It’s Bitcoin’s 13th Anniversary, Has it Delivered on its Promise?

On the 13th anniversary of the infamous white paper that gave birth to Bitcoin, the question is, “Has Bitcoin lived up to the original vision?”

The short answer is – Absolutely Yes.

The challenge is that there are two sides to Bitcoin

- Using Bitcoin – what is it and how it works, and

- Investing in Bitcoin – what it’s worth and where it’s going.

There’s a lot of hype about Bitcoin – but these two things are true.

- Many people use Bitcoin. Since its launch in 2009, more than 76 million people worldwide have used Bitcoin.

- Most investors have no idea how it works. One survey says that only about 17% of crypto investors “fully understand” their investment. In contrast, more than 33% have almost no idea how it works. This is not surprising since 40% of all crypto purchases come from new investors.

In this article, we’ll cover, what Bitcoin is and how it works.

We will cover Bitcoin investing in another post (receive Channelchek email updates).

How it All Started – The Birth of Bitcoin

October 31, 2008

On October 31, 2008, a nine-page white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” was published under the name Satoshi Nakamoto. As anyone familiar with Bitcoin history or legend knows, Nakamoto is a pseudonym. The search for the real “Nakamoto” has been going on since 2008.

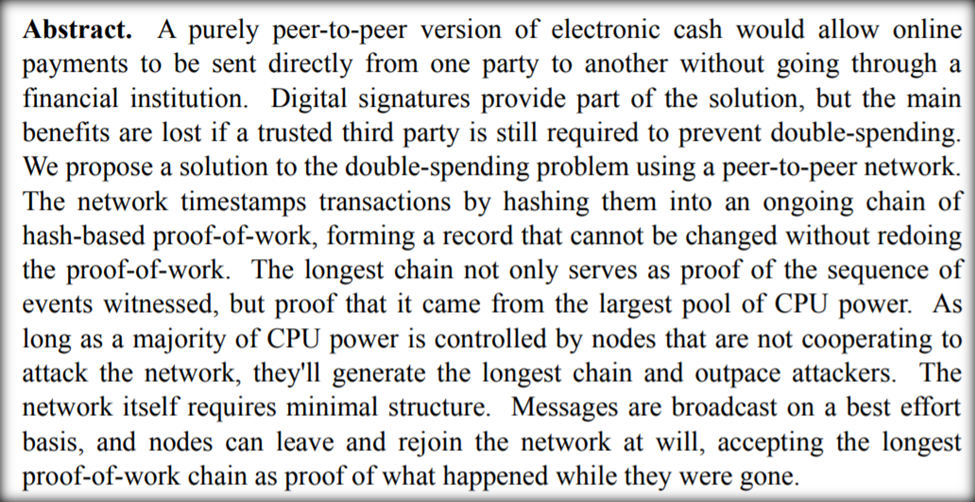

The white paper had a brilliant and novel idea to fix an inherent and growing weakness in the current banking system.

Nakamoto Explains the Problem with the Banking System

The majority of commerce on the Internet relied almost exclusively on third-party banks and financial institutions to process electronic payments. This system works well for most transactions. But the weakness is the reliance on a “trust-based model.”

Banks deal with each other by trusting each other to process the transactions – but this trust is not absolute. Bank transactions can be reversed and are also subject to mediation. The increasing cost of mediation and reversal of transactions lead to increase costs.

Merchants hassle customers for information to try and minimize the certain, inevitable, and acceptable amount of fraud that occurs in this system

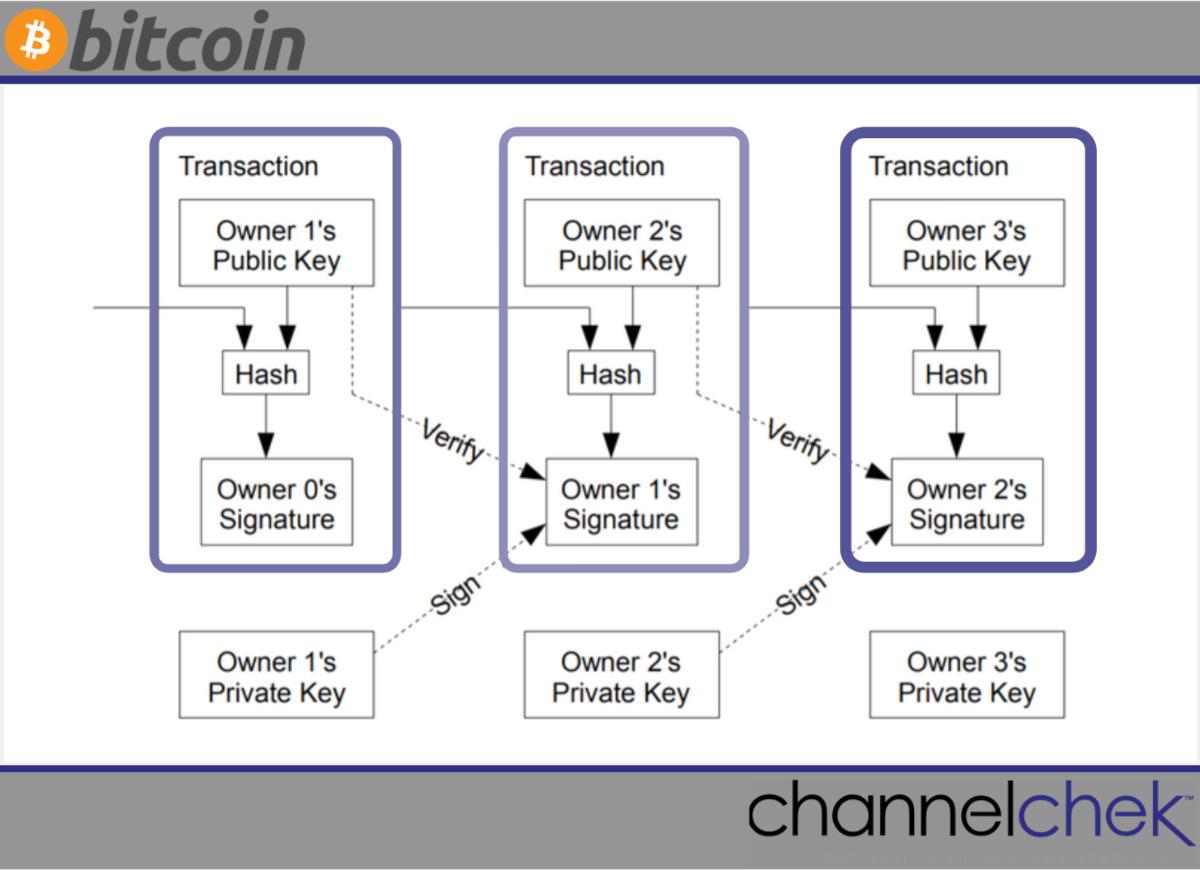

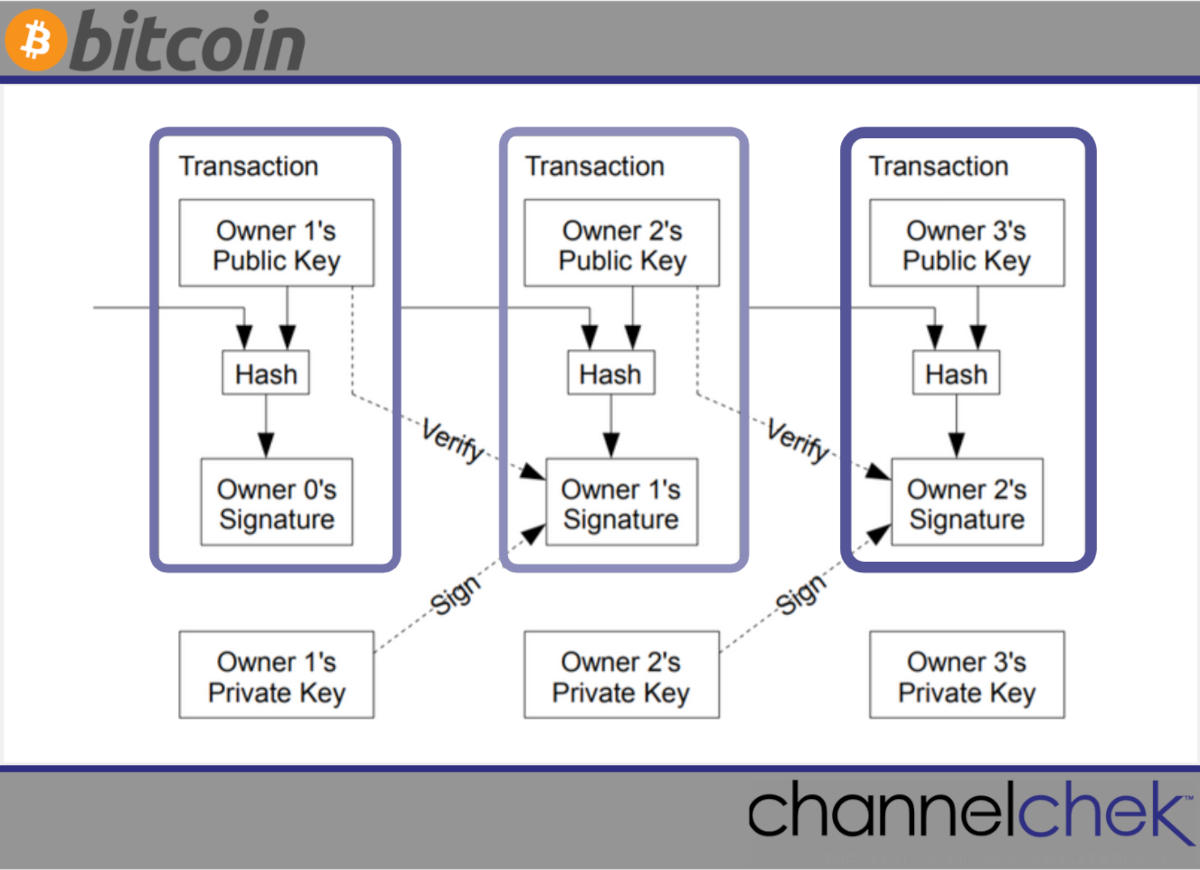

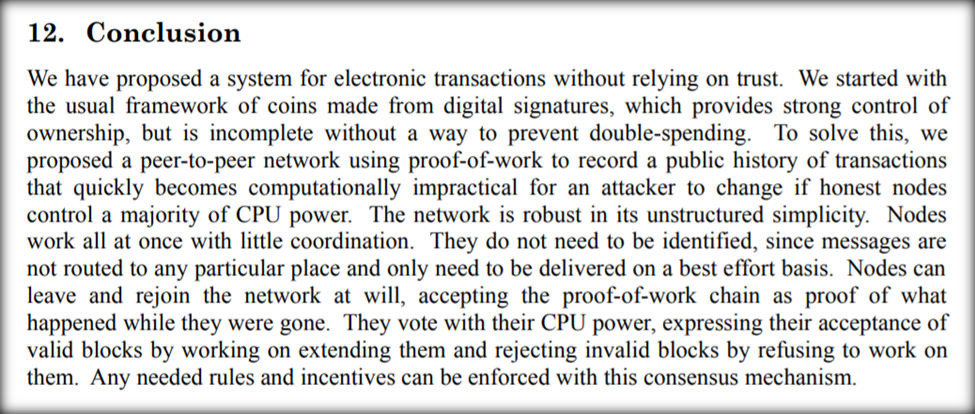

What was needed was a method allowing two willing parties to transact directly with each other without needing a trusted third party, namely banks.

The parties did not need to trust each other or even know each other. The transactions would be protected from fraud because they were “computationally impractical to reverse” and had routine escrow mechanisms.

And there is an impossible-to-change (can you say “blockchain”) timestamp server that generates proof of the chronology of the transaction.

Source: Bitcoin: A Peer-to-Peer Electronic Cash System (October 31, 2008)

So What is Bitcoin and is it a Currency?

Bitcoin is described as a decentralized digital currency.

It is known as a cryptocurrency because it uses cryptography algorithms for security.

That’s what Bitcoin is. Here is what Bitcoin is not:

- Physical. There are no coins or anything physical, only balances kept on an encrypted ledger.

- A Currency. The IRS classifies Bitcoin as property, like stocks painting or real estate. Although people use it like currency when they pay in Bitcoin, this can make tax time a bit of a nightmare to figure out. The IRS does a good job of explaining virtual currencies, cryptocurrencies and when a transaction is, or is not, taxable.

- Backed By Anything. Bitcoin is not backed by banks, gold, or anything of value. Some people argue that money, like the US dollar, is not backed by anything either. Since the dollar went off the gold standard in 1976, the dollar has been a fiat currency. But it is backed by the “full faith and credit of the US government.” Bitcoins are backed by the full faith and credit on no one, no company, and no government.

An Absolute Limited Number of Bitcoins

Supporters argue that Bitcoins have value because there can only be a limited number of Bitcoins created. Ever.

And that number is 21 million.

When Nakamoto wrote the Bitcoin source code, he set the upper limit at 21 million Bitcoins. He gave no explanation. But supporters argue this gives value to Bitcoin. They also believe this is a massive advantage to Bitcoin, the world’s oldest cryptocurrency, over other cryptocurrencies.

Bitcoins are created when they are “mined.”

“Mining” is done using sophisticated hardware and software to solve an extremely complex computational math problem. Whoever solves the problem first is awarded the next block of Bitcoins, and the process begins again.

According to Nakamoto’s source code, the ability to mine Bitcoins stops after 21 million are mined.

How Many Bitcoins are Currently in Circulation

As of August 2021, 18.7 million Bitcoins have been mined – that’s 83% of the total possible. You would think that the rest of the Bitcoins would be created in the next few years. But that would be wrong.

97% of Bitcoins will likely be mined within the next decade. But it is predicted that the remaining 3% will not be mined entirely until 2140, almost a century later.

This is because the code has an embedded process called “halving.” which reduces the number of Bitcoins released by 50% every four years.

Many investors believe this absolute limited supply creates a “store of value” that will continue to push up the price of Bitcoin. On the other hand, governments can print unlimited amounts of their fiat currencies, like dollars or rupees, which devalues their currencies.

Source: Bitcoin: A

Peer-to-Peer Electronic Cash System (October 31, 2008)

So, Has Bitcoin Lived Up to the Original

Vision?

Nakamoto wanted, “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. “

Did he/she/they accomplish this vision?

Absolutely.

As of January 2020, Bitcoin reached 400,000 transactions per day, which is more than any other cryptocurrency.

Nakamoto wanted, “A purely peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution.”

Did Nakatomi accomplish this vision?

Absolutely.

As of January 2020, Bitcoin reached 400,000 transactions per day, which is more than any other cryptocurrency.

The current price of a Bitcoin is over $60,000, and the market value of all Bitcoins in circulation today is about $866 billion.

Nakamoto reached his vision and more.

Suggested Reading:

Crypto’s Ancillary Businesses as an Opportunity for Investors

|

Opportunities and Challenges With Yield Farming

|

Why Researching Investment Ideas is Important

|

What the Approved Bitcoin ETFs do for the Markets

|

Sources:

How

Many People Own Blockchain

How

Much do Crypto Investors Know

Whitepaper –

Bitcoin Peer-Peer Electronic Cash System

Number

of Bitcoin Transactions Worldwide

Stay up to date. Follow us:

|