OPEC Members Have Complied with Production Cuts, but it’s Getting Tricky

OPEC indicated in its monthly report that it expects world oil demand to tumble by 9.06 million barrels per day (bpd) this year versus a previous estimate of 8.95 million bpd. The decline is, of course, due to the COVID-19 pandemic and largely reflects a decrease in jet fuel although gasoline demand will also be challenged. Recall that OPEC cut production on May 1 by 9.7 million bpd to address an expected drop in demand. That cut is scheduled to taper to 7.7 million beginning in August. Of course, announcing production cuts and achieving production cuts are two different things. OPEC members (including OPEC plus members) have a history of not complying with mandated production cuts. Iraq is often mentioned as the primary compliance violators, but there are others.

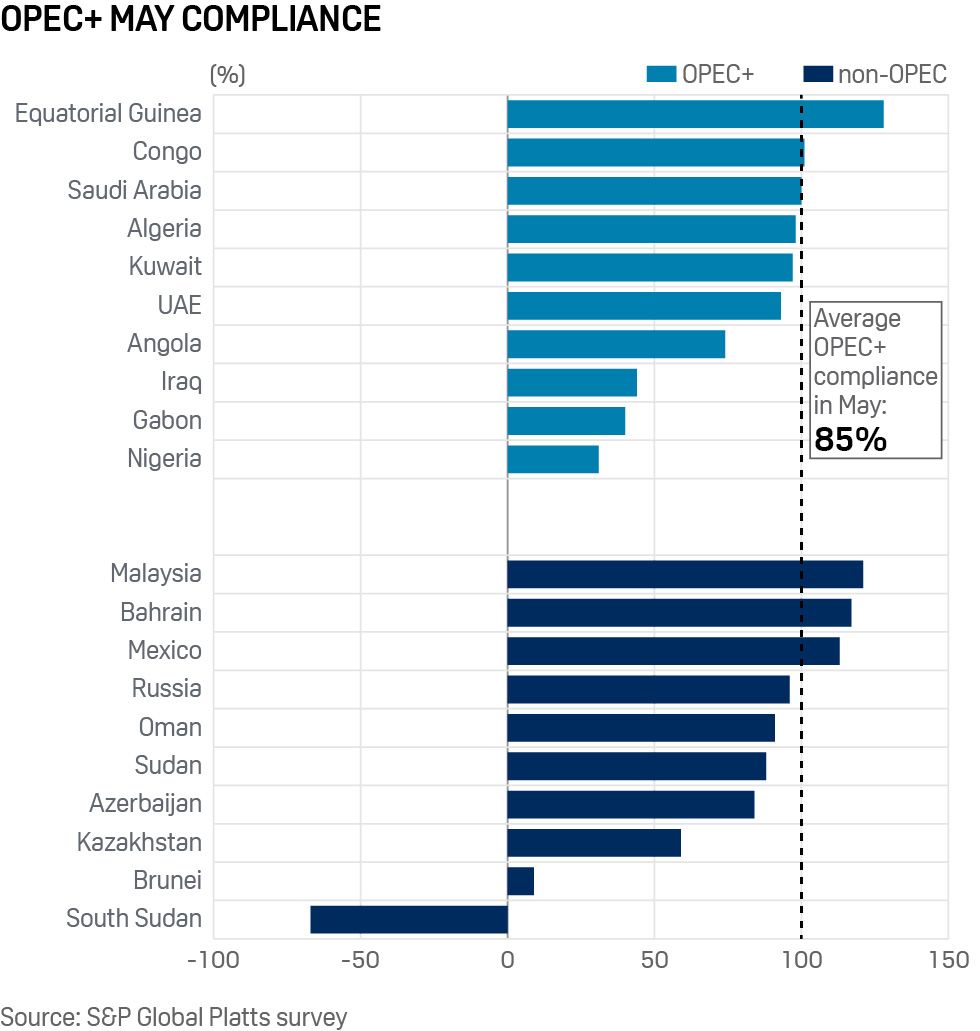

The compliance of the initial output cuts has been respectable. Compliance was near 85% in May according to a Platts survey. The chart below shows that OPEC members have generally done a better job than OPEC plus members. It also shows that several members have been producing at levels below their allocated output. Updated numbers in June and July have shown some slippage in compliance.

Bull Case for Compliance and Higher Oil Prices

- Saudi Arabia is In a Better Leadership Position. Saudi Arabia is the de facto leader of OPEC as the country with the largest reserves and the lowest cost of production. If production is not controlled and oil prices fall dramatically, it will be the last producer standing able to make a profit at lower prices. This is what happened in April when Russia would not agree to cost reductions. Saudi Arabia let oil prices fall forcing Russia and other countries back to the bargaining table. The result was the 9.7 million bpd cut agreed to in May. Saudi Arabia played a game of chicken and won. It emerged as a more powerful enforcer because it has shown its willingness to punish cheaters. Few OPEC plus members question whether Saudi Arabia would raise production if others were not complying. Nadir Itayim of Argus believes Saudi Arabia officials have taken an “all or nothing” approach. Either all countries do their part or nobody cuts.

- Measurement Techniques Have Improved. Measuring compliance is an arduous task given new areas of production, growing storage options (including floating storage) and a reliance on self-reporting. No wonder OPEC plus nations face a lack of trust when dealing with each other. That said, the level of distrust has eased as new technology grants members a better system of measuring compliance. Shipping tankers are better tracked and results are reported more frequently, both within and outside of OPEC.

Bear Case for Noncompliance and Lower Oil Prices

- Compliance May Be Impossible Due to Contractual Agreements. David Fyfe, chief economist at Argus, indicated that Iraq, Nigeria and Kazakhstan will have difficulties complying with mandated production cuts because of contractual agreements with upstream companies. Often, production cut arrangements are done hastily and simplistically. Those arrangements may work in theory but are difficult to implement in reality.

- Enforcement is Difficult. Saudi Arabia has shown a willingness to allow oil price to drop to punish non-compliers. However, it does so at great pain to its own financial position. Historically, the country has turned a blind eye towards minor violations and other OPEC plus countries know this. That leaves a temptation for members to test other members to see how far they can get away with challenging the system.

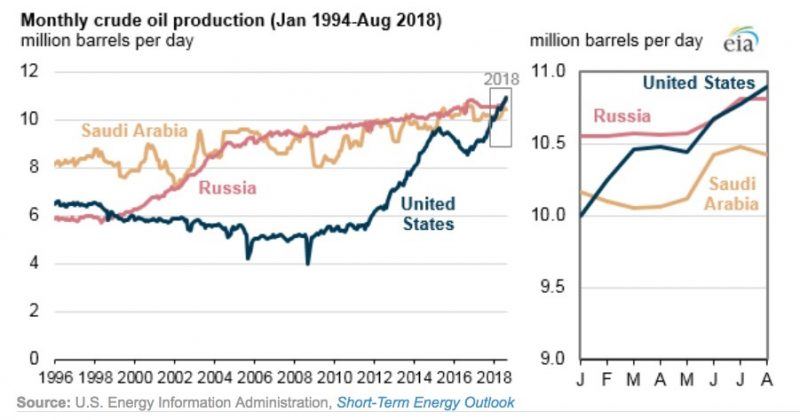

- The United States is the Largest Producer of Oil

and Not an OPEC Plus Member. OPEC became imperative when it lost market share to the United States in recent years. Much of the production has come from the Permian Basin where technological advances have lowered the price at which oil can be produced. The United States became the largest producer of oil in 2018. Domestic production has declined this year with the drop in oil prices. Should oil prices rise again, it’s safe to bet that domestic production will return.

Summary

It is always difficult to assess whether “this time is different” regarding OPEC compliance. Early indications are that production cuts have largely been adhered to. However, it is worth noting that production cuts during a period of lower demand are easier to enforce than during periods of robust demand. Everyone knows what will happen to oil prices if production is not cut to offset lower demand. When demand returns and oil prices start to rise, the temptation to cheat may be increased.

Suggested Reading:

EIA Reports the Largest Weekly U.S.

Crude Decline

Is M&A Picking up

in Energy Sector

Exploration and

Production Second Quarter Review and Outlook

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources

https://finance.yahoo.com/news/opec-trims-2020-oil-demand-125222084.html, Alex Lawler, Yahoo Finance, August 12, 2020

https://www.argusmedia.com/en/blog/2020/july/2/the-curious-case-of-opec-compliance, Nader Itayim, Argus, July 02, 2020

https://www.cnbc.com/2020/06/11/opec-mostly-met-cut-targets-in-may-but-future-compliance-uncertain.html, Natasha Turak, CNBC, June 11, 2020

https://www.spglobal.com/platts/en/market-insights/latest-news/oil/061020-opec-delivers-85-compliance-on-oil-output-cuts-in-may-sampp-global-platts-survey, S&P Global Platts, June 10, 2020

http://www.energyintel.com/pages/eig_article.aspx?DocId=1077457, International Oil Daily, July 4, 2020

https://momr.opec.org/pdf-download/, Organization of Petroleum Exporting Countries, August 2020