What’s Insider Trading? – Is it a Problem for Investors?

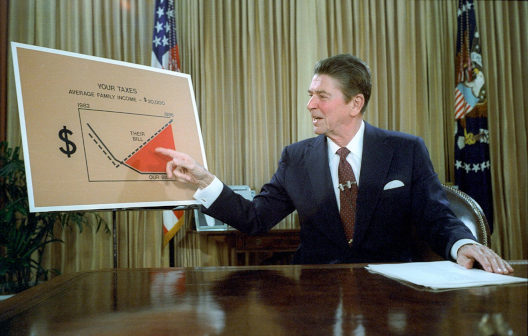

There’s a growing bipartisan push to prohibit members of Congress from buying or selling stocks. The shift follows news reports that several senators sold stocks shortly after receiving coronavirus briefings in early 2020 and that at least 57 lawmakers have failed to disclose financial transactions since 2012 as required by law.

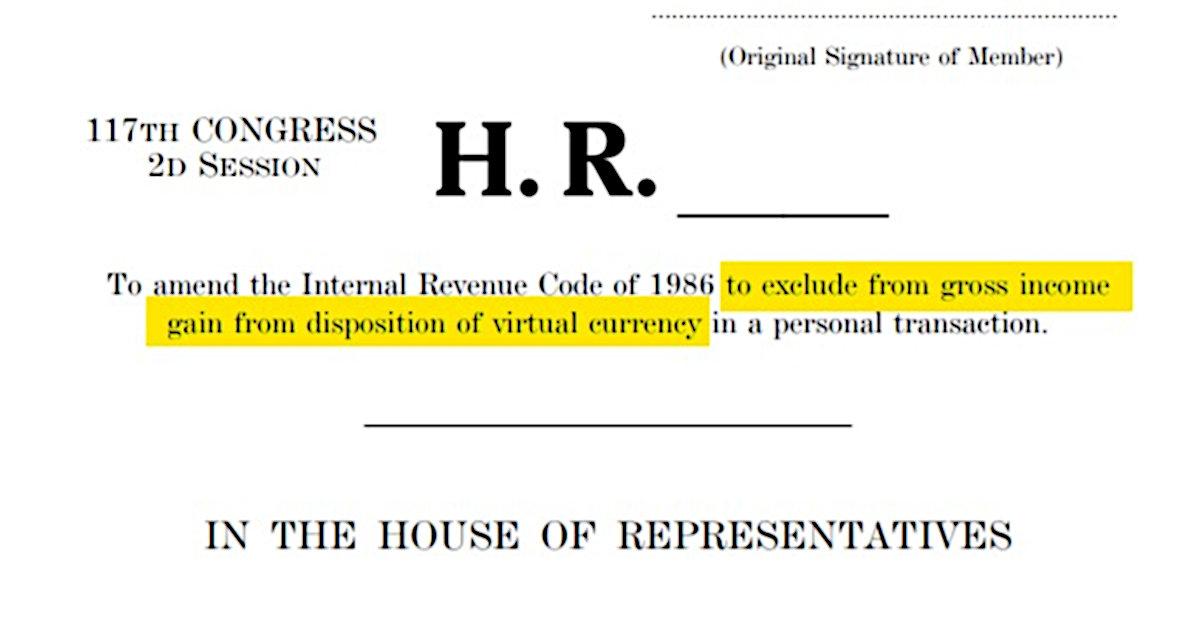

Congress passed that law – the Stop Trading on Congressional Knowledge Act, also known as the STOCK Act – in 2012 to fight insider trading among lawmakers with increased transparency. But a chorus of legislators and governance watchdogs argue that it didn’t go far enough and isn’t working.

All this raises two important questions: What exactly is insider trading and what’s the big deal?

|

This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It represents the research-based findings and thoughts of Alexander Kurov Professor of Finance and Fred T. Tattersall Research Chair in Finance, West Virginia University and Marketa Wolfe Associate Professor of Economics, Skidmore College.

|

We are a finance professor and an economics professor who have been studying financial markets and how investors try to take advantage of access to information for their personal gain. Our research shows it’s very common but difficult to stop.

What is Insider Trading?

Insider trading is whenever someone uses market-moving nonpublic information in the act of buying or selling a financial asset.

For example, say you work as an executive at a company that plans to make an acquisition. If it’s not public, that would count as inside information. It becomes a crime if you either tell a friend about it – and that person then buys or sells a financial asset using that information – or if you make a trade yourself.

Punishment, if you’re convicted for insider trading, can range from a few months to over a decade behind bars.

Insider trading became illegal in the U.S. in 1934 after Congress passed the Securities Exchange Act in the wake of the worst sustained decline in stocks in history. From Black Monday 1929 through the summer of 1932, the stock market lost 89% of its value. The act was meant to prevent a whole litany of abuses from recurring, including insider trading.

The issue was dramatized in Oliver Stone’s 1987 classic movie “Wall Street,” in which ruthless financier Gordon Gekko makes millions of dollars by trading on inside information on several companies obtained from his protege, Bud Fox.

“The most valuable commodity I know of is information,” declares Gekko, who by the end of the film is convicted of insider trading and sent to jail.

‘Informed Trading’

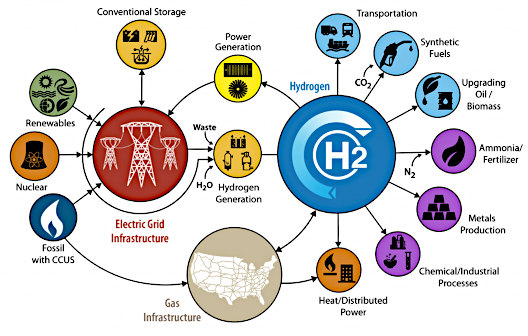

While insider trading typically involves trading stocks of individual companies based on information about them, it can involve any kind of information about the economy, a commodity or anything else that moves markets.

For instance, the monthly consumer price index figures have a huge impact on financial markets at the moment because of concerns about inflation and how it will affect the pace of Federal Reserve interest rate hikes. That data is collected and then closely guarded, but a small number of people have access to it before it’s officially released, making the information extremely valuable if any of them wanted to profit off it.

Our own research on financial trading ahead of the release of U.S. economic data shows that financial markets tend to move in the “correct” direction in the minutes before it’s released. That is, if the new data would be a positive for stocks, we saw patterns of stocks rising before that information becomes publicly available – something known as “informed trading.” We also found this to be the case on data released in China and the U.K.. This suggests that some traders may have advance knowledge of information in economic announcements.

Of course, alternative explanations could be that some traders are simply more skilled at collecting and analyzing available data that correctly predicts the economic announcements. For example, online prices collected in real time can be used to predict inflation levels. Also, satellite imagery and analyst forecasts can be used to predict crude oil and natural gas inventory levels.

Common, Profitable and Hard to Prove

Research shows that insider trading is common and profitable, yet notoriously hard to prove and prevent. A 2020 study estimated that only about 15% of insider trading in the U.S. is detected and prosecuted.

One of the more famous – and few – examples of insider trading being prosecuted was the 2004 conviction of businesswoman and media personality Martha Stewart for selling shares based on an illegal tip from a broker. Another came in 2016, when billionaire Steven Cohen and his now-defunct SAC Capital Advisors hedge fund entered into a US$135 million settlement over insider-trading allegations. The hedge fund also paid a fine of $1.8 billion in 2014 over similar charges.

And in 2020, former U.S. Rep. Chris Collins was sentenced to 26 months in prison for passing on a confidential tip to his son and then lying about it to the FBI.

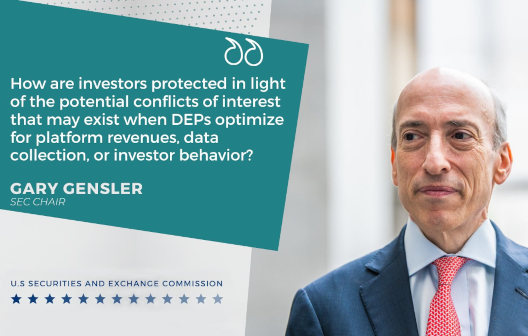

More recently, two Fed officials stepped down in September 2021 after disclosures showed they were trading extensively in 2020 at the same time the U.S. central bank was spending trillions saving the economy from the effects of the pandemic. And Sen. Richard Burr and his brother remain under investigation by the Securities and Exchange Commission over stock trades they made in February 2020 shortly after the North Carolina Republican received closed-door briefings on the pandemic.

Why it Matters

Insider trading is not a victimless crime. By throwing sand in the gears of financial markets, people trading on inside information benefit at the expense of others.

A key characteristic of well-functioning financial markets is high liquidity, which means it is easy to make large trades at low transaction costs. Insider trading adversely affects market liquidity and makes transaction costs higher, reducing investor returns. And since a lot of people have a stake in financial markets – about half of U.S. families own stocks either directly or indirectly – this behavior hurts most Americans.

Insider trading also makes it more expensive for companies to issue stocks and bonds. If investors think that insiders might be trading bonds of a company, they will demand a higher return on the bonds to compensate for their disadvantage – increasing the cost to the company. As a result, the company has less money to hire more workers or invest in a new factory.

There are also broader impacts of insider trading. It undermines public confidence in financial markets and feeds the common view that they odds are stacked in favor of the elite and against everyone else.

Furthermore, since inside traders profit from privileged access to information rather than work, this makes people believe that the system is rigged.

Chris Collins arrives at a federal court as cameras record him

Former U.S. Rep. Chris Collins pleaded guilty to insider trading and lying to the FBI. He was sentenced to 26 months in jail in 2020.

Curbing Insider Trading

The odds of Congress prohibiting lawmakers from trading stocks got a boost when House Speaker Nancy Pelosi recently said she may support the idea – though she’d like to see a ban also apply to the Supreme Court, which currently has no rules governing the practice. At least some Republicans, such as U.S. Rep. Kevin McCarthy and Sen. Ben Sasse, also say they support a ban.

For its part, the Fed reacted to trading by its two former officials by banning bank policymakers and senior staff from buying individual stocks or bonds.

There are also less heavy-handed ways to curb insider trading. In recent years, policymakers in the U.S. and the U.K. have tightened procedures governing the release of economic data. In the U.K., for example, dozens of public officials used to get market-moving economic data 24 hours before the public release. After the practice stopped in 2017, we found evidence of significantly less informed trading ahead of the release – suggesting it effectively prevented a lot of insider trading.

Surveys show widespread bipartisan public support for Congress to ban lawmakers from trading financial securities, with a recent poll showing 75% in favor. While that doesn’t mean a law will get passed, it does put pressure on lawmakers of both parties to do something about the problem.

Suggested Reading

Stay up to date. Follow us: