Image Credit: Pixabay (Pexels)

Will the Latest 2021 Stock Retrenchment Be a Variant from Previous Dips?

Greed has been rewarded in 2021.

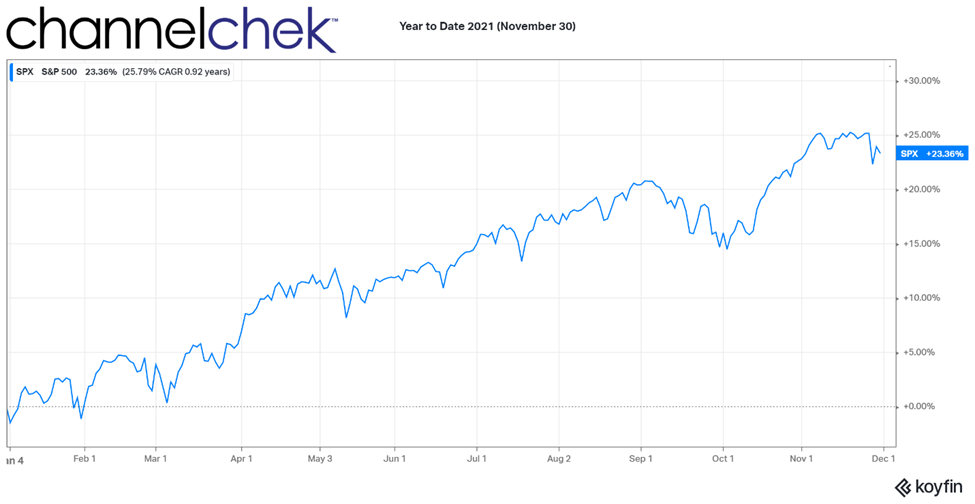

Eight of the last nine market dips have been undone with more buying and higher prices. The ninth, we’re in the midst of right now. This year’s dips have not been huge; buyers came in early before a high percentage of gains had a chance to be erased. Dip-buyers have been rewarded. Does this latest dip represent an opportunity to commit more to the market? Or is it the beginning of a larger fall-off? This is what many investors are deciphering right now. Let’s look at what we know.

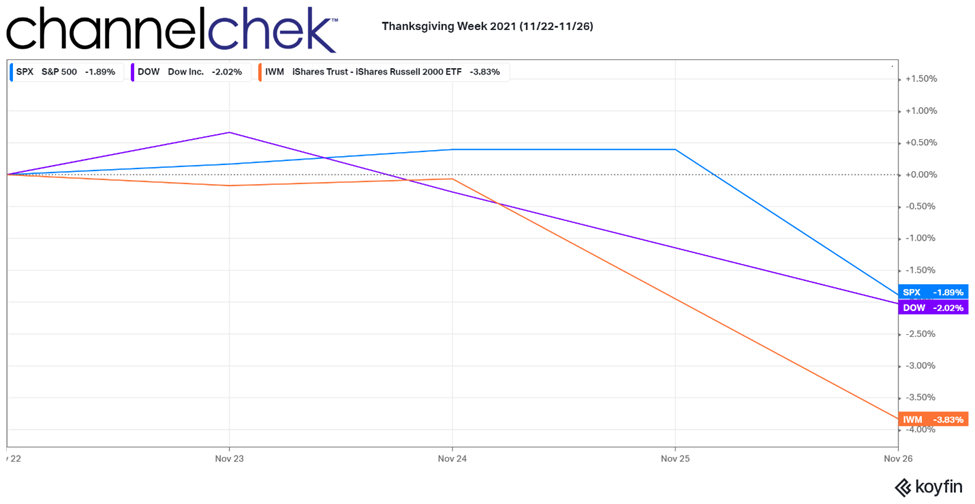

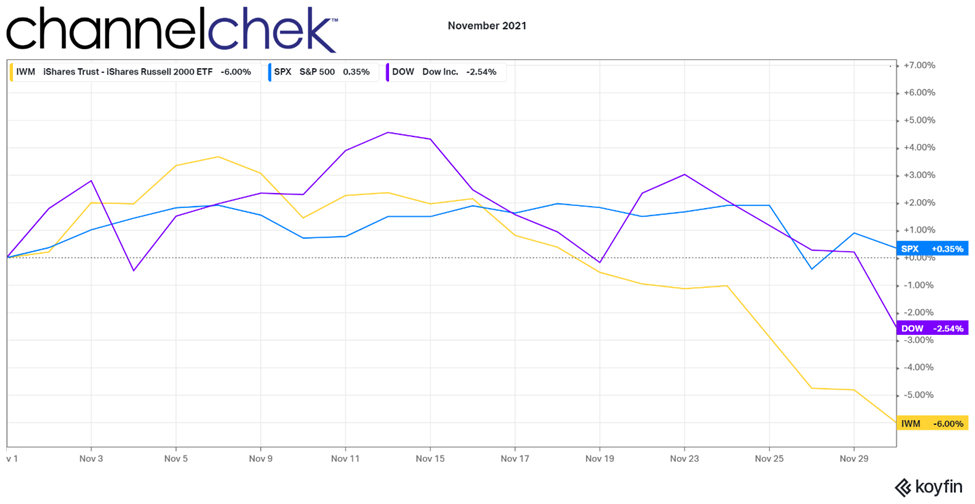

Last week’s holiday-shortened trading saw stocks fall, with the S&P 500 declining 1.89%, the DOW Industrials fell 2.02%, and the Russell 2000 Index which had been the outperformer in November fell off 3.83%. If 2021 maintains its current pattern, this decline will soon be replaced by higher price levels and new records.

In the past, money flow from investors into markets often was the result of chasing momentum – buying when stocks are rising, selling when falling. Cash would flow into stocks and equity funds, at times with a frenzy, at a market peak. Conversely, sell-offs were met with further selling until the move exhausted itself. The overall market behavior has been different over the past 18-22 months and it has taken on a pattern worth understanding, especially that which has been happening since the beginning of this year.

Sell-offs or retrenchments this year have come about largely from Covid 19 related news. Surges in cases, the arrival of the Delta variant, and the most recent sell-off with the Omicron variant. Strong rallies have come from good news, including the expanded roll-out of vaccinations, travel accelerating, and case numbers coming down.

Investors caught on to what is working, causing the market to take on a pattern where it has only been sinking single digits (<10%) before buyers committed more money. With this, the question is whether the news that brought it down in recent days will become an economy (and market) killer. This market mover is once again Covid-19 related. As with the past, there is no level of certainty what havoc a virus or variant of a virus (Omicron) may produce. However, we know more about the overall coronavirus than we did yesterday, last month, and at any time last year. If the past experience is any indicator, the odds are decent that this won’t cause a killer blow to the economy, especially since early reports are that this is not as deadly as earlier strains.

Take-Away

The “buy the dip” strategy has paid off this year. For now, investors have been paid by injecting more cash into their positions each time there is a one-week price drop. Interestingly, all of the opportunities have been at higher and higher averages. This time may be different, but there isn’t any obvious reason to believe it will be.

As measured by the S&P 500, Dow Industrials, and Russell Small-Cap index, the market dropped last week. We will soon know whether the trend continues and 9 out of 9 sell-offs quickly recover or if this will become a deviation from the trend.

Suggested Reading:

Is it Wise to Buy on Dips?

|

Protein Infused Chewing Gum Could Cut Spread of Covid 19 and Variants

|

Can the Fed Stop Inflation?

|

Will Small-Cap Stocks Outperform in 2022?

|

Sources:

https://www.thecut.com/2021/11/what-we-know-about-the-omicron-variant-so-far.html

Stay up to date. Follow us:

|