The Stock Market Measured in Four-Year Presidential Terms

The Presidents that President’s Day honors can all be said to have sacrificed quite a bit to serve their country. The role for most would be the epitome of a stressful job. Over time history judges them on their many accomplishments and becomes more tolerant of what was perceived as failings. Part of this Presidential history and measure of success are the statistics compiled during their time in office. Statistics are not necessarily the fairest measure of success with economic growth, the pressure to go to war, civil unrest, and all the other issues they are confronted with. After all, their office is only fractionally in control of anything. Still, there is some meaning in the data. Studying stock market history can better help us recognize trends should they begin to recur. With this in mind, let us look back at the citizens that we chose to sit in the oval office and review the returns of the S&P 500 under their watch.

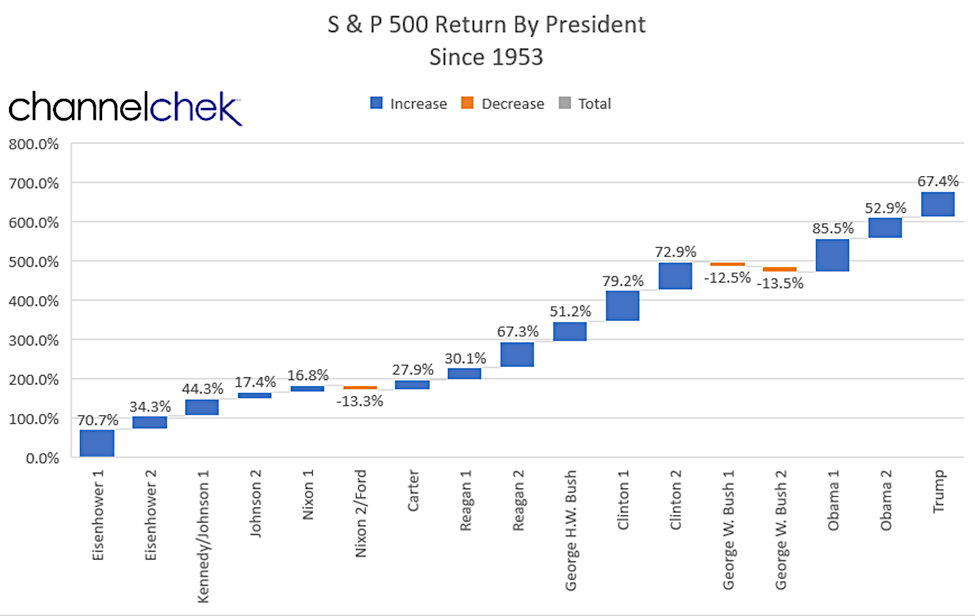

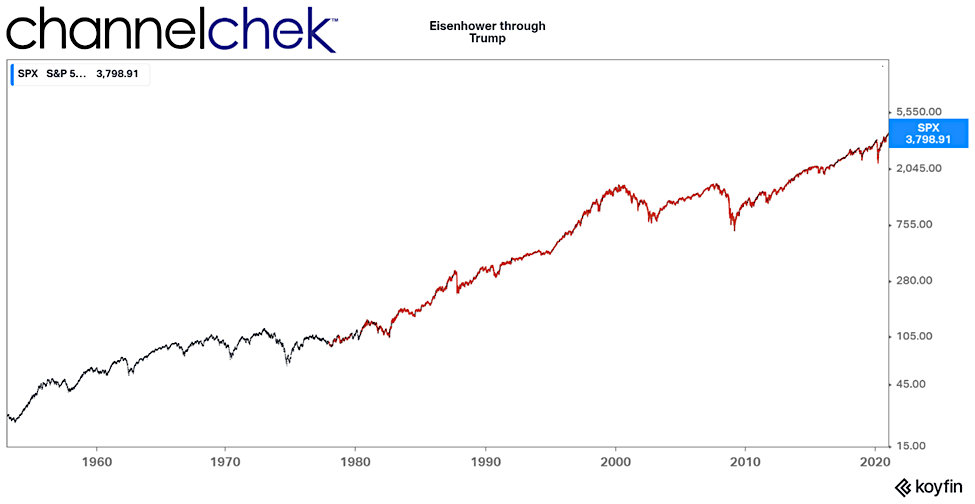

The S&P 500 began providing measurements to the public back in 1957, with data provided back to earlier in the decade. So our review begins in 1953, on the day President Eisenhower was inaugurated.

President Eisenhower (Ike) Served as President for two terms; during the first four-year term, investors saw the market shoot up by 70.7%. During the second term, investors were treated to an increase of 34.4%. This growth masks the three recessions Eisenhower faced during his two terms in office. The recessions of 1953 and 1958 were in large part tied to more restrictive monetary policy from the Federal Reserve, while another recession began in 1960 after the Fed had doubled interest rates over two years.

President Kennedy (Jack) Inaugurated in 1961 and assassinated in November of 1963; the combined return during his time in office and Vice President Johnson’s completion of the second term was a 44.3% increase. Kennedy ran on the slogans “Getting America Moving Again” and “A Time For Greatness.” However, the economy remained sluggish, and unemployment remained high at 6.8% when he took office. The only bear market under his term is said to have been triggered by his doing battle with U.S. Steel over prices. Wall Street rarely approves of the government dictating what private companies can do.

President Johnson (LBJ) was sworn in following Kennedy’s assassination. During his reelection term, the country enjoyed a rise in the S&P 500 of 17.4%. When LBJ took office, he quickly passed tax cuts proposed by Kennedy. There was a lot of speculation and probably overvaluation during his term. Johnson held a “guns and butter” policy that held the notion the taxpayer could pay for both the Vietnam War, along with “Great Society” social programs.

President Nixon (Dick) was in the oval office as the country experienced 16.8% growth during his first four years. He was reelected but resigned two and a half years into his second term. Nixon remains one of the most “progressive” Presidents in U.S. history based on the use of government directly controlling business. The economy experienced high unemployment and a high inflation rate (stagflation) along with sluggish growth during the ’70s. Because of this, in 1970, Nixon took the unusual step of using an executive order and imposed a freeze on wages and prices with hopes that declaring increasing prices illegal would help. A year later, he protected the faltering dollar’s value by taking the currency off the gold standard. The short-term result of the economic meddling was a stock market crash that halved the value of the S&P 500 between January 1973 and October 1974.

President Ford (Gerry) presided over the last two years of Nixon’s second term. He inherited many of the economic problems started by LBJ and compounded by Nixon’s actions. Stagflation continued, but the stock market began trending up again in 1975.

President Carter (Jimmy) The ‘70s were not a good time economically. Although the market rose 27.9%, The Feds easy money policies used to aid high employment resulted in skyrocketing prices. Under Carter, the country was handed the painful “medicine” it needed to regain health. The Fed tightened monetary policy and pushed interest rates all the way up to 20%. Interest-sensitive sectors saw sales plummet. Industries, such as housing and cars, were crippled by the increase in interest rates to double-digits. However, the circumstance halted any pricing power (inflation). These steps helped lead to Carter’s failed reelection bid while also setting the stage for some of the better economic times during the next decade.

President Reagan (The Gipper) The first years of the new decade produced one of the longest recessions in the post-war period; that downturn served to break the vicious cycle of inflation. The U.S. came out of recession in November of 1982. Weary businesses then expected inflation to return, the steady hand of the Fed helped keep those risks at bay. Reagan, who had majored in economics, took the policy reins and implemented his version of supply-side economics (the theory that growth can be created by reduced taxes minimum lower regulations). During Reagan’s first term stocks moved up 30.1 % and continued another 67.3% during his second. The stage was set for the U.S. to lead economically for years to follow.

President Bush (Poppy) The Fed continued to have moderate growth and tame inflation as its goal and target. If given a choice of one over the other, keeping inflation down was their priority. Although the stock market rose 51.2% during Bush’s four years, the Fed had been applying the economic brake pedal by raising rates to counter inflation. The economy responded by slowing toward the end of Bush’s term.

President Clinton (Bubba) stepped in as positive economic conditions all converged. The markets rose 79.2% during his first term and 72.9% during his second four years. Inflation fell to less than 3%, and the U.S. experienced the first decade-long expansion in history. The peacetime economy freed up some of the brightest minds that might otherwise have found employment designing weaponry. Instead, they graduated college and created technology benefitting the masses and fostering productivity. These tech companies and the potential they held led the stock market to a record high. Fed Chairman Alan Greenspan dubbed the period of high growth and low inflation the “Goldilocks Economy” suggesting that it was a fairy tale existence. He also warned of “irrational exuberance.”

President Bush (Dubya) is the only President since 1953 to have a four-year term with a negative stock market return. He had two of them. Stocks fell 12.5% during his first term and 13.5% during his second. A speculative bubble had formed around tech and dot-com companies during the ‘90s which unwound during his time in office. Toward the end of Bush’s second term, with interest rates above 5%, the Fed began slashing rates dramatically. The low rates set the stage for a housing bubble.

President Obama (Barry) the great recession which began in the financial sector under Bush had already had the “kitchen sink” thrown at it in terms of stimulus characterized by massive monetary injections and unprecedented corporate bailouts. The Fed kept its foot on the gas pedal, this caused U.S. debt levels to increase a massive $8.6 trillion. The lengthy debt-fueled expansion under Obama’s two terms also saw a surge in technological innovation, earnings, and extremely low-interest rates that left many investors no choice but to put their savings in the rising equities markets.

President Trump (The Donald) The United States was already eight years into the longest economic recovery in history when President Trump was elected. The market jumped immediately after he won the 2016 election. From the time he was inaugurated as the 45th President, it climbed another 67.4% (four years). Trump’s policies incentivized companies to repatriate back to the U.S. over one trillion in profits they were sheltering overseas from high U.S. taxes. Lower corporate taxes and more investible cash on U.S. soil pushed profits higher as the economy experienced some of its strongest numbers recorded. During the last year of his term, there was an intentional reduction in commerce as a reaction to a pandemic seeking to reduce the risk of workers infecting each other. Easy money and confidence in the future still provided for a double-digit year despite the pandemic.

Take-Away

The factors that move stocks within any period are many. They include; available financial capital, human capital, the global economic pace, taxes, natural disasters, war, national confidence, and prior economic momentum. The person sitting in the oval office can only influence a few of these. Often, that influence has a lag effect that has more impact years down the line. The above timeline includes over 70 years; with it, one can see how the policies of one presidency impacted the next. However, there is rarely a straight line of policy and result. Attributing one administration’s S&P 500 return to a prior administration is made even more cloudy by the market’s tendency to be forward-looking. The Federal Reserve Bank’s job is to maintain a sound banking system. The Fed reports to Congress and may have an agenda that conflicts with the executive branch in D.C.. The two could actually undermine the other. There are also immeasurables with great impact; these include trust. The forward-looking market doesn’t do well if it doesn’t trust that governmental policy won’t make unexpected changes that impact business and clouds investors ’ already faulty crystal ball.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

The Limits of Government Tinkering

Workcations Add a New Class of Traveler

Corporate Americas Fair Share of Taxes

Stay up to date. Follow us:

|

|

|

|

|

|