Scion Asset Management and Michael Burry Report Third Quarter Holdings

Four times a year, the quarter-end holdings of famous hedge fund manager Michael Burry become public through his firm’s required 13-F filing with the SEC. It’s newsworthy because people are interested in this iconic investor’s thinking. The list of 13-F securities is rarely more than a dozen positions and is just a one-day snapshot, but it can help one to understand his preferences and expectations.

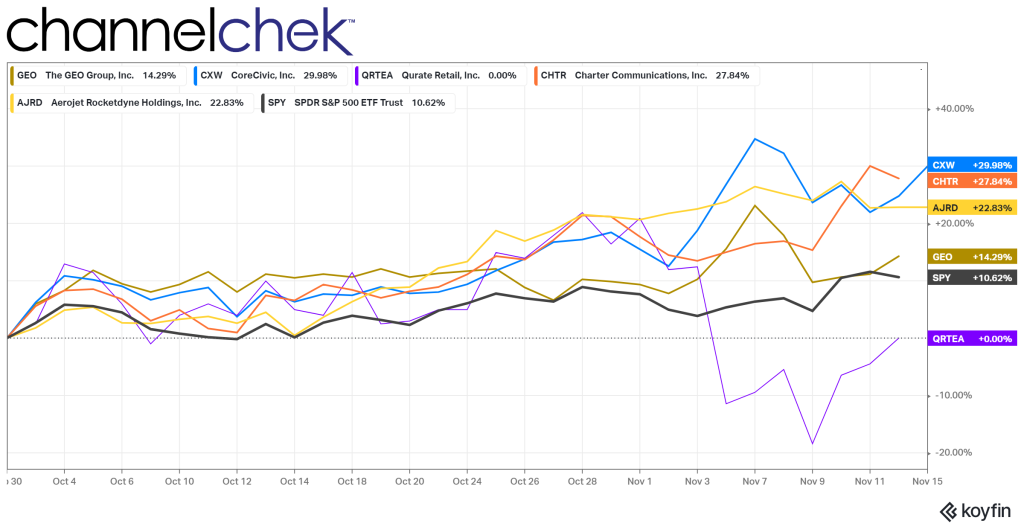

The latest 13-F filing became public on Monday (November 14). It shows that he is not negative on all stocks, as he has built on his one position from the last reporting period, and added a few others. He clearly does not limit himself to only meg-cap companies. In fact two of his positions are small-cap stocks, one is a midcap, and one large cap.

Scion Asset Management’s Positions

His largest position is Geo Group (GEO) and represents 37.65% of the five. The shares represent 0.409% of GEO’s outstanding stock or 501,360 shares. The average price was listed as $6.42 per share.

The quarter-end market value of Scion’s GEO position was $3,309,000 consisting of 501,360 shares. This represents 0.4092% of the company. According to Scion’s Form ADV, filed on April 18, 2022, Scion had assets under management of $291,659,289. The GEO position is not likely a significant portion of his entire portfolio, but it represents more than a third of the firm’s 13F reportable securities.

Michael Burry first reported owning GEO Group during the fourth quarter of 2020. It’s a unique company, which may be positioned to take advantage of changes in the U.S. and internationally.

The GEO Group, based out of Boca Raton, FL, specializes in owning’ leasing, and managing secure confinement facilities, processing centers, and reentry facilities in the United States and globally. In addition to owning and operating secure and community facilities, GEO provides compliance technologies, monitoring services, and supervision and treatment programs for community-based parolees, probationers, and pretrial defendants.

For the year ended December 31, 2021, The GEO Group generated approximately 66% of its revenues from the U.S. Secure Services business, 24% from its GEO Care segment, and 10% of revenue from its International Services segment.

On October 28, in a quarterly research report, Noble Capital Markets, Senior Research Analyst Joe

Gomes confirmed his earlier price target of $15.00 and reported solid operating results during the third quarter.

Scion’s third largest position is mentioned second because it also provides for correctional facilities and ancillary service, it is CoreCivic Inc. (CXW). CoreCivic is a private detention facility with three segments, CoreCivic Safety, CoreCivic Community, and CoreCivic Properties. It provides a broad range of solutions to governments with corrections and detention management, a growing network of residential reentry centers to help address America’s recidivism crisis, and government real estate solutions.

In his November 4 research report on CXW Joe Gomes pointed to the excess capacity of CXW, indicating that much of that could soon be utilized as covid restrictions loosen. Corecivic has ample excess capacity from which to add to their bottom line under improving conditions.

Burry’s second largest 13-F holding is Qurante Retail Group, Inc. (QRTEA). The company is involved in video online commerce and owns the well-known HSN (Home Shopping Network) and QVC shopping network. Its segments market and sell a wide variety of consumer products in the United States, primarily using its televised shopping programs and via the Internet through their websites and mobile applications; QVC International segment markets and sells a wide variety of consumer products in several foreign countries, primarily using its televised shopping programs and via the Internet through its international websites and mobile applications; and Zulily markets and sells a wide variety of consumer products in the United States and several foreign countries. Its geographical segments include the United States, Japan, Germany, and Other countries.

Aerojet Rocketdyne Holdings, Inc. (AJRD) is a midcap company that is Scion’s fourth largest holding. It designs, develops, manufactures, and sells aerospace and defense products and systems in the United States. It operates in two segments, Aerospace and Defense and Real Estate. The Aerospace and Defense segment offers aerospace and defense products and systems for the United States government, including the Department of Defense, the National Aeronautics and Space Administration, and aerospace and defense prime contractors. This segment provides liquid and solid rocket propulsion systems, air-breathing hypersonic engines, and electric power and propulsion systems for space, defense, civil, and commercial applications, and armament systems. The Real Estate segment engages in the re-zoning, entitlement, sale, and leasing of the company’s excess real estate assets. It owns 11,277 acres of land adjacent to the United States Highway 50 between Rancho Cordova and Folsom, California, east of Sacramento. The company was formerly known as GenCorp Inc. and changed its name to Aerojet Rocketdyne Holdings, Inc. in April 2015. Aerojet Rocketdyne Holdings, Inc. was incorporated in 1915 and is headquartered in El Segundo, California.

Burry’s smallest holding is the largest company. As the only large-cap stock of the five, Charter Communications, Inc. (CHTR) operates as a broadband connectivity and cable operator serving residential and commercial customers in the US. The company offers subscription-based video services, video on demand, high-def TV, DVR, and pay-per-view. It also has Web-based service management and sells local advertising across various platforms for networks, such as TBS, CNN, and ESPN to local sports and news channels.

Take Away

Michael Burry’s 13F filing for the third quarter showed two of his top three holdings are privately held correctional facilities that had relied on government contracts. The lifting of covid restrictions may help bolster future profits. Along with Aerojet, his fourth-largest position, GEO and Corecivic own real estate. Could this be part of Burry’s attraction?

The TV shopping channels owned by Qurante seem obscure, but the defense company Aerojet Rocketdyne should come as no surprise in a world that is moving more militarily and Space Force is gearing up.

If you have not already signed up to receive email from Channelchek with up-to-the-minute research reports on companies like GEO Group and Corecivic, along with insightful articles, sign-up here.

Managing Editor, Channelchek

Sources

https://www.forbes.com/advisor/investing/small-cap-stocks/

https://www.channelchek.com/company/GEO/research-report/3910

https://whalewisdom.com/filer/scion-asset-management-llc#tabholdings_tab_link