|

|

|

|

An Investment Tool That’s More Important than Ever

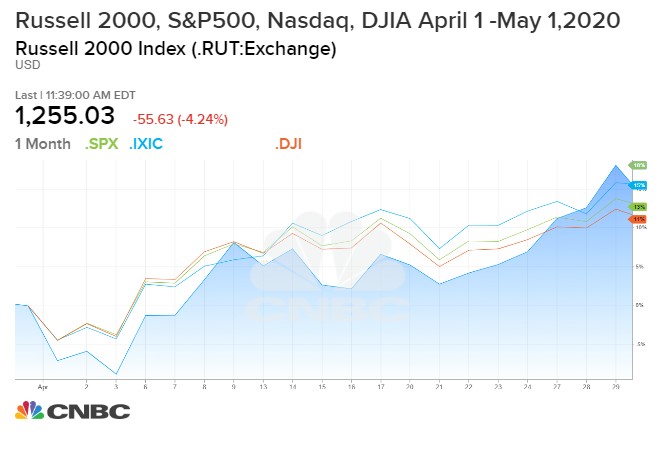

The overall stock market performance during April was one for the record books. The Dow 30 (+11.1%) and S&P 500 (+12.7%) put in their best one-month performance since January 1987. The Nasdaq (+15.4%) delivered its greatest one-month gains since June 2000, and the Russell 2000 (+16.22%) outperformed the other three major market indicators.

The April rally was a welcomed reversal from March, which was the worst month since the height of the financial crisis in 2008. The question most stock investors are trying to discern now is, will stocks reverse again in May? And How best to determine value?

The economy and its impact on the stock market are in extraordinarily uncertain waters. Any previous trends have all been derailed. This is not just true of the market overall, but also true for both companies that will benefit from the pandemic and the majority which will be hurt by it. One fact that will keep many self-directed investors active is the reality that, during times like these, opportunity is at its highest. It is also true that at times like these the risk of short-term realized or unrealized losses are also at a high level. Volatility, truly is a double-edged sword.

Many market participants are accustomed to companies earnings guidance and earnings forecasts, especially in highly capitalized corporations that are widely covered by sell-side analysts. The quarterly forecasts of these companies are so broadly covered by mainstream news outlets, that they’re sometimes treated and delivered to investors like they’re an event themselves. The problem now is, over the past few weeks analysts along with one company after another have pulled their guidance and stated, “we just don’t know.” This takes away one of the valuation tools investors use in their decisions to buy or sell.

For the companies part, they can not offer the earnings insight into the near future which they do not have. This is safe for them to not offer numbers with far less confidence than the market is accustomed to. Without the companies insight, analysts from both sell-side Wall Street firms and company-sponsored research have placed many companies near-term projected revenue in a wait-and-see mode. The analysts, oddly enough, probably have better visibility out a year or more when the crisis is presumed to be behind us, than they have out three months. This may not be as much of a drawback for investors as it feels.

Investors, enjoy experiencing immediate gratification and reassurance after investing in a company. However, it is long term results (longer than 90 days) that is most often the reason an investment is made in the first place. Similarly, as far as selling, a long-term negative outlook makes more sense than ridding your portfolio of a company because they are having a one-time hit to EBITDA.

Perhaps the economic lockdown will usher in an era of companies managing for long-term results. An era where analysts don’t feel a need to be as precise about their immediate estimates of income as opposed to longer-term prospects for the company and space in which it does business. Investors for their part could serve their future financial growth better if they look at companies through a longer-term lens. This would allow corporate management to create strategies with a longer-term focus.

Determining Value Now

Lower expectations of forecasting precision over the next two periods from the company’s investor relations or research analysts will be important for investors that want to stay involved and feel comfortable. By definition, people invest for the future, value expectations over a more appropriate time horizon may be the answer to this lack of information. Even during ideal times, it would be foolhardy to invest cash in a stock if you need that cash in a few months. A longer-term focus is more prudent for investors, and if companies are given leeway to focus long-term they should be able to make decisions that drive better results. This is better for investors and there are still forecasting tools. In fact, there are plenty of other fundamentals to review as a measure of future positive performance.

One thing the pandemic has done is cause us to see shifts in the economic landscape that may change industries. Some areas have earned a lot of buy-side interest because of the virus and lockdown and what it might usher in. Recognizing these changes early could be the key to finding performance and benefiting from the new paradigm. These could include industries providing work from home solutions, medical solutions, and safe havens such as precious metals, among many others. Once industry expectations are recognized, sort through high-caliber industry reports to make sure you aren’t missing anything. From there, find companies within the space and check the recent price trend; you don’t want to chase after a stock that perhaps has already received too many speculative investors. Then comb through institutional-quality research analyst reports to get a clearer picture of the inner workings of the business model and growth prospects. Narrow down the list of possibilities and hope to find the deserving company that has been overlooked in all the other noise.

Time Horizon Adjustment

The regularity of earnings projections with what had been a short feedback loop provides a sense of control and precision regarding accuracy, but perhaps not usefulness of these forecasts. Even with today’s murky conditions, wide estimation error, or lack of short-term guidance should not be a problem for investors. We know there is a temporary problem. If it were possible to forecast next quarter’s earnings per share for every stock in the S&P 500, any partially astute investor would assume that each companies profits this year are not representative of their longer-term potential. To put it another way, the accuracy of any earnings forecast during the first half of 2020 does not make it a valid measurement for determining normal expectations for the company. Companies that miss estimates can still have great earnings prospects. Conversely, companies that exceed expectations could still face difficulties. Within the past two months, and looking through next quarter, what is going on within the company books, within the various industries, and management goals to drive better performance can hardly be fully assessed by most self-directed investors or small RIA firms. They need more information and deeper insight on industries and company-specifics. The business model itself could be more telling than the numbers.

Without a crystal ball, we don’t know how “normal” next year will be. However, as an investor, we should try to take advantage. We know the focus should be longer-term. As far as Wall Street analysts are concerned, the direction of future numbers and ability to resume normalcy down the road provides a very good start to discerning where assets should be deployed and which investments are best sold now. Looking out beyond the immediate quarter reduces short-term “noise.” It also creates a longer-term horizon for management to measure success. Three years, five-years, ten years, these seem like an eternity in a world where immediate expectations drive stock price, and stock prices are available and rapidly changing throughout the day. But if your investing for a future measured in years, you may be surrounded by opportunities that you’re afraid of taking advantage of because you aren’t as certain what will happen over the next 90 days. This will work against your success in the new paradigm.

Paul Hoffman

Managing Editor

Suggested Reading:

Stock Index Adjustments and

Self-Directed Investors

Small-Cap VS Large-Cap Investing

Register for Channelchek Premium Content and Tools at No Cost!

Sources: