Ark Invest Warns of a Deflationary Ripple that Could Spread Around the Globe

Pricing, whether it be of the stock market, private placements, or other alternative investments is impacted by investor demand, and demand is the result of differing views. Cathie Wood, the Ark Investment Management CEO, has held the view that the U.S. and global economies are close to a deflationary spiral. She pointed to more evidence this week, and sounded the alarm for the potential dire consequences of the Federal Reserve’s ongoing rate tightening measures. According to Wood, deflation tied to China and actions by the U.S. central bank could set off a chain reaction of deflation-induced economic slowdowns, not just within the United States but across international markets.

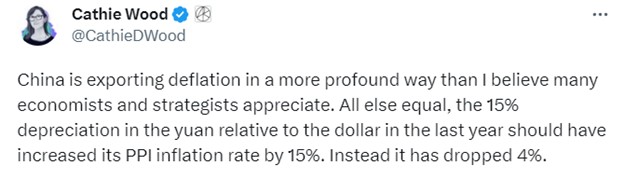

Ms. Wood, the 67-year-old market veteran, who falls in the category of celebrity investor, has many fans and followers. She shared her concerns in a string of posts on X, the platform formerly known as Twitter. Wood stated, “China is exporting deflation in a more profound way than I believe many economists and strategists appreciate.”

She explained that producer prices in China, the world’s second largest economy, were impacted by the U.S. dollar strengthening by 15% against the Chinese yuan, despite the devaluation adding around 15% to Chinese PPI, the Chinese reported a decline in the PPI inflation measure by 4%.

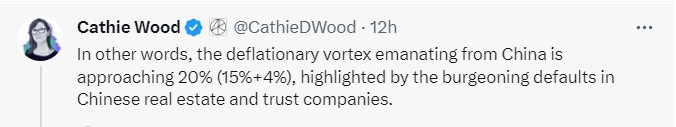

Wood expressed China is exporting deflation. She posted that, under normal circumstances, the 15% depreciation of the yuan against the dollar in 2022 should have led to a 15% increase in China’s annual producer inflation rate. Since it instead dropped 4%, In her math, this is creating near a 20% downdraft on prices of Chinese goods.

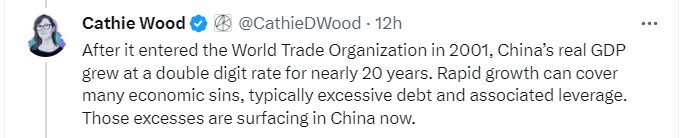

Turning her focus to China’s economic trajectory, Wood recounted the country’s impressive growth following its entry into the World Trade Organization in 2001. Over nearly two decades, China’s real GDP experienced a sustained double-digit expansion. However, Wood pointed out that rapid growth often conceals underlying economic vulnerabilities, including excessive debt and leverage. Her firm believes these vulnerabilities are now creating cracks in China’s economy.

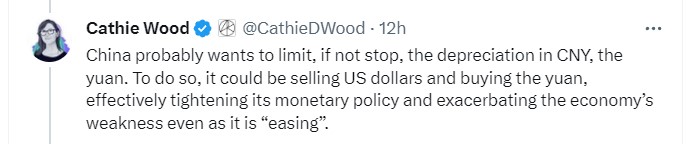

Wood suggested that China might attempt to halt the depreciation of the yuan. However, this would necessitate selling off U.S. dollars and acquiring yuan, which, in turn, tightens monetary policy and fuels the economy’s fragility, even amid efforts to stimulate it.

Ark Invest’s CEO posted, “The Fed has precipitated and exacerbated the risk of a global deflationary bust.” Drawing attention to the central bank’s remarkable 22-fold increase in the Fed funds rate, Wood warned that the repercussions of this move would first impact China and subsequently ripple through the rest of the world.

Recent economic data from China underscores the challenges it currently faces. Second-quarter GDP growth came in at 6.3%, falling short of the 7.3% projection by economists. Furthermore, new bank loans for July plummeted by 89% month-over-month, marking the lowest level since 2009, according to data from the People’s Bank of China.

The deflationary trend is evident in inflation figures as well. July inflation data showed both consumer and producer price inflation rates in negative territory.

Adding to the concerns, a trio of data released from the China National Bureau of Statistics revealed lackluster performance. Retail sales rose by a modest 2.5% year-over-year in July, well below the anticipated 4.5% increase. Industrial Production also lagged, with a 3.7% rise compared to the consensus estimate of 4.4%. Moreover, fixed asset investment figures raised further questions about the country’s economic health.

Take Away

There are certainly competing inflation forecasts opposing those coming out of Cathie Wood’s firm. However, her warnings do serve as a reminder, from a veteran in the asset management business, of the interconnectedness of global economies and the potential ramifications of central bank policy decisions. As markets continue to navigate the crosscurrents, attention remains on policymakers and economic indicators for signs of any change in trends.

Managing Editor, Channelchek

Sources

http://www.stats.gov.cn/english/PressRelease/202308/t20230815_1942019.html