|

|

|

|

The Nine Lives Investment Professionals Need to Survive the New Decade?

Money management in the coming decade is setting up to be far different than at any time in the past. This shouldn’t be a concern, change is natural. All industries go through waves of being reshaped, reinvented, and sometimes made obsolete. The main drivers of change to most industries are technology, demographic shifts, regulation, and customer preferences. Financial services companies, including investment advisors, wealth managers, and financial planners, may undergo dramatic shifts as their industry goes through a new cycle of growth and metamorphosis. For advisors, this new cycle represents a great opportunity. By quickly adapting their practice they can implement some important changes to their business model to excel. Those that take a business-as-usual approach, may not fare as well.

If you’re an advisor and need inspiration to act, remember this lesson: In a different industry, last decade, the drivers of change, along with a business-as-usual mindset, allowed the meteoric rise of Netflix (NFLX) and the quick demise of Blockbuster Video. The name, “Blockbuster” had been synonymous with movie rental. No longer. Unfortunately for the company, they defied change. Just as the show, Business

Wars explains in their episode, “Netflix vs. Blockbuster – Sudden Death,” in 2007 Blockbuster’s CEO, Jim Keyes said to the companies online general manager: “The online business is killing Blockbuster…I’m cutting off your budget so we can focus on the stores.” Up until then, Blockbuster had done well with their business model, from the perspective of management, they thought it best to stay that “proven” course.

Gaining proper perspective often involves stepping back or asking a trusted third-party for their view. Afterall, being too close to a subject often causes bias. Biases can be blinding. This is why third-party analysis from a service such as Channelchek, a provider of research for growth companies, is weighing in on the financial well-being industry outlook over for next decade. Using a perspective informed by analysis of demographics, technology, and other trends related to the money management industry, the following nine trends may be encountered through 2020 and beyond.

The Nine Red Flag Investment Advisor Challenges of the 2020s

- 100 is the New 80

Managing money with an additional 20 years in mind.

The decision to retire has always been met with important questions that involve the unknown. These unknowns include medical needs, inflation rates, investment returns, and longevity considerations. This last consideration, expected mortality, is a positive trend, but it does mean professionals involved in retirement planning will experience a growing risk to plan for. It wasn’t long ago life expectancy for someone retiring at the age of 65 was 13 additional years to 78 years-old. Amassing enough financial security to live another 13 years was not as difficult as what someone today faces at 65 years-old. Life expectancy has increased. Currently, it is much more probable that the 65-year-old will live another 30 or more years. Prudent investing with a 30-year time horizon may have to be less conservative than what it had been. Advisors may want to look at adding more growth-oriented investments than when the 13-year horizon was the standard.

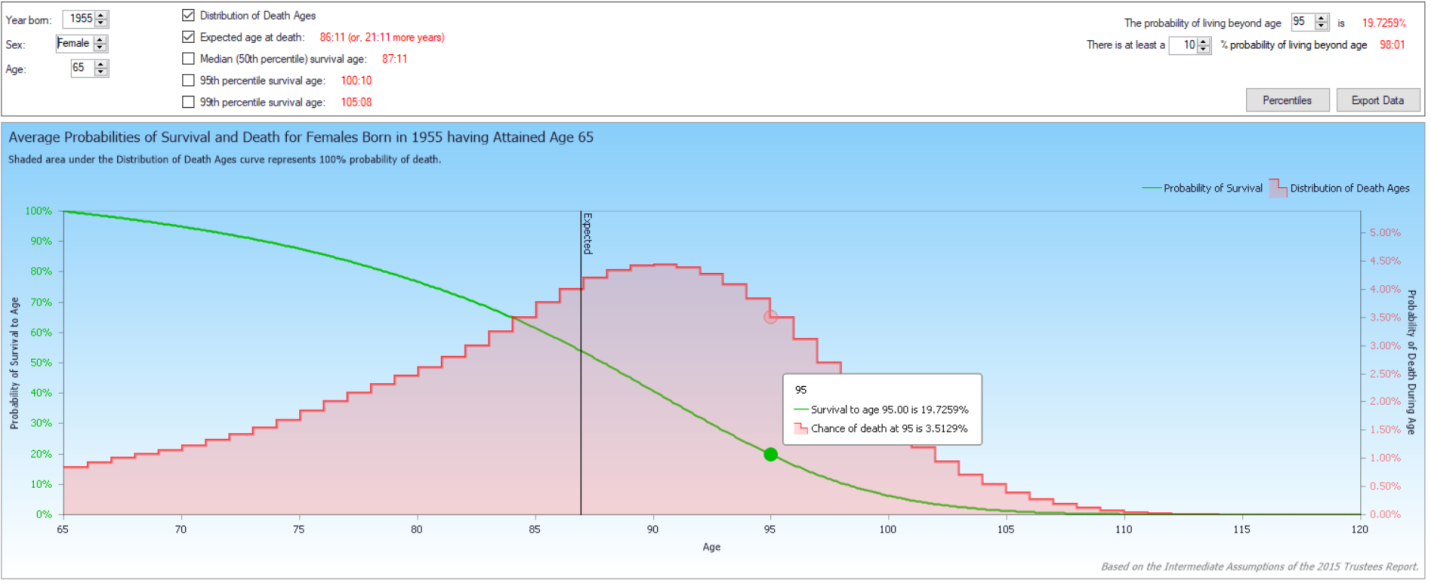

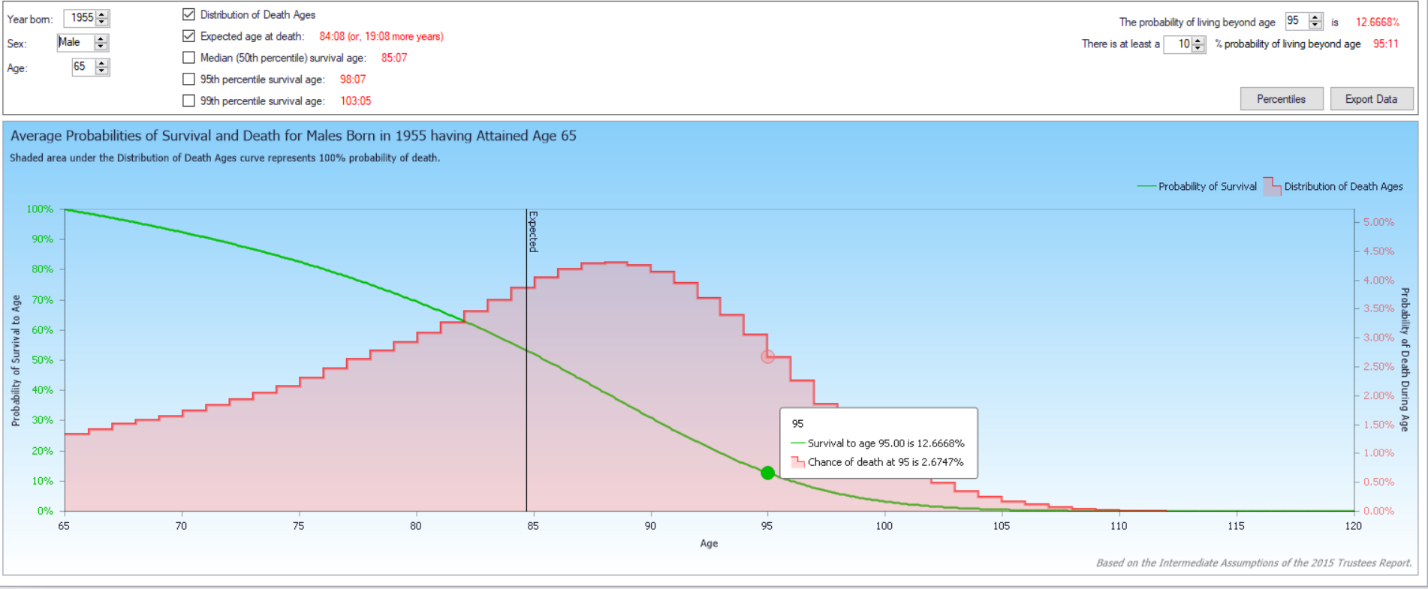

The Social Security Administration Office’s website (ssa.gov) provides analytical tools powered by its huge database. The tool used to create the charts below actuarially projects the amount of the population born in a specific year that is expected to remain alive in each successive year, along with the probability of death. Using the ssa.gov data, a woman born in 1955 who attains the age of 65 will have a 19.7% chance of living until age 95 and a 6.2% chance of living until 100. A male born the same year, after reaching their 65th birthday, has a 12.7% probability of reaching age 95 and a 3.2% likelihood of attaining age 100. Using the same analysis to gather estimates for men and women born 10 years earlier shows 10% more women living to age 95 and almost a 20% increase for men.

Tip: As an investment advisor in the 2020s, consideration should be given to not only invest “young” retirees money less conservatively in light of the dramatic change in longevity expectations, but to also provide clients with guidance of client money for decades after they retire.

- Surviving Probate

Clients children won’t always care how well you treated

their parent

Advisors, as part of their everyday business, make sure clients have selected proper beneficiaries for their financial assets. They document everything to help minimize any misinterpretation or possible legal challenges to completed forms or accounts. In the case of their Will, advisors will even inquire about other assets to make sure everything is considered. One goal is to make sure the process of probate is quick and easy for the survivors. This is part of the investment advisor role. IAs take time to protect and do what is best for the client’s heirs. Unfortunately, experience shows that this doesn’t mean when the money is passed down to the beneficiary that there is any feeling of loyalty by the heirs. The data demonstrates that the likelihood the assets will be retained under the original planner’s management after probate is very low.

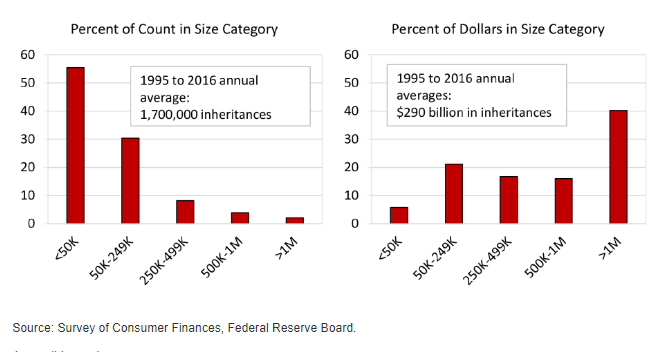

According to CNBC, $68 trillion will transfer to beneficiaries over the next two decades. Baby boomers whose needs were responsible for the growth of the financial advice industry will decrease in influence. Their assets may still require professional oversight, but there will be an enormous amount of movement. Those that inherit the money will likely be between the ages of 25 and 50. As life expectancy increases, the age of adult children inheriting their parent’s assets also increases. The older the children are, the more likely that they already have financial advisor relationships away from their parents. According to a survey of 544 advisors conducted by Investment News, “Sixty-six percent of children fire their parents’ financial adviser after they inherit their parents’ wealth.” The possibility of losing two-thirds of the assets under management is a risk that should not be taken lightl

If losing AUM isn’t enough motivation to adjust a firm’s business model, then consider that there may be a forward-thinking financial adviser who a few years earlier, accepted a number of $50 to $100-thousand accounts that another short-sighted advisor turned away. That adviser could soon be seeing some of these small accounts grow with sudden seven-figure deposits.

Over the 20-year period from 1995 through 2016 40% of inherited

assets were in excess of $1,000,000

Source: Federal Reserve Board

Tip: Diversifying a financial planning practice can be as smart as diversifying a client’s portfolio. Businesses need current income, and they should ensure their future income as well. It is far from a given that an RIA will retain assets as their clients begin to pass. It may be prudent to begin to bring on younger clients now, even if their account sizes are less profitable. General vetting of younger prospects may include young or middle-aged prospects from upper-middle-class families. Intentionally seeking no more than a 60% client base in or near retirement, 30% within a couple of decades until retirement, and 10% even younger, may protect your business from the great wealth transfer that statisticians say is inevitable.

- Fiduciary Trend

Client protection

requires broader expertise among advisory team

If the DOL rule is going to mimic the SEC rule, why has it taken so long to be released? Way back in May 2019, the Department of Labor (DOL) announced they are collaborating with the Securities and Exchange Commission (SEC) to announce final advice on the required duty of care by the end of May. This timeline was then changed to late Fall. Then to the end of 2019. As of this writing, it still has not been amended. When the original announcement was made, many expected the DOL was making amends with its original rule which may have overreached the authority of the DOL, a majority of the Fifth Circuit Court held that the DOL acted in an arbitrary and capricious manner when, among other things, it expanded the class of advisors regulated as “investment advice fiduciaries,” and created a new broad-based ERISA prohibited transaction class exemption known and referred to as the “Best Interest Contract Exemption.”

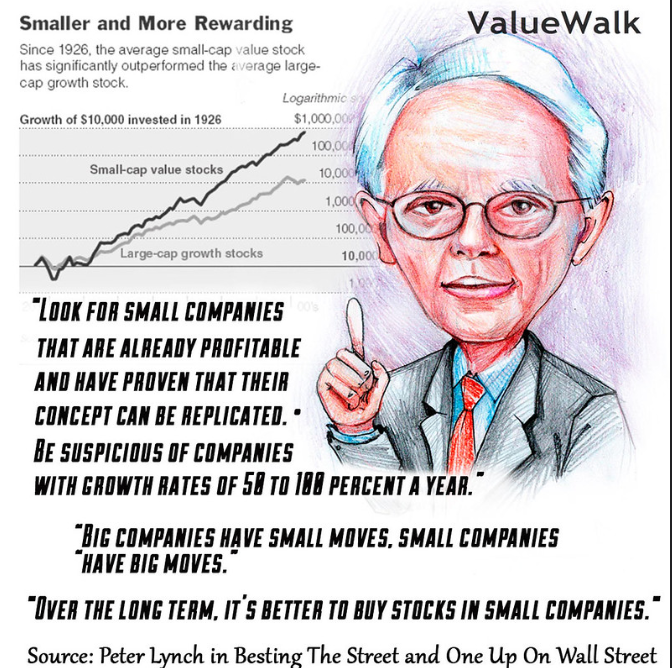

Most Investment Advisors overseeing retirement assets today are now making disclosures and believe they are following a “best interest” standard. But there are unknowns. What if the revised DOL rule does not have the best interest contract exemption (BICE). This may provide an opportunity for the small money manager or larger firms involved in both businesses to struggle to revise their business. One eventuality is that it is likely to create a complaint or even legal problems for some registered advisers. This doesn’t seem to be on anyone’s radar. Here’s a possible problem: The rule has the intent to protect clients. This protection is a sword that could swing both ways. One direction could be that an asset class that is typically considered too risky for qualified money for older adults is statistically prudent (or preferable) for the IRA rollover of a thirty-year-old. The thirty-year-old has 30-40 years for the money to grow. The asset classes that show the best probability of meeting a 30-year olds goals, it can be argued, should be considered in order to act in that client’s best interest. An aggressive attorney could potentially demonstrate that a non-aggressive adviser is not acting on their clients’ behalf no matter what the situation.

Tip: Planners who regularly give advice to clients regarding their qualified money should be proactive at keeping abreast of data on returns-over-time of certain sectors and the risk of implementing with funds versus securities. Another alternative is to leverage quality third-party research and probability-based projections.

- Boomer and Bust Cycle

America’s largest living generation is not the baby boomers

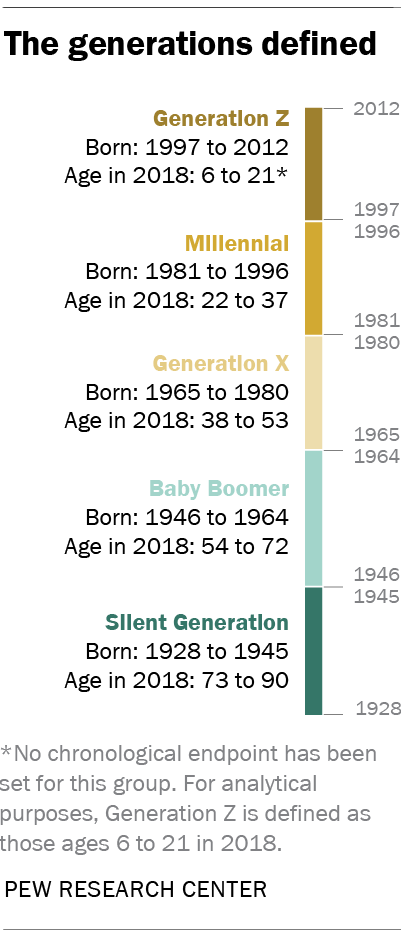

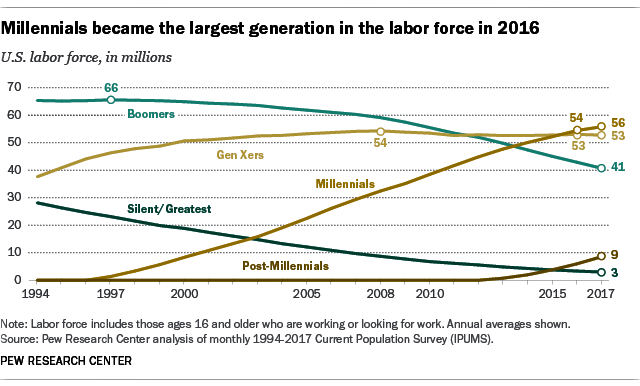

For advisory practices that view themselves as an ongoing concern, and for those that want to make sure their practice has value even after they retire themselves, prospecting where the money is now (born before 1965), could mean a future decline of AUM for the firm. As mentioned earlier, the great wealth transfer is going to shake-up the advisory firms that have been focused on clients with larger pools of assets. These were the baby boomers, and they have had a huge influence on everything as a result of their having been the largest living generation America has ever known. They still are impactful, but they are no longer the largest generation. Their influence is fading, the next impactful generation will be the millennials. They currently have more registered voters than the baby boom generation, and their employment rate is high. In fact, according to Pew Research, they are now the largest generation in the U.S. labor force.

The economic impact of this generation is hardly being spoken about now. Many counted in this group came of age during the great recession. They were slower to get started, but they are better educated and have been postponing expenses such as raising families until later in life. Millennials with a bachelor’s degree or higher, with a full-time job, had median annual earnings of $56,000 in 2018. This is roughly equivalent to those of college-educated Generation X workers in 2001.

Tip: To prospect for new clients of either age exclusively could be a mistake. The younger generations in most communities may not have amassed enough savings to allow advisors to exclusively focus on that age group. However, to continue to primarily prospect for the generation that is shrinking disregards the future. Advisors may want to diversify their client base using a variation on one of the methods employed in building a bond portfolio designed to protect from interest rate moves. That is, they can “barbell” their clients’ age where almost half are 25- 40 years old, and the rest are in or nearing retirement. Or, they could implement another bond management strategy that diversifies by “laddering” maturities. For an advisory practice, this just means if you are overweighted in boomers, begin prospecting the other age groups. Many younger people need and want financial advice, they have largely been ignored as the boomers have overshadowed them.

- Education Debt

A generation

accustomed to always making payment

The unemployment rate among educated millennials is lower than the national average. This is promising as they need the jobs because their student debt (according to Wakefield research) averages $22,919. The same research shows that they believe they will pay off the debt in 6 years. History suggests that 20 years of payments will be closer to actual experience. On average, Millenials are only repaying a little more than $1,000 a year, less than $3.25 per day. With cell phone bills, gym memberships, and other subscription type services, the generation is accustomed to having scheduled payments sent from their bank accounts. The generations before them were generally not electronically disciplined as there were fewer automatic mechanisms to pay bills or send to retirement accounts. Keep in mind, the baby boom generation was receiving paper paychecks at their age.

Tip: On the surface, prospecting clients that are in debt and not at the top of the pay scale may seem unwise. Remember, unlike baby boomers, they are less likely to have ever received attention from an advisor. Yet, they know how to regularly send money for things they have or want. One avenue to develop a younger client base is to hold educational seminars on student loan payment strategies. They could be held at a community center or local library as a public service. The seminar may be the first time anyone has paid attention to their finances. Those that attend are likely to be the ones that care and are in the best control over their money. If they are invited to become a client, and they accept, remember that as the student loan is paid off, the monthly payment that went to the lender could then be routed to their investments.

- Gig Economy

The workplace has changed, peoples retirement planning needs to

change

In 2005 the Bureau of Labor Statistics reported that “contingent workers,” those that we would now call freelancers or 1099 workers, represented 2 to 4 percent of all workers. Current studies place the percent of workers who earn all or part of their income in the so-called “gig economy” at 36%-50%. As dramatic as this seems, advances in smartphones, internet connectivity, and acceptance of working on a project with someone you’ve never met, has improved dramatically in 15 years.

This change in the labor force is important for investment advisors. Those working for themselves as opposed to a structured company could benefit from a financial adviser, helping them with their business and their retirement planning. Fewer 401k rollovers into IRA accounts will be available, but self-employed options, including Solo 401(k), SEP IRA, Simple IRA, and traditional and Roth IRA business, may replace a large percent of 401(k) rollover business. This shift to non-W2 income is increasing, excluding these earners could be a mistake.

Tip:

A good way to meet with people who either freelance full time or on the side is to become the local expert in these situations, then hold free educational sessions on working for oneself. Unlike other workers, many of these people are available during the day.

- Technology

You may not shake any hands when

you meet a client

The vast majority of clients will always gravitate toward those that pay attention to their specific circumstances. If you are hands-on, know your clients’ situation, check-in when there is something of interest to them, and they genuinely trust you, you shouldn’t lose business to a robo-advisor. But, the upcoming generation wants to be able to check account balances, allocation, and holdings online. You could lose assets if this is not part of your advisory platform. “Online” now includes their smartphone. Are you working with vendors that allow for everything (annuities, securities, and funds) to be viewed in the same place? Are values updated at the close each day? This is now expected in a world where people like to have their “whole world” in their hand.

If you aren’t having online meetings with clients, you soon will be. Younger clients could insist on it. At first, this may feel awkward, but once you’re set-up for digital meetings, you can save time. Check with your compliance officer to determine if any special recordkeeping or other protocol is expected.

Prospecting and serving clients and your community digitally introduce a whole host of compliance matters related to communications, advertising and blogs or articles. In order to avoid any violations, online articles or blogs may be expected to be submitted to compliance before they can be released. The advisor and all employees should know to be vigilant of what they post on their own social media. They could be putting the firm at risk with anything they share that could be deemed a recommendation.

Tip: Embrace technology to reach more people, make more information safely available, and to enhance the value of your brand. Don’t let technology get you in trouble, keep compliance involved.

- Securities Vs. Funds

Is your business prepared to custom

build portfolios?

When mutual funds, in their current form, gained public attention through the 80s and 90s, it was disruptive to the businesses of stockbrokers and investment advisors. At the fund companies there were professional portfolio managers behind the scenes, presumably with greater resources, creating portfolios for different sectors. As an investor, all one had to do was have the $2,500 minimum and they could be diversified to the extreme. Management fees were low compared to stockbroker commissions and seemingly painless as they were built into the overall return to the investor. The average person gained easier access to the markets, and funds flourished as the market trend was positive during much of this period.

During the period that mutual funds gained wide acceptance, financial advisors found it easy to incorporate them into their own business, and in many cases, went from a commissioned based feestructure to a percent of assets model. This new model was said to place both client and advisor’s interests on the same side. The more the assets grew, the more the advisor earned.

In 1993 the SPDR S&P 500 ETF was born. The purpose was to own the index and therefore perform in lockstep. Implementation of an ETF index fund in this way does not require the management that a mutual fund does, this allows for much lower underlying expenses. The Dow 30 ETF was not created until 1998. Nasdaq and the first small-cap ETF became available in 1999 and 2000. This new structure of funds took a bight out of the mutual fund business. Many mutual funds then reduced their expense ratios below their original level.

Life often comes full circle. Some conversation headed into 2020 among market pundits show concern that indexed funds and indexed ETFs may be harboring overvalued securities. One argument that has a less favorable view of indexed funds (mutual and ETF) sounds like this: Since most indexes weight components by market capitalization (stock price multiplied by shares outstanding), they don’t correct for possible overvalued holdings or sectors. They become an increased portion of the index as those assets keep rising. This phenomenon would place investors in funds that mirror the index at what could be viewed as a higher level of risk in a falling market. When markets decline, companies and sectors that are overvalued tend to decline faster. Another concern is that ever-increasing popularity of indexed funds and a rising market has caused weaker companies to ride the wave as fund managers are required to purchase more shares as more index investors come on board. Index funds may be required to own “undeserving” companies (based on traditional measures). At some point in the next decade there is likely to be a bear market. A prolonged selloff could mean havoc on “overvalued” stocks in the index.

Another concern pundits are discussing is the overlap of holdings for those that are “diversified” in several indexed funds. Clients may be less diversified than they are aware of if the same stocks appear in some of the various funds they hold

Tip: Know what is in the indexes of the funds your client holds. Mutual funds quarter-end holdings are available on the SEC Edgar online database. Index ETF underlying holdings are readily available as a percent of the index and there are also a number of websites that allow you to search a ticker to determine which ETFs are exposed to any ticke

Transaction costs for individual stocks are lower than ever. If your client has a large enough account to properly diversify, and you or someone in your firm are adept at analysis or subscribe to trusted third-party research, it could make sense to create managed accounts for clients.

Circa 1989

- Custodian Changes

Custodian Consolidation

and client satisfaction

According to Financial Advisor IQ, nearly half of RIAs surveyed by E*Trade say they expect a negative impact from continued consolidation among custodians. The survey was taken after Charles Schwab announced its acquisition of TD Ameritrade. The open question will be how well will these firms be able to integrate their processes, records, and reporting. RIAs may lose disgruntled clients if there is a long period of readjustments or outright mistakes made on client accounts.

Tip: If your firm uses a custodian that announces a consolidation, it may make sense to keep your options open if there are big differences between the two platforms. Another large firm that is not merging systems may be less disruptive to your clients.

Welcome

to the Twenties

Although no one knows for sure what meaningful change the future will bring, we can be sure there will be change, and it is likely to come at advisors even faster than it did over the past decade. To survive and thrive, every business has to be nimble and not be so set in their ways that they won’t adjust.

The current direction suggests that IA future clients will be younger, technology will play an even more important role, having the ability to offer more solutions to clients will help with best-practices. Bull markets eventually give way to bearish trends, no one knows when this will happen, as always, keep in contact with your clients, even if it isn’t in person.

Feel free to share this article, and if you haven’t already done so, create a (no cost) login at Channelchek.com for quality articles and research not found anyplace else. Look for Channelchek at the NobleCon16 investor

conference.

Reference Sources:

https://www.financial-planning.com/opinion/solutions-for-retaining-assets-after-a-client-dies

https://www.cnbc.com/2019/10/21/what-the-68-trillion-great-wealth-transfer-means-for-advisors.html

https://money.cnn.com/2017/01/09/pf/college/college-degree-payoff/index.htm

https://www.cnbc.com/2019/05/23/cengage-how-long-it-takes-college-grads-to-pay-off-student-debt.html

https://www.irs.gov/retirement-plans/retirement-plans-for-self-employed-people

https://financialadvisoriq.com/c/2586293/299723?referrer_module=article

https://www.stitcher.com/podcast/wondery/business-wars/e/53166712

https://www.ssa.gov/policy/docs/rsnotes/rsn2016-02.html#exhibit1

https://www.cnbc.com/2017/12/11/to-hang-on-to-boomers-assets-advisors-must-court-their-kids.html

https://www.bls.gov/cps/lfcharacteristics.htm#contingent

https://nation1099.com/gig-economy-data-freelancer-study/#BLS