Image Credit: freestocks.org (Flickr)

Not all Big Stock Market Gainers are Headline News, These Two Have Quietly Excelled This Year

This year has been tricky for investors and risky for savers. Inflation is taking away buying power at a rate of 8% or more, while market indexes have sunk by double that amount. Whether you’re young and looking to be prudent and build for the future, or you’re a baby boomer trying to stay even, whether you’re in the market or out, you can wind up worse off.

During this year’s S&P 500 decline there have been sectors that have stayed strong. Within those sectors, there are particularly decent performers. Everyone knows the energy sector has been a highflyer, but the reasons for this could reverse, remember it was recently the worst-performing sector. But outside of the energy industry, there are a few media companies that have performed exceptionally well even though the market has been bearish. If the overall market turns bullish, there is no reason to expect their performance to reverse.

Two companies that are in very different businesses in the media space caught my attention. One is a 99-year-old company that began in print media, and the other is one of the largest owners of radio stations. Both would seem to be old school companies, but they aren’t run that way, and the stocks are well in the positive so far this year.

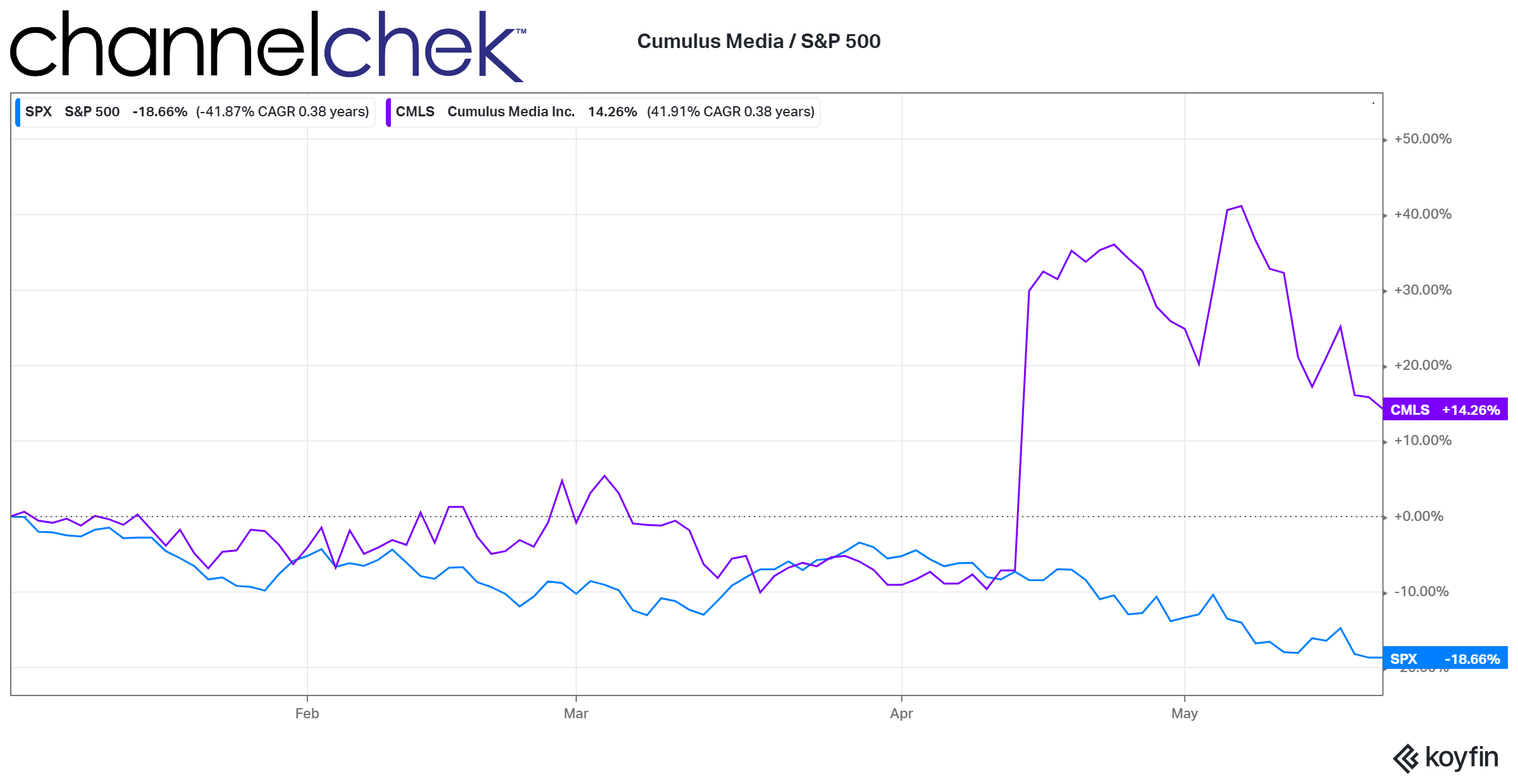

Cumulus Media (CMLS)

Cumulus Media (CMLS) is an audio-first media company that provides premium content to over a quarter billion people every month. It’s among the largest owners of radio stations in the United States. Perhaps you’ve heard of the groups it operates including Radio Station Group and Westwood One. It sells commercial advertising time to local, regional, and national advertisers; and network advertising. The company offers content through approximately 445 owned-and-operated stations in 90 United States media markets; and approximately 8,000 broadcast radio stations affiliates and various digital channels. Cumulus Media Inc. was founded in 1997 and is based in Atlanta, Georgia.

Source: Koyfin

Since the beginning of the year, the company has beaten the S&P 500 by more than 32%. Cumulus is in the process of conducting a Dutch auction to tender up to $25 million shares. According to a research report released by Noble Capital markets earlier this month, the move could position CMLS to be part of the Russell 3000 which would provide it with more natural holders. Read the research report here.

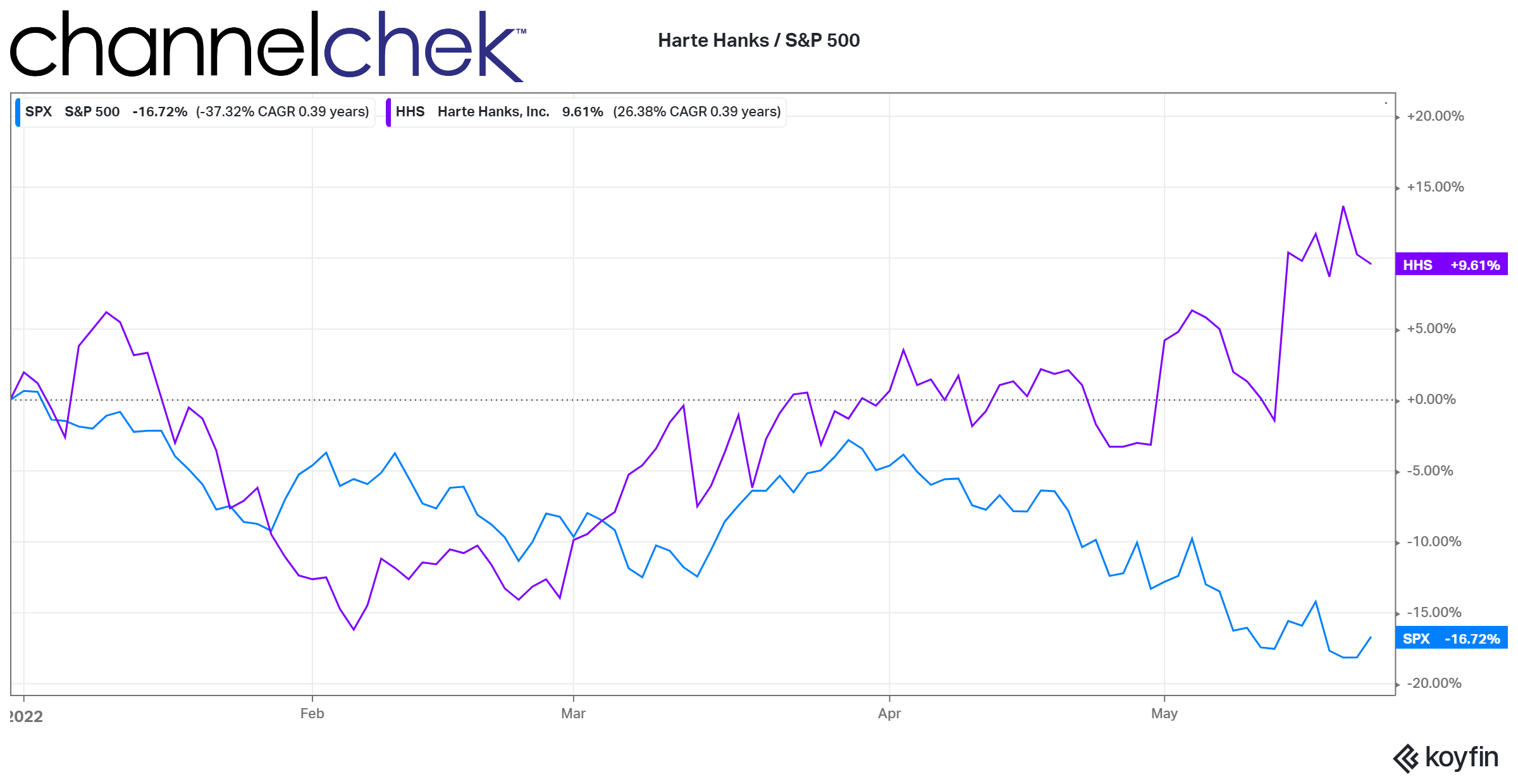

Harte Hanks

Harte Hanks (HHS) has been around for 99 years. While they sold the Pennysaver brand back in 2013, connecting business to business and business to customers is what they have always excelled at. Today their business is split into thirds, with one-third marketing to generate interest for other companies (B2B, B2C), another third that is a customer care business which primarily serves to answer customer concerns and chat, and the final third is a customer fulfillment business that takes orders and fulfills them in a B2B capacity. These three segments provide unparalleled service and function synergistically to leverage multiple segments and drive better outcomes for customers.

Harte Hanks is beating the S&P 500 index by 26.33%.

Source: Koyfin

In a research note published on May 13, Michael Kupinski, Director of Research at Noble Capital Markets wrote about the company’s positive upside potential, “In spite of the strong start, we are maintaining our full year 2022 adj. EBITDA estimate of $19.8 million. We believe that the stage is set for positive upside surprise potential should the company be able to replace a large portion of the anticipated fall off in its Customer Care business.” View the full report.

Take-Away

Both media companies, Cumulus Media and Harte Hanks presented at the recent NobleCon18 investor conference. Follow these links to listen to the management discussions, CMLS and HHS.

The battle of all savers and investors is real. Staying ahead of inflation to retain purchasing power has been elusive for many. There are sectors and stocks within the sectors worth reviewing. Channelchek provides research from Noble Capital Markets on companies that may not get as much attention as others. Sign-up to receive emails each morning with fresh reports pre-market opening.

Managing Editor, Channelchek

Suggested Content

What Media Experts Expect from the Metaverse

|

Forbes Global Media (OPA) NobleCon18 Presentation Replay

|

Avoiding the Noise and Focusing on Managing Your Investments

|

Noble Capital Markets Media Sector Review – Q1 2022

|

Sources

Stay up to date. Follow us:

|