|

|

|

|

Can the Market Continue to Defy Gravity?

The remainder of the year is likely to be historic as well. The latest economic releases are unfathomably bad. Over the past six weeks, the US Department of Labor reported 30.3 million new unemployment claims. This represents roughly 20% of the workforce. The read on first-quarter GDP shows a 4.8% contraction in economic output during the quarter. Keep in mind, the first half of the quarter was before the economy was put under sedation, so it was still contributing growth at a robust rate. This portends a much deeper contraction during the current quarter. Corporate earnings have, of course, become extremely strained. This is not necessarily reflected in the major market indexes. Instead, the equity markets have been defying gravity since late March as they have moved upward and are now at the same levels we had a year ago in May. GDP last May was at least 7% stronger than the current pace, and unemployment was low at 3.6%.

Wall

of Worry

The strength of the markets may seem out of place when contrasted against the surrounding economic environment, but this behavior is so common that there is a name for it, “The Wall of Worry.” Investopedia defines it this way: “Wall of worry is the financial markets’ periodic tendency to surmount a host of negative factors and keep ascending. Wall of worry is generally used in connection with the stock markets, referring to their resilience when running into a temporary stumbling block, rather than a permanent impediment to a market advance.” The Investopedia description further explains, “The markets’ ability to climb a wall of worry reflects investor confidence that these issues will be resolved at some point. However, market direction once the wall of worry has been surmounted is impossible to ascertain and depends on the stage of the economic cycle at which it occurs.”

Climbing the wall of worry is what the markets are doing now during the eye of this economic storm. Since the economic turmoil is self-induced and seems to have an (uncertain) expiration date, the situation is viewed as a temporary impediment. Most would presume the resumption of back-to-work both abroad and in the US before year-end. So the “shelter-in-place” situation that caused the sell-off initially is expected to clear, which leads to the market confidence of investors. The strong markets at first were probably driven by the opportunistic, searching for value, then carried by fear-based investors worried they would miss a chance to get in on the ride upward.

The

Market is Acting Rationally

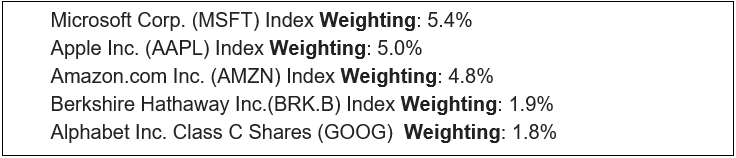

In addition to looking past the crisis, investors are also picking their spots. When you peel back the layers of the market’s strength to reveal individual sectors rather than look at the performance of the whole composite index, the market appears to be rational. The sectors, where you’d expect strength such as health care and information technology, have acted the most bullish, while materials, real estate, and energy have been laggards. What is more noteworthy is that the strongest of the individual stocks within the S&P are five large-cap names that now account for almost one-fifth of the 500 stocks. If these handful of companies are doing well, their weight impacts the

The success of these five (once small) companies’ accounts for much of the S&P 500’s climb. Small-cap, international, and value stocks are lagging. While these laggards made up some ground last week, they have more to go before they catch and pass the performance of the large-cap companies making up the indexes performance. Surpassing the large-cap stocks is likely to happen eventually. Over time, small-cap and value companies have outperformed large-cap. Look at the list above. Most can remember when four of the five were small-cap companies. The potential for outperformance within the equity arena is much higher away from large-cap equities.

Take-Away

While the market has recently experienced big gainers outpacing weaker names, the question of why stocks are showing strength at all confounds many market participants and TV pundits. The answer is that investors are climbing a classic wall of worry by looking through the next couple of quarterly economic releases. Also, they believe the current situation is temporary, and investors are confident that earnings will normalize in time. So, despite significant earnings declines, this situation is presumed to be short term.

Not unlike most rallies, forward-looking investors got in first. Others saw the move and joined them for fear of missing out; this drove the major market measures higher. Will these investors be quick to hit the sell button if the return to a stronger economic climate is slower than expected? Will the market climb of large-cap stocks cause some to seek opportunity in small-cap stocks or value? We are in the middle of this storm; the worst seems to be over, assessing the damages and repairing them will uncover new opportunities to embrace and others to avoid. Investors with the most information and insight into what is going on beneath the surface of both sectors and companies will have successful portfolios.

Suggested Reading:

Small-Cap

vs Large-Cap Investing

Economic Aid Programs – A Gargantuan Experiment with only

Modest Expectations

The Correlation Between Passive Investing &

Underperformance

Enjoy Premium Channelchek Content at No Cost

Sources:

Fed cuts rates

to blunt coronavirus impact, markets drop

Betting

On Retail Stocks At the End of the Brick-And-Mortar World