Will Stocks Snap Back After Tax-Loss Selling?

Offsetting portfolio capital gains by taking losses is permitted by the IRS. Within the tax guidelines, this generally occurs during the last month of the year as individuals and financial advisors strive to minimize money owed to the IRS. The stocks sold, naturally, are underperformers. This activity has a tendency to set the stage for a late December rally or a January rebound. This is especially true of the sectors or asset classes that were most sold. This is because portfolio managers often wish to keep a similar allocation, which translates to them then waiting 30 days or more before buying something that may be viewed as substantially similar.

With the major indexes like the S&P 500, Nasdaq 100, and Small Cap S&P 600 all down double digits this year, there are stocks that are doing far worse than index averages – just as there are stocks doing far better. Of course, if you own an ETF, you have to treat it like it is one stock and cannot offset a good underlying individual company sold with an underperforming company. In this way, holders of individual company shares can benefit more because they will have more options. And may even find it easier to qualify for the additional $3,000 tax benefit the IRS allows.

Why Might January Reverse December’s Slide

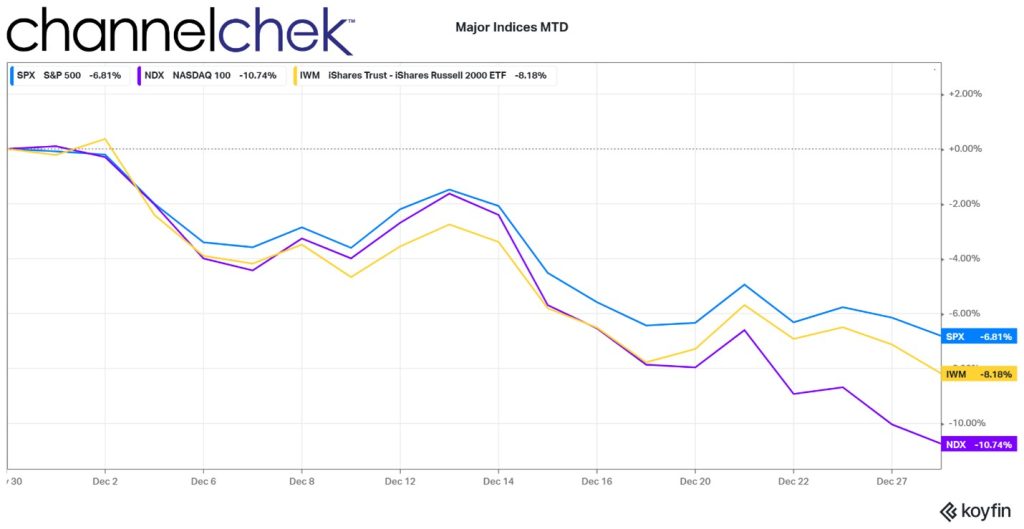

What happens after the 30-day period? Some investors try to get in, or back in, early with the notion that the most beaten-down stocks from 30 days earlier, could quickly bounce back hard for a time. This would all begin to occur following what could be perceived as the tax loss selling dip, (aged 30 days). The so-called Santa Rally is somewhat attributed to this, but that rally has not occurred during December 2022. The chart above shows a very weak December. So the buying may be postponed until early next year.

Without substantial buying this December, the first month or two of 2023 may bring buying as investors replace holdings for allocation purposes, plus any additional purchases used to bring the beaten-down sectors’ portfolio weightings up to whatever fits the investors’ strategy.

DoubleLine founder Jeffrey Gundlach told CNBC on Wednesday that risk assets will likely rally in January once retail investors finish tax-loss selling. Strategists at Evercore wrote on Nov. 30 that they were “buyers of stocks whose 2022 tax loss selling pressure will soon abate.”

Take Away

The main drivers of market moves next year are likely economic concerns such as inflation, recession, and monetary policy. But the potential for the most beaten down sectors this year, those that underperformed in December, may represent opportunity. The opportunity may not be long-lived, but for those involved in the markets, it is worth understanding why it may be occurring.

Managing Editor, Channelchek

Sources