Natural Gas Fell Hard Through Spring – Are We Seeing the Turnaround?

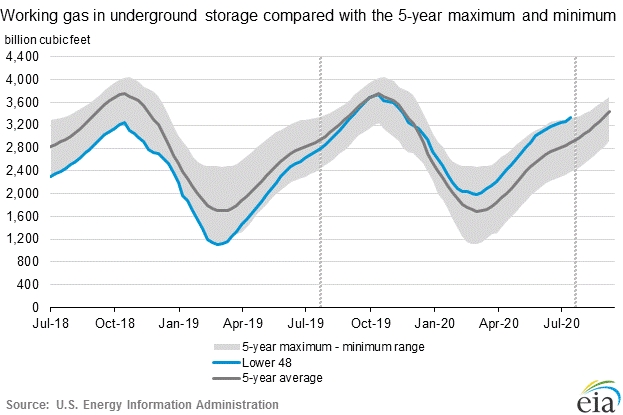

Natural gas in storage ended the winter heating season near historical averages. Then COVID-19 hit, and the demand for gas went away. The result is that natural gas in storage for the lower 48 states is now higher than it has been for five years at this time of year. The chart below shows that gas storage levels relative to trailing five-year averages, minimums, and maximums.

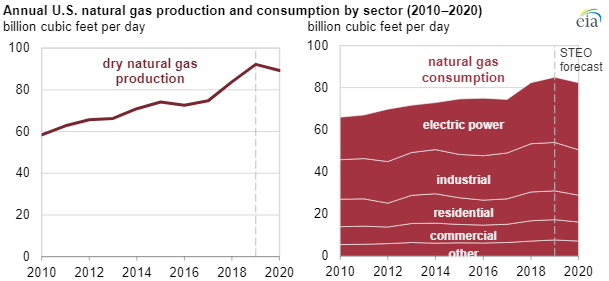

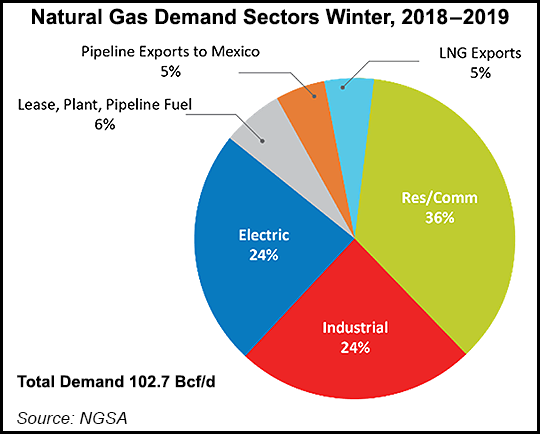

People tend to think of natural gas as a fuel used primarily for space heating. With more people staying at home, it would reason that natural gas demand would be near historical levels if not higher. In recent years, however, natural gas consumption has changed. While gas demand among residential and commercial customers (the primary users of natural gas for space heating) has been steady, demand for natural gas to fuel electricity generations has grown. Electricity generation now represents the largest use of natural gas.

In fact, the residential and commercial sectors, which tend to be associated with space heating, accounted for only 36% of U.S. natural gas demand, according to the Natural Gas Supply Association. Twenty years ago, residential and commercial users consumed roughly half of natural gas consumption. The implications are clear. Natural gas demand has become more economically sensitive over time and is being hurt by the economic slowdown caused by COVID-19.

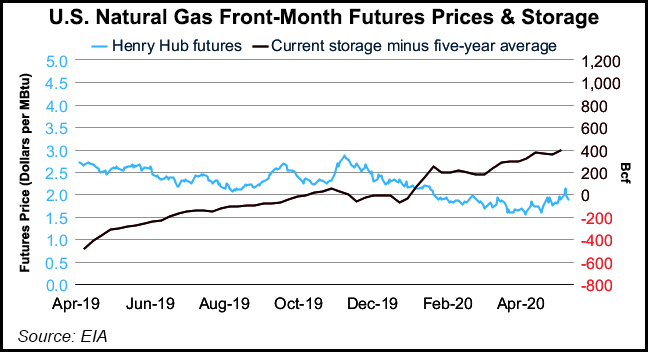

As one might expect, there is a direct correlation between natural gas in storage and natural gas prices. As storage levels have risen in recent months, natural gas prices have fallen. Natural gas prices began the winter around $2.75 per mcf and fell steadily to a level under $1.50 per mcf by June.

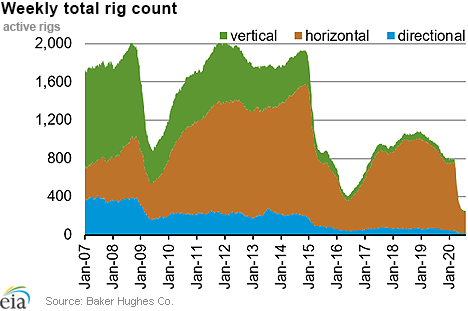

There is good news for natural gas prices. The drop in natural gas prices has led to a response from drillers. The number of rigs drilling for natural gas has dropped dramatically this spring. As of August 24, 2020, there were only 69 natural gas rigs drilling. That represents a 59% decline from a year ago.

The response has been a surge in natural gas prices in the last two weeks. Once below $1.50 per mcf, the upcoming September futures contract is now above $2.40 per mcf. The contract has risen $0.65 in the month of August alone. Clearly, investors anticipate that the natural gas storage numbers are about to correct to more normal levels.

Suggested Content:

OPEC Forecast Lower Demand as Output Cuts Taper

Energy Sector in Rapidly Growing Indonesia

Expect Today’s Nuclear Technologies to Provide an Important Role in the Future of Energy

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

https://crudeoilfacilitators.blogspot.com/2019/08/us-natural-gas-demand-is-at-record-and.html, Scott DiSavino and Stephanie Kelly, Reuters, August 8, 2019

https://www.bicmagazine.com/industry/natgas-lng/u-s-henry-hub-natural-gas-spot-prices-reached-record-lows-in/, BIC Magazine, July 13, 2020

https://www.eia.gov/naturalgas/weekly/#tabs-rigs-2, EIA, August 12, 2020