Barely an Impact on Oil Prices Despite Laura’s Wrath

Hurricane Laura ripped through the Gulf of Mexico this week forcing oil platforms to shut down. The Category 4 storm caused 84% of the production in the Gulf to go offline after reaching sustained winds of 150 miles per hour. Laura hit land on Wednesday night in the Lake Charles area, the heart of the domestic refinery business. Over 45% of total U.S. petroleum refining capacity is located along the Gulf Coast. One would expect oil prices to rise on drop in supply. Instead, oil price hovered in the $42 to $43 range. The benign impact on oil prices reflects changing dynamics in the U.S. energy industry.

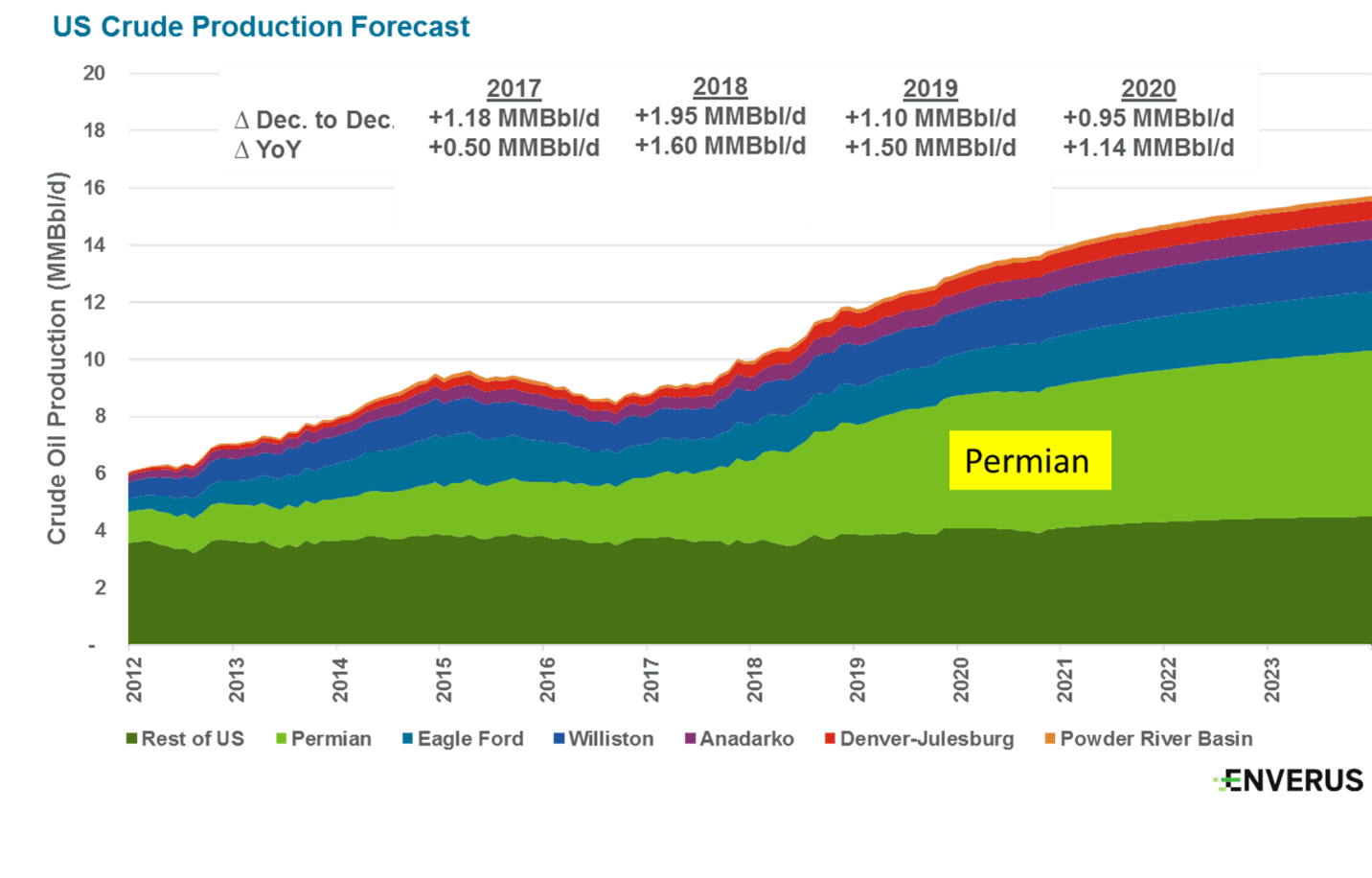

The Gulf is Less Important Due to Permian Basin Oil Production. Twenty years ago, production in the Gulf of Mexico represented almost one-third of domestic production. The boom in production in shale plays such as the Permian Basin have greatly decreased the country’s reliance on the Gulf of Mexico for oil. Now, the Gulf of Mexico represents only 17% of U.S. crude oil production.

Oil Inventories Were High. Petroleum product inventories were higher than normal before Hurricane Laura shut down oil refineries. The EIA reports that U.S. commercial crude oil inventories are about 15% higher than the five-year average for this time of year. The increase reflects a dramatic decrease in demand since the pandemic. Patrick De Haan, head of petroleum analysis at GasBuddy, estimates that gasoline demand, for example, is down 15% due to the effects of COVID-19. We are beginning to see a reduction in supply and an increase in demand, but it may take at least a year to work down excess inventory. The temporary drop in production due to Hurricane Laura can easily be met by oil in inventory.

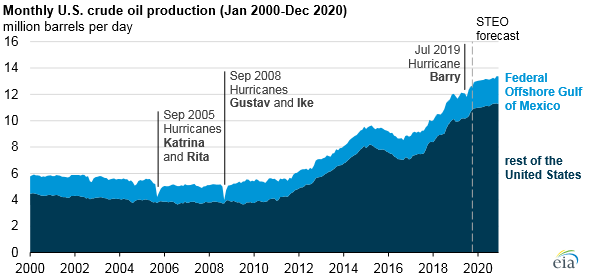

Producers Have Gotten Better at Restoring Production Quickly. In the past, a major hurricane resulted in a major disruption in production. The chart below shows the sudden drop off in production during Hurricanes Katrina and Rita in 2005 and Hurricanes Gustav and Ike in 2008. However, note the limited impact of Hurricane Barry last year. The smaller reduction in production may reflect the fact that Hurricane Barry was less severe than the earlier hurricanes. However, it also reflects the fact that hurricane forecasts have improved allowing producers to prepare for the hurricane and return to production sooner.

Refineries Outside the Gulf Were Running Below Capacity. Because of a drop in oil prices and oil demand following the economic impact of COVID-19, domestic oil production has decreased. Lower production has meant that domestic refineries are running below capacity. U.S. refineries were operating at 82% of capacity on August 21, 2020 according to the U.S. Energy Information Administration. Refineries that are not shut down due to Hurricane Laura should be able to increase production and offset lost production in the Gulf.

Sources:

https://finance.yahoo.com/news/oil-gas-prices-slip-hurricane-115423327.html, Jonathan Garber, Fox Business, August 27, 2020

https://finance.yahoo.com/news/oil-industry-shuts-platforms-rigs-214017121.html, Cathy Bussewitz, Associated Press, August 26, 2020

https://www.marketwatch.com/story/oil-prices-edge-lower-shrugging-off-hurricane-lauras-landfall-2020-08-27, Myra P. Saefong and William Watts, MarketWatch, August 27, 2020

https://www.marketwatch.com/story/hurricane-laura-may-do-little-to-disturb-relative-calm-in-summer-gasoline-prices-2020-08-27, Myra P, Saefong, MarketWatch, August 27, 2020

https://www.wwno.org/post/hurricane-barry-caused-biggest-gulf-oil-drop-more-decade, Travis Lux, WWNO, October 9, 2020

https://www.eia.gov/petroleum/supply/weekly/pdf/highlights.pdf, EIA, August 21, 2020

Suggested Reading

OPEC Forecasts Lower Demand as Output Cuts Taper

Canadian Oil Production Drops To the Lowest Level Since 2016

Unexpected Lower Oil Inventories are a Dent in the Upward Trend

Main image source: The Weather Channel, 11:00 am CST, August 27, 2020