Euroseas Ltd. Announces New Charters For Two Of Its Vessels, M/V “Evridiki G” and M/V “EM Corfu”

Research, News, and Market Data on Euroseas Ltd

ATHENS, Greece, Dec. 28, 2021 (GLOBE NEWSWIRE) — Euroseas Ltd. (NASDAQ: ESEA, the “Company” or “Euroseas”), an owner and operator of container vessels and provider of seaborne transportation for containerized cargoes, announced today the extension of the charter of its container vessels M/V “Evridiki G” and a new time charter contract for its container vessel M/V “EM Corfu”. Specifically:

- M/V “Evridiki G”, a 2,556 TEU vessel built in 2001, entered into a new time charter contract for a period of between a minimum of thirty-six and a maximum of thirty-eight months at the option of the charterer, at a daily rate of $40,000. The new rate will commence on February 1, 2022.

- M/V “EM Corfu”, a 2,556 TEU vessel built in 2001, entered into a new time charter contract for a period of between a minimum of thirty-six and a maximum of thirty-eight months at the option of the charterer, at a daily rate of $40,000. The new rate will commence upon completion of the vessel’s drydocking in mid-February 2022.

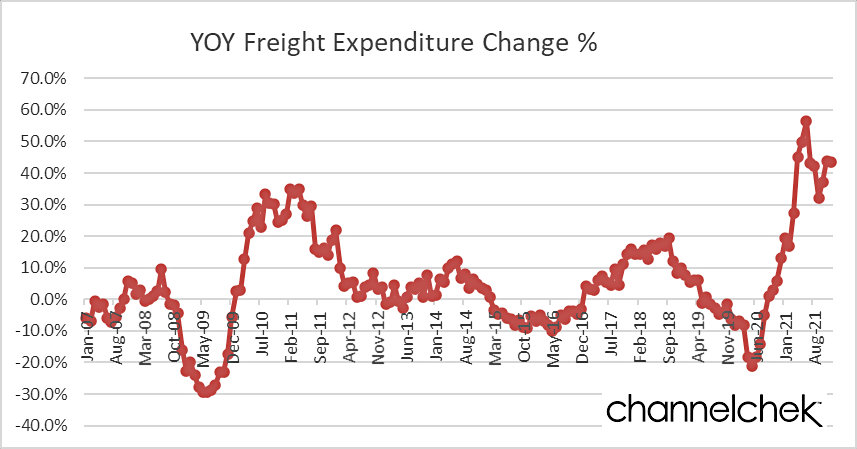

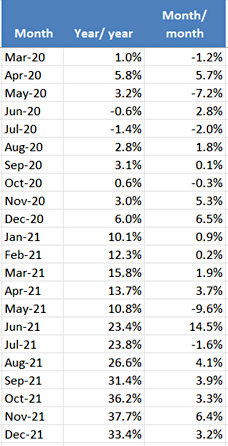

Aristides Pittas, Chairman and CEO of Euroseas commented: “We are very pleased to announce new charters for two of our vessels for periods of at least three years each at rates more than twice the levels of their existing employment. The new charters secure a minimum of $85m of contracted revenues and are expected to make an annualized EBITDA contribution in excess of $22.3m combined which is about $19m (or, at least, seven times) higher than their joint contribution over the last twelve months of about $3m. These new charters significantly improve both our profitability and cash flow visibility with our charter coverage for 2022 now exceeding 85% and for 2023 55%.

“Undoubtedly, the containership markets continue to show their strength and momentum as indicated by the rate and the duration of the above charters. We expect to be able to continue benefitting from the present strong market as there are another two of our vessels opening up for re-chartering within the next four months and, yet, another two vessels later in 2022. Furthermore, we started exploring chartering options for our two newbuildings which are expected to be delivered by the end of first and second quarters of 2023, respectively, as initially scheduled. If the present market levels continue, renewals of expiring charters should result in significant further increases in our profitability and employment coverage for the following years, providing a solid liquidity foundation for further growth of our company and rewards to our shareholders as our Board or Directors sees fit.”

Fleet Profile:

After the new charters of M/V “Evridiki G” and M/V “EM Corfu” the Euroseas Ltd. fleet and employment profile will be as follows:

| Name |

Type |

Dwt |

TEU |

Year Built |

Employment(*) |

TCE Rate ($/day) |

Container Carriers |

|

|

|

|

|

|

| MARCOS V |

Intermediate |

72,968 |

6,350 |

2005 |

TC until Dec-24

plus 12 months option |

$42,200

option $15,000 |

| AKINADA BRIDGE(*) |

Intermediate |

71,366 |

5,610 |

2001 |

TC until Oct-22 |

$20,000 |

| SYNERGY BUSAN(*) |

Intermediate |

50,726 |

4,253 |

2009 |

TC until Aug-24 |

$25,000 |

| SYNERGY ANTWERP(*) |

Intermediate |

50,726 |

4,253 |

2008 |

TC until Sep-23 |

$18,000 |

| SYNERGY OAKLAND(*) |

Intermediate |

50,787 |

4,253 |

2009 |

TC until Jan-21 then until Mar-22

then until Mar-26 |

$202,000

$130,000

$42,000 |

| SYNERGY KEELUNG (+) |

Intermediate |

50,969 |

4,253 |

2009 |

TC until Jun-22 plus 8-12 months option |

$11,750;

option $14,500 |

| EM KEA (*) |

Feeder |

42,165 |

3,100 |

2007 |

TC until May-23 |

$22,000 |

| EM ASTORIA (+) |

Feeder |

35,600 |

2,788 |

2004 |

TC until Feb-22 |

$18,650 |

| EM CORFU(+) |

Feeder |

34,654 |

2,556 |

2001 |

TC until Nov-21 then repositioning trip to drydock

TC until Feb-25 |

$10,200

$5,125 for up to 37 days ($35,000 if more than 37 days)

$40,000 |

| EVRIDIKI G (+) |

Feeder |

34,677 |

2,556 |

2001 |

TC until Jan-22

TC until Feb-25 |

$15,500

$40,000 |

| DIAMANTIS P. (*) |

Feeder |

30,360 |

2,008 |

1998 |

TC until Oct-24 |

$27,000 |

| EM SPETSES(*) |

Feeder |

23,224 |

1,740 |

2007 |

TC until Aug-24 |

$29,500 |

| JONATHAN P(*) |

Feeder |

23,351 |

1,740 |

2006 |

TC until Sep-24 |

$26,662(**) |

| EM HYDRA(*) |

Feeder |

23,351 |

1,740 |

2005 |

TC until Apr-23 |

$20,000 |

| JOANNA(*) |

Feeder |

22,301 |

1,732 |

1999 |

TC until Oct-22 |

$16,800 |

| AEGEAN EXPRESS(*) |

Feeder |

18,581 |

1,439 |

1997 |

TC until Mar-22 |

$11,500 |

| Total Container Carriers |

16 |

635,806 |

50,371 |

|

|

|

| Vessels under construction |

Type |

Dwt |

TEU |

To be delivered |

| H4201 |

Feeder |

37,237 |

2,800 |

Q1 2023 |

| H4202 |

Feeder |

37,237 |

2,800 |

Q2 2023 |

Notes:

(*) TC denotes time charter. Charter duration indicates the earliest redelivery date; all dates listed are the earliest redelivery dates under each TC unless the contract rate is lower than the current market rate in which cases the latest redelivery date is assumed; vessels with the latest redelivery date shown are marked by (+).

(**) Rate is net of commissions (which are typically 5-6.25%)

About Euroseas Ltd.

Euroseas Ltd. was formed on May 5, 2005 under the laws of the Republic of the Marshall Islands to consolidate the ship owning interests of the Pittas family of Athens, Greece, which has been in the shipping business over the past 140 years. Euroseas trades on the NASDAQ Capital Market under the ticker ESEA.

Euroseas operates in the container shipping market. Euroseas’ operations are managed by Eurobulk Ltd., an ISO 9001:2008 and ISO 14001:2004 certified affiliated ship management company, which is responsible for the day-to-day commercial and technical management and operations of the vessels. Euroseas employs its vessels on spot and period charters and through pool arrangements.

After the delivery of M/V Leo Paramount, the Company will have a fleet of 16 vessels comprising of 10 Feeder and 6 Intermediate containerships. Euroseas 16 containerships have a cargo capacity of 50,371 teu. Furthermore, after the delivery of two feeder containership newbuildings in the first half of 2023, Euroseas’ fleet will consist of 18 vessels with a total carrying capacity of 55,971 teu.

Forward Looking Statement

This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events and the Company’s growth strategy and measures to implement such strategy; including expected vessel acquisitions and entering into further time charters. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “hopes,” “estimates,” and variations of such words and similar expressions are intended to identify forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates that are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to changes in the demand for containerships, competitive factors in the market in which the Company operates; risks associated with operations outside the United States; and other factors listed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

Visit our website www.euroseas.gr

| Company Contact |

Investor Relations / Financial Media |

Tasos Aslidis

Chief Financial Officer

Euroseas Ltd.

11 Canterbury Lane,

Watchung, NJ 07069

Tel. (908) 301-9091

E-mail: aha@euroseas.gr |

Nicolas Bornozis

President

Capital Link, Inc.

230 Park Avenue, Suite 1536

New York, NY 10169

Tel. (212) 661-7566

E-mail: nbornozis@capitallink.com |