Research News and Market Data on FAT

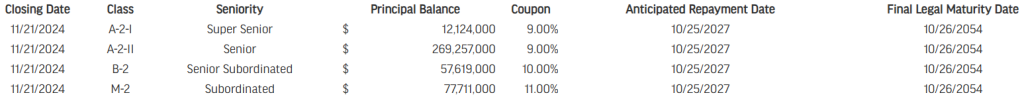

LOS ANGELES, Nov. 18, 2024 (GLOBE NEWSWIRE) — FAT (Fresh. Authentic. Tasty.) Brands Inc., (NASDAQ: FAT), a leading global franchising company and parent company of 18 iconic brands, is pleased to announce that Twin Hospitality Group Inc., the operating unit for its Twin Peaks and Smokey Bones restaurant brands, has priced the issuance of new notes to refinance its whole business securitization credit facility originated in October 2021. The aggregate principal balance of the new Series 2024-1 fixed rate notes (the “Notes”) is $416,711,000 across four tranches, with a weighted average interest rate of 9.5% per annum. The issuer of the Notes will be Twin Hospitality I, LLC, a wholly-owned subsidiary of Twin Hospitality Group Inc.

The Notes may be exchanged for a proportionate interest in Exchangeable Notes in two tranches, referred to as Class A2IIB2 (up to $326,876,000) and Class A2IIB2M2 (up to $404,587,000), which reflect in the aggregate the characteristics of the corresponding exchanged Notes.

Ken Kuick, Co-CEO of FAT Brands, said, “We are pleased to announce the successful pricing of the TWNP Series 2024-1 whole business securitization notes. This financing stabilizes Twin Peaks’ financial structure and represents a key milestone as we work toward the goal of creating a standalone public company.”

Kuick continued, “Additionally, the refinancing allows us to further drive the growth of Twin Peaks, our fastest-growing concept. Twin Peaks’ compelling unit economics continue to fuel strong demand from both existing and potential franchisees seeking new locations. Year to date, we have opened nine new lodges bringing our total to 115 Twin Peaks locations.”

Jefferies LLC acted as sole structuring agent and sole bookrunner for this transaction. Legal advisors were Katten Muchin Rosenman LLP for FAT Brands Inc., and King & Spalding LLP for Jefferies LLC.

This press release does not constitute an offer to sell or the solicitation of an offer to buy the Notes or any other security. The Notes have not been, and will not be, registered under the Securities Act of 1933 and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act of 1933.

About FAT (Fresh. Authentic. Tasty.) Brands

FAT Brands (NASDAQ: FAT) is a leading global franchising company that strategically acquires, markets, and develops fast casual, quick-service, casual dining, and polished casual dining concepts around the world. The Company currently owns 18 restaurant brands: Round Table Pizza, Fatburger, Marble Slab Creamery, Johnny Rockets, Fazoli’s, Twin Peaks, Great American Cookies, Smokey Bones, Hot Dog on a Stick, Buffalo’s Cafe & Express, Hurricane Grill & Wings, Pretzelmaker, Elevation Burger, Native Grill & Wings, Yalla Mediterranean and Ponderosa and Bonanza Steakhouses, and franchises and owns over 2,300 units worldwide. For more information on FAT Brands, please visit www.fatbrands.com.

About Twin Peaks

Founded in 2005 in the Dallas suburb of Lewisville, Twin Peaks franchises and owns 115 restaurants in the United States and Mexico. Twin Peaks is the ultimate sports lodge featuring made-from-scratch food and the coldest beer in the business, surrounded by scenic views and wall-to-wall TVs. For more information, visit twinpeaksrestaurant.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to significant business, economic and competitive risks, uncertainties and contingencies, many of which are difficult to predict and beyond our control, which could cause our actual results, including consummation and benefits of the potential transaction discussed in this press release, to differ materially from the results expressed or implied in such forward-looking statements. We refer you to the Form 10 Registration Statement filed by Twin Hospitality Group Inc., and the documents filed by FAT Brands Inc. from time to time with the SEC, such as its reports on Form 10-K, Form 10-Q and Form 8-K, for a discussion of these risks, uncertainties and contingencies. We undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date of this press release.

Investor Relations:

ICR

Michelle Michalski

IR-FATBrands@icrinc.com

646-277-1224

Media Relations:

FAT Brands Inc.

Erin Mandzik

emandzik@fatbrands.com

860-212-6509