Image Credit: Alexandr Podvalny (Pexels)

Inflation Seems Persistent, What Now?

One of the primary goals of investors is to out-earn inflation. At a minimum, keeping up with inflation helps our stored wealth from losing purchasing power. As CPI measurements have shown a higher inflation rate this year than we have seen over the past decade, investor concerns naturally have turned to consumer prices — investor conversations are often centered around finding the best reflation investments. The definition of “reflation trade” is finding assets that will outperform in a long-lived inflationary environment.

Background:

The year-over-year rate of inflation ran below 2.5% throughout the 2010s. This past summer, increased prices brought CPI and other measures well above 5%, indications are that upward pressure on prices will continue. The cost of basic inputs such as labor, raw materials, shipping, and energy are all pushing costs of final goods and services higher. If corporate tax rates are also increased, this burden will also be passed through to the consumer. In addition to increased costs pushing prices higher, scarcity has provided businesses an opportunity to require higher price tags on the goods already on their shelves. It’s the perfect setup for inflation to continue at the levels we’ve seen in recent months or move even higher.

Inflation

Friendly Investments

Every market cycle and inflation cycle has its own set of winners and losers. The winners this time around (assuming inflation is not transitory) may be different than last. However, there is a long history of inflation from which to look back on, and even recent history can put probabilities more in an investor’s favor.

The more popular reflation trade suggestions from some investment professionals I’ve spoken to on the subject suggest everything from Treasury Inflation-Indexed Notes (TIPS), to farm land and related basics of food production. Other thoughts included commodities, producers of basic materials, commodities, and technology.

TIPS

Back in 1997, I participated in the first Treasury auction of inflation-protected securities. Prior to that I was involved in discussions on behalf of my employer, with Secretary Robert Rubin’s U.S. Treasury team in 1996 meeting to resolve what my employer would support and perhaps build a fund around. From this experience, I have a strong understanding of and opinions of U.S. Treasury Inflation-Protected Notes.

Sticking to just facts and data, TIPS carry a fixed interest rate, well below similar maturity treasuries. As inflation (non-seasonally adjusted CPI-U) rises or falls, this amount is accreted to the principal of the bond. The semi-annual interest rates are calculated using the coupon (initial interest rate set at auction) multiplied by the new inflation-adjusted principal (divided by two for half a year). At maturity, the investor receives the final interest payment along with the principal adjusted for inflation’s impact.

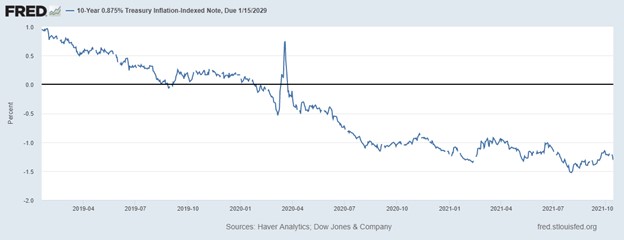

The above chart represents a TIP with an original maturity of ten years

and a coupon of 7/8%. As interest rates traded lower after 2004, TIPS spread themselves

off traditional treasuries and traded at a premium, providing a negative

return yield to investors while accreting the inflation rate to principal to be paid

at maturity.

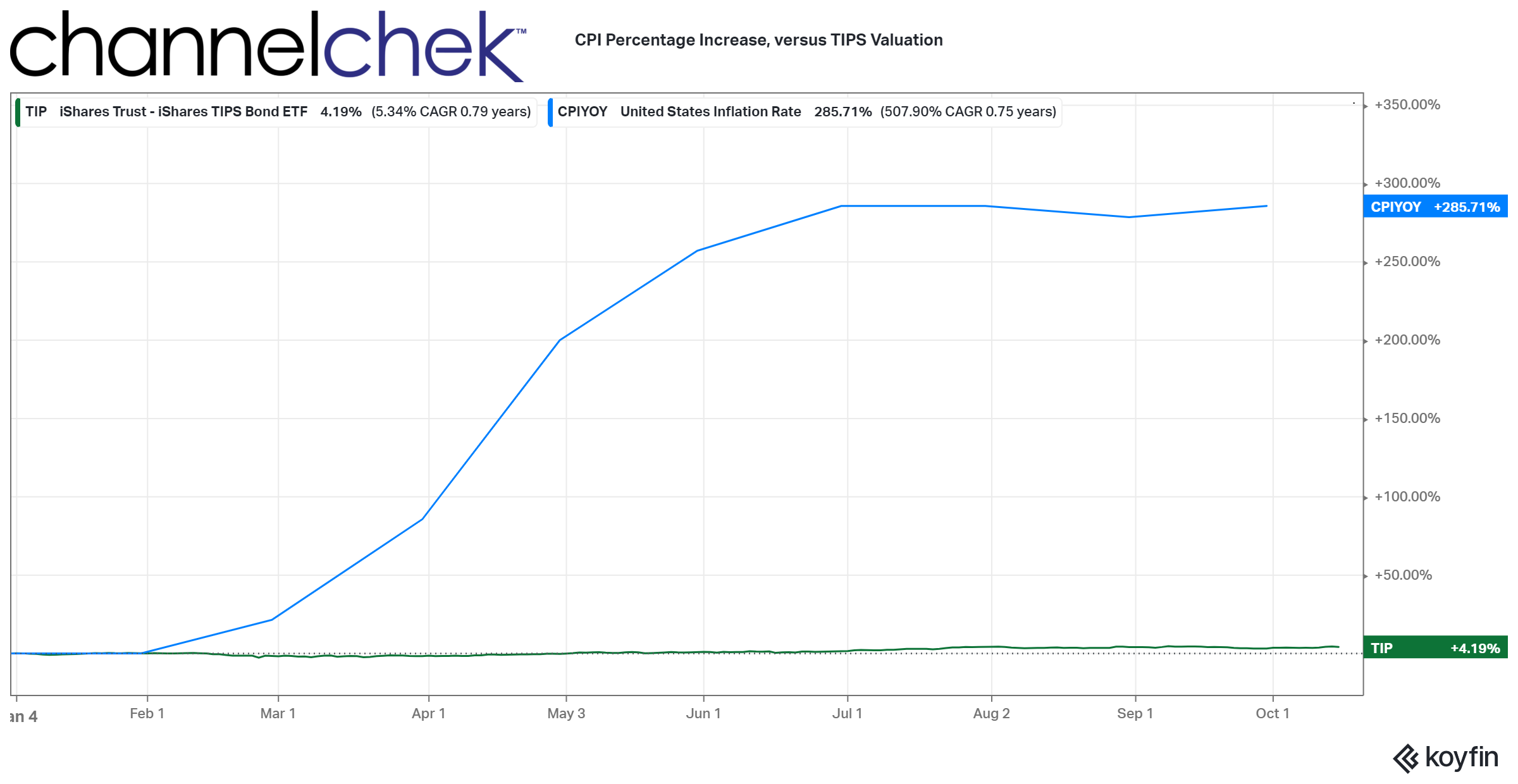

While the first chart demonstrates yield, the above shows year-over-year total return over the past 12 months. CPI increased 285% during this time while the value of a TIPS portfolio increased 4.2%.

While the first chart demonstrates yield, the above shows year-over-year total return over the past 12 months. CPI increased 285% during this time while the value of a TIPS portfolio increased 4.2%.

Farming

Chris Rawley is the CEO of the investment company Harvest Returns. His company provides capital to farmers or ranchers while creating income-oriented investment opportunities for qualified investors. Channelchek reached out to Chris who made a case for the industry he specializes in, “Farmland and agriculture make good inflation-proof investments. In addition to arable farmland shrinking around the globe, historically, land has appreciated in concert with the money supply. Food production is also generally a recession-proof industry, as growing populations continue to eat regardless of the economy,” said Rawley.

While people can put off the purchase of a new car, home furnishings, vacations, etc., existence relies on buying goods from farms. It’s unavoidable. Unlike TIPS and other public market securities, many of the investments in this category are for long-term-minded investors.

Healthcare/Technology

Companies that can successfully pass their increased costs on to the consumer without losing some along the way are by definition inflation resistant. Many examples of this exist in healthcare. Not unlike food, people will continue to find a way to provide for their most basic needs. Maintaining one’s health is basic.

Many consumers view keeping up with technology as basic. Within technology, the FAANG stocks, including Apple and Netflix as well as many smaller technology companies, don’t seem to lose demand as they increase their prices. People are still lining up to buy new iPhones, watching movies, and buying through Amazon Prime.

Basic

Materials

There are raw materials that are required for production by manufacturing businesses if they plan to stay in business. This includes timber, metals, and chemicals. Investing could, in some cases, be direct in the commodity or commodity futures. Investing in the producers, including mining companies, energy, chemical manufacturers, and lumber, could put the investor at the broadest end of the manufacturing process.

Consumer

Staples

There are products that most modern-day people won’t live without. The most basic foods are in this category, but if you recall the run on toilet paper as the pandemic set in, you know that people will risk their lives for basic amenities, including hygiene products. The theme is the same as some of the others above. If pricing is not going to be an issue for one reason or another, and the company is not overly diversified into more discretionary items, they may be worth looking at.

Government

Spending

The government’s appetite doesn’t take a break because of inflated prices. In fact, should a bout of high inflation be coupled with weaker growth, the government typically steps up fiscal spending to prime the pump and get money moving. Current spending themes are infrastructure, including transportation such as dredging harbors to make room for larger ships, improving the rail system, airport renovations, and highway projects. Part of this is subsidizing green initiatives to change the countries main production of electricity. The government also contributes a lot to support the healthcare system.

Take-Away

If inflation continues at the current pace, consumer behavior will change. Some of the better investment opportunities will be in companies where demand is maintained despite higher prices. Stocks of companies that produce discretionary items may not fare as well. In addition to consumers’ must-have list of food, consumer staples, and some technology, manufacturers also keep a must-have list. This list includes all the inputs to manufacturing, whether it be metals, textiles, timber, or even energy. The companies that produce these for businesses that have customers, will have pricing power as their customers need the basic building blocks to survive. The U.S. government is the largest consumer of all. Following where Washington is spending can lead you to companies with a customer that doesn’t balk at the price and seems to be resistant to economic downturns.

Managing Editor, Channelchek

Suggested Reading:

If Oil and Other Commodity Prices Feed Inflation, Where Might Investors Look?

|

The Sources of Deflationary Pressure According to Cathie Wood

|

Some Color on Prices and the Market’s Fixation on Inflation

|

U.S. Government Spending provides Investment Opportunities on Infrastructure

|

Sources:

https://www.treasurydirect.gov/indiv/research/indepth/tips/res_tips_rates.htm

Stay up to date. Follow us:

|