Nickel Mountain Ztem Survey Identifies New Pipe-Like Target

Research, News, and Market Data on Garibaldi Resources

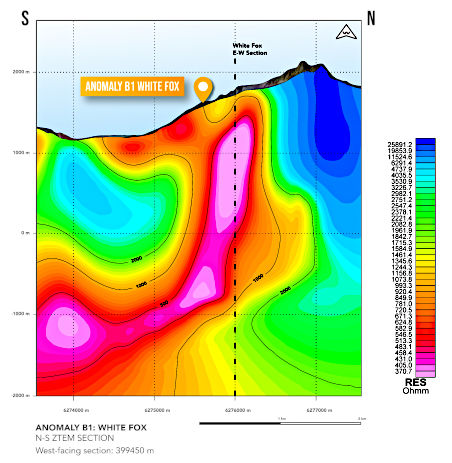

Vancouver, British Columbia, April 21, 2022 – Garibaldi Resources (TSXV: GGI) (the “Company” or “Garibaldi”) is pleased to announce that further to the company’s 2021 ZTEM survey results (see news release March 31, 2022) at Nickel Mountain in the Eskay Camp of northwest British Columbia, 3D processing has identified several new low-resistivity ZTEM responses located 5 km northeast of the E&L nickel-copper-cobalt massive sulphide zone, including an exciting new anomaly at target B1/White Fox.

The flagship E&L project generated especially promising deep penetrating ZTEM data providing renewed focus on several drill targets to test the large geophysical anomalies beneath and along trend from E&L, for mineralization. The ZTEM survey over the remainder of the claim group also identified an unexpected alignment of high priority targets, with similar features. The B1 ZTEM anomaly which rises from a great depth like E&L, extends vertically up to the B1 VTEM conductor near surface.

Several other features elevate the B1 target to high priority status besides the coincidence of a ZTEM anomaly with a VTEM conductor. The presence of gabbroic intrusions of the Nickel Mountain Complex, and numerous in-situ surface samples and mineralized boulder train samples with elevated copper, zinc and lead over a broad 3km strike length. Also, elevated MgO concentrations up to levels found at the E&L intrusion, along with anomalous nickel, indicating the potential for magmatic sulphides.

The ZTEM data for the B1 target, which has not been drill tested provides a key target for the 2022 property scale field program which is highlighted by the following observations:

- The property-wide ZTEM survey has identified several low-resistivity responses that plunge to considerable depth, and also correlate with the location of near surface conductors from the 2017 and 2018 VTEM surveys. Coinciding ZTEM and VTEM anomalies offer strong support for the B1 target. The ZTEM response rising to surface from great depth, may be highly significant.

- Similar low-resistivity responses to those beneath the E&L mineralized zones continue along a 15 km long trend of gabbroic intrusions within the Hazelton Group, striking to the northeast towards Mount Shirley. A corridor within this belt of coincident ZTEM-VTEM responses with clusters of samples containing elevated Base Metals, aligns over a 3 km trend.

- The modelled ZTEM responses along strike coincides with base metal assays from in-situ samples and boulder trains with elevated nickel, copper and zinc. Additional conductive data supports an alignment along the northeast strike of E&L extending over and continuing past B1.

The primary exploration focus will be on the robust ZTEM-VTEM targets supported by geochemistry, and located along strike from E&L. Garibaldi will provide shareholders with more forthcoming analysis of the most prominent amongst the notable dozen new ZTEM anomalies at Nickel Mountain, as they become available.

Figure 1 Anomaly B1: White Fox displays a consistent ZTEM low resistivity zone coincident with a near surface VTEM conductive anomaly. The ZTEM low resistivity zone extends to great depths, similar to the low resistivity zone beneath E&L.

Jeremy Hanson, Garibaldi’s VP Exploration, stated: “We now have numerous ZTEM anomalies corresponding to VTEM conductors, coupled with elevated surface base metal content in samples along a significant trend. This season we will be able to hone in on the highest priority targets, for possible drill testing, likely starting with B1.”

Steve Regoci, Garibaldi’s CEO, stated: “We look forward to a very productive 2022 exploration season, better than expected ZTEM results have identified over a dozen significant ZTEM responses to test. These prospective targets beginning at E&L are large with deep roots, providing significant potential for further discoveries at Nickel Mountain as strong nickel and battery metal prices continue rising.”

Please see www.garibaldiresources.com/investor/presentations/ for more details.

Qualified Person

James Hutter, P.Geo., qualified person as defined by NI- 43-101, has supervised the preparation of and reviewed and approved of the disclosure of information in this news release.

About Garibaldi

Garibaldi Resources Corp. is an active Canadian-based junior exploration company focused on creating shareholder value through discoveries and strategic development of its assets in some of the most prolific mining regions in British Columbia and Mexico.

We seek safe harbor.

GARIBALDI RESOURCES CORP.

Per: “Steve Regoci”

Steve Regoci, President

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or the accuracy of this release