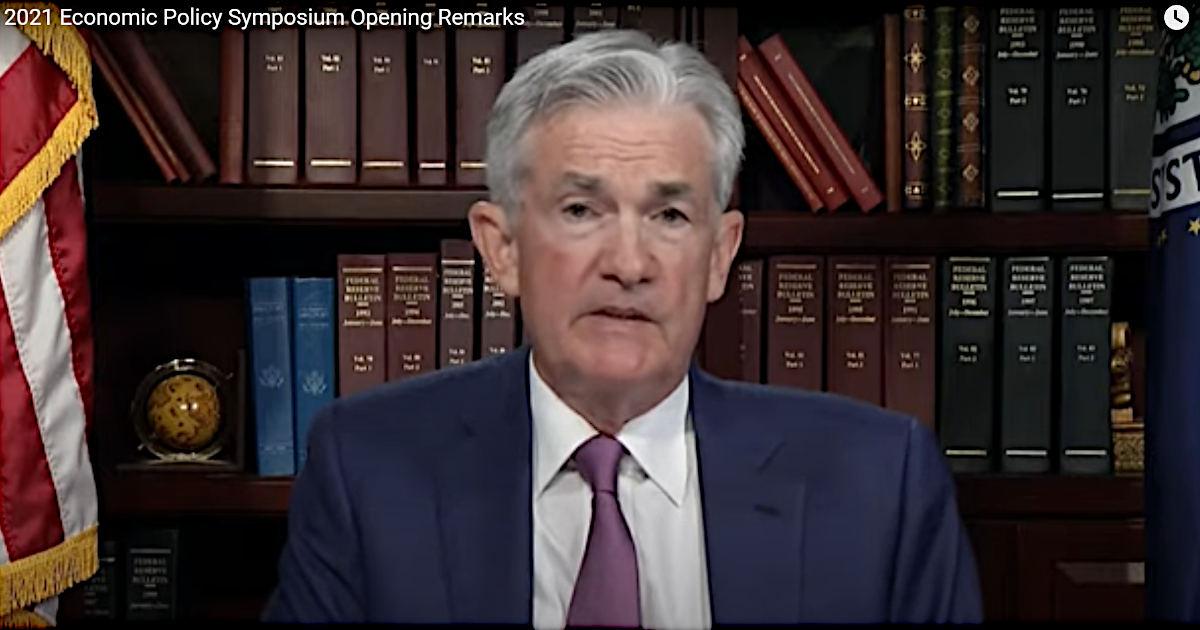

The High Points of Fed Chairman Powell’s Presentation are Worth Understanding

Each August, the main event is always the U.S. Federal Reserve Bank Chairman at the Jackson Hole Economic Policy Symposium. This year it was especially true as events of the past several months have allowed more policy leeway than usual for the Fed to conduct monetary policy. Some of the most impactful policy moves have had a dramatic lifting effect on markets and sectors of the economy. However, these policies that include quantitative easing, near-zero bank lending rates, securities purchases, and yield-curve control are seen by many as unsustainable and worth unwinding before the “medicine” harms the “patient.”

The challenge the Fed always faces after they have been using their arsenal to attack a faltering economy is withdrawing from the fight in measured steps and at a pace that is neither too late and ignites another problem, nor too soon allowing problems to resurface.

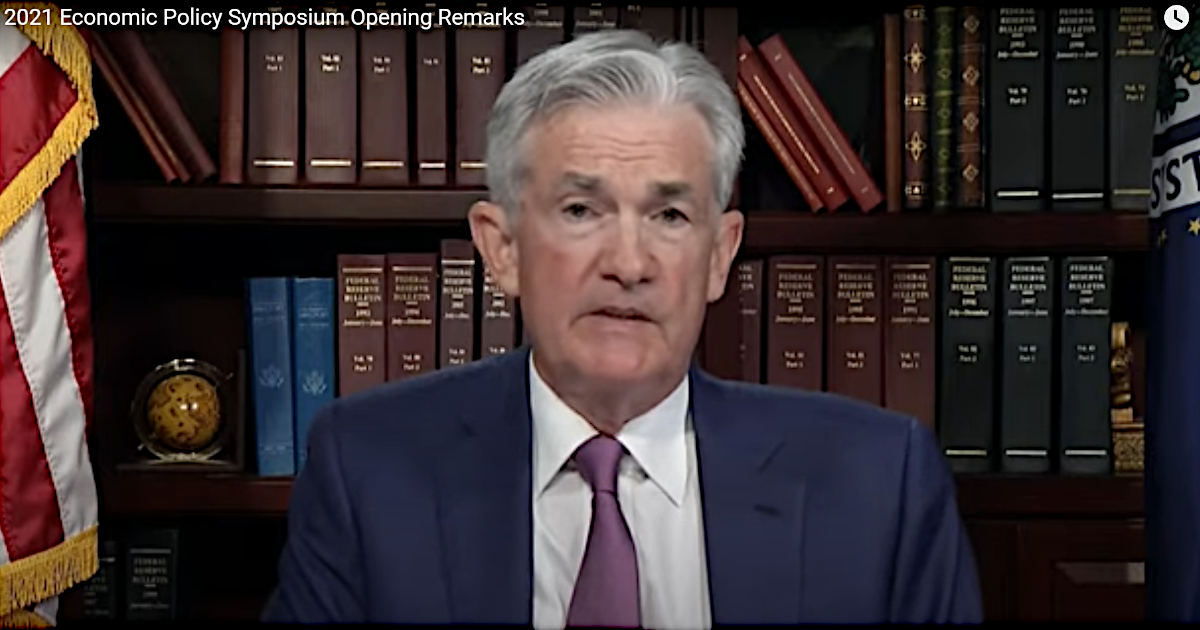

Federal Reserve Chairman Jay Powell was again the main event at the Jackson Hole Summit titled, “Macroeconomic Policy in an Uneven Economy.” The market has been waiting for weeks to measure his words to determine what the Fed’s actions may be, and then, how it impacts their portfolio, or what shift in strategy they may wish to make.

A briefing of the Fed Chairman’s comments at this event on Friday, August 27th is below.

Opening Remarks

The chairman discussed in his opening remarks how an aggressive policy has allowed for a vigorous economic recovery. He pointed out the economy during the downturn was atypical; personal income rose, spending shifted from service sectors to manufacturing, and the demand for goods has lead to bottlenecks and shortages.

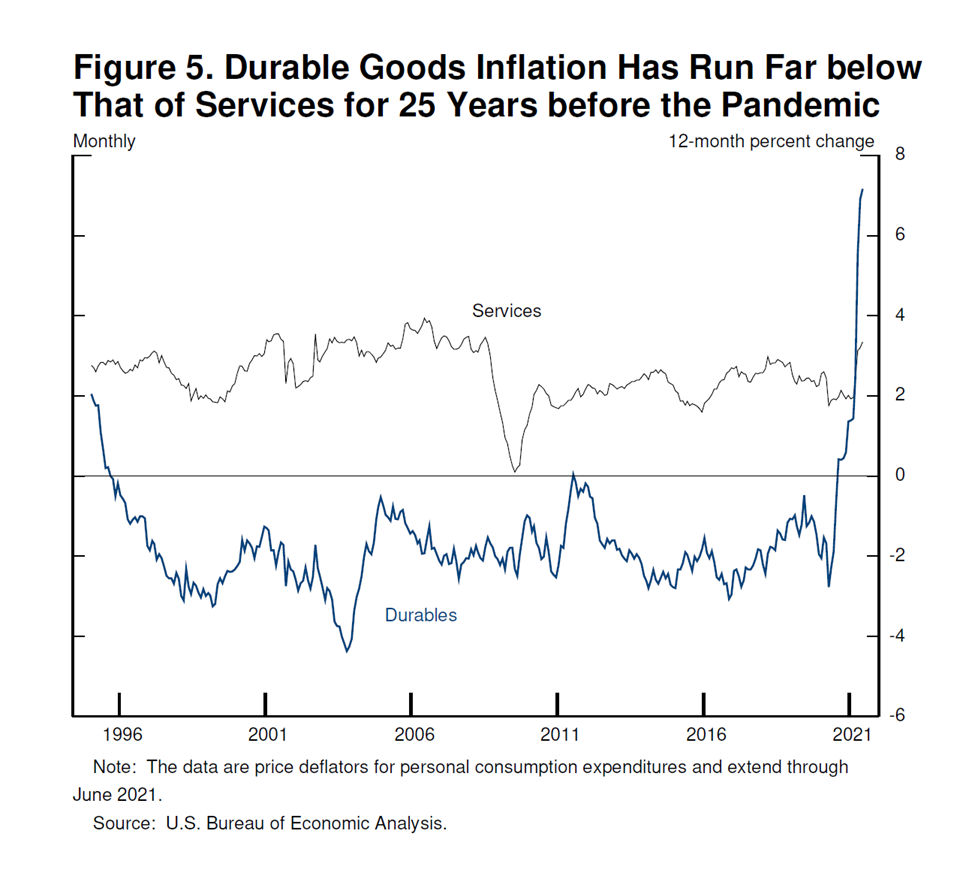

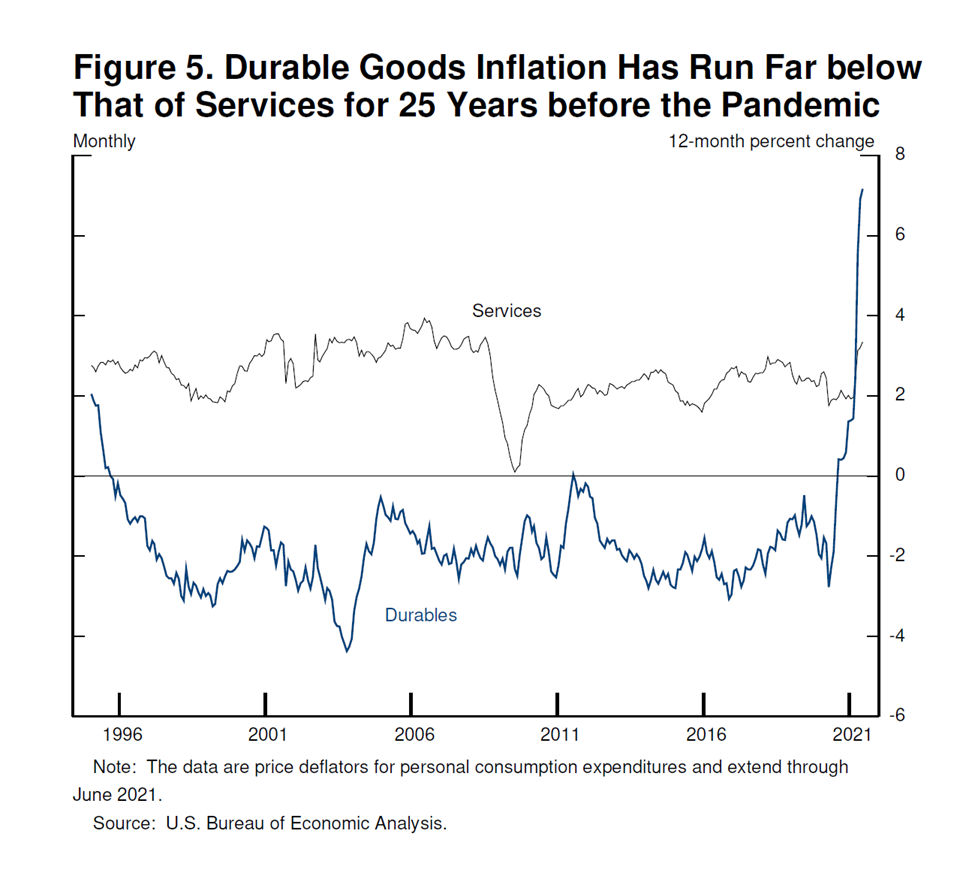

On the subject of prices, Powell’s opening remarks included,”…the result has been elevated inflation in durable goods—a sector that has experienced an annual inflation rate well below zero over the past quarter-century.” He sees labor markets improving but says the unknowns of the pandemic’s path create turbulence and risks to the improvement.

The Recession and Recovery

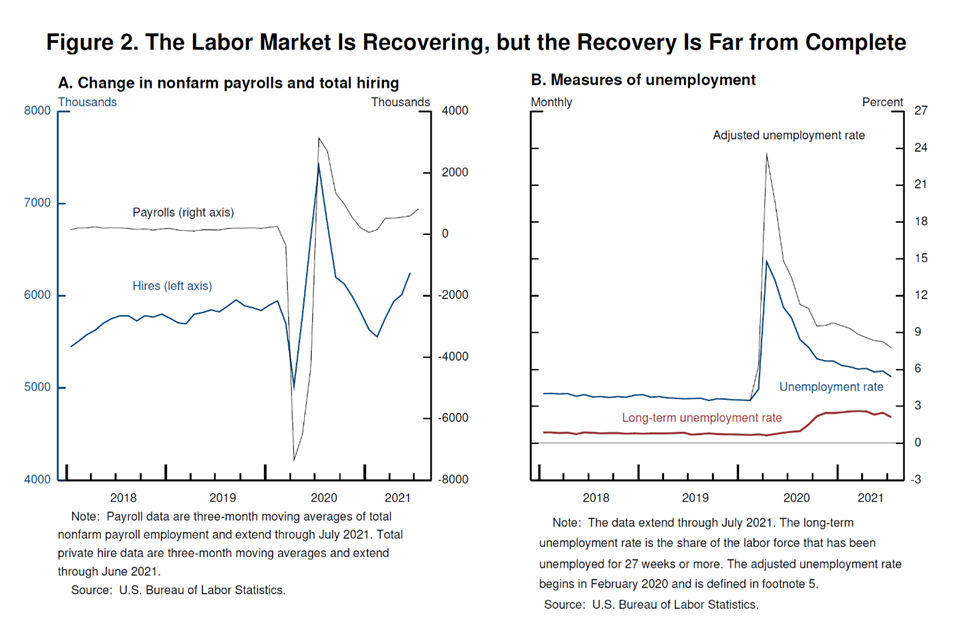

Powell pointed out the decline in output in the second quarter of 2020 was twice the full decline during the Great Recession of 2007–09. He reminded that the pace of output has not passed previous highs but exceeded the Fed’s expectations. He mentioned recovery in employment has lagged output but is also running above what was expected.

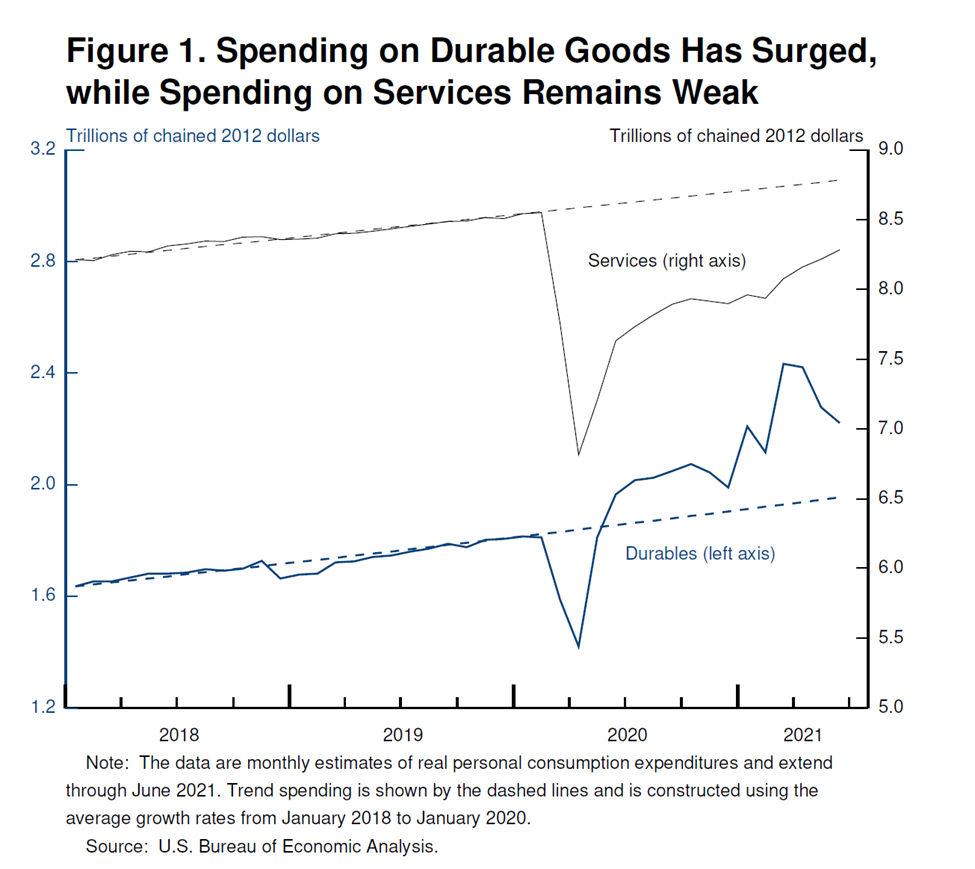

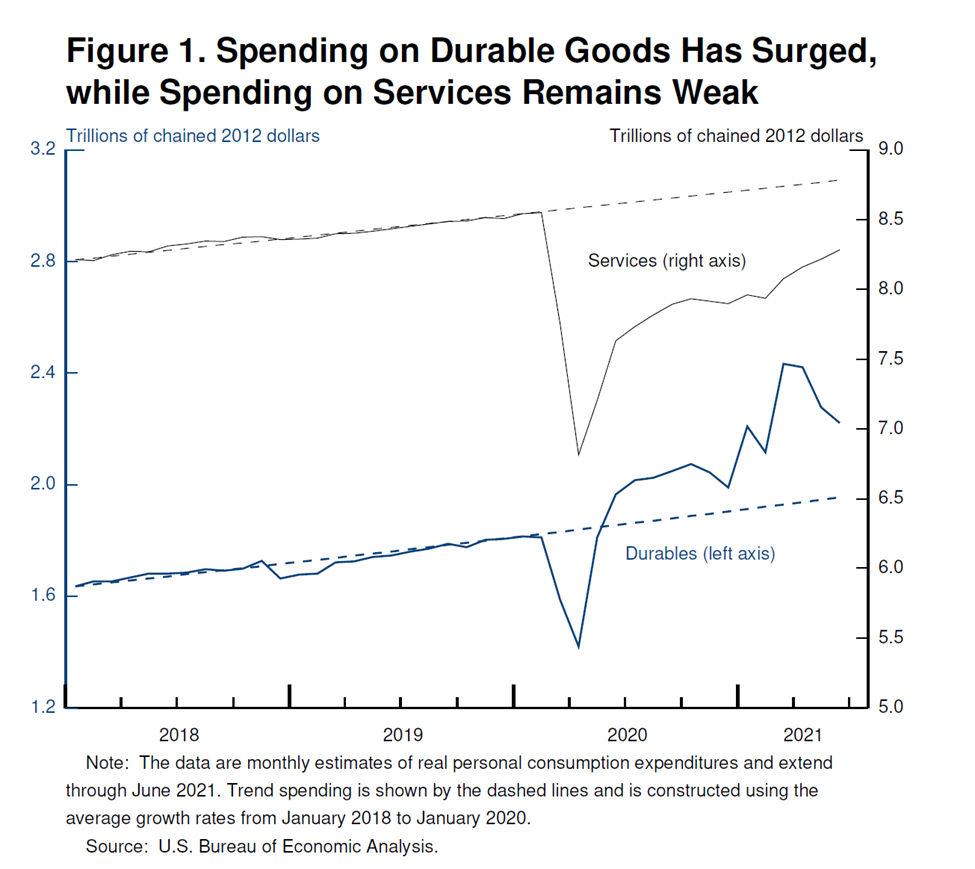

Data was given during the presentation to demonstrate the unevenness of the recovery and sector spending shifts to goods, “particularly durable goods such as appliances, furniture, and cars—and away from services, particularly in-person services in areas such as travel and leisure.” Powell reminded.

Providing more detail, Powell said, “As the pandemic struck, restaurant meals fell 45 percent, air travel 95 percent, and dentist visits 65 percent.” He pointed out that even today, with overall gross domestic product and consumption spending more than fully recovered, spending in the service sector remains about 7 percent below the expected level. He continued, “Total employment is now 6 million below its February 2020 level, and 5 million of that shortfall is in the still-depressed service sector.” Powell contrasted that with spending on durable goods, which he says is still running about 20% above pre-pandemic levels.

The inflation component he pointed shows demand outstripping pandemic-reduced supply, and rising durables prices that are a big factor in why inflation is running ahead of its 2% target.

The Path Ahead: Maximum Employment

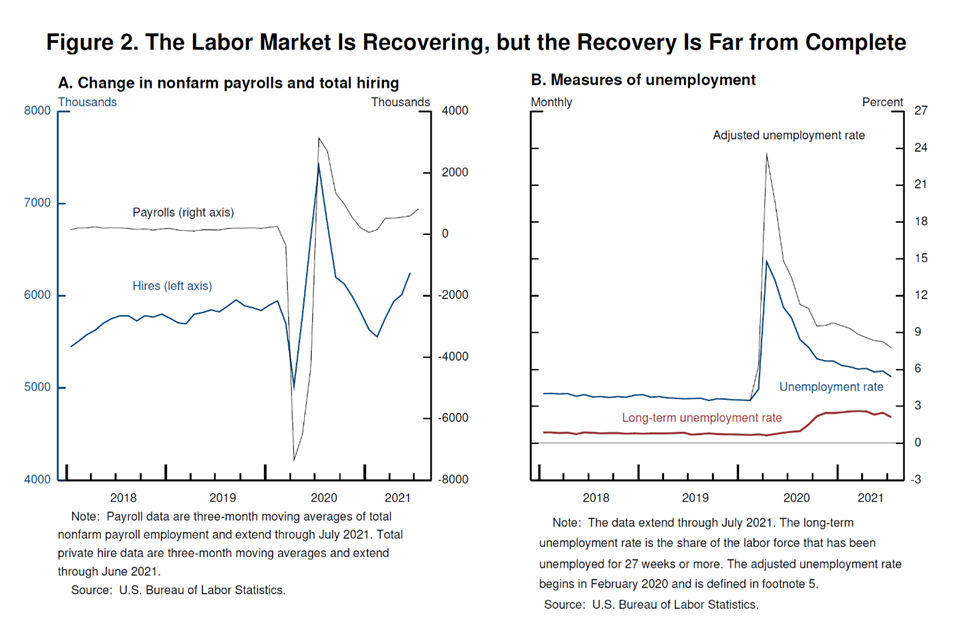

The labor market was described as “brightening considerably.” And, “The pace of total hiring is faster than at any time in the recorded data before the pandemic.” He then added that “openings and quits” are also at record highs and that employers are reporting they “cannot fill jobs fast enough to meet returning demand.”

Powell expects these conditions for job seekers should help the economy cover the remaining ground to reach maximum employment. He said that although unemployment is at a post-pandemic low, he considers it too high. Part of what he sees as the problem is that “Long-term unemployment remains elevated, and the recovery in labor force participation has lagged well behind the rest of the labor market, as it has in past recoveries.”

“With vaccinations rising, schools reopening, and enhanced unemployment benefits ending, some factors that may be holding back job seekers are likely fading. While the Delta variant presents a near-term risk, the prospects are good for continued progress toward maximum employment,” Powell said.

The Path Ahead: Inflation

Speaking specifically on the subject of inflation, the Fed chairman addressed different perspectives, including the absence of broad-based pressures, higher-inflation items, wages, long-term expectations, broke it down into five segments, broad-based and global forces.

The spike in inflation, he believes, is not broad-based. Instead, he described it as being “largely the product of a relatively narrow group of goods and services that have been directly affected by the pandemic and the reopening of the economy.” He said that durable goods contributed 1% to the most recent YOY measure — energy prices, another 0.8 percentage point to headline inflation. He pointed to history to explain why the Fed believes the increases are transitory.

We would be more concerned if inflationary pressures were spreading more broadly through the economy; this was the overall point he made.

Items that we saw experience higher inflation, he said are moderating. “Used car prices, for example, appear to have stabilized; indeed, some price indicators are beginning to fall. If that continues, as many analysts predict, then used car prices will soon be pulling measured inflation down, as they did for much of the past decade.” Powell said.

He believes the same dynamic, where falling prices may pull down the price index includes, durable goods. Chairman Powell explained, “As supply problems have begun to resolve, inflation in durable goods other than autos has now slowed and may be starting to fall. It seems unlikely that durables inflation will continue to contribute importantly over time to overall inflation.”

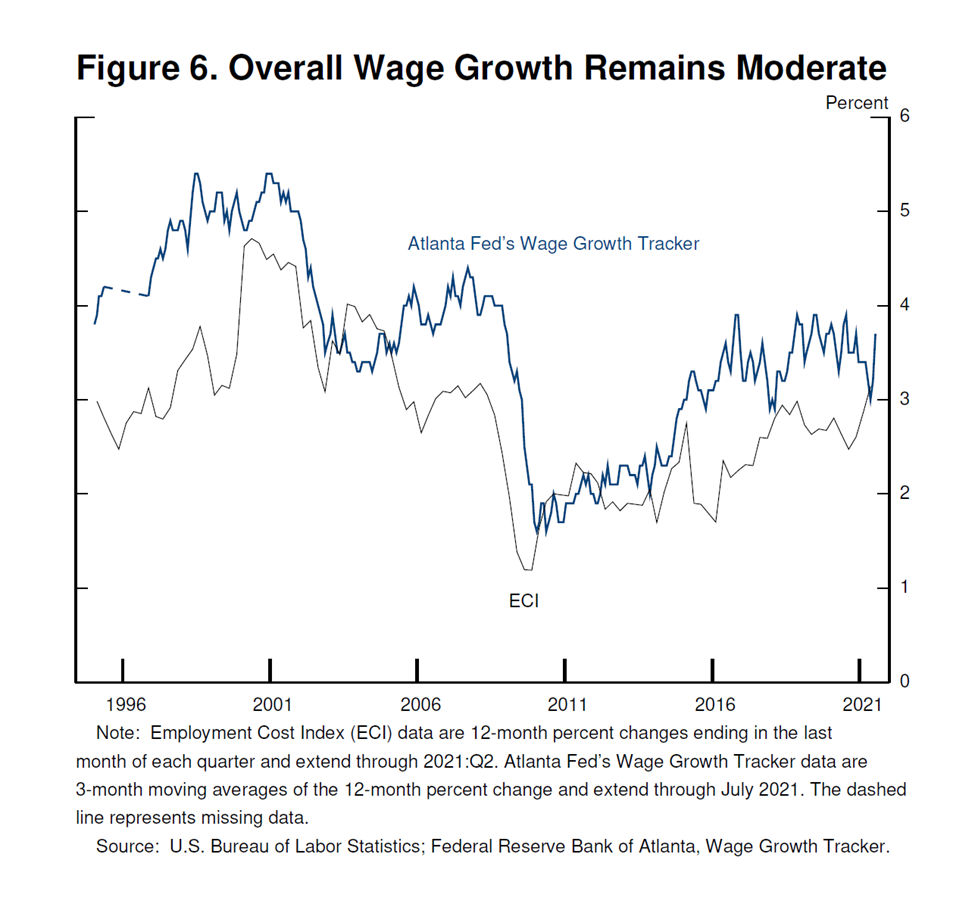

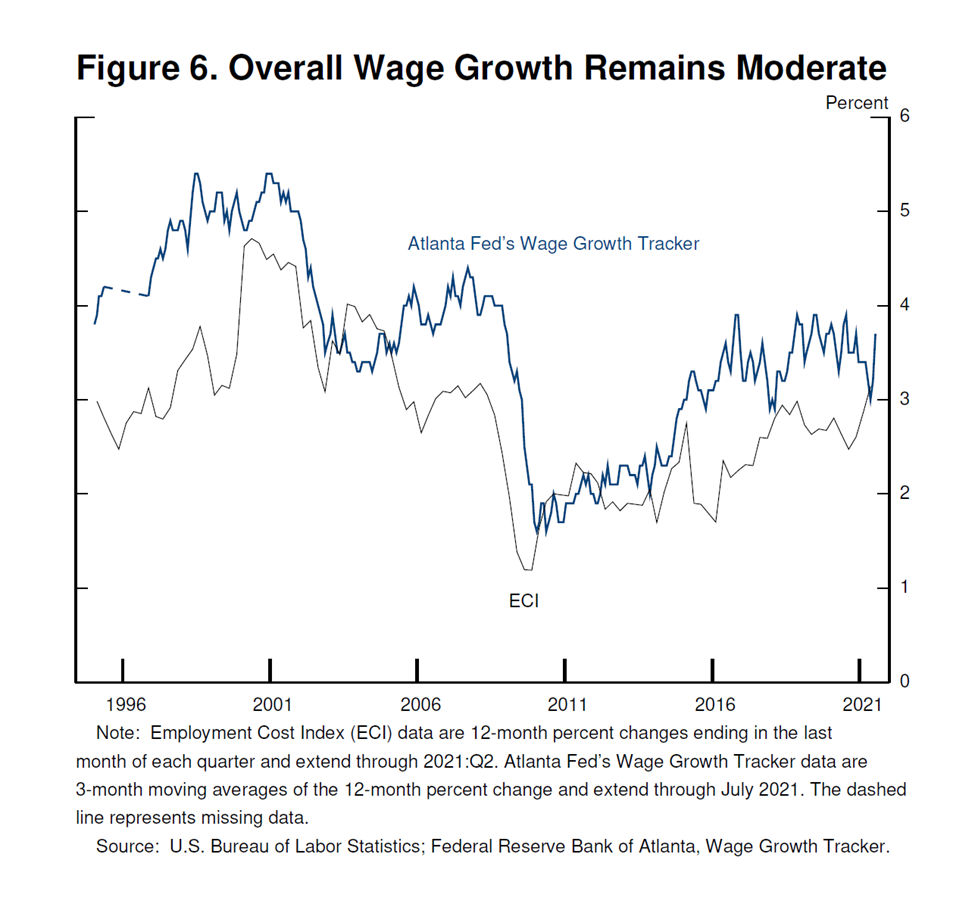

Wage increases, another important driver of consumer price increases, were also addressed. He described them as a welcome development driving an increased standard of living. Later the Fed chairman set expectations by saying, “But if wage increases were to move materially and persistently above the levels of productivity gains and inflation, businesses would likely pass those increases on to customers, a process that could become the sort of “wage–price spiral” seen at times in the past.10 Today we see little evidence of wage increases that might threaten excessive inflation.” He believes that broad-based measures of wage changes that adjust for the change in the composition of the labor force are better measures. He points to the employment cost index and the Atlanta Wage Growth Tracker as evidence that inflation is more consistent with 2% inflation growth.

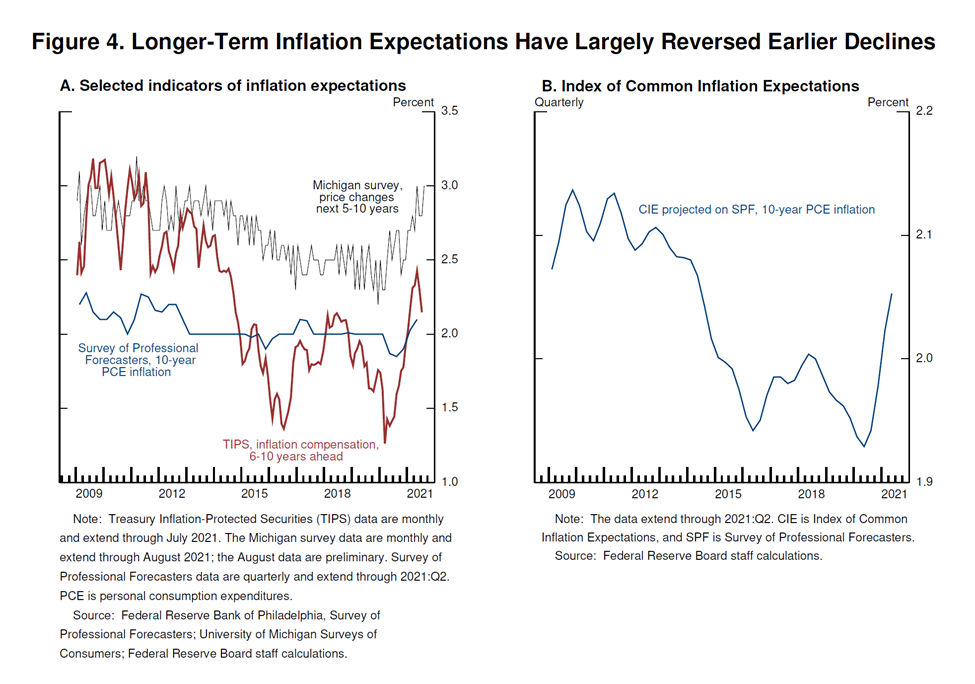

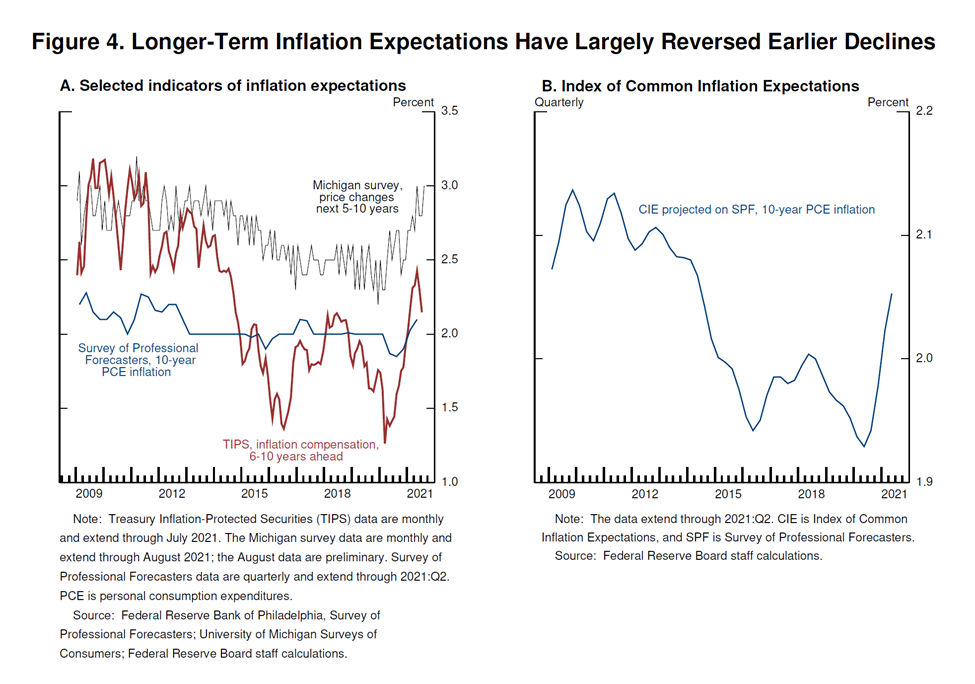

Policymaker’s longer-term inflation expectations remain anchored, according to Powell. He believes, policy should look through temporary swings. He indicated that most measures of inflation are “noisy.” As a result, they focus across many different measures. Powell said, “One approach to summarizing these patterns is the Board staff’s index of common inflation expectations (CIE), which combines information from a broad range of survey and market-based measures. This index captures a general move down in expectations starting around 2014, a time when inflation was running persistently below 2 percent. More recently, the index shows a welcome reversal of that decline and is now at levels more consistent with our 2 percent objective.” As a result, longer-term inflation expectations have moved much less than actual or near-term expectations. Although he said they are keeping a close eye on the gauges, the indication is that they are transitory.

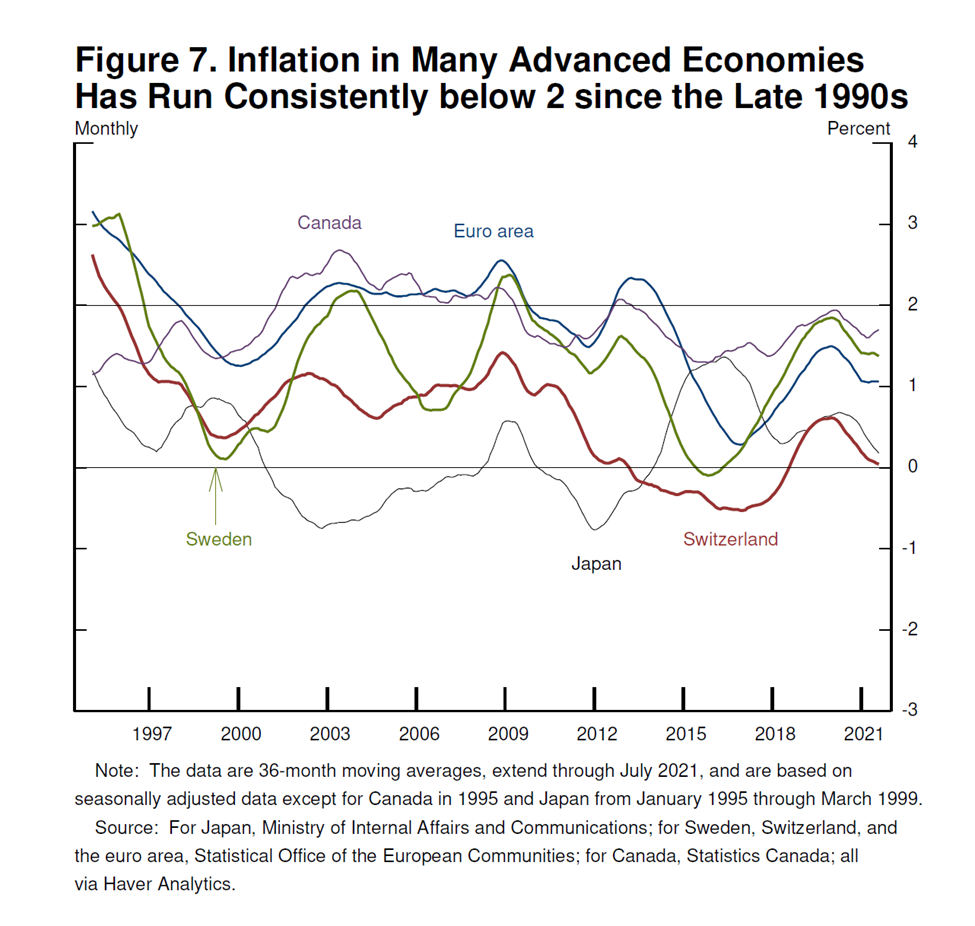

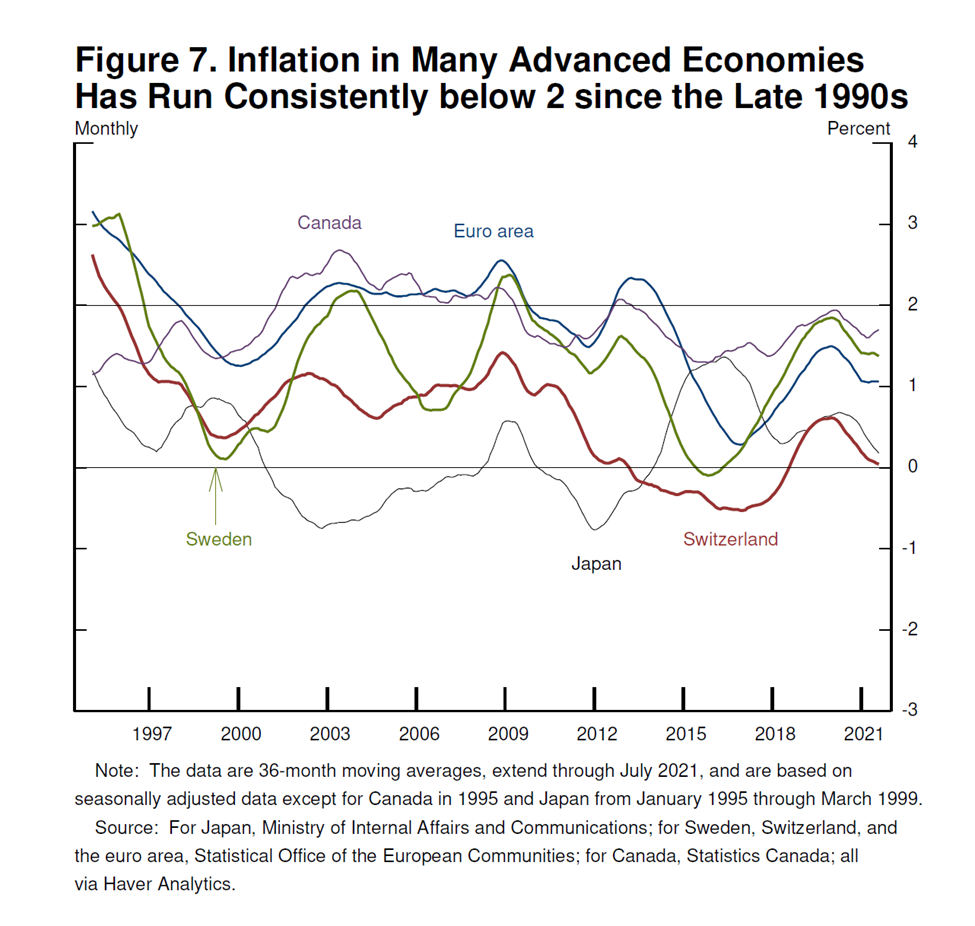

Powell also noted that, since the 1990s, inflation in many advanced economies had run somewhat below 2 percent even during good times. He attributes this to disinflationary mechanisms such as technology, shipping, demographics, and stronger commitment by central banks to price stability.

The financial and real estate markets got what they wanted with Powell’s wrap-up on inflation when he said, “To sum up, the baseline outlook is for continued progress toward maximum employment, with inflation returning to levels consistent with our goal of inflation averaging 2 percent over time.” In other words, the economy is growing but not so fast that we will have excessive inflation.

Implications for Monetary Policy>

Powell spoke about the history of central banks and that they can not take for granted that when the causes of inflation are transitory, that inflation won’t take on a life of its own beyond the initial impetus. His explanation was public expectations. He said, “The 1970s saw two periods in which there were large increases in energy and food prices, raising headline inflation for a time. But when the direct effects on headline inflation eased, core inflation continued to run persistently higher than before. One likely contributing factor was that the public had come to generally expect higher inflation.” He added that they now monitor expectations, as expectations can be a cause of continued rising prices.

He conceded that central; banks have been prone to calling inflation wrong. If this appears to become the case, he said, “[the]Federal Open Market Committee would certainly respond and use our tools to assure that inflation runs at levels that are consistent with our goal.”

He assured the FOMC was committed to staying in the fight for as long as it takes to support full economic recovery. He believes the changes made last year to the Statement on Longer-Run Goals and Monetary Policy

Strategy is well suited to address today’s challenges.

On the subject of the pace of asset purchases Powell asserted, “We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals, measured since last December when we first articulated this guidance.”

He believes the Fed’s elevated holding of longer-dated fixed income securities supports an accommodative stance. He is also of the view that they have met the previously spoken about “substantial further progress” test for inflation. He also noted that the progress toward maximum employment has been positive. Then Powell suggested tapering by saying, “At the FOMC’s recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year. The intervening month has brought more progress in the form of a strong employment report for July, but also the further spread of the Delta variant. We will be carefully assessing incoming data and the evolving risks.” This can be taken to mean that even without further asset purchases, those currently supporting the economy are expected to be sufficient.

Interest Rates

On the subject of interest rates, the Fed Chairman noted that a reduction in asset purchases is not necessarily a change in interest rate policy. “The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test,” Powell said.

Take-Away

This year’s economic policy symposium was held virtually. The title was “Monetary Policy in an Uneven Economy,” the discussion by Federal Reserve Chairman Powell reflected the title quite well. The Fed sees the economy growing, inflation abating, and their objectives being met. With each statement, he made clear that they are closely monitoring the situation since the economy is uneven, and pandemic concerns continue to vary. Powell reaffirmed the central bank’s emerging plan to begin reversing its easy-money policies later this year while explaining in greater detail why he expects a recent surge in inflation to fade over time.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

Source:

https://www.federalreserve.gov/newsevents/speech/powell20210827a.htm

Stay up to date. Follow us: