Tuesday, January 7, 2020

Minerals Industry Report

Metals & Mining 2019 Review and Outlook

Mark Reichman, Senior Research Analyst, Noble Capital Markets, Inc.

Listen To The Analyst

Refer to end of report for Analyst Certification & Disclosures

- Will strength build in 2020? In 2019, mining companies (as measured by the XME) appreciated 11.8% compared to 28.9% for the broader market as measured by the S&P 500 index. During the fourth quarter, the XME outpaced the broader market and rose 15.1% versus 8.5% for the S&P 500. For the full year, gold and silver futures prices rose 16.0% and 13.4%, respectively, while copper increased 5.7%. We note that copper futures prices rose 8.5% during the fourth quarter and outpaced both silver and gold. In 2019, precious metals prices reacted to changes in monetary policy, economic growth and geopolitical expectations. For base metals, the key catalysts were economic growth expectations and issues around trade.

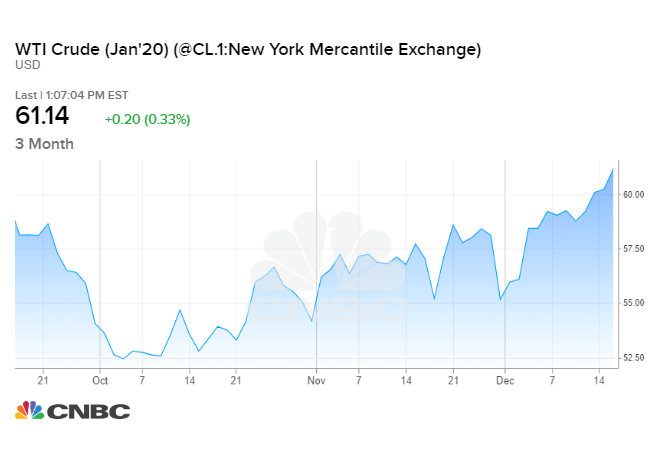

- Precious metals catalysts unfolding. As we move into the new year, the outlook for precious metals remains favorable in our view. Increasing geopolitical tensions, notably in the Middle East, increased risk of equity market volatility and a modest interest rate environment along with the potential for higher inflation may cause investors to increase allocations to precious metals for their defensive characteristics in a diversified portfolio.

- Increasing investor focus on the supply chain. With respect to base metals, economic growth expectations and issues around trade will influence prices. While the theme of “electrification” gained attention in 2019, sources and supplies of metals needed to support development of electric vehicles and green technologies will likely come into focus in 2020. As a result, investor interest in base metals-oriented companies could grow as the market begins to assess longer-term supply/demand and pricing trends for metals such as copper, zinc, cobalt and manganese.

- Mining stocks offer diversification benefits. In our view, mining stocks are an attractive way to gain exposure to metals given their leverage to strengthening metals prices. Precious metals equities may provide a hedge against volatility in the equity markets and offer diversification benefits.

Metals & Mining 2019 Review and Outlook

In 2019, mining companies (as measured by the XME) appreciated 11.8% compared to 28.9% for the broader market as measured by the S&P 500 index. During the fourth quarter, the XME outpaced the broader market and rose 15.1% versus 8.5% for the S&P 500. For the full year, gold and silver futures prices rose 16.0% and 13.4%, respectively, while copper increased 5.7%. We note that copper futures prices rose 8.5% during the fourth quarter and outpaced both silver and gold. In 2019, precious metals prices reacted to changes in monetary policy, economic growth and geopolitical expectations. For base metals, the key catalysts were economic growth expectations and issues around trade.

As we move into the new year, the outlook for precious metals remains favorable in our view. Increasing geopolitical tensions, notably in the Middle East, increased risk of equity market volatility and a modest interest rate environment along with the potential for higher inflation may cause investors to increase allocations to precious metals for their defensive characteristics in a diversified portfolio.

Central banks have increased gold reserves. According to the World Gold Council, reported 2019 net central bank purchases amounted to 562 tonnes through October 2019 which brought reported global gold reserves to 34,500.8 tonnes.

In 2019, exchanged traded products were a popular vehicle for investment exposure to gold. While 2019 global gold-backed ETF flows were a significant driver of gold demand, U.S. Mint sales of American Eagle gold bullion declined to 152,000 ounces in 2019 compared to 245,500 ounces in 2018. We think publicly-traded equities of metals producers offer an attractive way to invest given the disproportionate percentage impact higher commodity prices may have on a company’s bottom line and valuation for a given percentage increase in the commodity itself.

With respect to base metals, economic growth expectations and issues around trade will influence pricing. While the theme of “electrification” gained attention in 2019, sources and supplies of metals needed to support development of electric vehicles and green technologies will likely come into focus in 2020. As a result, investor interest in base metals-oriented companies could grow as the market begins to assess longer-term supply/demand and pricing trends for metals such as copper, zinc, cobalt and manganese. We note that for copper, the International Copper Study Group (ICSG) recently released preliminary data for September 2019. The data indicates that world mine production declined by 0.4% in the first nine months of 2019 due to reduced output in major producing countries such as Chile. World refined production was unchanged, while world refined copper balance in the first nine months of 2019 was a deficit of 390,000 tonnes.

In our view, mining stocks are an attractive way to gain exposure to metals given their leverage to strengthening metals prices. Precious metals equities may provide a hedge against volatility in the equity markets and offer diversification benefits.

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results. Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Senior Equity Analyst focusing on Basic Materials & Mining. 20 years of experience in equity research. BA in Business Administration from Westminster College. MBA with a Finance concentration from the University of Missouri. MA in International Affairs from Washington University in St. Louis.

Named WSJ ‘Best on the Street’ Analyst and Forbes/StarMine’s “Best Brokerage Analyst.”

FINRA licenses 7, 24, 63, 87

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of

transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc..

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public

appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

| NOBLE RATINGS DEFINITIONS |

% OF SECURITIES COVERED |

% IB CLIENTS |

| Outperform: potential return is >15% above the current price |

86% |

25% |

| Market Perform: potential return is -15% to 15% of the current price |

14% |

2% |

| Underperform: potential return is >15% below the current price |

0% |

0% |

NOTE: On August 20, 2018, Noble Capital Markets, Inc. changed the terminology of its ratings (as shown above) from “Buy” to “Outperform”, from “Hold” to “Market Perform” and from “Sell” to “Underperform.” The percentage relationships, as compared to current price (definitions), have remained the same. Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

225 NE Mizner Blvd. Suite 150

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

Report ID: 11091