Is This The Start Of A New Golden Age Of Gold Mining Deals?

We may be about to enter a new golden age of gold mining deals as explorers and producers seek to capitalize on higher metal prices and gain exposure to other key minerals, including copper, at a time when consolidation in the gold industry vastly trails that of other metals.

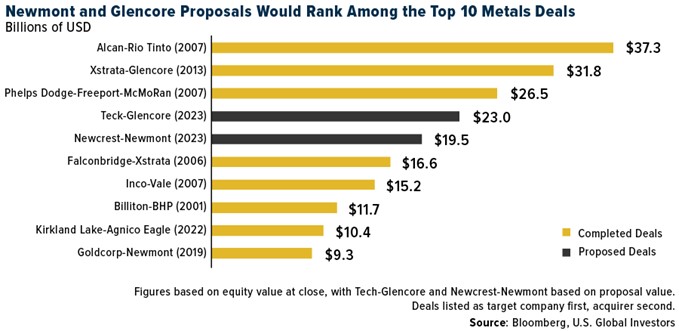

Last week, major U.S. gold producer Newmont raised its bid for Australian rival Newcrest Mining to $19.5 billion after its earlier bid of $17 billion was rejected. Due diligence is expected to take around four weeks, and if Newcrest’s board and shareholders accept the offer, the acquisition would represent one of the top 10 biggest metal deals ever and the single biggest gold mining takeover, nearly twice the value of last year’s merger between Kirkland Lake and Agnico Eagle.

(A note about the chart above: Just today, Teck Resources rejected Glencore’s $23 billion takeover bid, calling it “opportunistic and unrealistic.” Vancouver-based Teck says it will proceed with plans to spin off its steelmaking coal business, creating two new companies: Teck Metals and Elk Valley Resources. This separation “creates a significantly greater spectrum of opportunities to maximize value for Teck shareholders” compared to an acquisition by Glencore, says Teck’s Board of Directors Chair Sheila Murray.)

This article was republished with permission from Frank Talk, a CEO Blog by Frank Holmes

of U.S. Global Investors (GROW).

Time will tell if Newcrest approves of Newmont’s offer, but I believe this could be the start of a much-needed consolidation cycle in the gold industry, one that could potentially benefit shareholders.

Gold Is One Of The Most Fragmented Gold Mining Industries

Back in 2019, many analysts and market participants—myself included—heralded Newmont and Goldcorp’s $9.3 billion merger as the beginning of a new era of gold consolidation, and I believe the Newmont-Newcrest deal could serve as a (delayed) continuation of the trend.

The truth is that, compared to other important metals, gold is sorely in need of consolidation. The chart below, courtesy of metals and mining consultancy firm CRU Group, shows the global share of output from each metal’s top 10 producers. Gold is at the bottom, with its top 10 producers responsible for only 28% of global output. By comparison, the top 10 iron ore producers generate nearly 70% of the world’s supply.

Higher gold prices in recent years have not resulted in significantly increased exploration spending. In lieu of that, companies can expand and create shareholder value through mergers and acquisitions (M&A), which allow miners to “increase their production share, replenish depleting gold reserves and… lower production costs through relatively less risk,” writes CRU analysts.

Copper To Face Ongoing Supply Deficits

M&A can also result in metal diversification—one of Newmont’s stated goals in acquiring Newcrest. Copper currently accounts for roughly 25% of Newcrest’s total net revenue, and the company hopes to increase it to 50% of revenue by the end of the decade. As one of the key minerals in the global transition to renewable energy, copper is poised to surge in price in the coming years as demand far outpaces supply.

In fact, copper mining deals exceeded gold mining deals in total value last year, according to a new report by S&P Global. M&A work among copper companies in 2022 totaled more than $14 billion in value, a 103% jump over the previous year, while the combined value of gold deals stood at $9.8 billion, a 48% decrease from 2021.

US Global Investors Disclaimer

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Blockchain Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE. Effective 8/31/2018, Frank Holmes serves as the interim executive chairman of HIVE.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2021): Torex Gold Resources Inc., Centerra Gold Inc., Gran Colombia Gold Corp., Dundee Precious Metals Inc., Pretium Resources Inc., Endeavour Mining PLC, Barrick Gold Corp., Eldorado Gold Corp., SSR Mining Inc., Silver Lake Resources Ltd., Karora Resources Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.