How Cryptocurrencies, Gold, and Oil Trade When Political Tensions Rise

Cryptocurrency prices have moved down and gold has moved up as investors are weighing bitcoin and its crypto peers against traditional “safe haven” assets. At the moment, the preference is still with the assets that own the longer track record rather than the “newcomers. The reason for investor reallocation is the potential for military conflict among two countries that provide many natural resources to their region and around the globe. This has also caused oil, uranium, and other natural resources to strengthen.

What Has Been Affected?

Bitcoin has been trading in the $37k area (down 10% from a week earlier) while gold is up near 3% over the same period. Crude has been volatile, reaching as high as $98 per barrel but is currently relatively flat on the week at $92.50 per barrel. The overall stock market, for its part, has been trending lower.

Investors across asset classes have been focused on the possibility of a Russian invasion into Ukraine for a month. This is because Russia has been amassing troops along the countries shared border to show disapproval that Ukraine is being considered as a potential member of NATO. Ukraine’s large size now serves as a big buffer between NATO forces and Russia. The most recent jolt to these tensions and asset prices occurred as Russian lawmakers today authorized President Putin to use military force outside the country (February 22). The U.S. and some European leaders have informed an invasion is currently underway, the unanimous approval by lawmakers in Moscow suggests the situation may intensify.

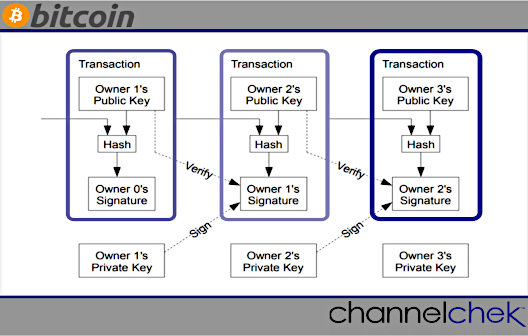

Many had expected bitcoin and other digital assets to trade independently from equity and other financial markets. This may one day become the case, but the move now is still into the most traditional “safe havens.” While many reason that cryptocurrencies should be a “safe haven” play, like gold or even more secure than precious metals, cryptocurrency reactions have shown themselves to be more correlated with risk-sensitive equities such as tech stocks. Cryptos have been in decline so far this year as interest rates have been rising and political tensions within countries and between countries have become tenser.

Oil

By the Summer of 2021, Russia became the second-largest exporter of oil to the U.S. after Canada. Post-pandemic consumption has been rising to pre-pandemic levels and the U.S. production is still well behind the country’s usage.

U.S. imports of crude and refined petroleum products from its sometimes adversary surged 23% in May last year to 844,000 barrels a day from the prior month. This is when Russia took the number two spot from Mexico.

Gold

Gold reached its highest level in nearly nine months after the Russian lawmaker vote, before it pulled back. Investors are watching developments in the crisis between the two countries and even listening to reactions of other countries that may be drawn into a conflict.

Spot gold is hovering around $1,900 per ounce by, having hit its highest since June 1 at $1,913.89.

Take-Away

A reallocation based on political tensions has taught investors that cryptocurrencies don’t offer the safe haven protection of other assets. The move from crypto and equities to gold and even U.S. Treasuries has traditionally been the play. In this case oil is benefitting from other factors which have caused many to expect an even more pronounced reaction. In the past, as the extent of tensions becomes more predictable, investors tend to move back to the perceived riskier assets to benefit from the dip.

Suggested Content

Who Benefits if Oil Price Increases are Not Transitory?

|

Will Gold Continue to Outperform in 2022?

|

Has Bitcoin Lived Up to its Original Vision?

|

Indonesia Energy Corp. Virtual Road Show (Video)

|

Sources

https://www.marketwatch.com/investing/future/crude%20oil%20-%20electronic

https://en.as.com/en/2022/02/16/latest_news/1645020978_604758.html.

Stay up to date. Follow us:

|