|

|

|

|

“The Big Short” Dr. Michael Burry’s Views on the Shutdown

When famous hedge fund manager Dr. Michael Burry clears his throat, Wall Street investors take note–Then they take positions. This past Monday, his firm, Scion Asset Management, added to their position of GameStop. When news got out that Burry was adding to GME, it caused the stock to rise 22%. So, if Burry takes a position on anything else, including public policy, economics, or the pandemic, the medically trained doctor turned hedge-fund manager, also gets attention.

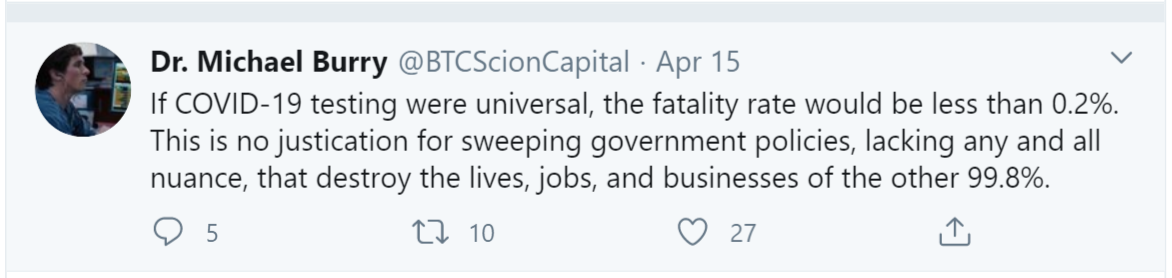

Burry, who was made famous by the movie “The Big Short,” has recently been very outspoken on his Twitter accounts. Mixed in with his regular Tweets on market activity, he’s been sharing his views on the economic shutdown. Overall, his position on the policy can be summarized by saying he believes lockdowns meant to contain the virus are more harmful than the disease.

Source:

Twitter account @BTCScionCapital

Background

Burry studied Economics in undergrad but went on to become an M.D. with residencies in pathology and neurology. During his residency years, he spent his free time applying concepts of securities analysis and “margin of safety” on stock picking. His extreme success caused him to choose investing as his career rather than practice medicine. He maintains his medical license in the state of California, including all continuing education requirements. He is most known by his character portrayed in “The Big Short,” an Oscar-winning movie based on the best-selling book by Michael Lewis.

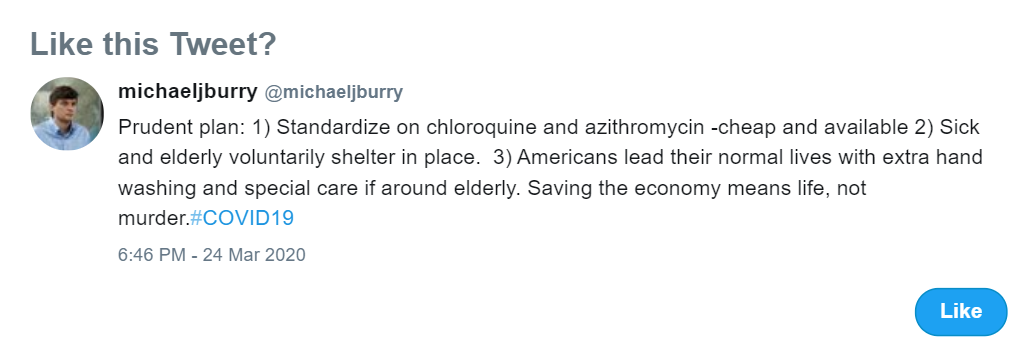

Burry keeps a low profile. He has given a couple of commencement addresses, but since his rise to fame he has not been very public. This changed last September when he began sharing his concerns on the valuations of passive investment products like indexed-funds. Over the past few weeks, his provocative views on how to best manage the COVID-19 outbreak in the U.S. have been getting the attention of his Twitter followers. In addition, he sent an email to Bloomberg discussing flaws he believes exist in the handling of the now crisis level pandemic and economic event.

Source: Twitter account @michaeljburry

Burry’s Bloomberg

Emails

“Universal stay-at-home is the most devastating economic force in modern history,” Dr. Burry wrote to Bloomberg News. “And it is man-made. It very suddenly reverses the gains of underprivileged groups, kills and creates drug addicts, beats and terrorizes women and children in violent now-jobless households, and more. It breeds deep anguish and suicide.”

In his first email to Bloomberg, he explained that he began speaking up because of how people would suffer from steps taken to contain the pandemic. He described job losses approaching 10 million as “Unconscionable.” Bloomberg News asked for the hedge fund manager to elaborate on his thoughts on the novel coronavirus and the world’s response to the outbreak including short and long-term impacts. Sections of his emailed response are categorized below.

China– “This is a new form of coronavirus that emanated from a country, China, that unfortunately covered it up. That was the original sin. It transmits very easily, and within the first month, it was likely all over the world. Very poor testing infrastructure created an information vacuum as cases ramped, ventilator shortages were projected. Politicians panicked, and media filled the space with their own ignorance and greed. It was a toxic mix that led to the shutdown of the U.S., and hence much of the world economy.”

“In hindsight, each country should have immediately ramped up rapid field testing of at-risk groups. But as I understand it, the CDC was tasked with some of this, and botched it, and other departments were no better. The bureaucracy failed in a good number of countries. Turf wars and incompetence have ruled the day. So the political cover for that failure on the part of the technocrats and politicians is a very harsh stay-at-home policy.”

U.S. Policy Response –“If there was ever a time for the government to stimulate with fiscal and monetary policy, it is now. Unfortunately, the U.S. has been adding $3 for every $1 of new GDP over a very long time, and interest rates were already near zero. Still, nothing is more important now that loans to small and mid-sized businesses, and the U.S. Treasury, backed by the Fed, is providing that liquidity, which is vital.”

Treatments – “It’s pretty clear that hydroxychloroquine is doing something good for many Covid-19 patients. The standard in medicine is a placebo-controlled double-blind study. But there is no time for that. The technocrats at the top are getting this wrong. Do the studies, make the vaccines, but allow doctors to have what they feel is working now. Don’t take tools or drugs out of the treating doctors’ hands. Trump should use the Defense Production Act more liberally in this area.”

“A more nuanced approach would be for at-risk groups — the obese, old and already-sick — to shelter in place, to execute widespread mandatory testing, and to ID and track as necessary while allowing society to function. Again, Trump should get the massive contract manufacturers like Flextronics to make testing machines.”

Getting Back to Normal – “I would lift stay-at-home orders except for known risk groups. We already know certain conditions that are predictive of severe disease. Especially since young, healthy lungs tend to be resistant, I would let the virus circulate in the population that is not likely to get severe disease from it. This is the only path that comes close to balancing the needs of all groups. Vaccines are not coming anytime soon, so natural immunity is the only way out for now. Every day, every week in the current situation is ruining innumerable lives in a criminally unjust manner.”

“When it comes to vaccines, coronaviruses are not known for imparting enduring immunity, and this will be one big challenge. It seems the genetic code is relatively conserved, and this will help the development of the vaccine. But we’re still looking at the end of the year. In the meantime, the world is an innovative place, and I expect many effective treatments — both new and repurposed — shortly. The question then will be regulation, expense, and availability.”

“Medically, the new normal will be the old normal. As long as innovation continues, medicine will conquer everything in our way.”

Economic Recovery – “Economically speaking, we have to realize the policy-driven demand shock will be resolved by 2021. But Japan and the U.S. are putting more than 20% of the GDP into new fiscal stimulus, and easy money will be the rule. Those things will all bring stock and debt markets back.”

“Countries will also look to bring supply chains home, and many employees will need retraining with higher cost. When we start working and playing again, inflation may be in store. The other big point is that consumers have learned new behaviors, which will drive business churn.”

Investments – He told Bloomberg News in March that he placed a “significant bearish market bet that is working out for now,” without providing details except to say it was a trade of a “good size” against indexes. He said the pandemic could unwind the passive investment boom, which he has compared to purchases of collateralized debt obligations that fueled the pre-2008 mortgage bubble.

Take-Away

Dr. Michael J. Burry is the most famous person to have both predicted the last big economic crisis and make a substantial profit off that call. It’s rare that Burry provides any news outlet with an interview, even an email interview. This makes him worth paying attention to. His Scion Twitter account had been so inactive that as of early March, it only showed 200 followers. That is minuscule for the head of a well-known hedge fund and unheard of considering his fame. Burry does not even have the coveted Twitter blue check-mark.

His feeling that what is going on now with the lockdown and passive-fund investing is a problem, is worth listening to. As an investor, it generally makes sense to pay attention to anything that others are paying attention to, especially people who can influence the market — Then, decide if you agree, don’t agree or choose to ignore it.

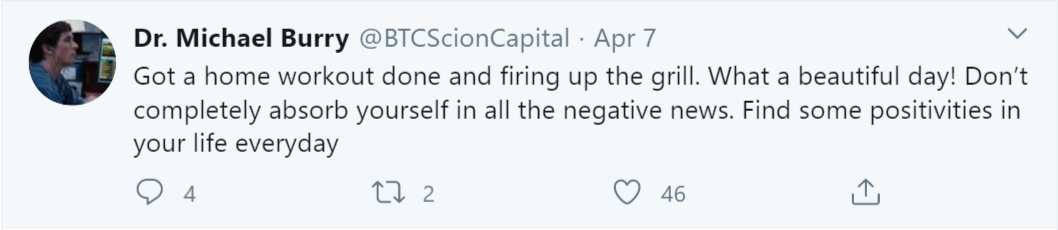

Here is one Michael Burry Tweet, most readers can agree with.

Suggested Reading:

Have Active

Managers Received a Bum Rap?

Is the Growth

of Index Funds Good or Bad for the Stock Market?

Is Company

Sponsored Research the Future for Small-Cap Stock Investors?

Sources:

GameStop Stock

Surged Because ‘Big Short’ Investor Michael Burry Bought More

The Big Short’s Michael Burry

Explains Why Index Funds Are Like Subprime CDOs

Michael Burry

of ‘The Big Short’ Slams Virus Lockdowns in Tweetstorm

Michael Burry Sticks With Japan Picks Even as Market Drops

Twitter Account

– Dr. Michael Burry

Twitter Account

– michaeljburry

Channelchek

Community:

Unlimited, no

cost subscription to company research and premium features