|

|

|

|

Who Would be Happiest with Negative Interest?

Negative interest rates can be hard to wrap your head around. After all, why would anyone accept earning less than the yield available keeping cash in their mattress? It doesn’t seem to make sense. The first time I experienced rates below 0% was the 2008 financial crisis after Treasury Bills, and even Federal Agency discount notes traded briefly below zero. Those occurrences, 11 years ago, seemed like a once in a lifetime oddity. But they weren’t. Since then, economies around the globe have had below zero interest from time to time, and we’ve become more accustomed to the concept. We used to think that the floor for rates was zero, now we know, in theory, it is infinitely low.

Interest Rate

Basics

The Federal Open Market Committee (FOMC), makes decisions on interest rate targets. These decisions are then implemented by the Federal Reserve Bank of New York (The Fed). Through open market operations, they impact the interest rate level banks charge each other to borrow money overnight (fed funds rate). They do this primarily by injection of money into the economy by purchasing securities or by taking money out by selling securities. This is how it works. Buying securities adds to money supply; this lowers the price (rates) banks need to pay for reserves. Selling securities takes money out of the system, which makes money tighter and puts upward pressure on rates. The impact of overnight rates and expectations on how long they will stay at a specific target impacts longer-term rate moves. This is the main lever by which The Fed steers the economy by adjusting rate targets.

Historically The Fed raises interest rates to tap the economic brake pedal to keep inflation at bay in a strong economy. This works because when borrowing costs by business and consumers are higher, demand for goods is reduced. Should the economy be weakening, The Fed targets a lower rate policy to encourage borrowing, thus spending.

The FOMC has not ever decided that U.S. interest rate policy is best served by negative rates. This is not to say it hasn’t been discussed. The Bank of Japan in its fight with deflation was the first central bank to move to a zero-interest policy (1999), its key overnight rate has been negative since 2016. Six years ago, the European Central Bank (ECB) adopted a policy of negative interest rates to avert an economic crisis. The ECB slashed its deposit rate to negative 0.1% that year to avert deflationary pressure and to stimulate the economic region. The current ECB deposit rate is negative 0.5%, which is the lowest ever.

How Do Sub-Zero Rates

Fight Deflation?

When the economy slows, consumer spending slows and businesses become more careful with their spending. Without confidence in an improving economic environment there is no reason to increase spending. This has at times led to lower prices and could cause unwanted deflation to become entrenched in the system. The undesirable cycle starts when spending slows, demand declines, prices fall (to attract buyers), teaching consumers to wait for even lower prices.

Negative rates fight deflation by increasing the costs of holding money while waiting for lower prices. It simply incentivizes spending. The choice for individuals are to keep their money in the bank and watch it become worth nominally less over time or spend it and perhaps even borrow at historically low levels which stimulates the economy

Are Negative Rates in

the Cards for the U.S.?

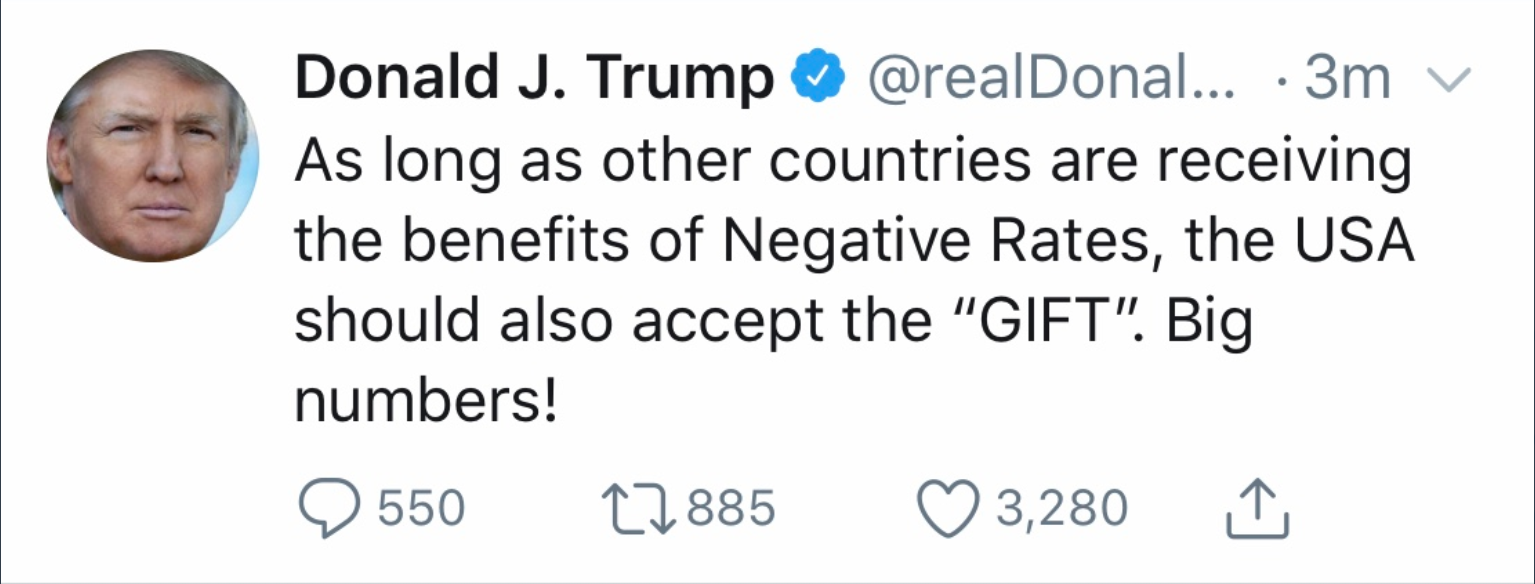

President Trump has been vocal on the subject of negative rates. He has referred to them as a “gift” for the economy. The Fed, which takes its marching orders from the FOMC, insists negative interest rates are not being considered. Federal Reserve Chairman Jerome Powell is on record as having said, “I continue to think, and my colleagues on the Federal Open Market Committee continue to think that negative interest rates are probably not an appropriate or useful policy for us here in the United States. ”

The Fed has a number of other tools in its arsenal that it has not been slow to use. For now, it seems clear the fed fund rate target will be zero or above.

How Would Personal Finances

Be Impacted by Negative Rates?

For most, rates directly impact us when we borrow, including credit cards and deposit accounts. The stock market, along with real assets, would also be affected:

Loans — The European experience with rates this low has been high loan demand after implementing negative rates. Denmark’s third-largest lender, Jyske Bank, serviced 10-year loans with a negative 0.5% APR. Nordea Bank, based in Finland, wrote 20-year mortgages at 0%. The risk is that demand is increased, and assets purchased on cash flow increase in value too quickly.

Credit Cards — The average credit card rate is 16.01%. Negative interest rates would certainly lower credit card terms. This would happen as negative interest rates create more competition between card issuers that make money on the spread between what they pay for money, which would be very low, and what they charge consumers. It is not likely consumer rates would approach zero, but they would be reduced to the point that card users would have more cash in their pockets. More cash could cause increased consumption

Deposit Savings — Yields on savings accounts would be reduced to near zero. When this has happened in the past, banks have then instituted fees that effectively cause depositor returns to drop below zero. One of the primary purposes of negative interest is to encourage spending by those waiting for lower prices. This could draw these people out to make their purchases. Big savers, such as retirees on a fixed-income, keep a high percentage of their “nest egg” in Certificates of Deposit. This age group has been hardest hit in the past as rates approached zero.

Equity & Real Estate

Markets –

Low rates have the effect of pushing savers and investors into riskier assets. As cash moves from safer investments to seeking more return, the equity markets could increase with the added demand. For many, potential earnings are preferable to sure erosion of savings. The actual stimulative impact of the zero and sub-zero rates would take time. The lag could be as much as a year for the cheap money to work its way into asset prices.

Increased activity in real estate

investments could also benefit. Banks will first need to have enough confidence in the economic future to lend, allowing homebuyers and speculators to become buyers. Financially strong borrowers are likely to have access to bank and private borrowing. The increase in real estate activity will put upward pressure on real estate prices. Additionally, large purchases are made based on cash-flow. Lower or negative borrowing rates reduce monthly payments. It would not take long before prices to get bid up by buyers or held high by stubborn sellers.

- Take-Away

Negative interest rates are a monetary policy tool for unprecedented economic times. They have been used to both stimulate economies and fight deflation in other countries. The U.S. has experienced its own market-driven (not policy-driven) negative rates. It should not shock and panic the markets if The Fed adopts a negative interest rate policy. The President has expressed his approval of such a policy. The Chairman of the Federal Reserve has repeatedly said it’s not looking to implement sub-zero borrowing rates at this time.

The equity markets could benefit as savers reach for potential return rather than sure loss and put more risk in their portfolios. The other asset class that could benefit is real estate. This would be driven by cheap money available in a market that is driven by borrowing

Paul Hoffman

Managing Editor

Suggested Reading:

Stock Index

Adjustments and Self-Directed Investors

The Correlation

between Passive Investing and Underperformance

Enjoy Premium Channelchek Content at No Cost

Sources:

Short-Term

Yields Go Negative in Scramble for Cash

Asset

allocation in a world of financial repression

Negative Rates, designed as a Short-Term Jolt, Have Become an Addiction