Endeavour Silver Provides 2022 Guidance, Including Production of 4.2-4.8 Million oz Silver and 31,000-35,000 oz Gold for 6.7-7.6 Million oz Silver Equivalent

Research, News, and Market Data on Endeavour Silver

VANCOUVER, British Columbia, Jan. 20, 2022 (GLOBE NEWSWIRE) — Endeavour Silver Corp. (“Endeavour” or the “Company”) (NYSE: EXK; TSX: EDR) is pleased to announce its consolidated production and cost guidance as well as its capital and exploration budgets for 2022. All dollar amounts are in US dollars (US$).

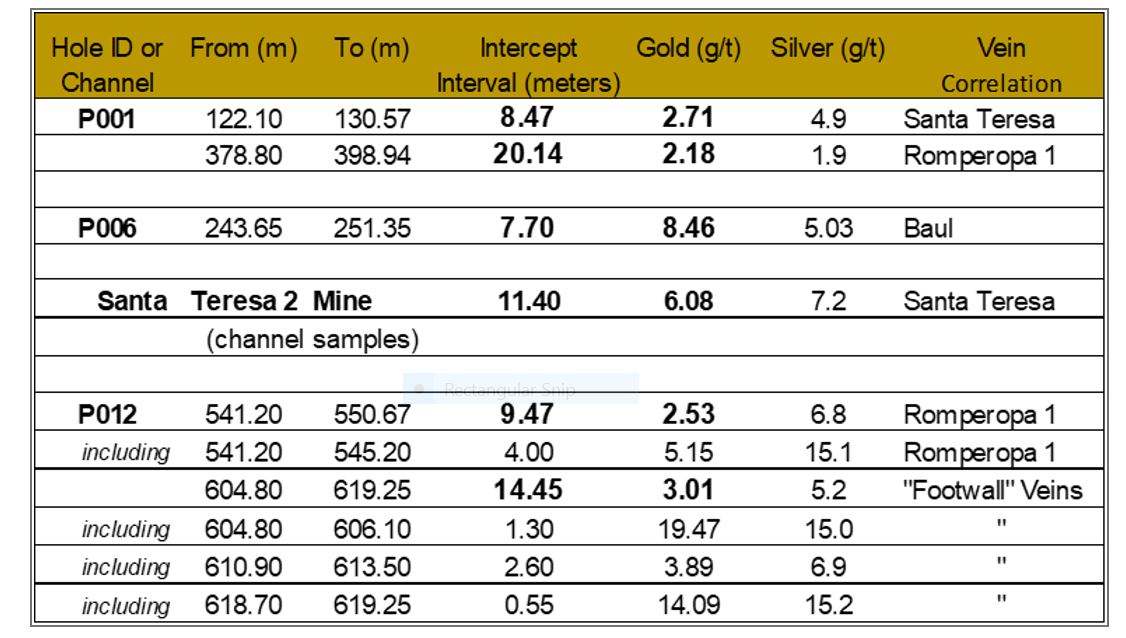

2022 Production and Cost Guidance Highlights

In 2022, silver production is expected to range from 4.2 to 4.8 million ounces (oz) and gold production is anticipated to be between 31,000 oz and 35,000 oz. Silver equivalent production is forecasted to total between 6.7 million and 7.6 million oz at an 80:1 silver:gold ratio.

Consolidated cash costs 2 and all-in sustaining costs 2 (“AISC”) in 2022 are estimated to be $9.00-$10.00 per oz silver and $20.00-21.00 per oz silver, respectively, net of gold by-product credits. The Company’s 2022 cost outlook is higher than the prior year as inflation, royalties and mining duties are expected to increase in 2022.

“Our operations outperformed last year with Guanacevi’s production bolstered by higher than anticipated mined ore grades,” stated Dan Dickson, Endeavour’s CEO. “In 2022, our production outlook is on par with the average of the last three years as we anticipate the grade at Guanacevi to be more in line with our estimated reserves and we remove the small annual contribution from our El Compas mine, which closed last August.”

Mr. Dickson added, “This year, the team is focused on managing costs in order to offset the inflationary pressures we are seeing across the industry. Equally important will be expanding resources and advancing our exceptional growth pipeline. Terronera will move from the funding and approval phase through to construction. As well, we will initiate a preliminary economic assessment at Parral and define a current resource at Pitarrilla following the closing of this acquisition in the first half of the year.”

2022 Guidance Summary

| |

|

Guanacevi |

Bolanitos |

Consolidated |

| Tonnes per day |

tpd |

1,100 – 1,200 |

1,000 – 1,200 |

2,100 – 2,400 |

| Silver production |

M oz |

3.8 – 4.2 |

0.4 – 0.6 |

4.2 – 4.8 |

| Gold production |

k oz |

10.0 – 12.0 |

21.0 – 23.0 |

31.0 – 35.0 |

| Silver Eq production 1 |

US$/oz |

4.6 – 5.2 |

2.1 – 2.4 |

6.7 – 7.6 |

| Cash costs, net of gold by-product credits 2 |

US$/oz |

|

|

$9.00 – $10.00 |

| AISC, net of gold by-product credits 2 |

US$/oz |

|

|

$20.00 – $21.00 |

| Sustaining capital 2 budget |

US$M |

|

|

$34.3 |

| Development budget |

US$M |

|

|

$11.5 |

| Exploration budget |

US$M |

|

|

$13.0 |

Operating Mines

At Guanaceví, 2022 production will range from 1,100 tonnes per day (tpd) to 1,200 tpd and average 1,165 tpd from the Milache, SCS and P4E orebodies. A significant portion of production will be mined from the Porvenir Cuatro extension on the El Curso concessions. The El Curso concessions were leased from a third party with no upfront costs but with significant royalty payments on production. Compared to 2021, ore grades are expected to decrease slightly with similar recoveries. Cash costs per ounce and direct operating costs per tonne are expected to increase in 2022, primarily due to the impact of inflation on power costs, re-agent costs and salaries as well as higher estimated royalty and mining duty payments.

In 2022, production at Bolañitos is expected to range from 1,000 tpd to 1,200 tpd and average 1,080 tpd from the Plateros-La Luz, Lucero-Karina and Bolanitos-San Miguel vein systems. Ore grades and recoveries are expected to be similar to 2021. Cash costs per oz and direct costs per tonne are expected to increase primarily due to inflationary impact on power costs and salaries.

Operating Costs

In 2022, cash costs, net of gold by-product credits, are expected to be $9.00-$10.00 per oz of silver produced. Consolidated cash costs on a co-product basis 2 are anticipated to be $13.00-$14.00 per oz silver and $1,100-$1,200 per oz gold.

All-in sustaining costs, net of gold by-product credits, in accordance with the World Gold Council standard, are estimated to be $20.00-$21.00 per oz of silver produced. When non-cash items such as stock-based compensation and accretion are excluded, AISC are forecast to be in the $19.00-$20.00 range.

Direct costs 2 per tonne are estimated to be $95-$100 with inflationary pressures expected to continue in 2022. Direct operating costs 2 , which includes royalties and special mining duties are estimated to be in the range of $120-$125 per tonne.

Management made the following assumptions in calculating its 2022 cost forecasts: $22 per oz silver price, $1,760 per oz gold price, and 20:1 Mexican peso per US dollar exchange rate.

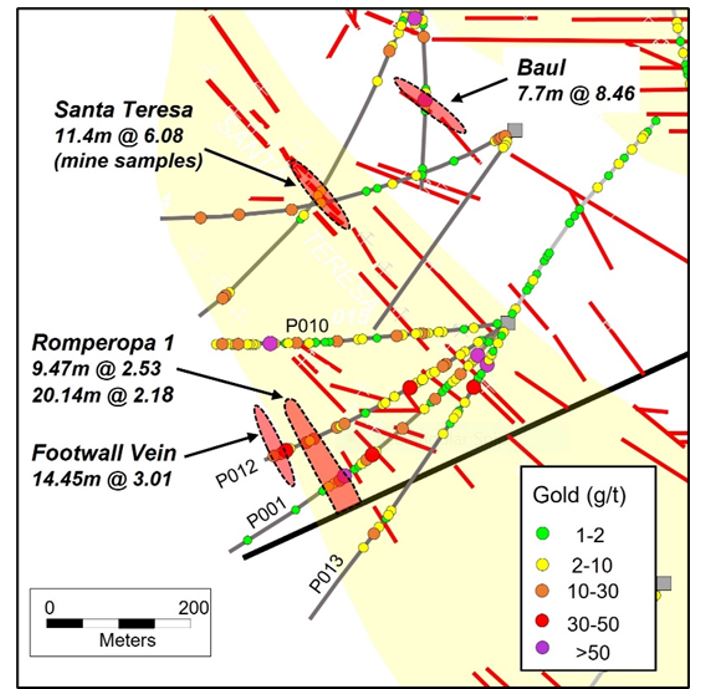

2022 Capital Budget

| |

Mine

Development |

Other

Capital |

Sustaining

Capital |

Growth

Capital |

Total

Capital |

| Guanaceví |

$10.3 million |

$10.1 million |

$20.4 million |

– |

$20.4 million |

| Bolañitos |

$8.4 million |

$3.8 million |

$12.2 million |

– |

$12.2 million |

| Terronera |

– |

– |

– |

$9.5 million |

$9.5 million |

| Corporate |

– |

– |

$1.7 million |

$2.0 million |

$3.7 million |

| Total |

$18.7 million |

$13.9 million |

$34.3 million |

$11.5 million |

$45.8 million |

Sustaining Capital Investments

In 2022, Endeavour plans to invest $34.3 million in sustaining capital, including $32.6 million at its two operating mines and $1.7 million to maintain exploration concessions and cover corporate infrastructure. At current metal prices, the sustaining capital investments are expected to be paid out of operating cash flow.

At Guanacevi, $20.4 million will be invested in capital projects, the largest of which is the development of 5.7 kilometres of mine access at the Milache, SCS and the P4E orebodies for an estimated $10.3 million. The additional $10.1 million will go to upgrade the mining fleet, support site infrastructure and expand the tailings dam.

At Bolañitos, $12.2 million will be invested in capital projects, including $8.4 million for 5.5 kilometres of mine development to access resources in the Plateros-La Luz, Lucero-Karina, Bolanitos-San Miguel and Belen vein systems. The additional $3.8 million will go to upgrade the mining fleet, support site infrastructure, raise the tailings dam and commence a new portal to access the Belen ore body.

At Terronera, $9.5 million is budgeted for the first quarter of 2022 to continue with final detailed engineering, early earth works, critical contracts and procurement of long lead items. The Company intends to make a formal construction decision, subject to completion of a financing package and receipt of amended permits, in the coming months, at which time the budget for the remainder of 2022 for the project will be determined.

The capital budget presented above does not include the $70 million acquisition cost associated with the Company’s recently announced acquisition of the Pitarrilla Project ( see January 13, 2022 news release ) in Durango State, Mexico from SSR Mining Inc. The transaction is expected to be completed in the first half of 2022.

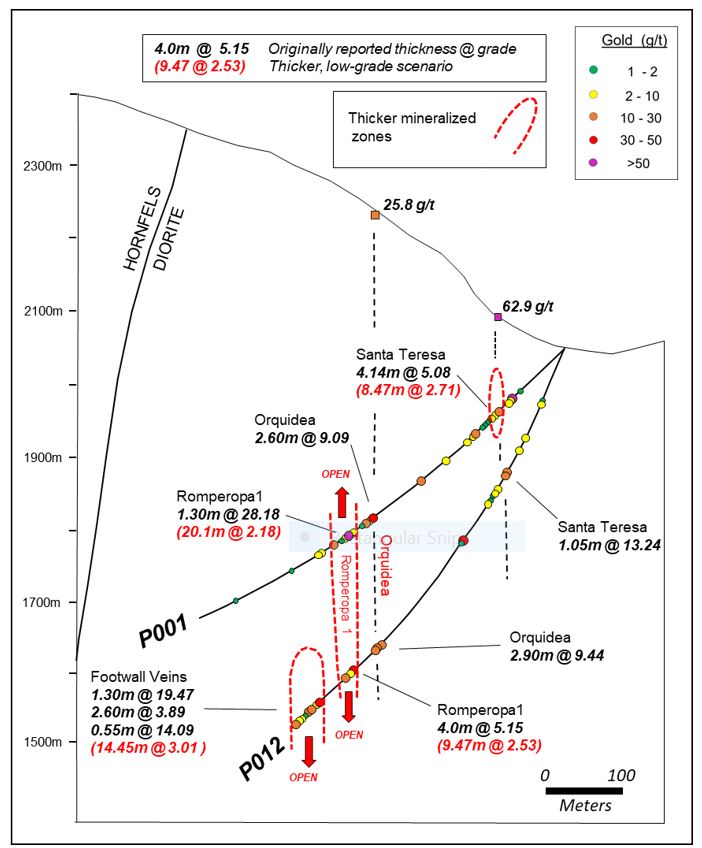

2022 Exploration Budget

| Project |

2022 Activity |

Drill Metres |

Expenditures |

| Guanaceví |

Drilling |

11,000 |

$1.8 million |

| Bolañitos |

Drilling |

10,000 |

$1.5 million |

| Terronera |

Drilling |

11,000 |

$1.9 million |

| Parral |

Drilling/Economic Study |

7,000 |

$1.7 million |

| Chile – Aida |

Drilling |

3,000 |

$1.5 million |

| Chile – Other |

Evaluation |

– |

$0.9 million |

| Bruner |

Drilling/Evaluation |

3,000 |

$1.9 million |

| Pitarrilla |

Drilling/Evaluation |

5,000 |

$1.8 million |

| Total |

|

50,000 |

$13.0 million |

In 2022, the Company plans to spend $13.0 million drilling 50,000 metres across its properties.

At the Guanacevi and Bolanitos mines, 21,000 metres of drilling are planned at a cost of $3.3 million to replace reserves and expand resources.

At the Terronera development project, 11,000 metres are planned to test multiple regional targets identified in 2021 to expand resources within the district.

At the Parral project in Chihuahua state, 7,000 metres are planned at a cost of $1.7 million to delineate existing resources, expand resources and test new targets. In the second half of the year, the Company expects to initiate a preliminary economic assessment.

In Chile, management intends to invest $1.5 million to test the Aida exploration project located in the northern Chile Region II along the Argentina border accessible by paved highway and dirt road. The Company plans to drill 3,000 metres to test a manto target with significant silver-manganese-lead-zinc anomaly at surface in the second half of 2022. Additionally, the Company plans to advance mapping, sampling and surface exploration on its other exploration projects in Chile, estimated to cost $0.9 million including administration costs in the country.

At the Bruner project management plans to invest $1.9 million to evaluate and verify historical data to define a current resource, map and sample new targets and drill 3,000 metres verifying historical data and testing new targets.

Similarly, subject to closing the Pitarrilla acquisition, management plans to invest $1.8 million for drilling to verify the historical data and define a current resource in 2022. Management plans to release a more detailed exploration and evaluation plan for the Pitarrilla project following closing of the transaction.

About Endeavour Silver – Endeavour Silver Corp. is a mid-tier precious metals mining company that operates two high-grade underground silver-gold mines in Mexico. Endeavour is currently advancing the Terronera mine project towards a development decision, pending financing and final permits and exploring its portfolio of exploration and development projects in Mexico, Chile and the United States to facilitate its goal to become a premier senior silver producer. Our philosophy of corporate social integrity creates value for all stakeholders.

SOURCE Endeavour Silver Corp.

Contact Information

Trish Moran

Interim Head of Investor Relations

Tel: (416) 564-4290

Email: pmoran@edrsilver.com

Website: www.edrsilver.com

Follow Endeavour Silver on Facebook , Twitter , Instagram and LinkedIn

Endnotes

1 Silver equivalent is calculated using an 80:1 silver:gold ratio.

2 Non-IFRS Financial Measures

The Company has included certain performance measures that are not defined under International Financial Reporting Standards (“IFRS”). The Company believes that these measures, in addition to conventional measures prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company. The non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

Cash costs and cash costs per ounce

Cash costs per ounce is a non-IFRS measure. In the silver mining industry, this metric is a common performance measure that does not have a standardized meaning under IFRS. Cash costs include direct costs (including smelting, refining, transportation and selling costs), royalties and special mining duty and changes in finished goods inventory net of gold credits. Cash costs per ounce is based on ounces of silver produced and is calculated by dividing cash costs by the number of ounces of silver produced.

Cash costs on a co-product and cash costs on a co-product per ounce

Silver co-product cash costs and gold co-product cash costs include mining, processing (including smelting, refining, transportation and selling costs), and direct overhead costs allocated on pro-rated basis of realized metal value. Cash costs on a co-product per ounce is based on the number of either silver or gold ounces produced.

Direct operating costs and direct costs

Direct operating costs per tonne include mining, processing (including smelting, refining, transportation and selling costs) and direct overhead at the operation sites. Direct costs per tonne include all direct operating costs, royalties and special mining duty.

All-in sustaining costs (“AISC”) and AISC per ounce

This measure is intended to assist readers in evaluating the total cost of producing silver from operations. While there is no standardized meaning across the industry for AISC measures, the Company’s definition conforms to the definition of AISC as set out by the World Gold Council and used as a standard of the Silver Institute. The Company defines AISC as the cash costs (as defined above), plus reclamation cost accretion, mine site expensed exploration, corporate general and administration costs and sustaining capital expenditures. AISC per ounce is based on ounces of silver produced and is calculated by dividing AISC by the number of ounces of silver produced.

Sustaining capital

Sustaining capital is defined as the capital required to maintain operations at existing levels. This measurement is used by management to assess the effectiveness of an investment program.

For further information on reconciliations of Non-GAAP measures, refer to the Non-IFRS Measures section of the Company’s Management’s Discussion & Analysis for the three and nine months ending September 30, 2021, beginning on page 19.

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the United States private securities litigation reform act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking statements and information herein include but are not limited to statements regarding Endeavour’s anticipated performance in 2022 including changes in mining operations and forecasts of production levels, anticipated production costs and all-in sustaining costs, the timing and results of various activities and the impact of the COVID 19 pandemic on operations. The Company does not intend to and does not assume any obligation to update such forward-looking statements or information, other than as required by applicable law.

Forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, production levels, performance or achievements of Endeavour and its operations to be materially different from those expressed or implied by such statements. Such factors include but are not limited to the ultimate impact of the COVID 19 pandemic on operations and results, changes in production and costs guidance, national and local governments, legislation, taxation, controls, regulations and political or economic developments in Canada and Mexico; financial risks due to precious metals prices, operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining; the speculative nature of mineral exploration and development, risks in obtaining necessary licenses and permits, and challenges to the Company’s title to properties; as well as those factors described in the section “risk factors” contained in the Company’s most recent form 40F/Annual Information Form filed with the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to: the continued operation of the Company’s mining operations, no material adverse change in the market price of commodities, mining operations will operate and the mining products will be completed in accordance with management’s expectations and achieve their stated production outcomes, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.