Research News and Market Data on EGLE

June 22, 2023 at 5:25 PM EDT

Adopts Limited Duration Shareholder Rights Plan to Protect the Best Interest of Shareholders

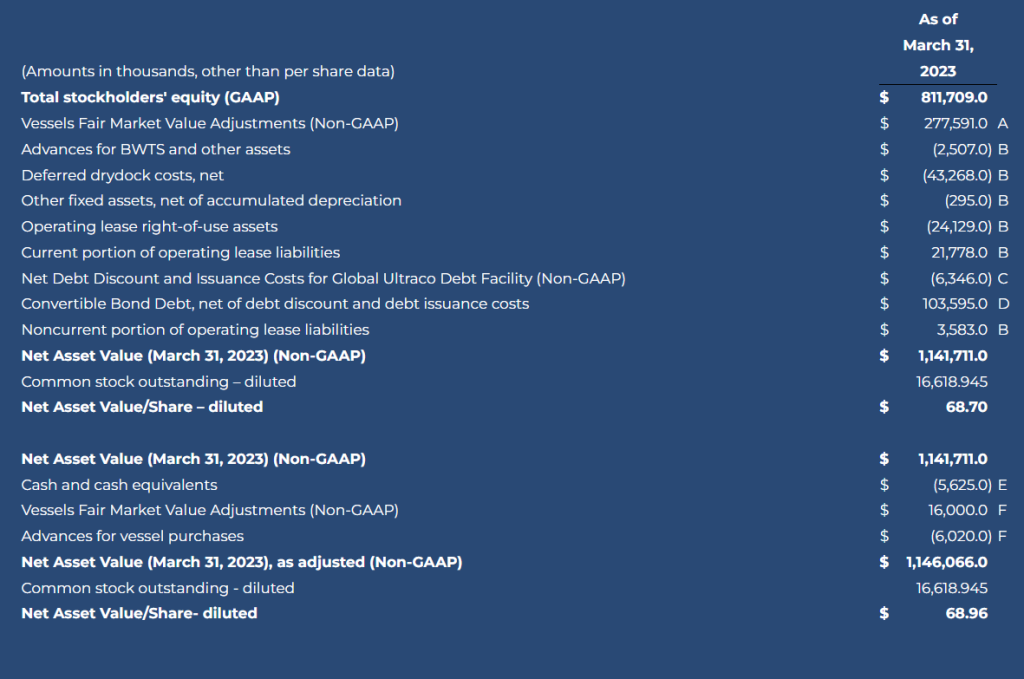

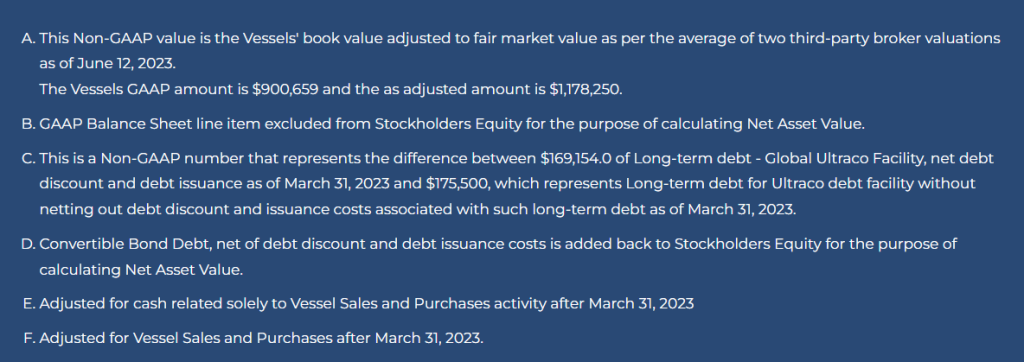

STAMFORD, Conn., June 22, 2023 (GLOBE NEWSWIRE) — Eagle Bulk Shipping Inc. (NYSE: EGLE) (“Eagle Bulk”, “Eagle”, or the “Company”), one of the world’s largest owner-operators within the midsize drybulk vessel segment, today announced that its Board of Directors has approved an agreement with Oaktree Capital Management (“Oaktree”) and certain of its affiliates pursuant to which Eagle has repurchased approximately 3.8 million shares of Eagle common stock, representing Oaktree’s entire stock ownership of approximately 28% in the Company, for an aggregate purchase price of approximately $219.3 million. The purchase price of $58.00 per share represents a discount of approximately $11.00 per share or approximately 16% to Net Asset Value, as adjusted (“NAV”) per share-diluted based on March 31, 2023 financials and current fleet valuations.1

The Board unanimously arrived at its determination after careful consideration, including consultation with outside legal and financial advisors.

Eagle’s Chairman Paul Leand, Jr. commented, “Today’s transaction is in the best interest of our shareholders, both financially and strategically. It ensures that shareholders maintain the opportunity to realize the value of their investment in Eagle Bulk and eliminates any potential disruption resulting from the sale of a very significant interest in the Company.”

Eagle’s CEO Gary Vogel added, “We believe the transaction will be significantly accretive to NAV per share and EPS in future periods based on historically strong supply-side fundamentals. Looking ahead, we will continue to execute on our growth and renewal strategy, including building upon our 33 previous ship acquisitions, and remain committed to acting opportunistically to create value for all of our shareholders.”

Eagle’s balance sheet remains strong, with total liquidity of approximately $188 million based on March 31, 2023 financials, as adjusted for this transaction, previously communicated financing, and vessel sale and purchase activity. The Company noted that it remains committed to its balanced capital allocation strategy, including maintaining its current dividend policy of 30% of net income, which we believe will be positively impacted by this transaction, and continued repayment of term debt.

As a result of this transaction, the Company’s outstanding common stock will be reduced to approximately 9.3 million shares. The transaction will be financed by cash-on-hand and drawings under the Company’s credit facility.

Eagle Bulk provided supplemental slides in connection with this announcement under the “Investors” section of the Company’s website https://ir.eagleships.com/.

Oaktree became a shareholder in Eagle Bulk in October 2014.

Shareholder Rights Plan

Additionally, the Company announced that its Board of Directors has unanimously adopted a limited duration shareholder rights plan (the “Rights Plan”). The Rights Plan is effective immediately and has a one year duration expiring on June 22, 2024 unless extended by shareholders. The Rights Plan will reduce the likelihood that any person or group gains control of the Company through open market accumulation, or other abusive tactics potentially disadvantaging the interests of all shareholders, without paying all shareholders an appropriate control premium or providing the Company’s Board of Directors sufficient time to make informed decisions in the best interest of all shareholders. The Rights Plan is not intended to interfere with any transaction that the Board of Directors determines to be in the best interests of shareholders, nor does the Rights Plan prevent the Board of Directors from considering any proposal.

Pursuant to the Rights Plan, the Company will distribute one right for each share of common stock outstanding as of the close of business on July 3, 2023. While the Rights Plan is effective immediately, the rights generally would become exercisable only if a person or group (including a group of persons that are acting in concert with each other) acquires beneficial ownership, as defined in the Rights Plan, of 15% or more of the Company’s common stock in a transaction not approved by the Company’s Board of Directors. In that situation, each holder of a right (other than the acquiring person or group) will have the right to purchase, upon payment of the then-current exercise price, a number of shares of Company common stock having a market value of twice the exercise price of the right. In addition, at any time after a person or group acquires 15% or more of the Company’s common stock, the Company’s Board of Directors may exchange one share of the Company’s common stock for each outstanding right (other than rights owned by such person or group, which would have become void).

The Rights Plan will expire on the close of business on the first anniversary of the date of entry into the Rights Plan unless extended for two more years by shareholders. It could also expire earlier if prior to such date, the rights are redeemed or exchanged. The Company’s Board of Directors may consider an earlier termination of the Rights Plan if market and other conditions warrant.

Further details regarding the Oaktree transaction and Rights Plan will be contained in a Current Report on Form 8-K that the Company will be filing with the U.S. Securities and Exchange Commission (“SEC”). These filings will be available on the SEC’s web site at www.sec.gov.

Akin Gump Strauss Hauer & Feld LLP is serving as legal advisor to the Company. Hogan Lovells US LLP is serving as legal advisor and Houlihan Lokey is serving as financial advisor to the Company’s Board of Directors.

About Eagle Bulk Shipping Inc.

Eagle Bulk Shipping Inc. (“Eagle” or the “Company”) is a US-based, fully integrated shipowner-operator providing global transportation solutions to a diverse group of customers including miners, producers, traders, and end users. Headquartered in Stamford, Connecticut, with offices in Singapore and Copenhagen, Eagle focuses exclusively on the versatile midsize drybulk vessel segment and owns one of the largest fleets of Supramax / Ultramax vessels in the world. The Company performs all management services in-house (including strategic, commercial, operational, technical, and administrative) and employs an active-management approach to fleet trading with the objective of optimizing revenue performance and maximizing earnings on a risk-managed basis. For further information, please visit our website: www.eagleships.com.

Investor and Media Contact

investor@eagleships.com

+1 203 276 8100

Supplemental Information – Non-GAAP Financial Measures

This release includes Net Asset Value per share-diluted, a non-GAAP financial measure as defined under the rules of the SEC. We believe non-GAAP measures provide important supplemental information to investors regarding the information discussed in this release. However, you should not rely on any non-GAAP financial measure alone as a measure of our performance. We believe that non-GAAP financial measures reflect an additional way of viewing our business that, when taken together with GAAP results and the reconciliations to corresponding GAAP financial measures that we also provide, give a more complete understanding of factors and trends affecting our business. We strongly encourage you to review all of our financial statements and publicly-filed reports in their entirety and to not solely rely on any single non-GAAP financial measure. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures, even if they have similar names.

Forward-Looking Statements

Matters discussed in this release may constitute forward-looking statements that may be deemed to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, and are intended to be covered by the safe harbor provided for under these sections. These statements may include words such as “believe,” “estimate,” “project,” “intend,” “expect,” “plan,” “anticipate,” and similar expressions in connection with any discussion of the timing or nature of future operating or financial performance or other events. Forward-looking statements in this release reflect management’s current expectations and observations with respect to future events and financial performance. Where we express an expectation or belief as to future events or results, including future plans with respect to financial performance, the payment of dividends and/or repurchase of shares, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to risks, uncertainties, and other factors, which could cause actual results to differ materially from future results expressed, projected, or implied by those forward-looking statements.

Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to risks, uncertainties, and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements. The principal factors that affect our financial position, results of operations and cash flows include market freight rates, which fluctuate based on various economic and market conditions, periods of charter hire, vessel operating expenses and voyage costs, which are incurred primarily in U.S. dollars, depreciation expenses, which are a function of the purchase price of our vessels and our vessels’ estimated useful lives and scrap value, general and administrative expenses, and financing costs related to our indebtedness. The accuracy of the Company’s assumptions, expectations, beliefs and projections depends on events or conditions that change over time and are thus susceptible to change based on actual experience, new developments and known and unknown risks. The Company gives no assurance that the forward-looking statements will prove to be correct and does not undertake any duty to update them. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors which could include the following: (i) volatility of freight rates driven by changes in demand for seaborne transportation of drybulk commodities and in supply of drybulk shipping capacity; (ii) changes in drybulk carrier capacity driven by levels of newbuilding orders, scrapping rates or fleet utilization; (iii) changes in rules and regulations applicable to the drybulk industry, including, without limitation, regulations of the International Maritime Organization and the European Union (the “EU”), requirements of the Environmental Protection Agency and other governmental and quasi-governmental agencies; (iv) changes in U.S. and EU economic sanctions and trade embargo laws and regulations as well as equivalent economic sanctions laws of other relevant jurisdictions; (v) actions taken by regulatory authorities including, without limitation, the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”); (vi) changes in the typical seasonal variations in drybulk freight rates; (vii) changes in national and international economic and political conditions including, without limitation, the current conflict between Russia and Ukraine, the current economic and political environment in China and the environment in historically high-risk geographic areas such as the South China Sea, the Indian Ocean, the Gulf of Guinea and the Gulf of Aden; (viii) changes in the condition of the Company’s vessels or applicable maintenance or regulatory standards (which may affect, among other things, our anticipated drydocking costs); (ix) the duration and impact of the novel coronavirus (“COVID-19”) pandemic and measures implemented by governments of various countries in response to the COVID-19 pandemic; (xi) volatility of the cost of fuel; (xii) volatility of costs of labor and materials needed to operate our business due to inflation; (xiii) any legal proceedings which we may be involved from time to time; and (xiv) other factors listed from time to time in our filings with the SEC.

We have based these statements on assumptions and analyses formed by applying our experience and perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. The Company’s future results may be impacted by adverse economic conditions, such as inflation, deflation, or lack of liquidity in the capital markets, that may negatively affect it or parties with whom it does business. Should one or more of the foregoing risks or uncertainties materialize in a way that negatively impacts the Company, or should the Company’s underlying assumptions prove incorrect, the Company’s actual results may vary materially from those anticipated in its forward-looking statements, and its business, financial condition and results of operations could be materially and adversely affected.

Risks and uncertainties are further described in reports filed by Eagle Bulk Shipping Inc. with the SEC.

1 This is a non-GAAP financial measure. A reconciliation of GAAP to this non-GAAP financial measure has been provided in the financial table included in this press release.