Money Supply is Like Caffeine for Stocks

The growth of money supply over the past year is beyond comparison to any other point in history. Change in money in circulation has a fairly predictable impact on many areas of the economy. When it grows above the pace of the economy it impacts prices. This includes asset prices such as stocks and real estate. The impact on financial assets that provide income such as bonds is most often negative. Investors should be well-versed on the impact increased money in the economy has on investments.

Money Supply

“Money Supply” refers to the amount of money in circulation. This could include everything from physical currency, the amount of unused revolving credit, and short-term deposits such as checking and longer-term deposits in CDs. Money supply in effect is a measure of the purchasing power of a population. The economic law of supply and demand, says, the higher the money supply (easy money), the more difficult it is for the currency to retain its value. When any currency loses its value, it takes more of it to buy goods, services, even investments. The number of dollars it takes to buy something is inflated.

The growth can be shown to be directly correlated to increases in stock market valuation. When there is a greater amount of money available, there is more money to be put in stocks. Anecdotally, we saw an impact on stock prices each time a new stimulus check was approved (forward-looking investors) and again after they hit people’s accounts. The reason is basic; more money in circulation, with a roughly unchanged supply of equity to be owned, results in pushing the value of the equity up.

In the past year, money supply as measured by the widely quoted M2 data (cash, checking deposits, and easily convertible “near money”) are striking. As a reference, the money supply surge in 2020 exceeded any in the one-and-a-half centuries for which there is data. Between March and November, the measure of M2, jumped 24%. The steep rise has flattened a bit, but growth remains rampant into 2021.

Inflation

As prices move up (inflation), investors demand a higher return on their investments to make up for the erosion in purchasing power of their money. They reduce their investments in interest-bearing securities such as bonds until the yield reaches their future inflation expectations, plus some additional level of protection. Bond investors are particularly cautious because higher interest rates reduce the value of their comparatively lower yielding portfolio. This disincentive to invest in bonds, or lend in other ways, motivates more people to move more money into stocks. The trend that occurs with investors moving out of bonds and chasing superior equity returns, can become self-fulfilling. The more stocks rise and bonds fall, the more investors allocate their portfolio to include more equities. They are chasing return and it may snowball for them.

Stock Prices

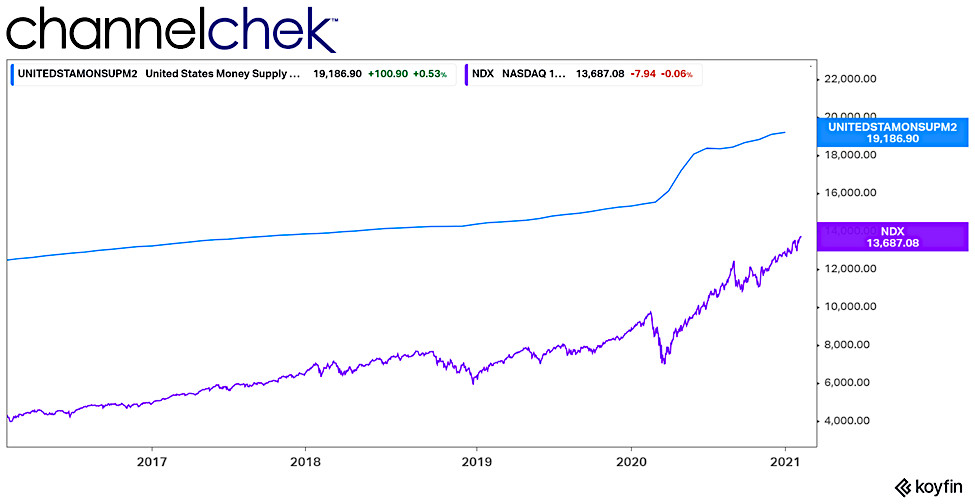

Visually, the trend in Money Supply growth is shown below to coincide with the trend in stock market returns. As more activity and money flows into a market, that market naturally has a positive upward trend. Because of this, market analysts keep an eye on big changes in money as an indicator of the way the stock market will behave in the near future.

Money Supply (M2) Trend compared to Stocks (Nasdaq 100) trend since 2016. M2 has a smooth line as money in circulation has few bumps or dips. The trajectory over most time periods is mostly equivalent.

Take-Away

The growth trend of the overall ability to spend throughout the economy has been growing at rates not seen since the 1970s. That decade was known for its struggle to tame price increases. The annual inflation rate (CPI-U) measured in December 2020 was 1.4%. During the year inflation reached a high of 2.5%, in January and a low of 0.1 in May. The Fed forecasts a 2% CPI-U growth rate for 2021. Their open market operations, which include buying bonds and bond ETFs are ongoing. This injects money, directly into the system, and into the hands of investors (sellers). There are many factors impacting stock prices, this is one of those factors that is positive for equities.

About the Author:

Laila Jiwani is a freelance writer specializing in topics related to social finance and international economic trends. Currently based in Dallas, Texas, she is an Erasmus Mundus Joint Master’s Graduate and has worked for economic development organizations in the U.S., Morocco, Kenya, Pakistan and Kyrgyzstan.

Suggested Reading:

What Stocks do you Buy When the Dollar Goes Down?

Financial Markets Lifted Household Wealth to Record Levels

Expect 500,000 Fewer Births in 2021

Sources:

Higher Inflation is Coming and it Will Hit Bondholders