Winners and Losers as Interest Rates Shift Investor Focus

Treasury bonds sold-off pushing yields higher over the past week. The tech sector and other interest rate sensitive stocks felt downward pressure as individual investors and fund managers may have begun cutting their exposure. Experience tells us that when rates rise, particularly suddenly, tech stocks suffer. Technology shares have been prone to getting ahead of themselves since the 1990s. Last week saw selling in tech in part because of the precarious interest rate scenario.

A Quick Look Back

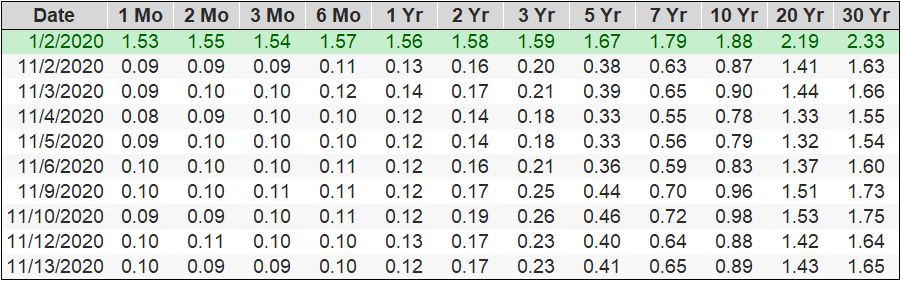

At the beginning of 2020 there was an 80bp spread between 1-month US Treasuries and the 30-year Treasury Bond. As of close of business last Friday the spread sat at 155bp. Although the entire yield curve has shifted lower, industries that make money on the spread between short deposit rates and longer lending rates benefit from the wider spread and the amount of economic activity rather than the absolute level. This could include securities brokers where customers have large, uninvested balances, credit card companies, banks, and other finance companies.

US Treasuries at Open of 2020 and November 2020 Daily Closing Yields

Source: www.treasury.gov

Activity This Past Week

Hope for a stronger economy ahead caused yields to rise after a release from Pfizer and BioNTech announcing a vaccine that achieved 90% efficacy against COVID-19. The 10-year US Treasury, responded by hitting .97% which is a seven-month high and later closed out the week at .89%. According to data from the US Treasury all maturities past 1-year also posted a similar upward movement. This spooked some sectors as market participants considered the impact of higher rates on various industries that don’t do well as financing costs increase or bonds become an attractive alternative.

Yields are still 70-140bp below their start of the year and well below their 5-year average. Forward looking stock market participants last week lightened positions in shares that ran up during the rally that pushed the S&P 500 up 58% from its March low.

What May Lie Ahead

Expectations are that an economy that has been partially sedated to minimize spreading of a novel virus may resume more rapid growth moving forward. Higher economic activity would continue an already strong recovery trend as releases showing massive improvement in GDP and employment have beat expectations. A continuation of positive reports would reduce the need for the Fed to maintain rates at the low levels the FOMC now targets. Higher overall rates could reduce profits for tech companies with high debt loads and industries where customers depend on financing such as the real estate and automotive industries. The popular list of companies that roared as people stayed home, (Zoom, Facebook, Peleton, Amazon, and others) are unlikely to achieve those levels of enthusiasm in a world less threatened by COVID-19.

.

Suggested Reading:

How Will Remote Working Change After the Pandemic

Which Stocks Do Well After a Presidential Election

Many

Investors are Keeping Their Powder Dry

Do You Know a College Student?

Tell them about the College Challenge!

Sources:

https://robinhood.com/us/en/support/articles/earning-interest/