|

|

|

|

Investment Portfolios are Checked Twice as Often by Millennials

The needs of younger adults are often overlooked by investment professionals. Despite the younger generation’s size, high education, and earning power, the efforts of financial professionals remain focused on those closer to the end of their lives, while paying less attention to those on the way up. Millennials and the Generation that followed (Gen Z) are both at stages in their adulthood where they have assets they’re trying to maximize. The assets may not yet be as large as those in or near retirement, so far fewer investment professionals focus on serving them.

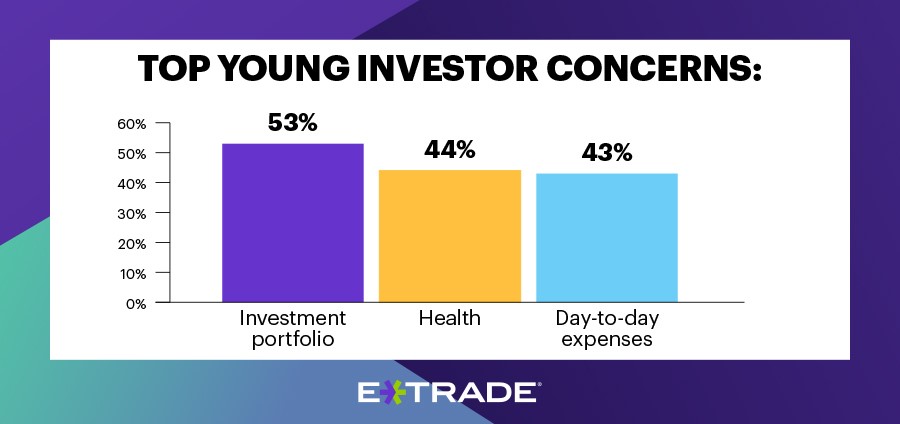

These younger investors came of age at a time where they witnessed the stock market grow at a historic pace to record levels. For more than a decade, they experienced a bull market like no other; now, they’re experiencing something new. They’re rightfully concerned about the realities of investing. In fact, there is evidence that they are more concerned about their investment accounts than their monthly income or their health.

In a press release earlier this month, E*TRADE revealed surprising survey data captured on their quarterly tracking study of experienced investors. The research found that Gen Z and Millennials (adults 30 and under) have become very concerned about investing since the beginning of the pandemic crisis.

Findings

in Tracking Study

The findings show that investors in this age group with accounts of $10,000 or more will check the value of their accounts twice as often as older investors. It’s evident from the report that providers of information to investors, including advisors, investment platforms, and financial publications, may want to expand their focus. The main points from the release are below.

- Portfolio

concerns surpass health worries – Investors under 30 say their number one concern during the COVID-19 crisis is their investment portfolio (53%), followed by their health (44%), and then their ability to afford day-to-day living expenses (43%).

- They

are checking their portfolio much more often than other generations –More than half of investors under 30(54%) check their portfolio at least daily, compared to 29% of the total population. In fact, almost three out of five investors under 30 (58%) say they check their portfolios more frequently since the coronavirus pandemic.

- Confidence remains, albeit slightly reduced – Nearly three out of five young investors (59%) remain confident they’re making the right decisions for their portfolios, compared to 38% of the total population. Confidence has dipped seven and 10 percentage points since the survey last quarter among young investors and the total population, respectively.

Dealing With

Volatility

It’s understandable to hear portfolio concerns in this market. Even investors that have experienced volatility in their accounts during other crises are likely to be monitoring their positions more closely. Fortunately, time is on the side of those that are younger, but it’s still very disconcerting to be looking at the balance one day, then a week later, find it to be 20%-30% lower.

In some cases, it may be that a voice of experience and better understanding of stock market history may be helpful to get younger investors to feel more confident. In other cases, it may be best for an investor (of any age) to leave it to a trusted professional to look after.

In the press release, Mike Loewengart, Chief Investment Officer, E*TRADE Capital Management, is quoted as saying, “Those who are concerned about market volatility should remain grounded in their financial goals, keep their eyes on the long term, and stay diversified. While these are no doubt unsettling times, they will run their course.”

Mr. Loewengart and the E*TRADE release also offered these suggestions to young investors concerned about their portfolio in the current environment:

- The

market doesn’t move in one direction. It makes sense seeing skittish behavior in the current environment. Although this was the quickest sell-off since the Great Depression, the S&P 500 is still up significantly from where it was even just five years ago—suggesting the importance of keeping a long-term view.

- Don’t

attempt to time the market. Chasing performance is a risky business—you’re always looking in the rear-view mirror. While historical data can be helpful, it bears repeating that past performance does not guarantee future results. What goes down hard can come up strong and vice versa. A solid example is April’s impressive rally from the March low. If investors had fled the exits at the bottom, they would have missed out on those gains. Stay committed to the portfolio you’ve worked so hard to build.

- Diversification

proves its mettle in this environment. In times of extreme market volatility, a balanced portfolio can help you ride out market swings. As earnings season continues, it’s becoming clearer that the pandemic is not hurting all sectors equally—consumer staples and health care are thriving. A simple way to participate in the market’s various sectors is to be broadly exposed, which one can achieve through such instruments as index ETFs or mutual funds.

Take-Away

Although we tend to equate stock market investing with an older graying population, Gen Z and Millennials are all adults and represent the largest living generation. The age-group is at a stage where they’re developing and implementing their financial plans and are concerned. They’ve witnessed a long bull run, so they know the benefits of investing, however, experience has not prepared them for the current gyrations. Learning by mistakes is normal, but when they are financial mistakes such as selling too soon, taking on too much or too little risk, or poor allocations, the mistakes may be detrimental as they could severely impact plans for the future.

In another article published on Channelchek earlier this year, it was discussed that younger investors are more likely to understand regularly scheduled saving. They also tend to be less interested in owning a home, and may not have work-sponsored retirement plans because a higher percent are part of the gig economy. It’s clear that service providers can do more to support and provide information and advice to this age group.

It was unclear from the press release if the “E*TRADE Baby,” now 14, is still killing it with his investments.

Paul Hoffman

Managing Editor

Suggested Reading:

The

9 Paradigm Shifts Investment Professionals Can’t Ignore in the New Decade

Stock

Index Adjustments and Self-Directed Investors

Where

Investors Found Double-Digit Growth in the First Quarter

Enjoy Premium Channelchek Content at No Cost

Sources:

Investment Concerns Overshadow Health and Daily Expenses Amid Pandemic

A Guide to Millennial Investing (Bankrate)

Photo: Business

Wire