OPEC Output Reductions Expire Soon – Members are Anxious to Open the Taps

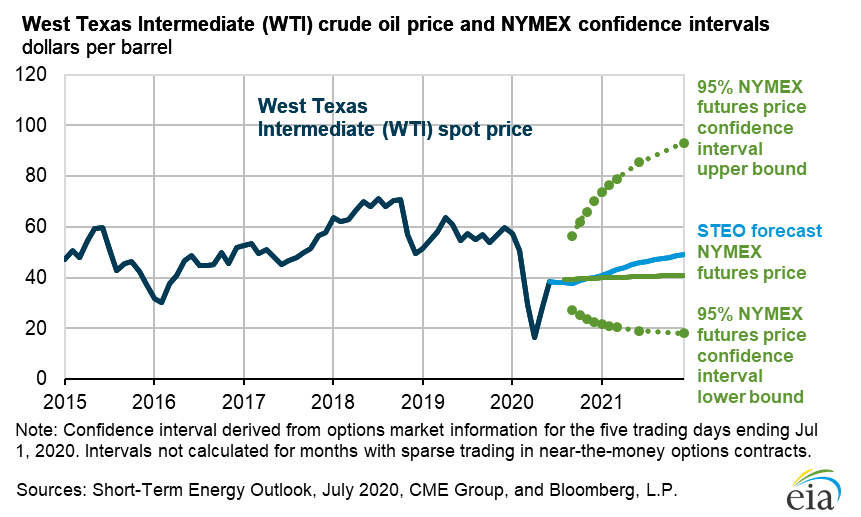

West Texas Intermediate (WTI) crude oil prices have traded in a range of $40 to $80 per barrel (bbl) for the last several years. Prices dropped below that range in April when the combination of pandemic fears and a price war between Saudi Arabia and Russia caused prices to drop sharply. Since April, WTI oil prices have improved to a level near $40/bbl as economies have begun to reopen, and OPEC plus members reached an agreement to cut supply by 10%. The oil future’s curve is flat, implying that investors believe the price of oil will stay near $40 per barrel. Has $40/bbl, once considered the bottom end of the trading range, become the new normal?

The case against $40/bbl oil being the new norm and prices returning to higher levels

- OPEC has regained its market dominance. After demonstrating its willingness to corral production cheaters by threatening to open the spigots, Saudi Arabia successfully negotiated a 10% output reduction among the OPEC plus members. By showing its dominant position, it has once again taken a leadership position that will help reduce the temptation for members to cheat and overproduce.

- Economies are improving due to governments’ stimuli and the hopes of a vaccine. Governments have been aggressively pumping money into their economies to offset economic weakness caused by the pandemic. The EU recently announced an $859 billion fund to prop up their economies while the United States is working on a $1 trillion, stage two stimulus package. Several vaccines have entered the testing stage, giving hope to investors that the world economies could return to a more normal state shortly.

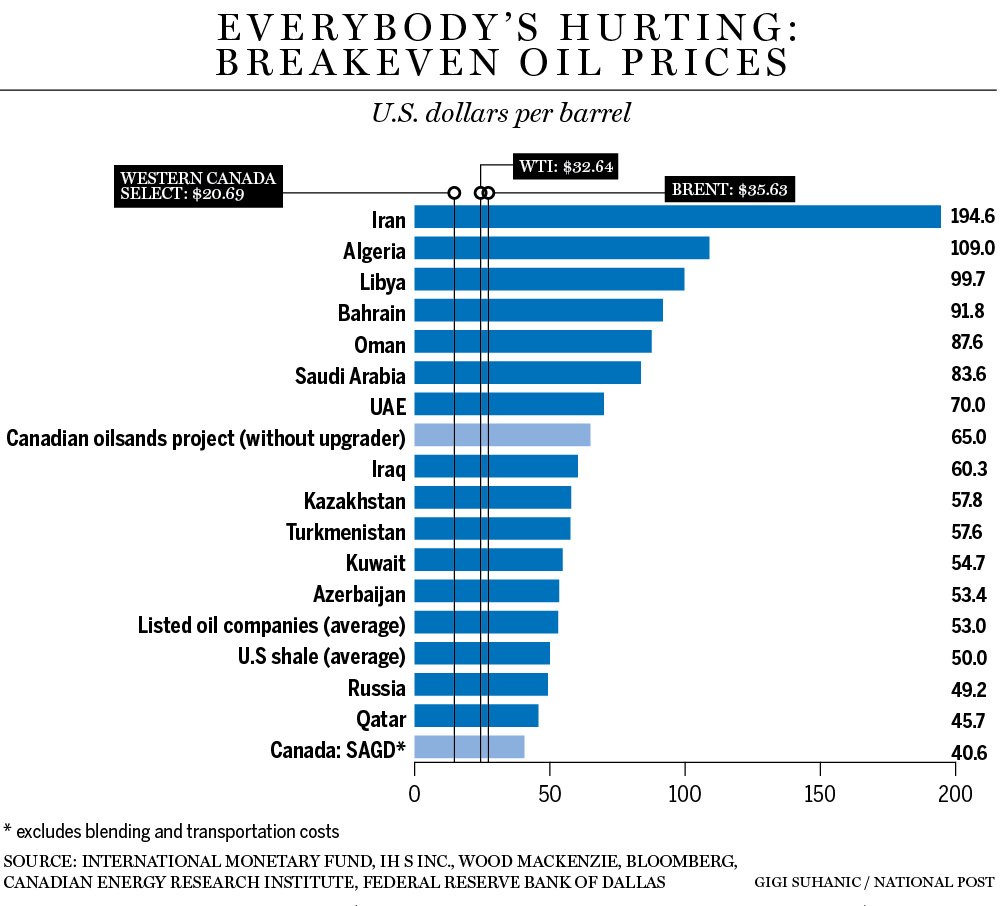

- North America needs prices above $40/bbl to justify new drilling. To obtain double-digit returns, most production areas need oil prices above $40/bbl. When prices rose above $50/bbl, domestic producers responded by increasing drilling and made the United States the largest producer of oil. However, when oil prices dropped below $40, drilling came to a virtual standstill. U.S. producers are the producers on the margin who will determine the price of oil, and $40/bbl is not enough to satisfy U.S. producers.

The case for $40/bbl (or lower) being the new normal

- The OPEC reduction expires soon. Production cuts for May and June were extended through July. OPEC members, however, are anxious to turn the spigots back on now that prices are above $40/bbl. Importantly, not all members signed on to the extension citing economic difficulties as a reason they could not participate. A further extension is far from being certain, meaning a drop in oil prices below $40/bbl is a possibility.

- The effects of the pandemic could last years. Government stimulus has propped up economies giving hope that things will return to normal when a vaccine is available. However, that may not be the case. The secondary effects of the pandemic could last for years. Governments that are saddled with debt may need to cut back future spending. Unemployment is unlikely to return to pre-pandemic levels as economies shift to a new way of life. Consumers that have run through savings will be reluctant to spend.

- Shale production continues to improve. Domestic producers may be the producers on margin and need oil price north of $40/bbl. However, that is changing. Technological improvements continue. Producers continue to refine the drilling process experimenting with differing fracking laterals and fracking components. The result is a continuing declining cost of production that makes drilling at lower prices feasible. Today, few wells earn adequate returns at $40/bbl. But soon, wells may earn attractive returns at prices in the thirties.

There are many unknowns facing the energy industry. When will demand come back? Will OPEC be able to remain united in its efforts to curb production? Will production cost reductions continue? The fact that the oil future’s curve is flat at $40/bbl may be a sign that there is uncertainty in the market more than a belief that prices will hold constant. There are good arguments for oil prices, both going up and going down. But then again, that usually is the case.

Suggested Reading:

Exploration and Production Second Quarter Review and Outlook

Is M & A Picking up in the Energy Sector?

Ruling Out Nuclear Energy Now Could Be a Mistake

Enjoy Premium Channelchek Content at No Cost

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources

https://qz.com/1880939/why-oil-prices-have-stalled/?utm_source=YPL&yptr=yahoo, Tim McDonnell, Quartz, July 15, 2020

https://finance.yahoo.com/news/oil-steady-vaccine-news-counters-020853525.html, Laila Kearney, Reuters, July 20, 2020

https://www.cnbc.com/2018/12/19/the-permian-basin-has-a-new-problem-40-crude-oil-price.html, Tom DiChristopher, CNBC, December 19, 2018

https://www.cnn.com/2020/06/06/investing/opec-oil-opec-production-cuts/index.html, Shannon Lee, CNN Business, June 6, 2020