GDPNow from the Atlanta Federal Reserve Has a Surprising Forecast

If good news is bad, The Atlanta Federal Reserve’s GDPNow report is horrible – that’s how good it is. GDPNow is a model for estimating Gross Domestic Product (GDP). Created and published by the Federal Reserve Bank of Atlanta, it has been fairly accurate in recent years. An estimate of third-quarter US GDP released on August 15th forecasts that growth is increasing dramatically – inflation is also shown to inch up in the forecast.

The Indicator

GDPNow uses recently published economic data to update a model to estimate GDP, a statistic that is reported with a significant lag to the input data.The output, or forecast, is an aggregation of other current economic indicators within the quarter. The data is entered into the mathematical model to calculate a GDP estimate at that specific point in time. There are still 45 days left in the third quarter, but up until now, this is what it calculated the growth to have been. As time passes and more reports are issued, more economic indicators are fed into the model. These reports come from the US Bureau of Labor Statistics, the US Census Bureau, the Institute for Supply Management, and the US Department of the Treasury. The accumulated data contributes to the historical accuracy of GDPNow’s calculations in relation to the GDP reports that the US Bureau of Economic Analysis (BEA) releases.

The Current Forecast

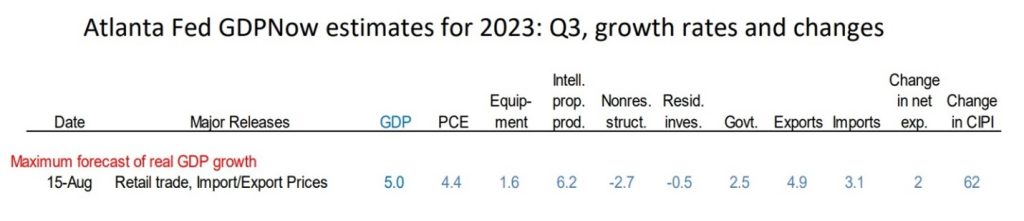

The GDPNow model’s latest estimates show the real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 5.0 percent on August 15, up from 4.1 percent where the estimate stood on August 8. Included in the model are recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the US Department of the Treasury’s Bureau of the Fiscal Service.

The model also provides other forecasts, from statistics, that will present themselves during the quarter and be finalized after the quarter ends. This includes third-quarter real Personal Consumption Expenditures (PCE). Remember that PCE is the Federal Reserve’s favored inflation gauge. The PCE inflation forecast, by this model, has been near accurate. It’s latest forecast is for it to rise to 4.4% annualized.

Take Away

There are a lot of mixed signals in the market recently, savings is down, consumer borrowing is up, interest rates out on the yield curve have finally moved up, and there are some fund managers that are extremely bearish, while bullishness is on the rise on the prospect of a soft or undetectable economic landing in the US.

The GDPNow snapshot of where a mathematical model shows where we may be now has no human intervention. It is created by a model without the kinds of bias that could cause a human to overweigh one factor over another. The most recent report shows tremendous growth and an uptick in inflation. In today’s financial marketplace, where the markets still sell-off on good economic news and rally on bad, it’s uncertain what this means for the markets. But it is important for investors to understand that others view this and weigh it in their own expectations.

Managing Editor, Channelchek

Sources

https://www.atlantafed.org/-/media/documents/cqer/researchcq/gdpnow/RealGDPTrackingSlides.pdf