No matter if you are just starting your investing journey or a seasoned professional, making a sound investment decision is always complex. However, one crucial aspect that can separate successful investors from the rest is equity research.

But, what exactly is equity research, and why is it so vital in the world of investing?

Today, we are going to dive deep into this topic to help you understand how equity research can be leveraged to make more informed investment decisions. By shedding light on this intricate process and providing valuable insights from free equity research reports, you can arm yourself with actionable tips and tools to become a smarter investor.

Understanding Equity Research

Equity research is the detailed analysis and evaluation of companies and their equity securities like common and preferred stocks. The core goal is to develop an informed, unbiased opinion on the financial valuation and future prospects of a public company along with its shares. Equity researchers, often referred to as equity analysts, conduct rigorous financial modeling, ratio analysis and due diligence research to provide actionable investment recommendations and targets.

These comprehensive equity research reports become invaluable resources that help all classes of investors make prudent decisions on which stocks to buy, hold or sell. The reports provide a holistic perspective of a company’s financial health, operations, industry dynamics, and management team. By reviewing equity research reports, investors can better assess the inherent risks and growth opportunities of a potential investment.

For example, research reports incorporate detailed financial projections, valuation models, and investment theses that indicate whether a stock may be undervalued or overpriced. Having access to high-quality equity research from Wall Street analysts can provide individual investors with a distinct edge when selecting stocks to build their portfolios.

What are the different types of equities?

Common Stock – This represents ownership in a company. Common stockholders typically get voting rights and a claim on dividends and corporate earnings after other stakeholders are paid.

Preferred Stock – This represents partial ownership in a company. Preferred shareholders have priority over common stockholders when it comes to claims on assets and earnings. They typically receive regular dividend payments before common shareholders. However, preferred stock usually does not come with voting rights.

Blue Chip Stocks – These are stocks of large, reputable companies with a long history of sound financials and steady dividends. Blue chip stocks are generally considered lower risk. Examples include companies like Johnson & Johnson, Procter & Gamble, and Coca-Cola.

Growth Stocks – These are stocks of companies expected to grow at an above-average rate compared to the broader market. Typical growth stocks trade at higher valuations and reinvest profits into expansion rather than pay dividends. Examples include tech companies like Alphabet, Facebook, and Netflix.

Income Stocks – These stocks regularly pay out higher than average dividends to shareholders. They are ideal for investors seeking regular income. Traditional income stocks include utilities, real estate stocks, and consumer staples companies.

Penny Stocks – These are inexpensive stocks that trade for under $5 per share. Penny stocks are generally more volatile and risky since they belong to smaller companies.

Now you may be wondering, who actually conducts all this intensive equity research that gets distilled into reports? Equity research is primarily conducted by financial analysts employed by investment banks, wealth management firms, hedge funds, pension funds, and other institutional investors. These analysts possess deep financial acumen and industry expertise that allows them to build complex financial models and derive reliable stock valuations for public companies.

Top firms like Goldman Sachs, Morgan Stanley and Noble Capital Markets have entire teams of equity analysts covering different sectors, industries, and regions. The lead analyst generally focuses on and specializes in a specific industry they have experience in. For instance, some analysts may focus on just healthcare stocks or technology companies. These specialists leverage their knowledge to provide invaluable insights and analysis.

Why is Equity Research Essential?

Now that we’ve covered the basics of what equity research encompasses, let’s discuss why it is such an indispensable tool for investors:

Identifying Promising Investment Opportunities

One of the biggest benefits of equity research is it can uncover promising investment opportunities that may be flying under the radar. The due diligence conducted by analysts digs much deeper into a company’s fundamentals to determine if its stock is potentially undervalued relative to its growth prospects. This allows analysts to identify stocks poised for upside that the broader market may be mispricing.

Assessing Downside Risks

While finding hidden gems is great, equity research also evaluates potential downside risks and red flags that may not be apparent to an average investor. This cautionary perspective helps mitigate losses from investments that seem enticing but have underlying issues.

Making Informed Investment Decisions

Equity research provides a holistic 360-degree perspective of a company that individual investors typically lack. Investors can leverage these comprehensive insights to prudently decide where to deploy their capital and build conviction around investment choices.

Gaining Expert Industry Knowledge

Seasoned equity analysts also provide key insights into industry trends, competitive dynamics, economic cycles and sector outlooks that most retail investors do not possess. Their expertise helps investors make bets in promising high-growth industries primed for secular tailwinds.

Considering these myriad benefits, equity research can aid all types of investors ranging from novice individuals to large institutions. Even professional fund managers at marquee hedge funds and investment banks routinely utilize equity research to inform multi-million dollar investment decisions. Leveraging expert third-party research analysis levels the playing field.

The Equity Research Process

Now that we’ve covered why equity research is so invaluable, let’s explore how analysts actually conduct this complex and meticulous process:

Step 1 – Data Gathering & Financial Analysis

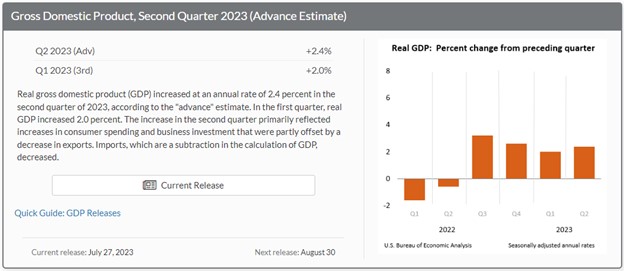

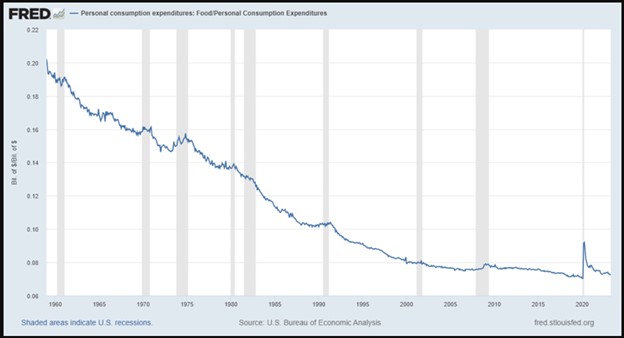

The first step of equity research involves gathering all available data and information on the target company. Analysts will thoroughly study annual reports, SEC filings, earnings calls, conference presentations, industry publications, news articles, economic data, and management commentary to ensure nothing is overlooked.

Next, they dive into analyzing the company’s financial statements and operating metrics using various techniques:

– Building detailed financial models based on historical financials

– Projecting future income statements, balance sheets, and cash flows

– Calculating financial ratios like P/E, EV/EBITDA, PEG, current and quick ratios

– Benchmarking metrics and multiples against peers through comparable company analysis

This rigorous financial analysis focuses on developing an objective understanding of the company’s financial health and performance.

Step 2 – Industry and Competitive Analysis

Analysts will also conduct in-depth research on the company’s industry, end-markets, competitive landscape and business model. This includes identifying market size, growth trends, industry drivers, pricing dynamics, competitive threats, opportunities, and regulatory issues.

They’ll assess the company’s positioning and advantages versus rivals. The goal is to develop specialized industry expertise and perspective.

Step 3 – Technical Analysis

Equity researchers will analyze the stock’s price patterns, trends, volatility, trading volume and momentum indicators over time to identify optimal entry and exit points. This technical analysis complements the fundamental financial analysis.

Step 4 – Valuation Analysis

Armed with the financial data and industry insights, analysts derive price targets and fair valuation ranges for the stock. Common valuation methodologies include:

– Discounted cash flow (DCF) analysis

– Applying P/E multiples based on industry averages

– Leveraging valuation multiples from past M&A transactions

Each methodology makes certain assumptions that are tested through sensitivity analysis. The end valuations consider both quantitative data and qualitative assessments.

Step 5 – Final Recommendation

Finally, the analyst sums up their buy/sell recommendation and 12-month price target in an equity research report. This final call is based on the upside potential versus downside risks assessed through their rigorous analysis. Top analysts revisit and update their models regularly as new data becomes available.

Tools and Resources for Equity Research

For those looking to leverage equity research, many free resources are available:

Access Free Equity Research Reports

Channelchek is a resource that provide clients with free equity research reports on companies and stocks they cover. New and seasoned investors should take full advantage of these free resources. When reviewing equity research, look for reports that exhibit quality and objectivity. Some hallmarks to seek out: impartial analysis not motivated by investment banking relationships, the right balance of quantitative and qualitative insights, data/assumptions from credible sources, and serious financial modeling.

Additonally, resources like Capital IQ allow you to practice modeling, while reading analyst reports from top firms can provide templates to learn from. Investor education sites like Investopedia also have introductory content to develop core competencies.

Register with an account with Channelchek today to get free access to our Equity Research Reports.

Equity research is the fuel that powers informed investing. By properly leveraging analyst insights, both novice and seasoned investors alike can make smarter stock picking decisions. As you embark on your investing journey, be sure to educate yourself on the equity research process and analysis techniques. With quality research in hand, you can invest with conviction and confidence. Check out our free equity research reports to accelerate your investing education today!