Reddit, Robinhood, and Rocketships

Playgrounds aren’t only for the young. They’re also used by older adults to sit, watch and remember when they were at an age when they barely concerned themselves with bumps, cuts, and bruises that are part of a good day of play. Last year and continuing into 2021, the U.S. stock market has become a playground of sorts to many younger investors. While much has been written that scoffs at the carefree attitude of the subreddit WallStreetBets, Robinhood, and rocket emoji users, perhaps those sneering overlook the benefits the trading app investor is getting from their interaction with the markets and each other. The newest investor class is gaining respect, recognition, and legitimacy among traders and investors of more traditional styles.

Winning

Percentage

Staying with the playground theme; imagine it’s Sunday morning, you’ve finished going through overnight emails, just read today’s Channelchek article, and now decide to walk over to the park. You check your favorite weather app, and it reads there is a 5% chance of rain. Do you dare go out? Is it smarter to skip the potential reward of activities in the park that have been given a 5% chance of being ruined and instead stay inside so you don’t run the risk of being rained on? After all, on days like this, there is only a 95% chance that it will turn out well.

Please excuse my sarcasm, but over the past 12 months, 5% is the statistic of companies that are part of the broad Wilshire 5000 that finished 12 months ending March 23, in the red. Looking back, that was the chance of having picked a bad U.S. headquartered company stock, 5% or one in twenty. In fact, I understated the percentage, actually, 95.9% of the 3000+ stocks in the Wilshire 5000 index had a positive return from a year ago (4.1% were not positive). The only other 12- month period that comes close was in 2004 when 93% had a positive return. I used the Wilshire 5000 because it’s a much more inclusive, broader measure than other more reported on indexes. This makes it better for gauging the price performance of American publicly traded U.S. companies.

Chicken

Little (The Sky is Falling)

Is anyone served if someone is at the park and warning those happily playing that there’s a 5% chance of rain? Or should those benefitting from the still positive environment be left to play until the odds noticeably change? They may have forgotten that it sometimes rains? A better approach is, if there’s a long streak of fair weather, capitalize on it until there’s a change in the air. Perfect performance doesn’t exist, but we’re in a period that is experiencing as close to it as we’ve ever seen. Whatever the reason, it doesn’t much matter, even Jesse Livermore, who is considered the greatest trader that ever lived said, “The market is always right.”

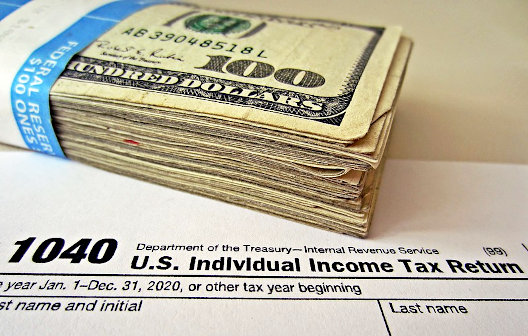

One derisive comment often heard in market reports or posted online is that “…Robinhood traders are a bunch of kids living with their parents wasting their stimulus checks in the market like it’s a game.” The CARES Act was signed into law one year ago on March 27th. By mid-April, a large percentage of the first $1,200 paid would have been in the accounts of individuals. If this is part of what helped fund or add fuel to this group’s transactions, the timing was fantastic. Luck, skill, or serendipity, doesn’t matter, a large portion of the population that may never have considered any kind of investing, are now active and learning more than they otherwise would have. Certainly, market conditions will one day be negative, and most periods will be weaker than they have been, but those bumps and bruises will be the price of education, social interaction, taking chances, and even play.

Robinhood

(High App-titude Traders)

I use the term Robinhood investors to include all trading app and online platform users that have only become active during the past five or six years amidst a period of above-average market return – all relatively newcomers to stock buying/selling that by conventional judgment (and often their own open assessment) are doing everything wrong, yet doing pretty good. The investors/traders that post that they have no idea what they’re doing or ask the most basic questions in public forums often have remarkably good performance. The ranks of this investor class have grown substantially. There is no formal name for this group, so Robinhood is the generic moniker often used. I like to refer to them as high app-titude traders (HATs).

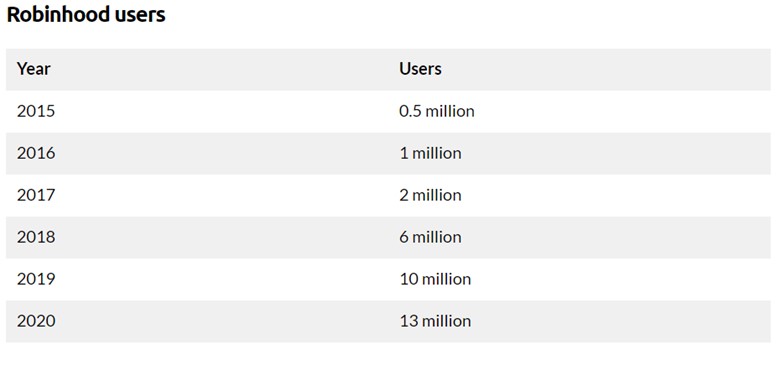

The growth of this group since the advent of commission-free trades has been phenomenal. Using account growth from broker Robinhood alone, there have been years where the size has doubled and tripled.

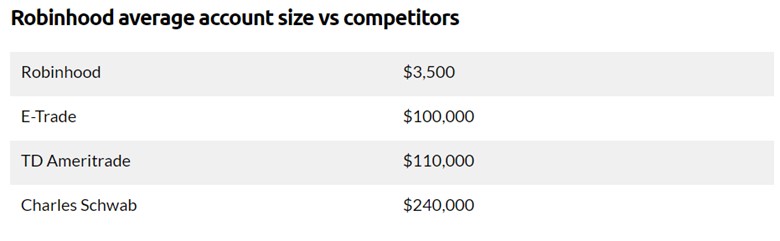

Below we see the average dollar size of the accounts are small, so in reality, high-levels of concern for their “gambling” may be misplaced. The amount they can lose (w/o margin) is not reckless. As a group, they may not know much about stocks but they are savvy and learning.

The average Robinhood user age is 31 years old, which means most began school after the internet became widely used in homes. Many are adept at online games played on their smartphone or desktop. This may even give them an advantage not appreciated by those who learned while having to dial their broker from a landline.

Take-Away

Playground visitors practice and hone important skills. If the Robinhood style investors are treating the market like a playground, they are likely learning through their own play. This by far is more mass investment education being obtained than by any group of young adults that came before them. At a time when everyone is living longer, and many of those now approaching retirement are financially unprepared, education (even through play), with smaller sums of money, may become extremely positive for the future.

Any visit to the more popular subreddits, Facebook discussion groups, and even Stocktwits will reveal posts by people investing that openly declare they don’t know what they’re doing. There are throngs of account owners with their finger on the buy or sell button that solicit advice from others that they know could be even less informed. Yet many of the same inexperienced market participants or HATs declare almost daily they just made another $300 or more. The upward trending broad market has allowed them to not only stay alive but for many, actually thrive.

Why suggest newcomers stay away from the markets when the win percentage remains so high? There has never been anywhere near as positive of a win percentage at other “playgrounds” like a casino. Even most lotteries only return 65% to very few players. Both of these activities are accepted because we know play is its own reward. Stock trading is just as legitimate with limits.

In the case of today’s newest market participants, huge by comparison to those in their age group at any time in the past, they are becoming accustomed to being active in the stock market. This could help them. For many, the most valuable lessons will come when the market is no longer repaying on such a high percentage of positions. When that occurs, we’ll have over 13 million, who on average have invested the same amount as they’d have invested on a couple of three-credit classes at a U.S. University. That’s very cheap for a hands-on real-world financial market education.

Managing Editor, Channelchek

Suggested Reading:

|

|

Stimulus Checks, Taxes, and Investments

|

Understanding the Robinhood Class Action Lawsuit

|

|

|

Will Robinhood be Sued for Gamification?

|

What is an ESG Score?

|

Sources:

https://www.investopedia.com/articles/basics/09/compare-investing-gambling.asp

https://en.wikipedia.org/wiki/Jesse_Livermore

https://studentloanhero.com/featured/cost-per-credit-hour-study/

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|