The Fed Updated Its Approach Toward Influencing Inflation and Employment

The policy goals of the Federal Reserve are to support economic conditions that achieve both stable prices and maximum sustainable employment. On August 27, the Federal Reserve’s Federal Open Market Committee (FOMC) announced updates to its Statement on Longer-Run Goals and Monetary Policy Strategy. With respect to maximum employment, the FOMC stated that its policy decisions would be informed by its assessments of shortfalls of employment from its maximum level instead of deviations from its maximum level. With respect to price stability, the FOMC adjusted its strategy for achieving its longer-run inflation goal of 2%. It now will seek to achieve inflation that averages 2% over time, meaning those following periods when inflation has been running persistently below 2%, monetary policy will likely aim to achieve inflation moderately above 2% for some time. The updates were intended to address the challenges of implementing monetary policy in a persistently low-interest-rate environment. What are the implications of the new policies?

Stable Prices and Inflation Goals

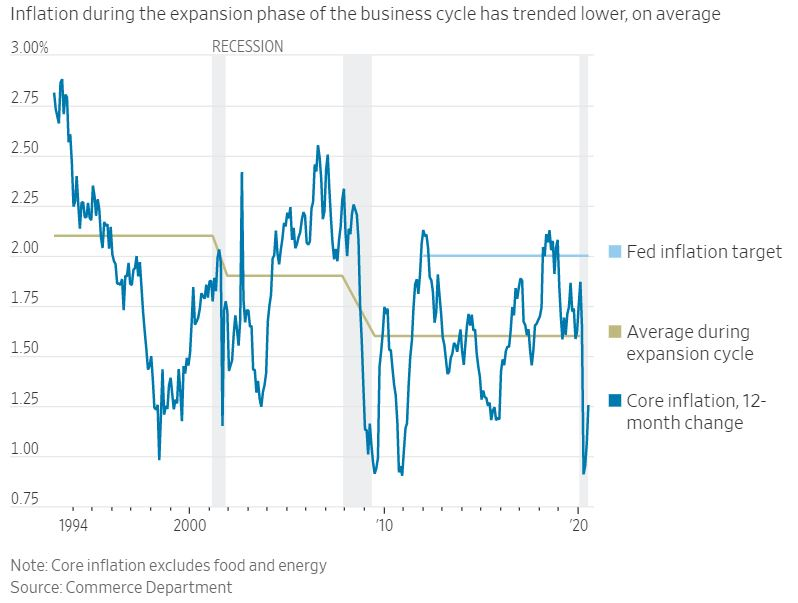

The FOMC believes that an inflation rate of 2% per year, as measured by the annual change in the price index for personal consumption expenditures, is congruent with achieving its dual mandate. The chart below, sourced from the Wall Street Journal, illustrates core inflation relative to the Fed’s target since 1994.

Source: Wall Street Journal, August 27, 2020.

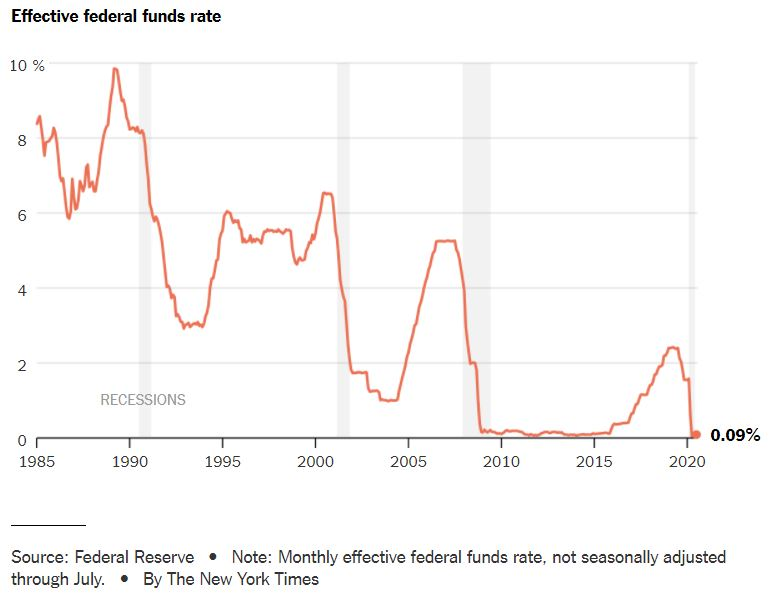

According to Federal Reserve Board Of Governors Chairman Jerome Powell speaking at an August economic symposium sponsored by The Federal Reserve Bank of Kansas City, inflation that runs below its desired level can lead to lower long-term inflation expectations, which can pull actual inflation even lower, resulting in an adverse cycle of ever-lower inflation and inflation expectations. This is perceived as problematic, given that expected inflation influences interest rates. Chairman Powell stated that if inflation expectations fall below its 2% target, interest rates would also decline, which would leave the Fed with less ability to cut interest rates to boost employment during an economic downturn. The chart below, sourced from The New York Times, illustrates the effective federal funds rate over time. Despite decreases in the fed funds rate, inflation has remained below the Fed’s 2% inflation target in recent years.

Source: The New York Times, August 27, 2020.

While some worry about the potential for Fed policy to result in asset bubbles that could destabilize the economy, Chairman Powell indicated that if excessive inflationary pressures were to build or inflation expectations were to ratchet above levels consistent with our goal, the Fed would not hesitate to act.

Maximum Employment

To assess the sustainable maximum-employment level, the FOMC considers a broad range of labor market indicators. Because the structure of the labor market is strongly influenced by nonmonetary factors that can change over time, the FOMC does not set a fixed goal for maximum employment. The policy update appears to indicate that the Fed will be less apt to increase rates to stave off fears of inflation at times when unemployment is low. Chairman Powell stated that the new policy reflects the view that a robust job market can be sustained without causing break-away inflation.

The Take-Away

While critics of the updated policies believe it will inflate asset prices without enhancing economic growth, others believe the inflation target should be raised to avoid deflation. Based on Chairman Powell’s remarks, it appears the Federal Reserve is more concerned with the prospect of inflation running below its 2% target than above it. Importantly, the new policy framework seems to suggest that interest rates will remain lower for longer. However, it will be important for the Fed to strike a balance between interest rates and inflation. Low-interest rates have penalized savers, who are finding it difficult to earn an adequate return on cash. Other financial assets, including equities, have benefited, along with housing due to low mortgage rates. Precious metals are often prized as a store of value and hedge against inflation. Since the end of the first quarter through September 2, gold and silver futures prices have risen 21.7% and 93.0%, respectively. Time will tell whether the Federal Reserve will get it right this time.

Suggesed Reading:

Backed by the Full Faith and Credit of Blockchain

The Role of Confidence in Today’s Fed Policy

This Is What Could Slam the Brakes on EV Growth

Enjoy Premium Channelchek Content at No Cost

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

Monetary Policy: What Are Its Goals? How Does It Work?, Monetary Policy Principles and Practice, Board of Governors of the Federal Reserve System.

Federal Open Market Committee Announces Approval of Updates to its Statement on

Longer-Run Goals and Monetary Policy Strategy, Press Release, Board of Governors of the Federal Reserve System, August 27, 2020.

New Economic Challenges and the Fed’s Monetary Policy Review, “Navigating the Decade Ahead: Implications for Monetary Policy,” an economic policy symposium sponsored by the Federal Reserve Bank of Kansas City, Jerome H. Powell, Chair, Board of Governors of the Federal Reserve System, August 27, 2020.

Fed Chair Sets Stage for Longer Periods of Lower Rates, The New York Times, Jeanna Smialek, August 27, 2020.

Fed Changes Its Approach to Inflation, as Leaders Aim to Navigate Future Crises and Reach Full Employment, The Washington Post, Rachael Siegel, August 27, 2020.

Fed Approves Shift on Inflation Goal, Ushering in Longer Era of Low Rates, Wall Street Journal, Nick Timiraos, August 27, 2020.