Further Evidence of his Future Outlook is Provided By “The Big Short” Michael Burry

It has been three-plus years since Michael Burry first warned that index funds’ popularity is creating distorted valuations of stocks included in the larger indexes. The reason for his warning is fund managers need to own the companies in the index. This creates buying pressure on stocks that might not otherwise be as strong of a buy candidate. In other words, investments are not being purchased on their own merit and, therefore could be thought of as overvalued. He called this the “passive investment bubble,” and he is still warning investors about a stock market investment bubble.

“Difference between now and 2000 is the passive investing bubble that inflated steadily over the last decade,” he tweeted late last year. “All theaters are overcrowded, and the only way anyone can get out is by trampling each other. And still, the door is only so big,” Burry said in October 2022. While his SEC filings show he is not opposed to owning individual stocks with a unique opportunity, he’s expecting a market collapse that dwarfs the dot-com crash because there’s so much money parked in index funds.

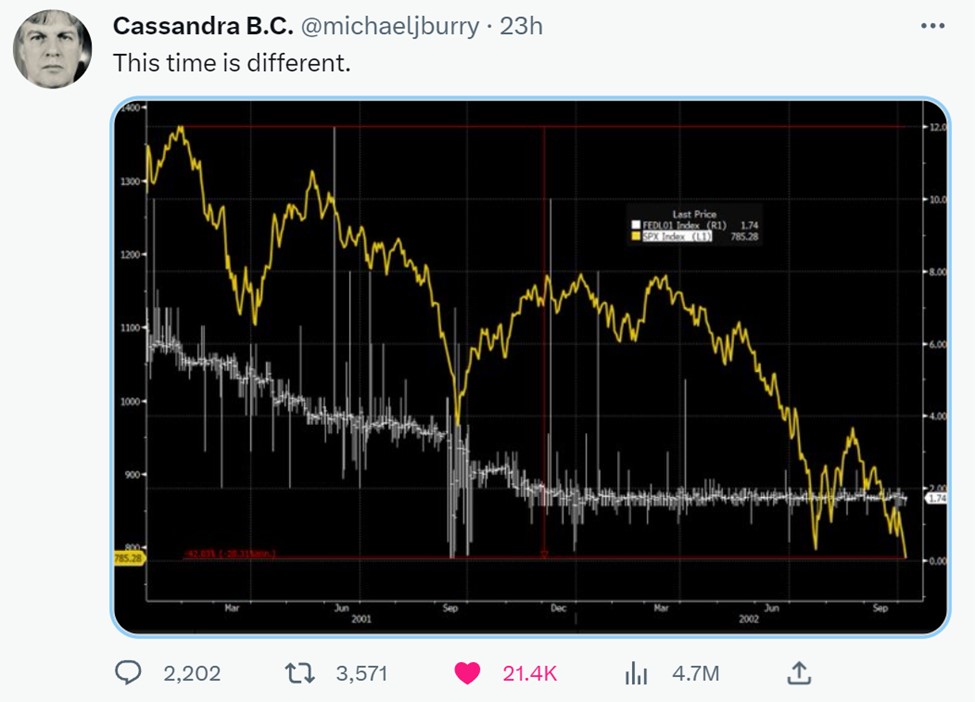

This week Burry provided a backup argument to his thesis in the form of a chart. The Bloomberg produced chart showed the S&P’s 40% plunge between February 2001 and October 2002. The S&P data was plotted alongside the sharp decline in the Fed Funds overnight benchmark interest rate. Burry’s latest tweet suggests a feeling of deja-vu that includes the stock market’s surge in early 2001, when rates were 6%. There seems to be concern that market participants are looking for enough weakness for the Fed to drop rates. The chart, and his written message is one to be careful what you wish for.

His tweet read, “This time is different.” This apparent sarcasm could be read, if you want lower rates, it may come at a cost.

Burry seems to expect enough economic weakness that the Fed will again ratchet down rates in a hurry. The poor economic scenario would likely cause the S&P 500 to tumble.

Take Away

Higher rates encourage traditional savings, which then becomes money not used to stimulate the economy. It also slows growth by making borrowing more expensive. This dampens demand and increases the risk of a bad recession. Burry, a widely followed hedge fund manager has been warning of the broader market taking a huge hit.

Burry has noted that blistering but brief rallies are common during market downturns.

Managing Editor, Channelchek

Sources

https://nypost.com/2022/10/03/michael-burry-flags-passive-investing-bubble-as-market-risk/