In a major vindication for Geron Corporation’s therapeutic pipeline, the biotech company’s shares skyrocketed nearly 90% in after-hours trading Thursday after receiving a critical green light from U.S. drug regulators.

In a 12-2 vote, the Food and Drug Administration’s Oncologic Drugs Advisory Committee (ODAC) ruled that the clinical benefits of Geron’s investigational drug imetelstat outweigh its risks for treating a serious blood disorder. Specifically, the independent panel of experts endorsed imetelstat as a potential new therapy for transfusion-dependent anemia in certain adult patients with low to intermediate-risk myelodysplastic syndromes.

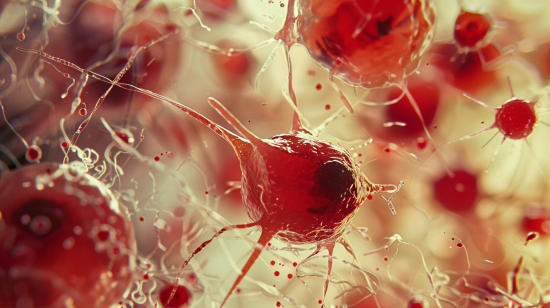

Myelodysplastic syndromes (MDS) are a group of malignant bone marrow disorders that disrupt the production of healthy blood cells. In the lower-risk forms of MDS being targeted by imetelstat, anemia caused by a lack of red blood cells is one of the most problematic complications, often requiring regular blood transfusions.

Imetelstat, an innovative first-in-class drug candidate, works by inhibiting the enzyme telomerase. This mechanism of action allows imetelstat to potentially restore normal red blood cell production and alleviate the need for transfusions in these MDS patients.

In Geron’s pivotal phase 3 IMerge study involving over 200 patients, those treated with imetelstat showed significantly higher rates of achieving red blood cell transfusion independence for at least 8 weeks compared to placebo. The study also found 28% of imetelstat patients achieved transfusion independence for 24 weeks or longer – with a median duration of 80 weeks. Only 3% of those on placebo matched that level of durable response.

“There are few treatment options and significant unmet medical need remains for these patients, particularly among those with difficult-to-treat subtypes of this blood cancer,” said Faye Feller, Geron’s chief medical officer. “We believe that imetelstat has the potential to be an important new medicine.”

Wall Street clearly agrees with that assessment. Geron shares, which had already surged over 60% year-to-date in anticipation of Thursday’s advisory meeting, ripped nearly 90% higher in extended trading after the result was announced.

While not binding, the FDA typically follows the recommendations of its advisory panels when making final approval decisions. The agency has set a target action date of June 16 to decide on whether to greenlight imetelstat for MDS patients based on the totality of evidence – including the IMerge trial data and ODAC’s favorable risk-benefit evaluation.

Approval appears likely after the decisive ODAC vote, providing a tremendous boost for Geron as it pushes ahead with commercialization plans for imetelstat. In addition to seeking FDA approval, the company is pursuing European regulatory clearance after submitting its marketing application to health authorities there last year.

Analysts see imetelstat generating hundreds of millions in peak sales if approved for this initial MDS population with unmet needs. But Geron is also evaluating the drug’s potential utility in other blood and bone marrow disorders like myelofibrosis, significantly expanding imetelstat’s commercial opportunity.

Even after Thursday’s enormous stock spike, Geron remains modestly valued at around $1.5 billion in market capitalization. While certainties remain around pricing, reimbursement and ultimate market penetration, the positive ODAC outcome drastically improves the outlook for this longtime drugmaker to finally bring its first product to market after years of development setbacks.

For a company that has relied primarily on partnerships, licensing deals and equity raises to sustain its operations, having a wholly-owned product with multi-billion dollar sales potential could completely transform Geron’s outlook – validating the bold decision to double down on imetelstat’s high-risk, high-reward proposition in recent years.

While challenges still lie ahead, investors are clearly salivating over imetelstat’s bright future after the pivotal FDA panel vote removed a major roadblock on the path to potential commercialization. The overwhelmingly positive outcome sent an unmistakable signal that Geron may finally be nearing the lucrative promised land after getting mired in drug development purgatory for decades.