Why Apple Can Hold the Line on iPhone Prices and Keep Getting Relatively Cheaper

Inflation in the U.S. is surging to near a 40-year high, with prices on food, fuel and pretty much everything seeming to rise more every month.

Smartphones may be an exception.

Apple, for example, recently announced its new versions of the iPhone and other gadgets, and turned a lot of heads when it said it wouldn’t charge more despite higher costs to make the devices.

This is puzzling because companies typically raise prices in line with inflation – or at least enough to cover the increased costs of making their products.

Consumer price data tells an even more befuddling story. The latest consumer price index data suggests smartphone prices are actually down 20.4% in August from a year ago, according to an index released on Sept. 13, 2022. That’s the biggest drop of any detailed expenditure item the Bureau of Labor Statistics tracks, and contrasts with the overall 8.3% increase in prices.

What’s going on?

As an economist teaching business school students, I enjoy exploring and explaining these economic puzzles. I believe there are two basic explanations – one for the data and another for Apple.

Why Consumer Prices on Smartphones Fell

The story behind the consumer price index data is easier to explain, if a bit technical.

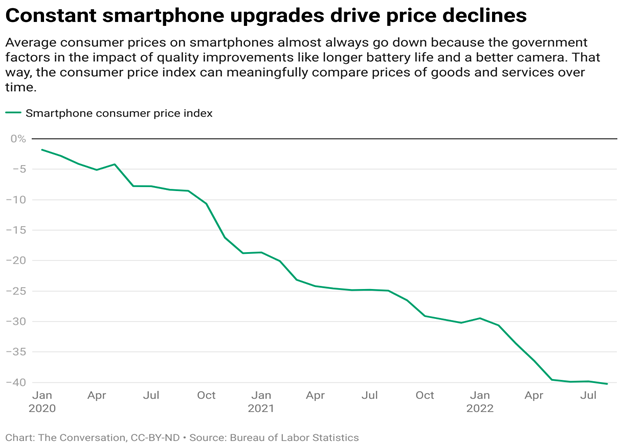

The 20% drop over the past year isn’t unusual for smartphones. In fact, according to the index, they almost always go down from month to month. Since the end of 2019, smartphone prices have come down a whopping 40%.

And though smartphones are showing the biggest drop in the index, tech gear more broadly – from computers to smartwatches – also tend to fall over time. In the previous 12 months, televisions are down 19% and what the government calls information technology commodities are down 8.8%.

Part of the reason for their steady decline is found buried in the Bureau of Labor Statistics website. The consumer price index tries to measure a constant quality of goods and services in the economy. This means it seeks to track the price changes of the exact same set of goods and services each month. It’s comparing the price today with the price of the exact same thing a month or year ago.

For most goods, it’s not really an issue because their quality doesn’t change much over relatively small periods of time. For example, an apple you bite into today is pretty much the same as an apple you ate a year ago.

Smartphones and other technology-heavy gadgets are different. Because smartphones are constantly improving in quality – with the latest updates of an iPhone or Samsung Galaxy awaited breathlessly every year – it is more difficult to ensure you’re comparing prices of products of the exact same quality.

For rapidly improving items, the Bureau of Labor Statistics uses what are called “hedonic regression models” to estimate these changes in quality over time. Hedonic models measure the same amount of satisfaction. While this sounds complicated, the goal is simple: to figure out how much each new smartphone feature changes the price.

As a consumer, you are essentially doing this whenever you decide whether it is worth paying the extra money for that marginally better camera or extended battery life when buying a new phone.

And so, the 20.4% drop doesn’t mean you’re going to pay less for a new smartphone. But it does suggest you’re getting 20% more bang for your buck versus the same phone a year earlier. Whether it’s worth it is another question.

Why Apple Kept Prices Flat

That brings us to why Apple didn’t change its prices, even as the quality of the iPhone improved and supply chain costs went up.

Beyond the quality issues, one of the main ways supply chain problems are affecting phones is in the shortage of computer chips. If there is any product dependent on computer chips, it is smartphones. The shortage has resulted in delays to produce cars, trucks and many other consumer items.

The shortage has also increased the price of semiconductor parts. The U.S. government’s producer price index shows the price of semiconductor parts like chips and wafers steadily rising since the COVID-19 pandemic began in 2020, after falling for years. Chip prices are likely going up 20% in the next year.

For these and other reasons, analysts were expecting Apple to increase its prices.

Instead, Apple released its latest iPhone models at the same prices as the last two models, or US$799 for the iPhone 14 and $999 for the pro version. Keeping prices constant during inflationary times means iPhones are getting relatively cheaper.

So why isn’t Apple increasing prices? Is it just being kind to its customers, who have fueled tremendous profits for the company over the past decade?

Probably not.

With a gross profit margin of over 40% – meaning that’s how much it makes over the cost of producing all its products and services – Apple can probably afford to absorb increased chip and other component costs.

My best guess, since the smartphone market is fairly competitive, is that Apple is keeping prices the same to build market share in the U.S. – beyond the record 50% it recently hit – so the iPhone remains one of the best-selling smartphones.

So while the cost of almost everything we buy is rising, you can take some comfort in knowing at least one item is getting both better over time and not succumbing to an inflationary price spiral.

| This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It represents the research-based findings and thoughts of Jay L. Zagorsky, Clinical associate professor, Boston University. |