Why the Future Value of the Lottery’s Grand Prize is Significantly Higher than Last Year

There is a link between the current $1.9 billion Powerball prize money and Federal Reserve Chair Jerome Powell – and it is inflating the prize money.

A new billionaire was not minted over the weekend, at least not because of winning the enormous Powerball jackpot prize. So the weekend prize money, plus a small fortune more, is up for grabs at 10:59 PM Monday, November 7. The headline prize money, in this case, $1.9 billion, is the future value of the cash award, which, according to Powerball.com, is $929.1 million. The larger, almost two billion amount, would not have been nearly as large last year. Its sum is much bigger because the Fed has been jacking up interest rates.

To drill down a bit more, the prize calculation uses the 30-year U.S. Treasury bond interest rate to determine the annuity paid to the winner based on the cash lump sum award. The present value of that number, even if on par with a cash award a year ago, would pay a substantially larger annuity. And it is the annuity that is the advertised prize, which draws more and more players as it grows. The more players, the higher the present value or cash prize.

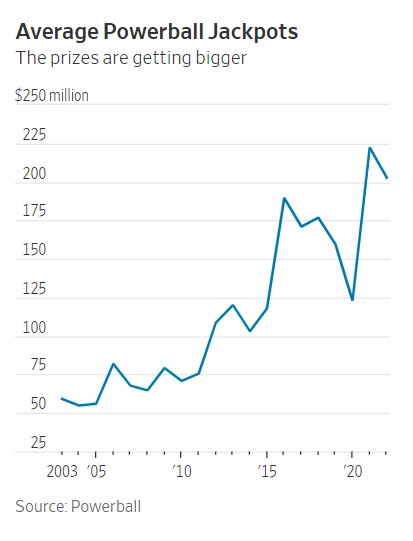

A year ago (November 8, 2021), the 30-year US Treasury bond had a yield of 1.90%. This was used to calculate the headline prize amount. Today, the same term Treasury is yielding 4.27%. This yield impact is roughly reflected in the average prizes over the years.

The Numbers Boiled Down Further

Of all ticket sales, 34% of Powerball ticket sales fund the grand prize. Another 16% fund the lower-tier prizes. (The remaining 50% goes to various state programs, operating costs, and retailer commissions.) If a winner chooses the lump sum payout, they receive the 34%. If instead, the winner chooses the jackpot in annual payments over 30 years, the prize money is invested in a portfolio of bonds.

The last time a winner chose an annuity was in 2014.

Economists who have researched lotteries have learned that once jackpots near the $500 million mark, non-regular lottery players are more likely to take a chance. The $500 million or more mark is where the media begins to make “lottery fever” a news event worth reporting on. The added publicity then feeds more money into the pot.

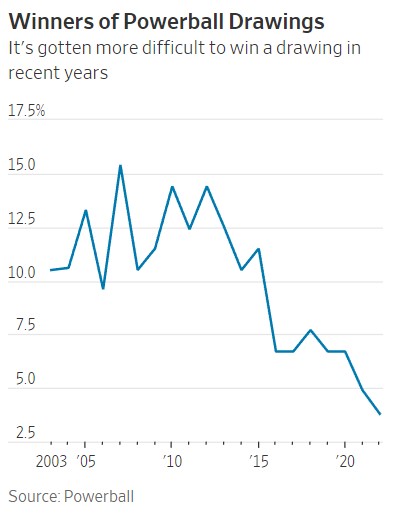

The prize pools are also growing because the games of chance have become statistically more difficult to take the top prize. In 2015, Powerball increased the cost of the ticket and altered the game to make it easier for players to win smaller prizes while reducing the odds of winning the headline prize.

Only 3.8% of drawings so far this year had had a winner, down from roughly 11% in 2014, the last full year before the change went into effect.

This is why the five times in the U.S. where $1 billion has been surpassed have all been recent. They include the biggest one, a $1.58 billion prize from Powerball in 2016, followed by a $1.53 billion Mega Millions jackpot in 2018 and this week’s $1.5 billion Powerball prize.

Lottery tickets also tend to become more popular during economic downturns and when people become more money conscious.

Even though the odds of winning Powerball are 1 in 292.2 million, players will take a shot and buy a ticket to have the fantasy. If the prize money continues to reach over $500 million on a regular basis, it may work against the program as those who don’t normally play won’t feel it is a special event.

Good luck to those of you holding a ticket.

Managing Editor, Channelchek

Sources: