How Oil is Expected to Remain an Important Part of the Energy Mix

EIA Releases its Annual Energy Outlook

The U.S. Energy Information Administration (EIA) released its Annual Energy Outlook for 2021. The Annual Outlook provides modeled projections of domestic energy markets through 2050, including scenario analysis using various assumptions. The EIA, is part of the U.S. Department of Energy, and is the nation’s most authoritative source of data, forecasts, and analysis of the U.S. energy market. The report outlines energy production expectations over the next thirty years.

Noble Capital markets recently held a panel titled Managing the Transition to a Greener Energy Environment which brought together executives representing different energy sources to discuss the future of their respective fuelsand will present a livestream of its presentation on February 3rd at 2:00 pm ET (register at https://bipartisanpolicy.org/event/eias-annual-energy-outlook-2021-release).

Renewable and Natural Gas are projected Winners but Other Fuels Should see Declines Level Off

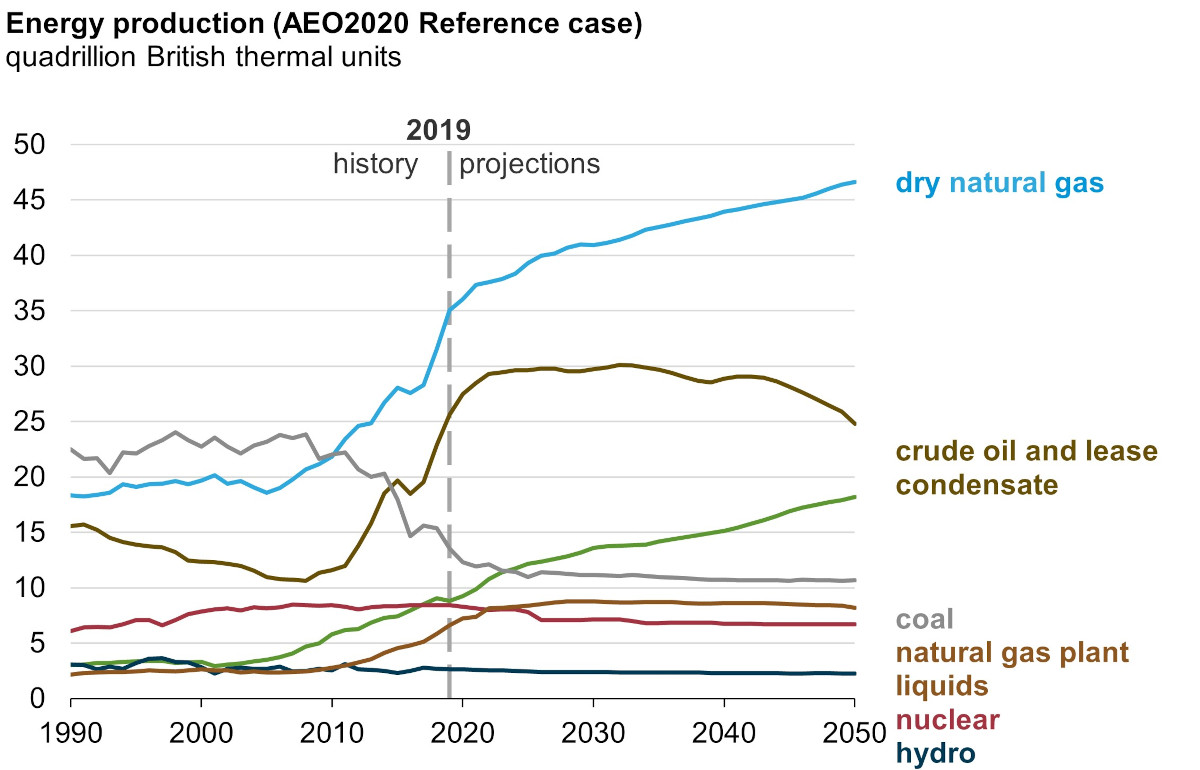

As one might expect, the EIA projects that natural gas and renewable fuels will grow in importance as the United States works to reduce carbon emissions. Coal production, which has fallen sharply in recent years, begins to level off by 2025 in response to falling prices. Oil production, which has expanded over the last decade due to production improvements and a growing economy, begins to stagnate and eventually decline with the proliferation of electric vehicles.

Source: United States Energy Information Administration (EIA): Annual Energy Outlook 2020

Generation to Grow in Importance with a Move to Electric Vehicles

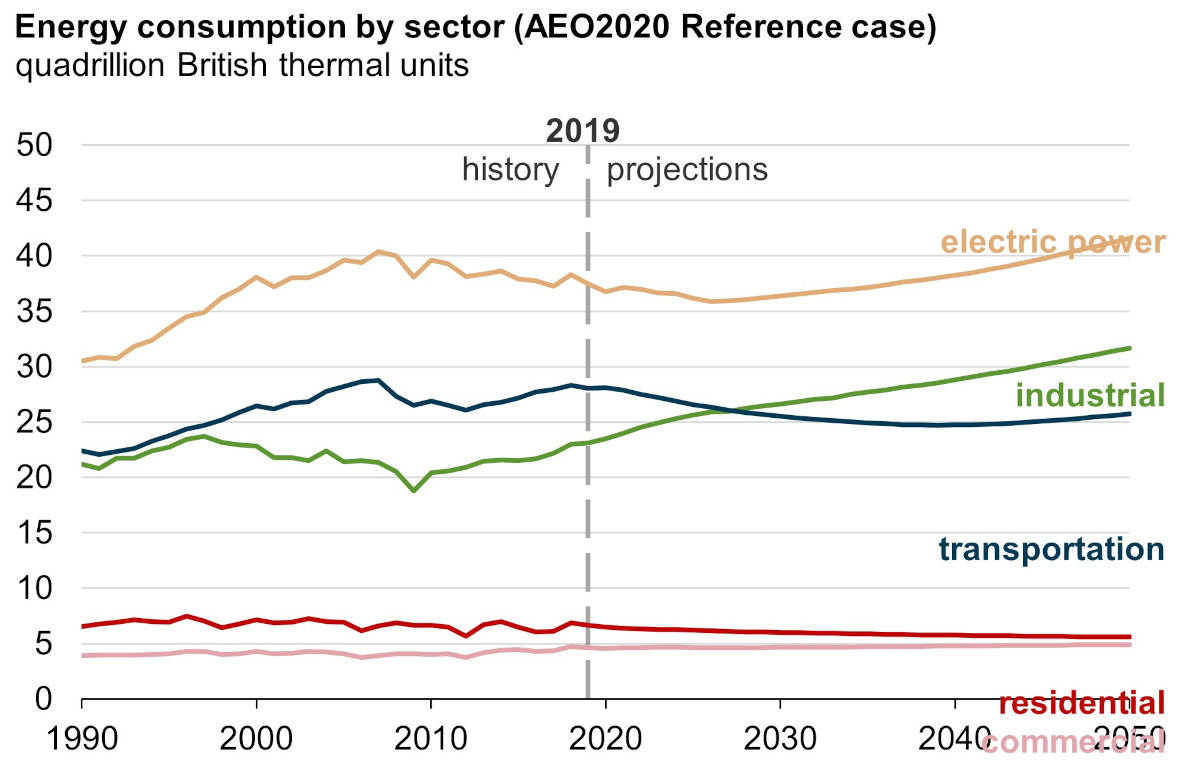

Looking at consumption by sector; electric power remains the largest source of energy demand representing about one-third of consumption. The EIA sees generation demand reversing recent declines associated with efficiency gains and picking up demand from transportation starting around 2030. Industrial demand grows with an expanding economy and low energy prices.

Source: United States Energy Information Administration (EIA): Annual Energy Outlook 2020

Oil Prices Projected to Rise

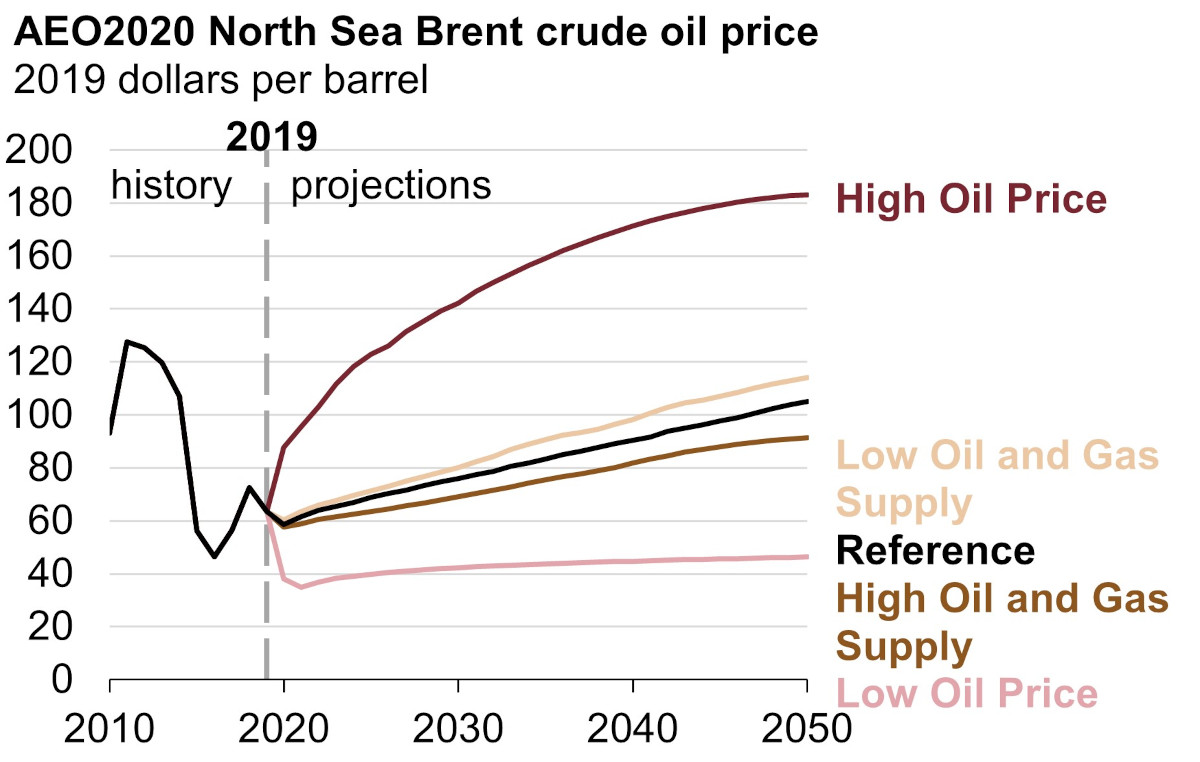

EIA projections call for oil prices to rise steadily over the next thirty years as lost transportation and generation demand is replaced by increased industrial demand. The EIA’s base case has Brent oil prices rising above $100 in the next 25-30 years.

Source: United States Energy Information Administration (EIA): Annual Energy Outlook 2020

With Growing Tight Sand Production, the U.S. Will Remain A Net Exporter

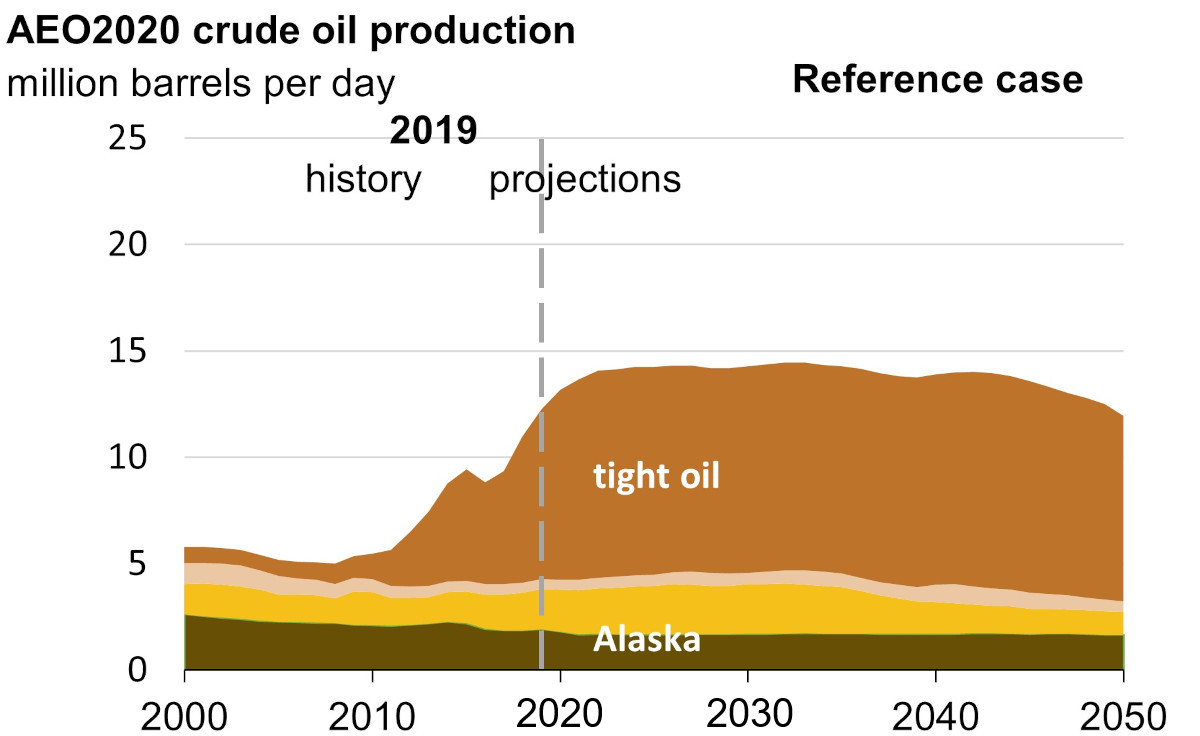

Production from tight oil formations, led by production in the Permian Basin, has become the dominate source of U.S. production and the EIA believes that will continue. The United States will remain a net exporter of oil and energy for the foreseeable future.

Source: United States Energy Information Administration (EIA): Annual Energy Outlook 2020

Take-Away: Renewables Are Growing But Don’t Rule Fossil Fuels Out

The EIA’s conclusions match up with that of the NobleCon17 Energy Panel. Specifically:

- Renewables will continue to take market share as costs continue to decline.

- A portfolio of energy sources is needed to provide backup and react to changing prices.

- Fossil fuels may lose market share but will see overall demand and pricing increase.

- Efficiency gains will continue in all fuels.

Suggested Reading:

What Should the Price Range be for Oil and Gas?

Gevo, Inc. (GEVO) Fire Side Chat

Is the Price of Uranium Rising?

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|