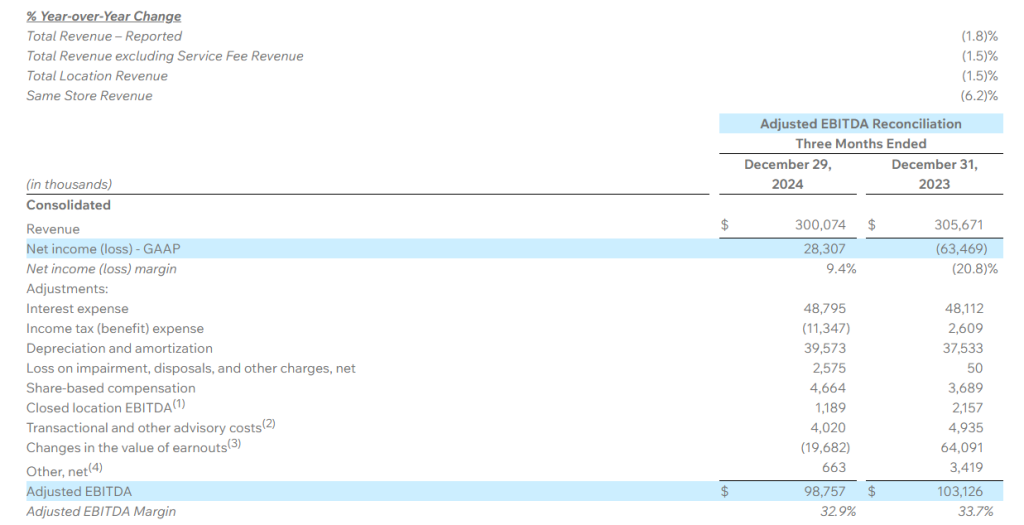

- Adjusted EBITDA of $98.8 million versus $103.1 million in the prior year

- From September 30, 2024 through February 5, 2025, opened four new builds and acquired one bowling location, six family entertainment centers and one water park. Total locations in operation as of February 5, 2025 is 364

“This most recent quarter came with heightened macroeconomic uncertainty. We began the quarter with the corporate events business on hold due to concerns over the election outcome. Compounding this was Thanksgiving falling later in the year, shortening the corporate holiday events window by about a third. And finally, New Year’s Eve fell into our next quarter vs being in the second quarter last year. Our sticky leagues business continued to grow, and retail walk-in customer traffic has been steady despite headlines of the weak consumer,” said Founder, Chairman, and CEO Thomas Shannon. “During this quarter, we opened four new Lucky Strike centers—two in Denver, one in the heart of Beverly Hills, and one in Ladera Ranch, California. Lucky Strike Beverly Hills and Lucky Strike Ladera Ranch each generated over $1 million in revenue within their first 30 days of operation. They represent an evolution of our best-in-class product that underscores our position as leaders in consumer entertainment. We also began the rebranding of centers to Lucky Strike, with four centers converted to date and the rollout ramping up.”

“In the quarter, we acquired Boomer’s which added six family entertainment centers and one stunning water park to our portfolio. Those assets operate at losses during the winter periods and generate significant cash flow during the summer months. We look forward to incremental earnings during our seasonally slow Fourth and First quarters,” said Bobby Lavan, Chief Financial Officer.

Share Repurchase and Capital Return Program Update

From September 30, 2024 through January 31, 2025, the Company repurchased 5.1 million shares of Class A common stock for approximately $56 million. The company has $101 million currently remaining under the share repurchase program.

The Board of Directors declared a quarterly cash dividend of $0.055 per share of common stock for the second quarter of fiscal year 2025. The dividend will be payable on March 7, 2025, to stockholders of record on February 21, 2025.

Fiscal Year 2025 Guidance

The Company reiterated financial guidance for fiscal year 2025. We expect total Revenue to be up mid-single digits to 10%+ year-over-year, which equates to $1.23 billion to $1.28 billion of total Revenue. Adjusted EBITDA margin is expected to be 32% to 34%, which equates to Adjusted EBITDA of $390 million to $430 million.

Investor Webcast Information

Listeners may access an investor webcast hosted by Lucky Strike Entertainment. The webcast and results presentation will be accessible at 10:00 AM ET on February 5, 2025 in the Events & Presentations section of the Lucky Strike Entertainment Investor Relations website at https://ir.luckystrikeent.com/overview/default.aspx.

About Lucky Strike Entertainment

Lucky Strike Entertainment is one of the world’s premier location-based entertainment platforms. With over 360 locations across North America, Lucky Strike Entertainment provides experiential offerings in bowling, amusements, water parks, and family entertainment centers. The company also owns the Professional Bowlers Association, the major league of bowling and a growing media property that boasts millions of fans around the globe. For more information on Lucky Strike Entertainment, please visit IR.LuckyStrikeEnt.com.

Forward Looking Statements

Some of the statements contained in this press release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risk, assumptions and uncertainties, such as statements of our plans, objectives, expectations, intentions and forecasts. These forward-looking statements are generally identified by the use of forward-looking terminology, including the terms “anticipate,” “believe,” “confident,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and, in each case, their negative or other various or comparable terminology. These forward-looking statements reflect our views with respect to future events as of the date of this release and are based on our management’s current expectations, estimates, forecasts, projections, assumptions, beliefs and information. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. All such forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to be materially different from those stated or implied in this document. It is not possible to predict or identify all such risks. These risks include, but are not limited to: our ability to design and execute our business strategy; changes in consumer preferences and buying patterns; our ability to compete in our markets; the occurrence of unfavorable publicity; risks associated with long-term non-cancellable leases for our locations; our ability to retain key managers; risks associated with our substantial indebtedness and limitations on future sources of liquidity; our ability to carry out our expansion plans; our ability to successfully defend litigation brought against us; our ability to adequately obtain, maintain, protect and enforce our intellectual property and proprietary rights and claims of intellectual property and proprietary right infringement, misappropriation or other violation by competitors and third parties; failure to hire and retain qualified employees and personnel; the cost and availability of commodities and other products we need to operate our business; cybersecurity breaches, cyber-attacks and other interruptions to our and our third-party service providers’ technological and physical infrastructures; catastrophic events, including war, terrorism and other conflicts; public health emergencies and pandemics, such as the COVID-19 pandemic, or natural catastrophes and accidents; changes in the regulatory atmosphere and related private sector initiatives; fluctuations in our operating results; economic conditions, including the impact of increasing interest rates, inflation and recession; and other factors described under the section titled “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) by the Company on September 5, 2024, as well as other filings that the Company will make, or has made, with the SEC, such as Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this press release and in other filings. We expressly disclaim any obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

Non-GAAP Financial Measures

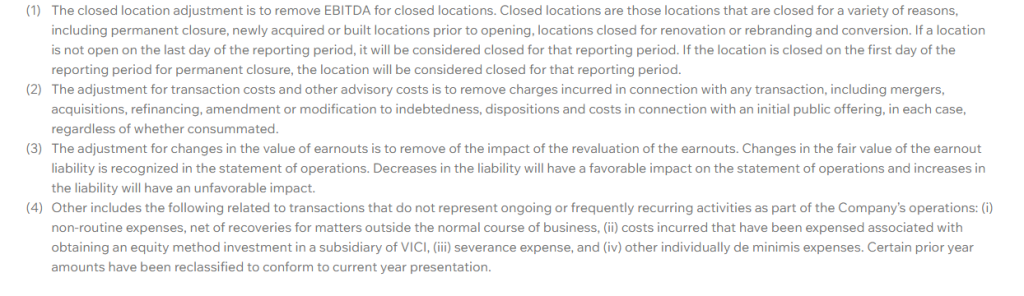

To provide investors with information in addition to our results as determined under Generally Accepted Accounting Principles (“GAAP”), we disclose Revenue Excluding Service Fee Revenue, Total Location Revenue, Same Store Revenue and Adjusted EBITDA as “non-GAAP measures”, which management believes provide useful information to investors because each measure assists both investors and management in analyzing and benchmarking the performance and value of our business. Accordingly, management believes that these measurements are useful for comparing general operating performance from period to period, and management relies on these measures for planning and forecasting of future periods. Additionally, these measures allow management to compare our results with those of other companies that have different financing and capital structures. These measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for revenue, net income, or any other operating performance or liquidity measure calculated in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies. Our fiscal year 2025 guidance measures (other than revenue) are provided on a non-GAAP basis without a reconciliation to the most directly comparable GAAP measure because the Company is unable to predict with a reasonable degree of certainty certain items contained in the GAAP measures without unreasonable efforts. For the same reasons, the Company is unable to address the probable significance of the unavailable information. Such items include, but are not limited to, acquisition related expenses, share-based compensation and other items not reflective of the company’s ongoing operations.

Revenue Excluding Service Fee Revenue represents total Revenue less Service Fee Revenue. Total Location Revenue represents total Revenue less Non-Location Related Revenue, Revenue from Closed Locations, and Service Fee Revenue, if applicable. Same Store Revenue represents total Revenue less Non-Location Related Revenue, Revenue from Closed Locations, Service Fee Revenue, if applicable, and Acquired Revenue. Adjusted EBITDA represents Net Income (Loss) before Interest Expense, Income Taxes, Depreciation and Amortization, Impairment and Other Charges, Share-based Compensation, EBITDA from Closed Locations, Foreign Currency Exchange Loss (Gain), Asset Disposition Loss (Gain), Transactional and other advisory costs, changes in the value of earnouts, and other.

The Company considers Revenue Excluding Service Fee Revenue as an important financial measure because it provides a financial measure of revenue directly associated with consumer discretionary spending and Total Location Revenue as an important financial measure because it provides a financial measure of revenue directly associated with location operations. The Company also considers Same Store Revenue as an important financial measure because it provides comparable revenue for locations open for the entire duration of both the current and comparable measurement periods.

The Company considers Adjusted EBITDA as an important financial measure because it provides a financial measure of the quality of the Company’s earnings. Other companies may calculate Adjusted EBITDA differently than we do, which might limit its usefulness as a comparative measure. Adjusted EBITDA is used by management in addition to and in conjunction with the results presented in accordance with GAAP. We have presented Adjusted EBITDA solely as a supplemental disclosure because we believe it allows for a more complete analysis of results of operations and assists investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are that Adjusted EBITDA:

- do not reflect every expenditure, future requirements for capital expenditures or contractual commitments;

- do not reflect changes in our working capital needs;

- do not reflect the interest expense, or the amounts necessary to service interest or principal payments, on our outstanding debt;

- do not reflect income tax (benefit) expense, and because the payment of taxes is part of our operations, tax expense is a necessary element of our costs and ability to operate;

- do not reflect non-cash equity compensation, which will remain a key element of our overall equity based compensation package; and

- do not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations.

Lucky Strike Entertainment Corporation Investor Relations

IR@LSEnt.com

Source: Lucky Strike Entertainment Corporation