March 5, 2024

Provides Update on Digital Commercial Partnership with Meta Platforms

Declares Quarterly Cash Dividend of $0.05 Per Share Payable on March 29, 2024

Company to Cancel Today’s Conference Call

SANTA MONICA, Calif.–(BUSINESS WIRE)– Entravision Communications Corporation (NYSE: EVC), a leading global advertising solutions, media and technology company, today announced financial results for the three- and twelve-month periods ended December 31, 2023, and provided an update on its digital commercial partnership with Meta Platforms. Entravision is canceling the conference call scheduled for 5 p.m. Eastern Time today.

Digital Commercial Partnerships Business Update

Through Entravision Global Partners, our digital commercial partnerships business, the Company acts as an intermediary between primarily global media companies and advertisers. These global media companies include Meta, for whom the Company acts as an Authorized Sales Partner (ASP), ByteDance, X Corp., Spotify, Snap and Pinterest, as well as other media companies, in 31 countries throughout the world.

On March 4, 2024, the Company received a communication from Meta that it intends to wind down its ASP program globally and end its relationship with all of its ASPs, including Entravision, by July 1, 2024. For full year 2023, the Company estimates Meta’s ASP program represented approximately $23.8 million of the Company’s $57.7 million total consolidated EBITDA and $586.4 million of the Company’s $1,106.9 million of total consolidated revenue. Entravision has initiated a review of its operating strategy and cost structure and will provide an update on associated plans as soon as practicable.

As of December 31, 2023, Entravision reported $118.9 million of cash and marketable securities. The Company is in compliance with all debt covenants under its current credit facility and, except for quarterly principal scheduled payments, has no maturities under that facility until March 17, 2028.

“While we are disappointed in Meta’s decision, we are confident in Entravision’s long-term opportunities given the strength of our advertising and marketing platforms and the need for our solutions globally. We are conducting an extensive review of our strategy and cost structure to reinforce our operating foundation and ensure we are best positioned to capitalize on Entravision’s global, market leading advertising, media and technology solutions. Our balance sheet is solid with a strong cash position to support the business as we navigate these changes,” said Michael Christenson, Chief Executive Officer.

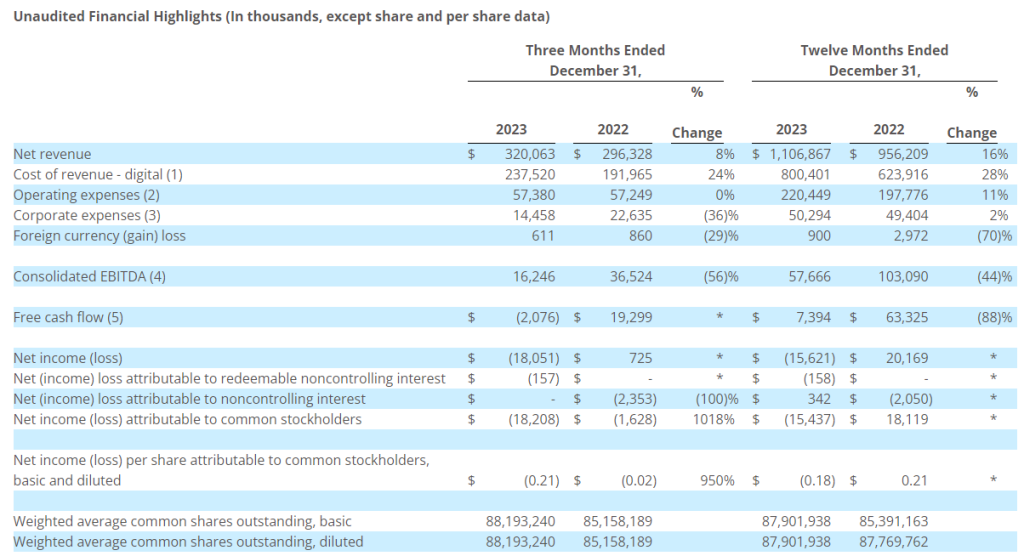

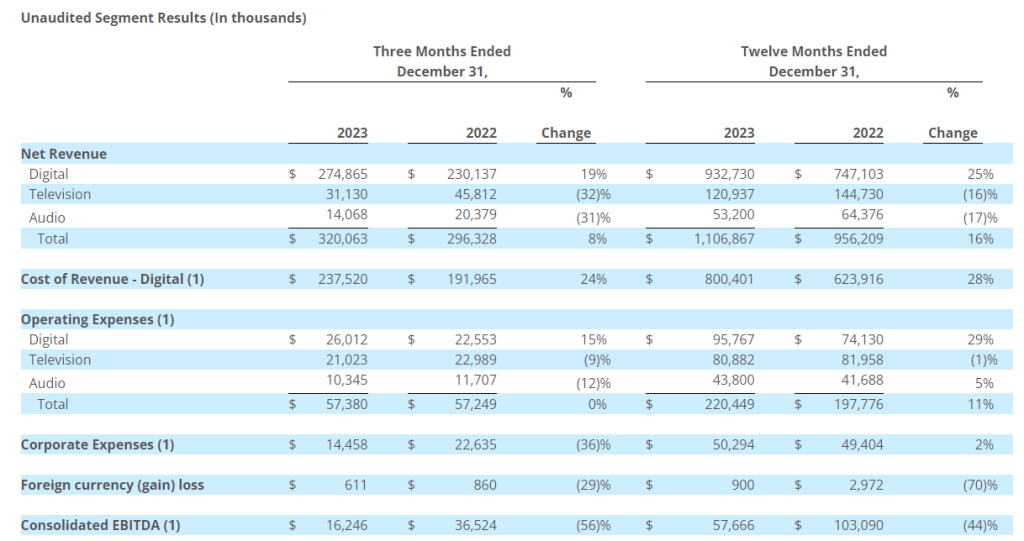

| (1) | Consists primarily of the costs of online media acquired from third-party publishers. Media cost is classified as cost of revenue in the period in which the corresponding revenue is recognized. | |

| (2) | Operating expenses include direct operating and selling, general and administrative expenses. Included in operating expenses are $2.3 million and $2.8 million of non-cash stock-based compensation for the three-month periods ended December 31, 2023 and 2022, respectively, and $9.5 million and $5.7 million of non-cash stock-based compensation for the twelve-month periods ended December 31, 2023 and 2022, respectively. | |

| (3) | Corporate expenses include $4.4 million and $9.2 million of non-cash stock-based compensation for the three-month periods ended December 31, 2023 and 2022, respectively, and $14.2 million and $14.3 million of non-cash stock-based compensation for the twelve-month periods ended December 31, 2023 and 2022, respectively. | |

| (4) | Consolidated EBITDA means net income (loss) plus gain (loss) on sale of assets, depreciation and amortization, non-cash impairment charge, non-cash stock-based compensation included in operating and corporate expenses, net interest expense, other operating gain (loss), gain (loss) on debt extinguishment, income tax (expense) benefit, equity in net income (loss) of nonconsolidated affiliate, non-cash losses, syndication programming amortization less syndication programming payments, revenue from the Federal Communications Commission, or FCC, spectrum incentive auction less related expenses, expenses associated with investments, EBITDA attributable to redeemable noncontrolling interest, acquisitions and dispositions and certain pro-forma cost savings. We use the term consolidated EBITDA because that measure is defined in our 2017 Credit Agreement and 2023 Credit Agreement, and does not include gain (loss) on sale of assets, depreciation and amortization, non-cash impairment charge, non-cash stock-based compensation, net interest expense, other income (loss), gain (loss) on debt extinguishment, income tax (expense) benefit, equity in net income (loss) of nonconsolidated affiliate, non-cash losses, syndication programming amortization less syndication programming payments, revenue from FCC spectrum incentive auction less related expenses, expenses associated with investments, EBITDA attributable to redeemable noncontrolling interest, acquisitions and dispositions and certain pro-forma cost savings. | |

| (5) | Free cash flow is defined as consolidated EBITDA less cash paid for income taxes, net interest expense, capital expenditures (less amounts reimbursed by landlord) and non-recurring cash expenses plus dividend income, and other operating gain (loss). Net interest expense is defined as interest expense, less non-cash interest expense relating to amortization of debt finance costs, and less interest income. |

Net revenue for the fourth quarter and full year of 2023 increased primarily due to an increase in advertising revenue from our digital commercial partners business, and from various acquisitions, which did not fully contribute to our financial results in the comparable prior period. The increase was partially offset by a decrease in political advertising revenue in our television and audio segments.

Cost of revenue for the fourth quarter and full year of 2023 increased primarily due to the increase in digital advertising revenue.

Operating expenses for the fourth quarter of 2023 remained constant.

Operating expenses for the year ended December 31, 2023 increased primarily due to expenses associated with the increase in advertising revenue, increases in salary expense and non-cash stock-based compensation, rent expense, and expenses from various acquisitions, which did not fully contribute to our financial results in the comparable prior period.

Corporate expenses for the fourth quarter of 2023 decreased primarily due to non-recurring severance expense incurred in the fourth quarter of 2022 upon the passing of our former Chief Executive Officer, and due to a decrease in bonus expense.

Corporate expenses for the year ended December 31, 2023 increased primarily due to professional service fees, audit fees and rent expense, partially offset by a decrease in severance expense incurred in 2022 upon the passing of our former Chief Executive Officer, and due to a decrease in bonus expense.

Quarterly Cash Dividend

The Company announced today that its Board of Directors approved a quarterly cash dividend to shareholders of $0.05 per share on the Company’s Class A and Class U common stock, in an aggregate amount of $4.4 million. The quarterly dividend will be payable on March 29, 2024 to shareholders of record as of the close of business on March 15, 2024, and the common stock will trade ex-dividend on March 14, 2024. The Company currently anticipates that future cash dividends will be paid on a quarterly basis; however, any decision to pay future cash dividends will be subject to approval by the Board.

Non-GAAP Financial Measures

This press release contains certain non-GAAP financial measures as defined by SEC Regulation G. The GAAP financial measure most directly comparable to each of these non-GAAP financial measures, and a table reconciling each of these non-GAAP financial measures to its most directly comparable GAAP financial measure is included beginning on page 8.

Balance Sheet and Related Metrics

Cash and marketable securities as of December 31, 2023 totaled $118.9 million. Total debt as defined in the Company’s credit agreement was $210.6 million. Net of $50 million of cash and marketable securities, total leverage as defined in the Company’s credit agreement was 2.8 times as of December 31, 2023. Net of total cash and marketable securities, total leverage was 1.6 times.

| (1) | Cost of revenue, operating expenses, corporate expenses, and consolidated EBITDA are defined on page 2. |

About Entravision Communications Corporation

Entravision is a global advertising solutions, media and technology company. Over the past three decades, we have strategically evolved into a digital powerhouse, expertly connecting brands to consumers in the U.S., Latin America, Europe, Asia and Africa. Our digital segment, the company’s largest by revenue, offers a full suite of end-to-end advertising services. We have commercial partnerships with Meta, X Corp. (formerly known as Twitter), TikTok, and Spotify, and marketers can use our Smadex and other platforms to deliver targeted advertising to audiences around the globe. In the U.S., we maintain a diversified portfolio of television and radio stations that target Hispanic audiences and complement our global digital services. Entravision remains the largest affiliate group of the Univision and UniMás television networks. Shares of Entravision Class A Common Stock trade on the NYSE under ticker: EVC. Learn more about our offerings at entravision.com or connect with us on LinkedIn and Facebook.

Forward-Looking Statements

This press release contains certain forward-looking statements. These forward-looking statements, which are included in accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, may involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results and performance in future periods to be materially different from any future results or performance suggested by the forward-looking statements in this press release. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that actual results will not differ materially from these expectations, and the Company disclaims any duty to update any forward-looking statements made by the Company. From time to time, these risks, uncertainties and other factors are discussed in the Company’s filings with the Securities and Exchange Commission.

View full release here.

Christopher T. Young

Chief Financial Officer and Treasurer

Entravision Communications Corporation

310-447-3870

cyoung@entravision.com

Kimberly Orlando

ADDO Investor Relations

310-829-5400

evc@addo.com

Source: Entravision Communications Corporation