The FOMC Left Policy the Same in June, But Became More Hawkish

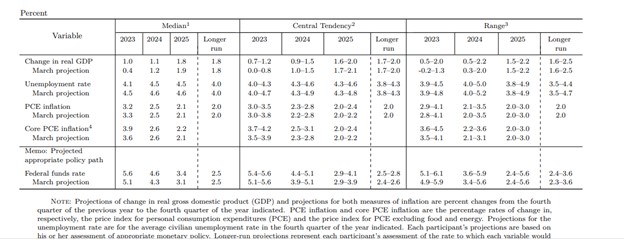

The Federal Open Market Committee (FOMC) voted to hold its target rate steady on overnight interest rates at 5.00% – 5.25% after the June 2023 meeting. This is considered a pause, not a halt to a hawkish stance as indicated by the post-meeting announcement. The announcement indicated FOMC members, on average, expect Fed Funds to be 50bp higher by year-end. This could come about as two 25bp moves. The lack of policy shift was in overnight bank lending rates and the quantitative tightening cycle previously announced. However, a slightly more hawkish Fed includes statements that are more certain that rates will still be pushed up, and member projections of where funds will be at year-end, which include one member seeing as high as 6.25% for the first time.

The vote was unanimous.

The minutes discuss that indicators suggest that economic activity has continued to expand at a modest pace. Job gains have been robust in recently, and the unemployment rate has remained low. However, they are concerned that inflation remains well above its targeted range.

After the meeting, the Fed says it believes the U.S. banking system is sound and resilient. They expect tighter household and business credit conditions are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5 to 5-1/4 percent,” according to the Fed’s announcement. “Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy,” it continued.

The Fed indicated that it will continue to assess “incoming information for the economic outlook.” The FOMC’s said its assessments will take into account readings on labor market conditions, inflation pressures and inflation expectations, financial and international developments, as well as other data.

The Summary of Economic Projections (SEP), relative to previous meetings, makes clear that Fed members are on average expecting to have to do more to combat inflation tan they had previously forecast.

Fed Chair Powell generally shares more thoughts on the matter during a press conference beginning at 2:30 PM EST after the statement.

Managing Editor, Channelchek

Source