Bipartisan Legislation to Expand Use of Virtual Currency

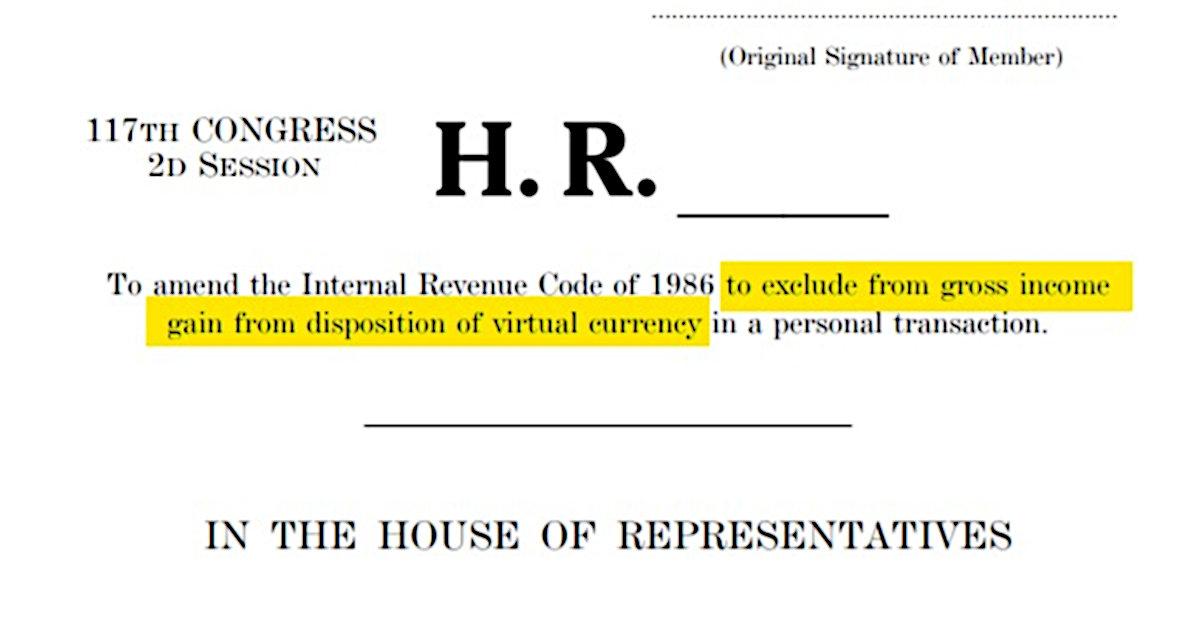

Two lawmakers introduced a bill on Thursday (February 3) to create legislation that allows a functional structure for taxing purchases made with cryptocurrency. The bill is dubbed “The Virtual Currency Tax Fairness Act”. The proposed law was introduced during tax season as many are now faced with the FORM 1040 asking them if over the past year they received, sold, sent, exchanged, or acquired any financial interest in any virtual currency.

The bill was introduced by Rep. DelBene, D-Washington, and Rep Schweikert, R-Arizona, and is co-sponsored by Rep. Soto, D-Florida, and Rep. Emmer, R-Minnesota. The legislation would exempt personal transactions made with virtual currency when the gains are $200 or less. The IRS has in recent years made it more of a priority to pursue those that transact in cryptocurrencies such as Bitcoin (BTC.X) or Ether (ETH.X) and avoid taxes on gains. They have even issued summonses to cryptocurrency exchanges like Coinbase (COIN) and Kraken, asking for the identities of their users. Under current law, this makes sense as any gain from the sale of cryptocurrency must be reported as taxable income regardless of the size or purpose of the transaction.

The problem the proposed new law would solve is that currently using crypto as a payment method entails a sale for IRS purposes. For example, if a moviegoer buys

a ticket to see a movie using Dogecoin ($DOGE.X), and the crypto spent had been acquired at a lower U.S. dollar price, the difference would be viewed as a capital gain, requiring reporting and a tax situation for the moviegoer.

The legislation seeks to amend the IRS Code of 1986 to remove these tax requirements when the capital gain doesn’t exceed $200, specifically to not discourage small transactions and allow the digital economy to grow.

A co-sponsor of the bill, Rep. Delbene said “Antiquated regulations around virtual currency do not take into account its potential for use in our daily lives, instead treating it more like a stock or ETF,” she adds, “However, virtual currency has evolved rapidly in the past few years with more opportunities to use it in our everyday lives. The U.S. must stay on top of these changes and ensure that our tax code evolves with our use of virtual currency. This commonsense bill cuts the red tape and opens the door to further innovations, ultimately growing our digital economy.”

Take-Away

“The Virtual Currency Tax Fairness Act” aims to remove a major hurdle to the everyday use of cryptocurrencies. If enacted it should benefit individuals, businesses accepting virtual currency, crypto exchanges, blockchain companies, and even the IRS.

Suggested Reading

The Fed and MIT are Experimenting with Digital Money

|

New Measures to Limit Government Officials Trading

|

Tax Treatment for Crypto Miners Could Cause U.S. Exodus

|

Why Zuckerberg Won’t be Adding a Cryptocurrency to Meta’s Features

|

Sources

https://delbene.house.gov/news/documentsingle.aspx?DocumentID=3035

https://mikerogers.house.gov/legislation/cosponsoredbills.htm

https://delbene.house.gov/uploadedfiles/virtual_currency_bill_text.pdf

https://airbnbase.com/kraken-ipo/

Stay up to date. Follow us:

|