Robinhood’s Latest Step Could Increase the Influence of its Customers

Robinhood made an exciting announcement at the close of business last week that went largely unnoticed. It is creating an index consisting of the most held stocks by its customers. For Robinhood ($HOOD) users and everyone else, this unique index will be useful intelligence to help serve as a barometer as to what top stocks users of the brokerage app are adding and which they are paring down. The Robinhood Investor Index will be based on the top 100 most owned stocks and is unique in how it is configured and weighted.

About the Index

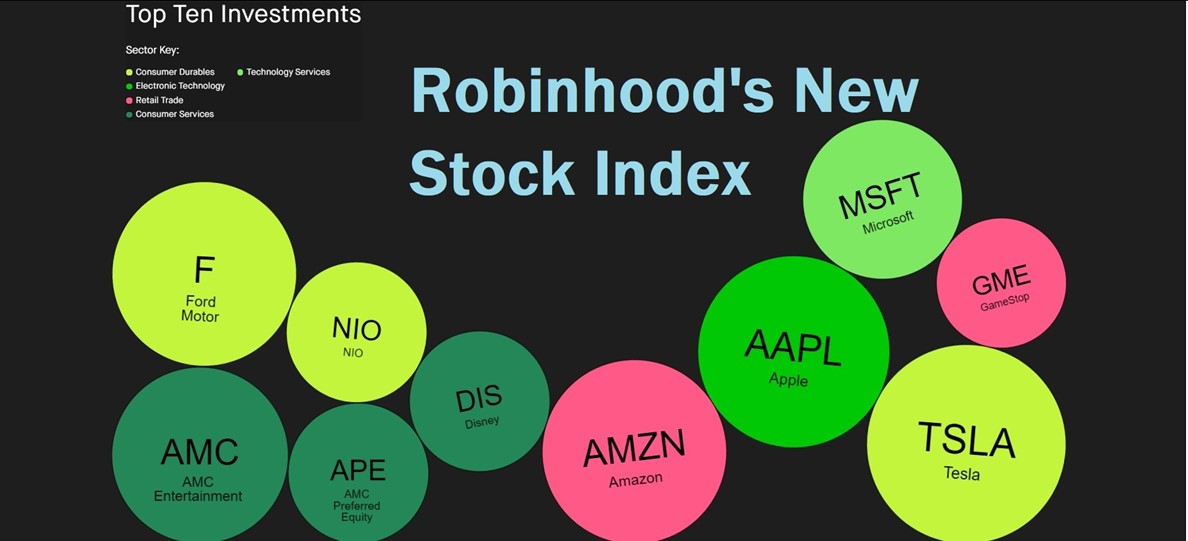

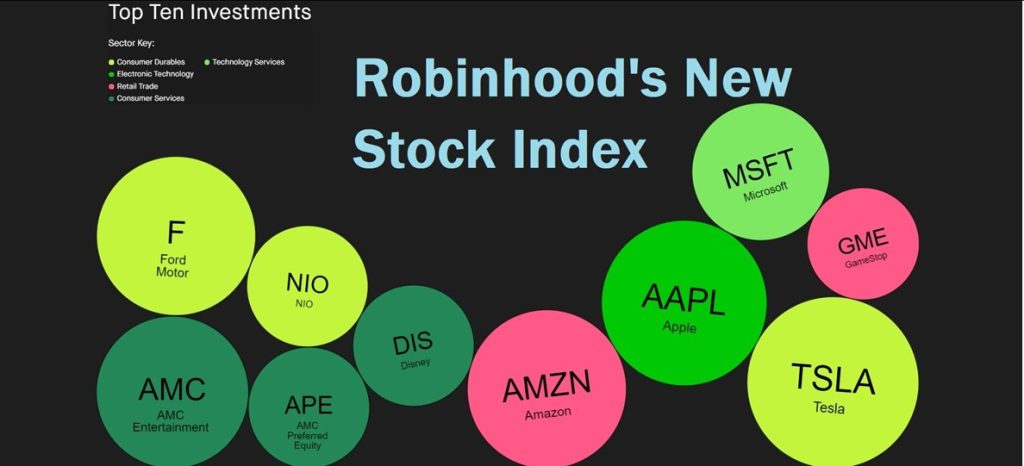

The Robinhood Investor Index presents an aggregate view of its customers’ top 100 most owned investments (does not account for shorts) and tracks the performance of those investments. Unlike the S&P 500 or Nasdaq 100, the index isn’t weighted by the size of the company but instead by the “conviction” of the 20+ million investors using the app.

Robinhood will take a monthly snapshot of holdings of each ticker and look at the percentage each comprises of each customer portfolio. They’ll ensure that all customers are equally included by averaging the conviction for each investment across all customers. In this way, whether clients have $500 or $500,000 in their account, it is the weighting per account percentage, not shares or dollar value.

Robinhood plans to update the index once a month and will share the valuable insights reflecting where its customers are allocating their assets in the index. Robinhood says its data tells them that customers invest in the companies they’re passionate about, and the Robinhood Investor Index aims to make this known.

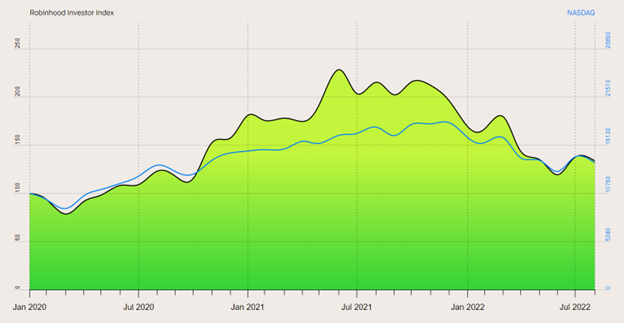

The index weights are re-calculated at the beginning of each new month, using data from the last trading day of the previous month. These monthly updates are expected to be published on a dedicated site within five trading days after the first trading day of each month. The index inception date for performance measurement is January 2020.

Performance

Robinhood says its customers tend to invest in what they know, entertainment, technology, and non-obscure staples in most of their lives.

For comparison, below is a look back to the beginning of 2020 (index inception date) comparing the Nasdaq 100 (NDX) in blue to the Robinhood Investor Index (RII) in green. Robinhood has shared that the evolution of its customer’s portfolios have shown an increased conviction to growth in electric vehicles with Tesla at the top, and growth in Ford and NIO, which has moved these holdings up the ranking system. Entertainment is also well represented, with Disney and AMC consistently among the top stocks. The sector representation, is diversified, also spanning financial services, energy and healthcare.

Overall, the RII leans towards large cap stocks with 75% in large-cap, 16% in midcap and 9% in small-cap.

Why it is Very Different

The Nasdaq Composite Index is a market capitalization-weighted index of more than 3,600 stocks listed on the Nasdaq stock exchange. The index is constructed on a modified capitalization methodology. This modified method uses individual weights of included companies according to their market capitalization. Similar methods are used for other often quoted market indices. The holdings captured in the Robinhood index are directly invested in by its users and weighted in the proportion weighted in each of the user accounts.

The sectors are defined using the FactSet Revere Business and Industry Classification System (RBICS). Sectors may be excluded if they are not among the holdings with the highest conviction.

Market capitalization evaluation is broken into three categories, large-cap (greater than $10 billion), midcap (between $2 and $10 billion), and small-cap (between $300 million and $2 billion). The RII does not include securities considered microcap (below $300 million).

Take Away

This new index could be of interest to financial professionals and other traders that monitor the activities of retail investors as a factor behind stock-market moves. The average age of Robinhood account holders is 32, this demographic has become an increasingly powerful driver of movement and it will be worth monitoring its trends.

Channelchek reports on index changes that we believe impact our readers. The Robinhood Investor Index, now in its infancy, will certainly be reported on in its early stages.

Sign-up for Channelchek news and research free to your inbox each day.

Managing Editor, Channelchek

Sources

https://www.wsj.com/articles/robinhood-unveils-index-to-track-customers-favored-stocks-11662748639

https://robinhood.com/us/en/investor-index/

https://blog.robinhood.com/news/2022/introducing-the-robinhood-investor-index