Will Tesla’s Big Reveal Slash Electric Vehicle Prices?

Elon Musk said the forthcoming “Battery Day” would be “one of the most exciting days in Tesla’s history.” This was announced after Tesla’s Q1 2020 earnings report in late April. The Tesla CEO said the event might be a two-part special, with a webcast first, and an in-person event a few months later. They were scheduled to reveal their new advanced battery technology on May 18 (Battery Day), the coronavirus lockdown postponed the event. To date, it has not been rescheduled.

Tesla has been frustratingly quiet regarding the highly anticipated event, although rumors and leaks have been rampant. Most people expect Tesla to unveil a less expensive electric battery that will last one million miles, something not seen in the automotive industry before. Tesla is also rumored to avoid the use of costly cobalt in the company’s next-gen batteries.

Musk has estimated that current Tesla batteries last between 300 and 500 thousand miles (approx.. 1500 cycles). An average vehicle is expected to last, on average, 200 thousand miles. Jeff Dahn, a professor in the Department of Physics & Atmospheric Science and the department of chemistry at Dalhousie University, who joined Tesla in 2016 to conduct research, has said lithium-ion batteries, which are used to power electric vehicles, have the capability of lasting over 1 million miles.

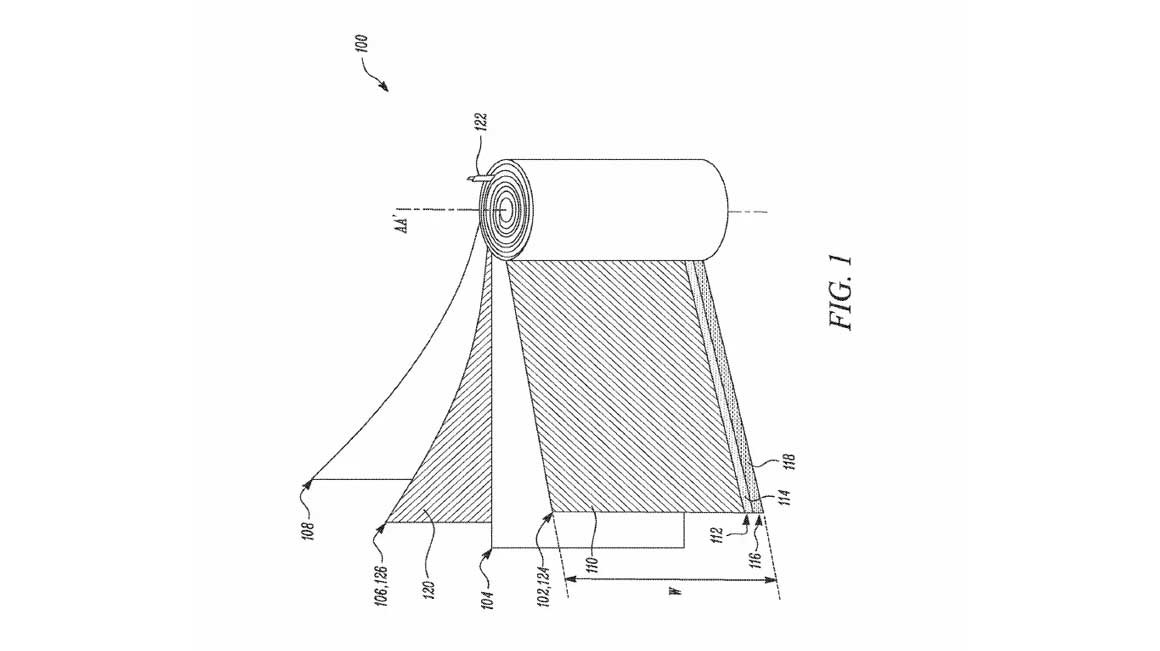

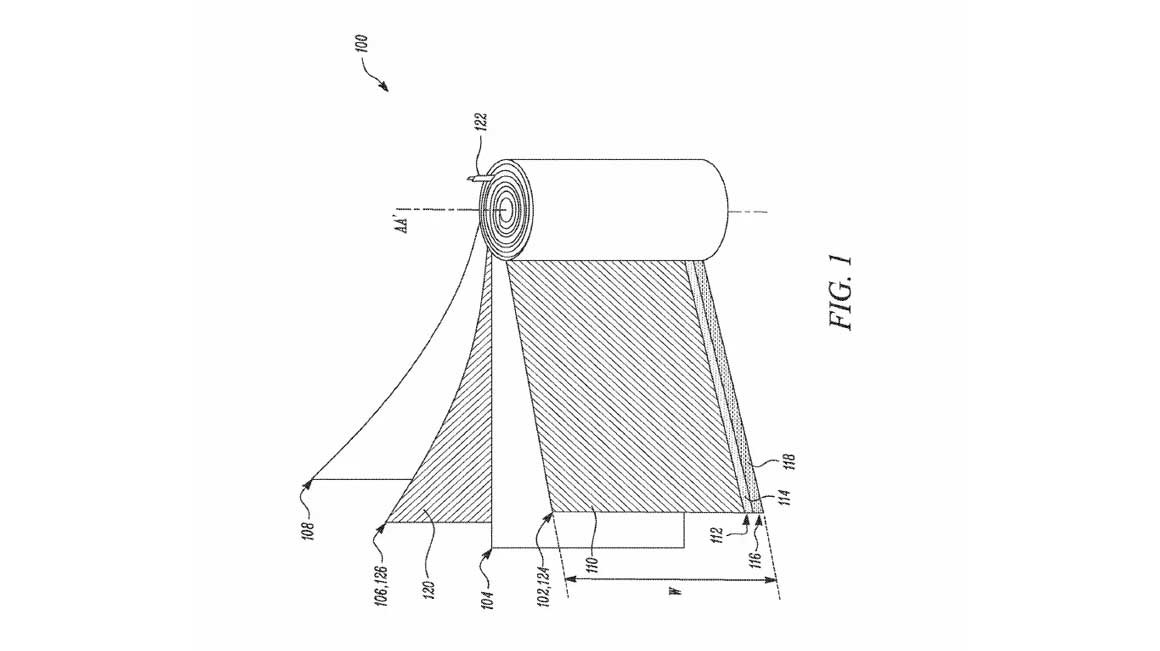

Tesla, along with Dahn, filed a patent to use dioxazolones and nitrile sulfites as electrolyte additives. The outcome, the introduction of a new lithium-ion battery. The patent claims to provide new energy, efficiency, and longevity. The cathode structure would increase durability, creating a longer lifespan and result in more charging cycles and greater mileage.

In January of 2020, Tesla started production with CATL, a leading supplier for batteries in China. In February, a report from Reuters announced Tesla was “in talks” to use CATL’s lithium-ion phosphate batteries, which completely excludes the use of cobalt, which is the most expensive metal in EV batteries. In 2018, Elon Musk tweeted that Tesla uses 3% cobalt now, and they plan on being cobalt-free in their next-gen batteries.

As Tesla aims to improve affordability for their electric vehicles, the company is reaching for a price point below $100/kWh, a number industry experts have said would make them directly comparable, price-wise, to gas-powered vehicles. Today, electric vehicle batteries can be found no lower than $150/kWh.

Tesla recently announced plans for a new factory in Austin, Texas. They had previously announced plans for a “Cybertruck Gigafactory.” Musk has said that he hopes to have vehicles produced by the end of the year, an extremely aggressive and optimistic timeline.

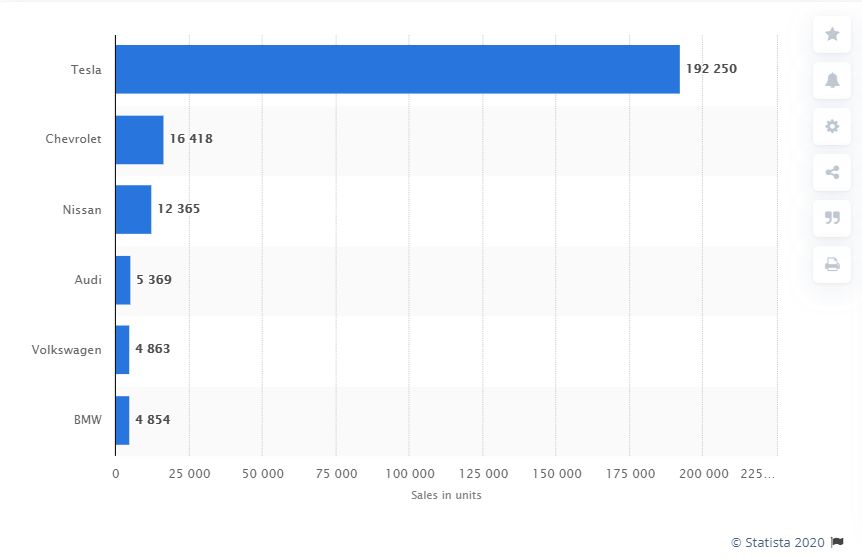

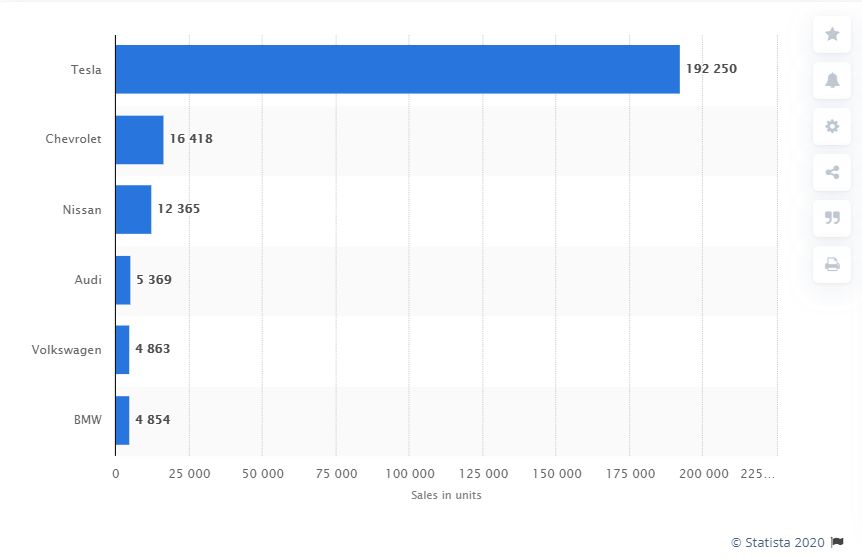

In 2019, Tesla’s Model 3 was by far the best-selling electric vehicle, selling over 67,650. Tesla also held second place, with the Model X SUV, and took 3 out of the top 5 spots among EV makers. Just yesterday, Tesla announced a price cut on the company’s Model S and improved the range to 402 miles on a single charge, the first electric vehicle with such capabilities; a 20% increase when compared to the 2019 model.

U.S. Battery Electric Vehicle Sales in 2019, by Brand

The number of battery electric vehicles sold in the United States came to about 245,000 in 2019, with sales of Tesla models accounting for almost 80 percent of that figure. Second-ranked Chevrolet accounted for only seven percent of U.S. battery electric vehicle sales.

There is no indication Battery Day has been canceled or that there is an issue other than deciding how and when to make their full announcement. The event has already been postponed over 45 days, with no timeline expectations set. After the initial postponement, Musk announced, as mentioned earlier, a possible virtual event rather than live. Social distancing still prevents the typical Telsa unveiling. When the day finally happens, a rumor is that the electric storage design will be a leap forward in battery storage with many benefits for consumers. One benefit could be a reduced price. Tesla fans, bloggers, vloggers, and aficionados are expecting industry-changing news from the automotive giant.

Suggested Reading:

Cobalt and Rare Earth Metals from the Ocean Floor Eyed to Meet Growing Battery Demand

Space Force Will Require Emerging Technologies

Cryptocurrency and the Howey Test:

Are They Securities?

Enjoy Premium Channelchek Content at No Cost

Sources:

Tesla’s secret batteries aim to rework the math for electric cars and the grid

Musk Tweet April 13

Musk Cobalt Tweet

Statista

Tesla’s New Lithium-Ion Patent