Electric vehicle technology firm Exro Technologies is acquiring e-mobility drivetrain maker SEA Electric in an all-stock $300 million deal. The strategic merger combines two complementary electric propulsion platforms, setting the stage to disrupt the surging commercial EV space.

For investors, the transaction provides Exro with enhanced scale, revenue, and a clear path to profitability. With SEA’s major OEM customers like Volvo and Toyota, over 1,000 EV system orders are forecast for 2024 generating above $200 million sales.

The consolidated entity targets delivery of complete, next-gen propulsion solutions demanded by fleet operators and manufacturers transitioning to electric. Significant synergies, cross-selling opportunities, and cost savings are expected from the integration of the companies’ technologies.

Massive Addressable Market

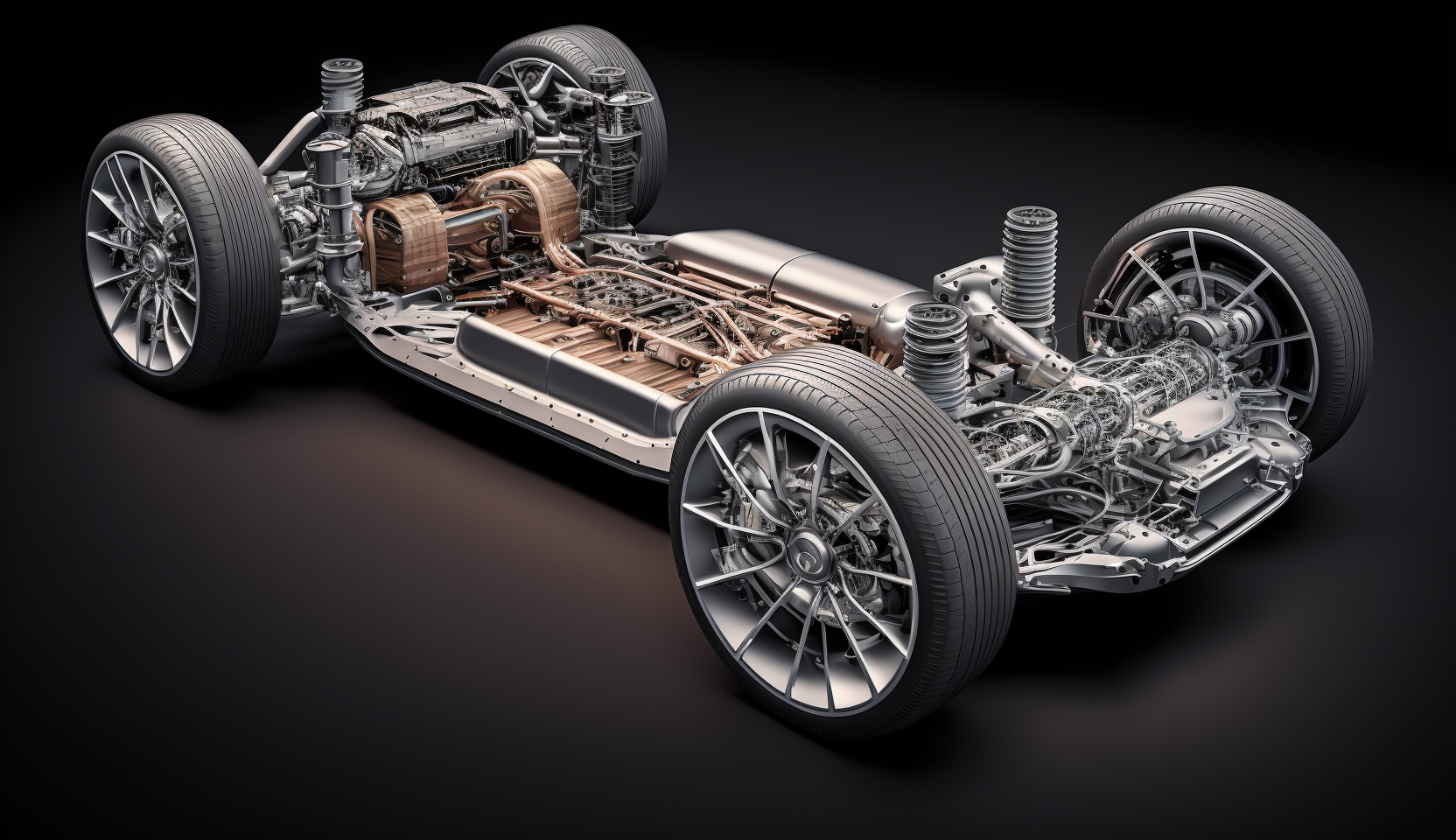

Exro’s battery control electronics and SEA’s full electric drive systems together optimize EV power, efficiency, and costs. This unique, end-to-end capability unlocks a share of the enormous global commercial EV market.

Market research firm IDTechEx sees the medium and heavy commercial EV market reaching over $140 billion annually by 2031. With increasingly stringent emissions regulations worldwide, electrifying trucks, buses, construction equipment and beyond offers massive potential.

Exro and SEA aim to be at the forefront of this shift providing the integrated propulsion technologies enabling OEMs to electrify their offerings at scale.

Key Customer Wins

A huge value driver is SEA Electric’s multi-year supply agreements with heavy-duty truck leaders Mack and Hino for thousands of initial EV systems. This provides the merged Exro with committed volumes and Tier 1 auto relationships to leverage.

SEA’s proven proprietary technology underwent extensive validation by the major OEMs. Having signed binding long-term deals, SEA Electric immediately thrusts Exro into a commanding competitive position and cash flow generation.

Clear Path to Profitability

Beyond the technology and growth synergies, the transaction offers investors a profitability catalyst for Exro. Management estimates achieving positive cash flow within 12 months post-close given the ramping order book.

This would mark a key inflection point in Exro’s maturation toward becoming a fully self-sustaining EV enterprise. Profitability could further enhance access to capital to fuel expansion efforts.

The merger is subject to shareholder greenlighting, but the strategic fit and near-term income opportunity make a compelling case. With Polestar and others vying in electric commercial vehicles, Exro seizes pole position through its SEA Electric deal.