Nuclear Fusion’s Potential to Be a Highly Disruptive Breakthrough with Investment Opportunities

Scientists at the Energy Department’s Lawrence Livermore National Laboratory (LLNL) in California announced the first-ever demonstration of fusion “ignition.” This means that more energy was generated from fusion than was needed to operate the high-powered lasers that triggered the reaction. More than 2 megajoules (MJ) of laser light were directed onto a tiny gold-plated capsule, resulting in the production of a little over 3 MJ of energy, the equivalent of three sticks of dynamite.

This important milestone is the culmination of decades’ worth of research and lots of trial and error, and it makes good on the hope that humanity will one day enjoy 100% clean and plentiful energy.

This article was republished with permission from Frank Talk, a CEO Blog by Frank Holmes

of U.S. Global Investors (GROW).

Find more of Frank’s articles here – Originally published December 19, 2022.

Unlike conventional nuclear fission, which produces highly radioactive waste and carries the risk of nuclear proliferation, nuclear fusion has no emissions or risk of cataclysmic disaster. That should please activists who support renewable, non-carbon-emitting energy sources such as wind and solar and yet oppose nuclear power.

75th Anniversary of Another Great American Invention, The Transistor

I think it’s only fitting that this breakthrough occurred not just in the U.S., the most innovative country on earth, but also on the 75th anniversary of the invention of the transistor.

Like fusion energy, the transistor’s importance can’t be overstated. Invented in December 1947 in New Jersey’s storied Bell Labs—also the birthplace of the photovoltaic cell, fiber optic cable, communications satellite, UNIX operating system and C programming language—the transistor made the 20th century possible. Everything we use and enjoy today, from our iPhones to our Teslas, wouldn’t exist without the seminal American invention.

In 2021, the electric vehicle maker unveiled its proprietary application-specific integrated circuit (ASIC) for artificial intelligence (AI) training. The ASIC chip, believe it or not, boasts an unbelievable 50 billion transistors.

Private Investment in Fusion Technology Has Been Increasing

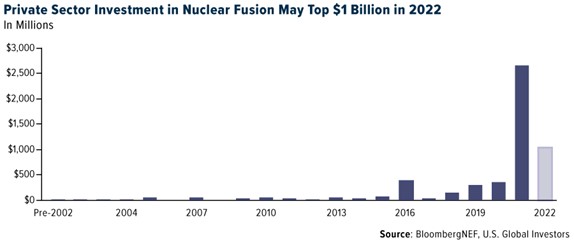

Getting your electricity from a commercial fusion reactor is still years if not decades away, but that hasn’t stopped money from flowing into the sector. This year, private investment is estimated to top $1 billion, following the record $2.6 billion that went into fusion research in 2021, according to BloombergNEF.

Private Sector Investment in Nuclear Fusion May Top $1 Billion in 2022

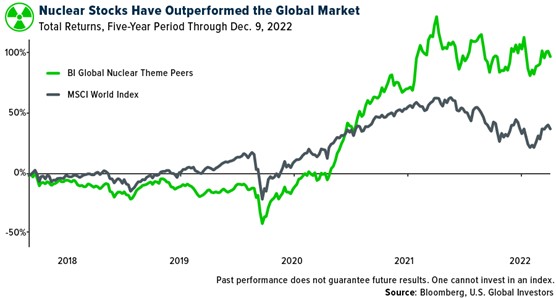

At the moment, there aren’t any publicly traded fusion companies. However, Bloomberg has a Global Nuclear Theme Peers index that tracks listed companies with exposure to the industry, estimated by Bloomberg to one day achieve a jaw-dropping $40 trillion valuation. Some of the more recognizable names include Rolls-Royce, Toshiba, Hitachi and General Electric.

For the five-year period, the index of 64 “nuclear” stocks has advanced approximately 100%, compared to the MSCI World Index, up 38% over the same period.

The number of private firms involved in R&D continues to grow, raising the possibility that some will tap public markets in the coming years.

Among the largest is Commonwealth Fusion Systems, or CFS, which spun out of MIT’s Plasma Science and Fusion Center in 2018. The company raised $1.8 billion in December 2021, on top of the $250 million it had raised previously. Its investors include Bill Gates and Google, along with oil companies, venture capital firms and sovereign wealth funds. CFS claims to have the fastest, lowest cost solution to commercial fusion energy and is in the process of building a prototype that is set to demonstrate net energy gain by 2025.

Another major player is TAE Technologies. Located in California, the company has raised a total of $1.2 billion as of December 2022, from investors such as the late Paul Allen, Goldman Sachs, Google and the family office of Charles Schwab. TAE says it is developing a fusion reactor, scheduled to be unveiled in the early 2030s, that will generate electricity from a proton-boron reaction at an incredible temperature of 1 billion degrees.

Other contenders in the field include Washington State-based Helion Energy, Canada’s General Fusion and the United Kingdom’s Tokamak Energy. In February 2022, Tokamak broke a longstanding record by generating 59 MJ of energy, the highest sustained energy pulse ever.

As an investor, I would keep an eye on this space!

Solar Accounted For 45% Of All New Energy Capacity Growth In The U.S.

In the meantime, energy investors with an eye on the future still have renewable energy stocks to consider.

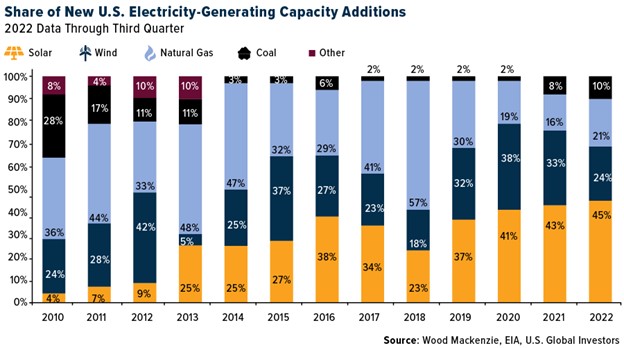

2022 has been a challenging year for the industry, with much of it facing supply constraints. According to Wood Mackenzie, total new solar installations in the U.S. were 18.6 gigawatts (GW), a 23% decrease from 2021.

Even so, solar accounted for 45% of all new electricity-generation capacity added this year through the end of the third quarter. That’s greater than any other energy source. Wind was in second place, representing a quarter of all new energy power, followed by natural gas at 21% and coal at 10%, its best year since 2013.

WoodMac expresses optimism in the next two years. Solar projects that were delayed this year due to supply issues may finally come online in 2023, and by 2024, the real effects of President Biden’s Inflation Reduction Act (IRA) should be felt. The U.K.-based research firm forecasts 21% average annual growth from 2023 through 2027, so now may be an opportune time to start participating.

One of our favorite plays right now is Canadian Solar, up more than 11% for the year. On Thursday of this week, the Ontario-based company announced that it would begin mass-producing high efficiency solar modules in the first quarter of 2023. Canadian Solar shares were up more than 1% last week, despite experiencing two down days on this week’s news of continued rate hikes into 2023.

US Global Investors Disclaimer

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The BI Global Nuclear Theme Peers is an index not for use as a financial benchmark that tracks 64 companies exposed to nuclear energy research and production. The MSCI World Index is a free-float weighted equity index which includes developed world markets and does not include emerging markets.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/22): Tesla Inc., Canadian Solar Inc.