Sierra Metals Confirms New High-Grade Silver Zone At Its Cusi Mine, Mexico, Including 17 Meters True-Width Of 428 Grams Per Ton Silver, And Provides An Operational Update

New zone opens a new exploration horizon and will allow for innovative and highly productive operational design at Cusi

TORONTO—June 18, 2020 – Sierra Metals Inc. (TSX: SMT) (BVL:SMT) (NYSE AMERICAN: SMTS) (“Sierra Metals” or “the Company”) announces the discovery of a new high-grade silver zone with significant widths in an area called Northeast – Southwest System of Epithermal Veins and is providing a corporate update for its Cusi Mine in Mexico.

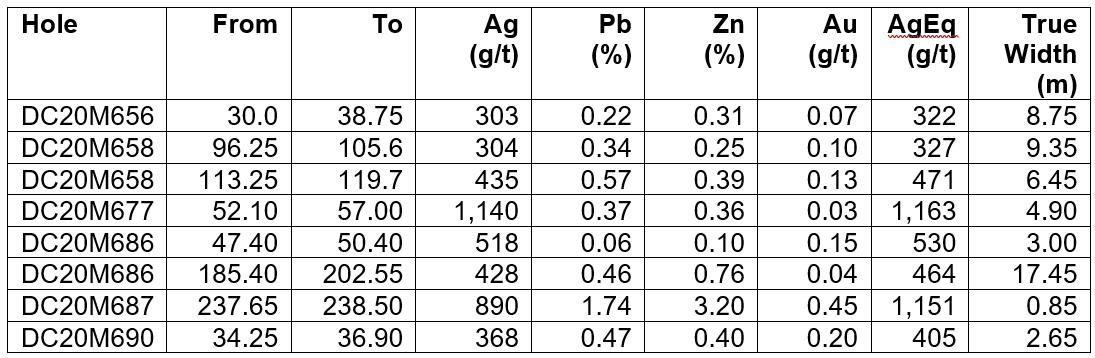

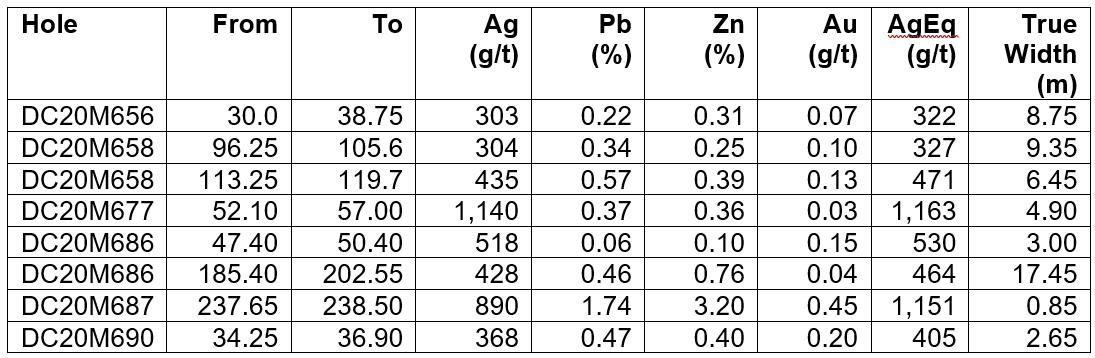

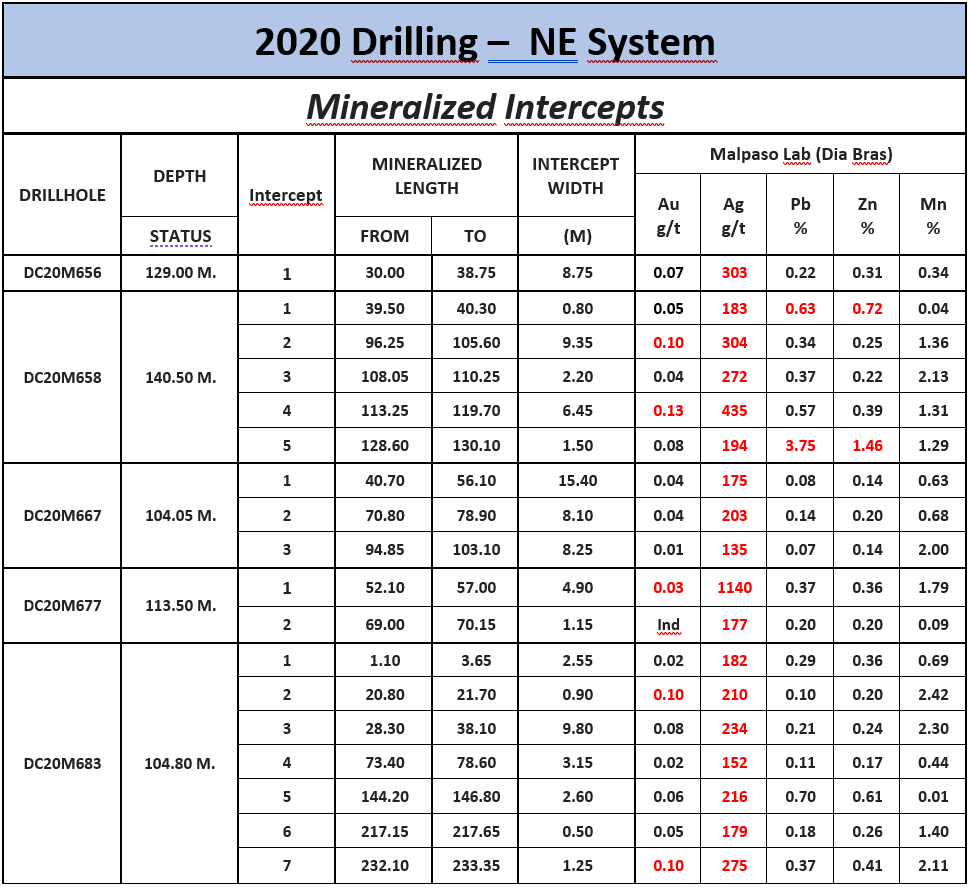

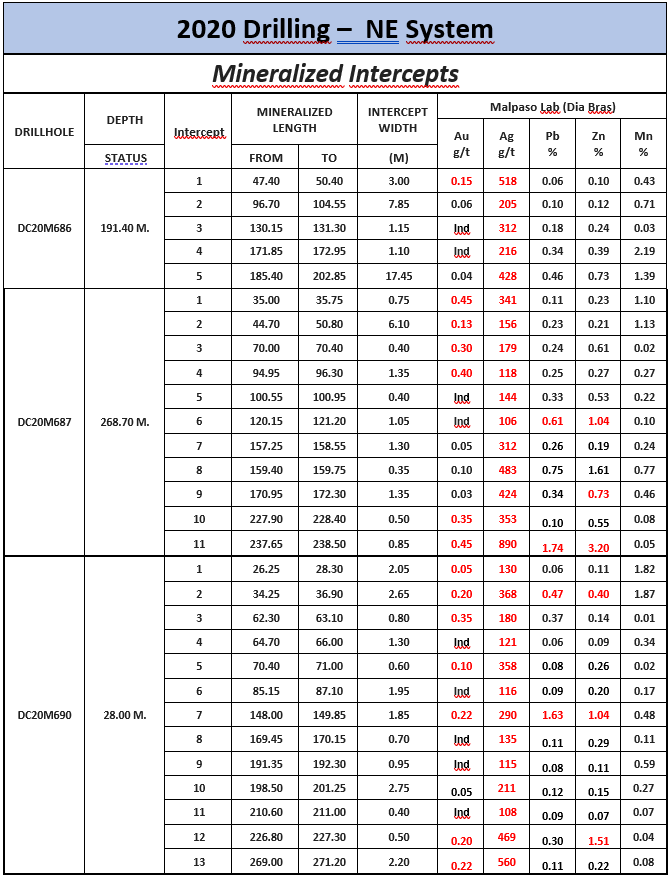

The new high-grade silver vein system was discovered as a consequence of a combination of mine development work in recent months and confirmatory drilling which is reported in this press release which includes true widths of 17.45 meters of 428 g/t silver (464 g/t silver equivalent), 9.35 meters of 304 g/t silver (327 g/t silver equivalent), 8.75 meters of 303 g/t silver (322 g/t silver equivalent) and 4.90 meters of 1,140 g/t silver (1,163 g/t silver equivalent).

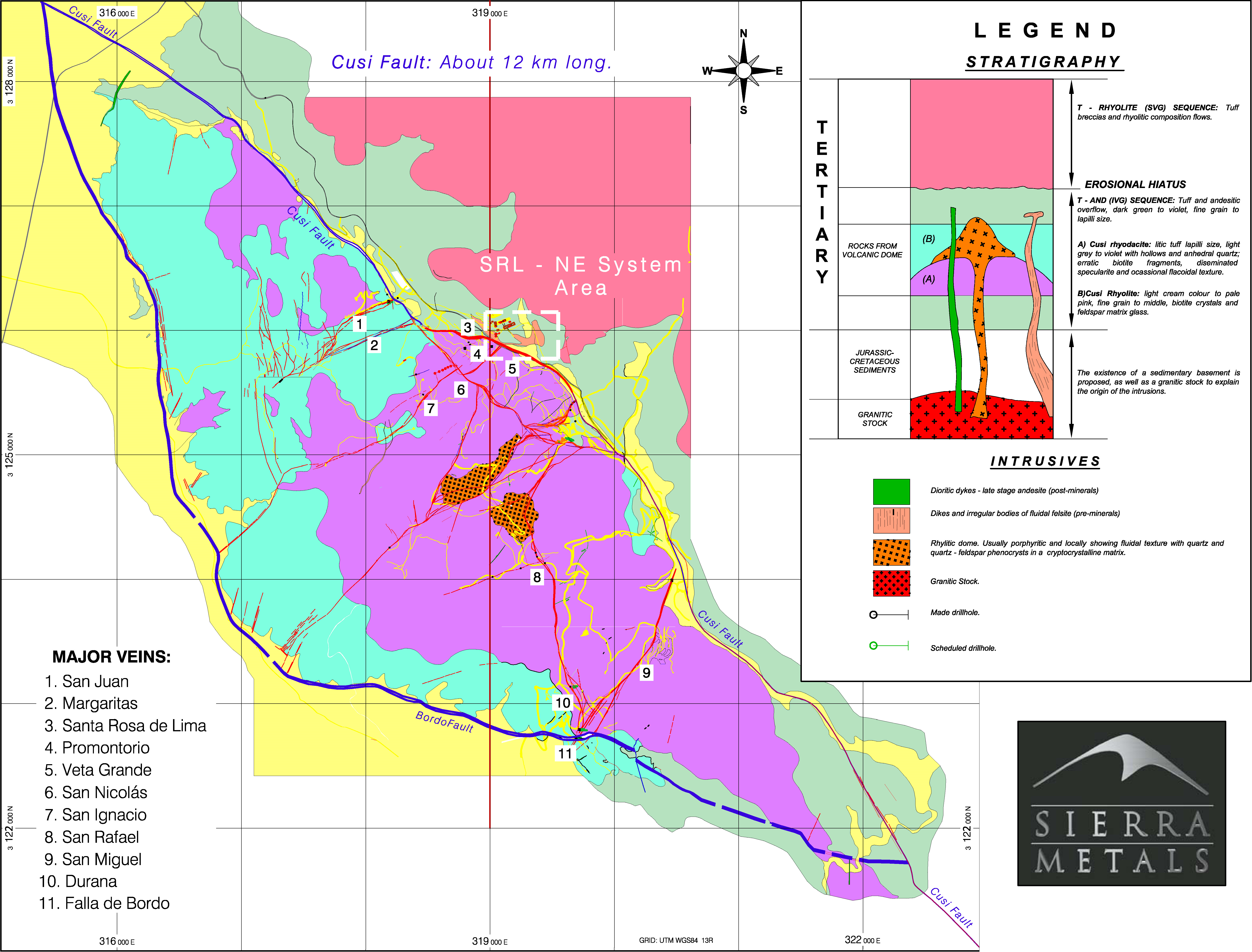

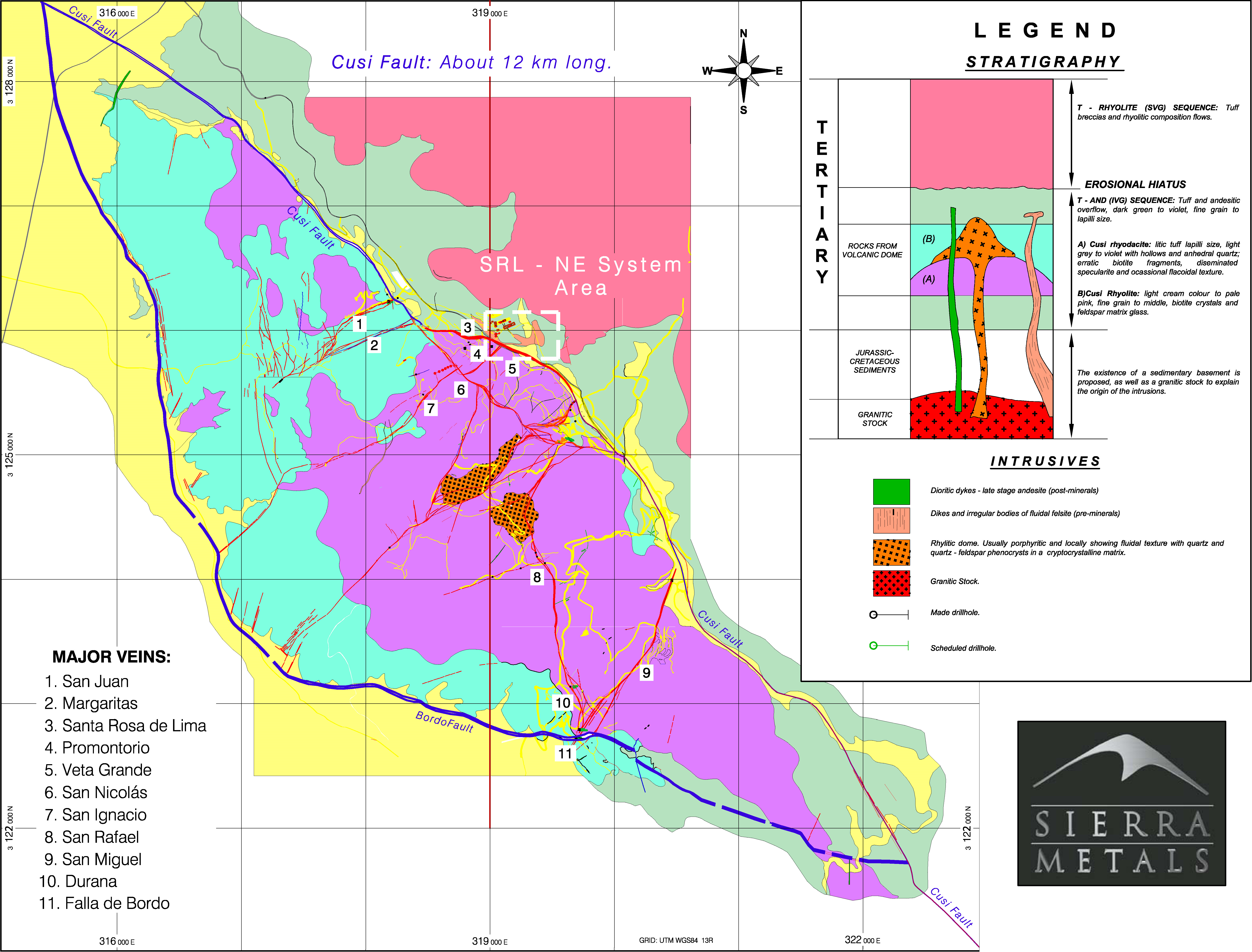

Sierra Metals announced with a press release on June 29, 2018 the discovery of a 40-meter wide high-grade stockwork area within the Santa Rosa de Lima vein at Cusi. As the area was developed for mining in the later part of 2019 and early 2020, our geologists re-interpreted the stockwork structure as a series of high-grade veins that had an orientation perpendicular to the Santa Rosa de Lima Structure. The most important implication of this re-interpretation is that rather than a widening of the Santa Rosa de Lima zone, these veins extended further to the North East side of the Cusi fault, which was considered barren of silver mineralization before. Note that the Cusi fault coincides with The Santa Rosa de Lima structure. All the historic silver mineralization at the Cusi mine reported by Sierra Metals was in the South Western side of this regional fault. The new discovery is an extension of the Cusi Vein systems in the North East of the fault and, rather than barren, the veins are reporting silver grades and widths above the average of the structures previously known at the mine in the South West to the Cusi fault.

The Company has plans to drill an additional 1,000 meters to better understand the extension of the zone at depth and to Northeast. This mineralized zone is made up of multiple veins extending over 300 meters in length which are in proximity to the existing operations. The Cusi Mine is located within the municipality of Cusihuiriachi in the central portion of the State of Chihuahua, in Mexico. The Mine area encompasses 11,657 hectares at an elevation range of 1,950 to 2,460 meters above sea level in the Sierra Madre Occidental Mountain Range.

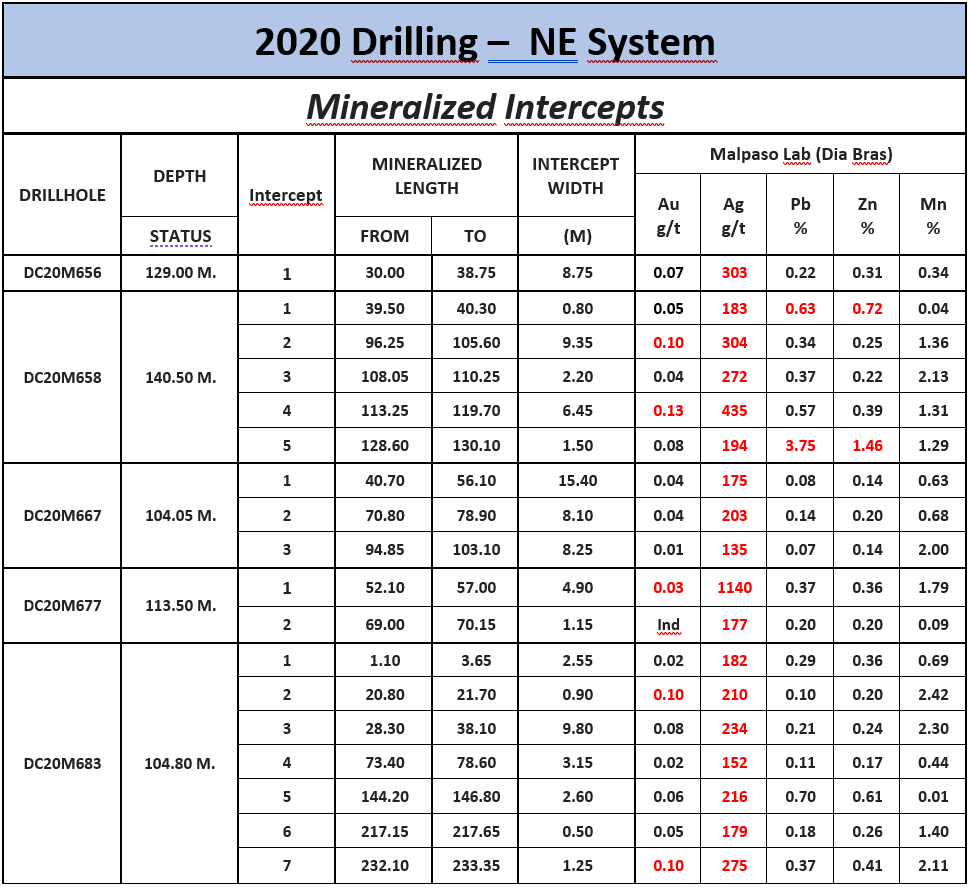

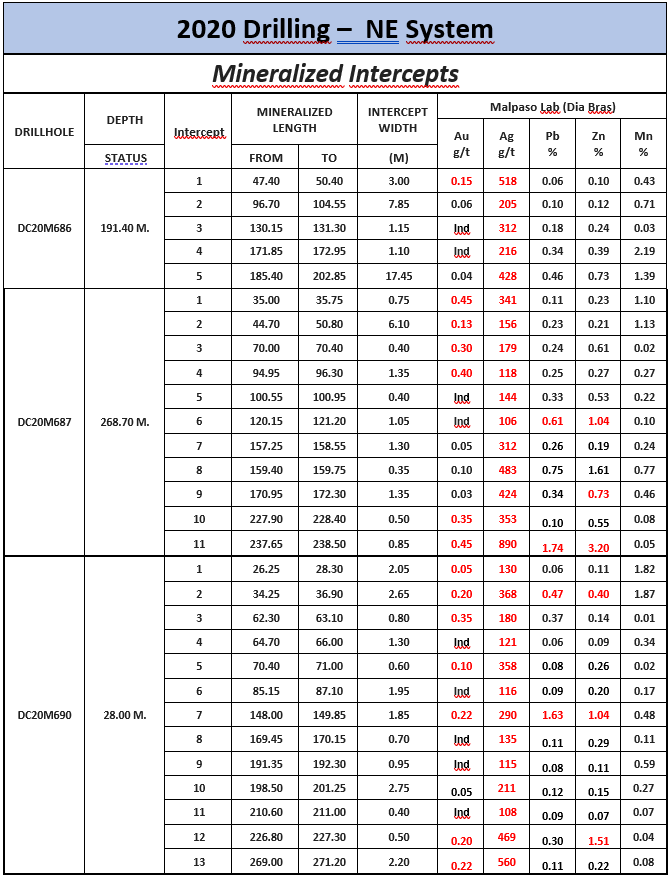

Drill Hole Highlights include:

*The metallurgical recoveries used were based on averages obtained from production data provided by Sierra Metals. The metallurgical recoveries used are: 87% Ag, 57% Au, 86% Pb, 51% Zn.

**Metal prices used were based on consensus are: $17.86/Oz Silver, $1,431/Oz Gold, $0.93/lb Lead, and $1.06/lb Zinc.

“This exploration program confirms the existence of high-grade silver mineralization and demonstrates the

important potential of this new zone. It will also allow the Company to use a mining method which results in high

productivity thus achieving the planned objectives for the Cusi Mine” stated J. Alonso Lujan, Vice President Exploration of Sierra Metals. He continued, “Intercepts such as those shown especially in holes DC20M658, DC20M677, DC20M686 and DC20M687 are common in high-grade epithermal deposits, and demonstrate further potential. As such, they give us a reason to continue exploration in the Cusi fault area at depth and along strike, as well as at other high-value zones such as the San Rafael, San Nicolas and the Bordo fault. We look forward to an exciting future as we explore the Cusi district”.

Luis Marchese, CEO of Sierra Metals commented, “Today’s drilling results demonstrate the potential for further development of high-grade zones at Cusi. We are excited for further drill results, as they along with today’s results will potentially increases the value of the asset and play an important role in our growth strategy for the Cusi Mine”.

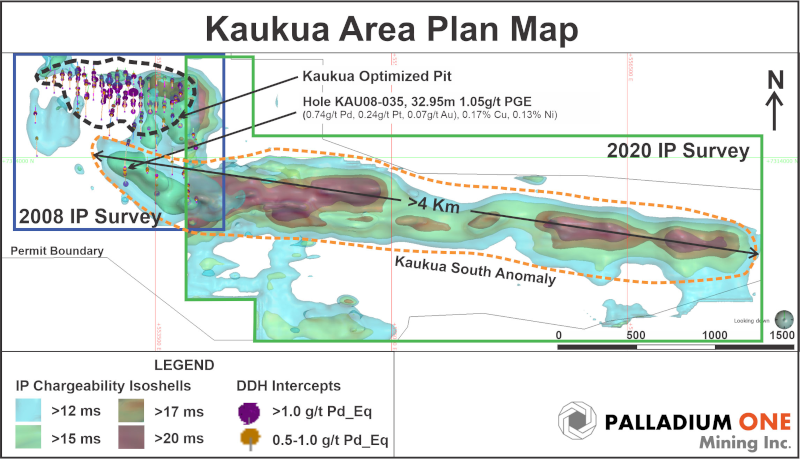

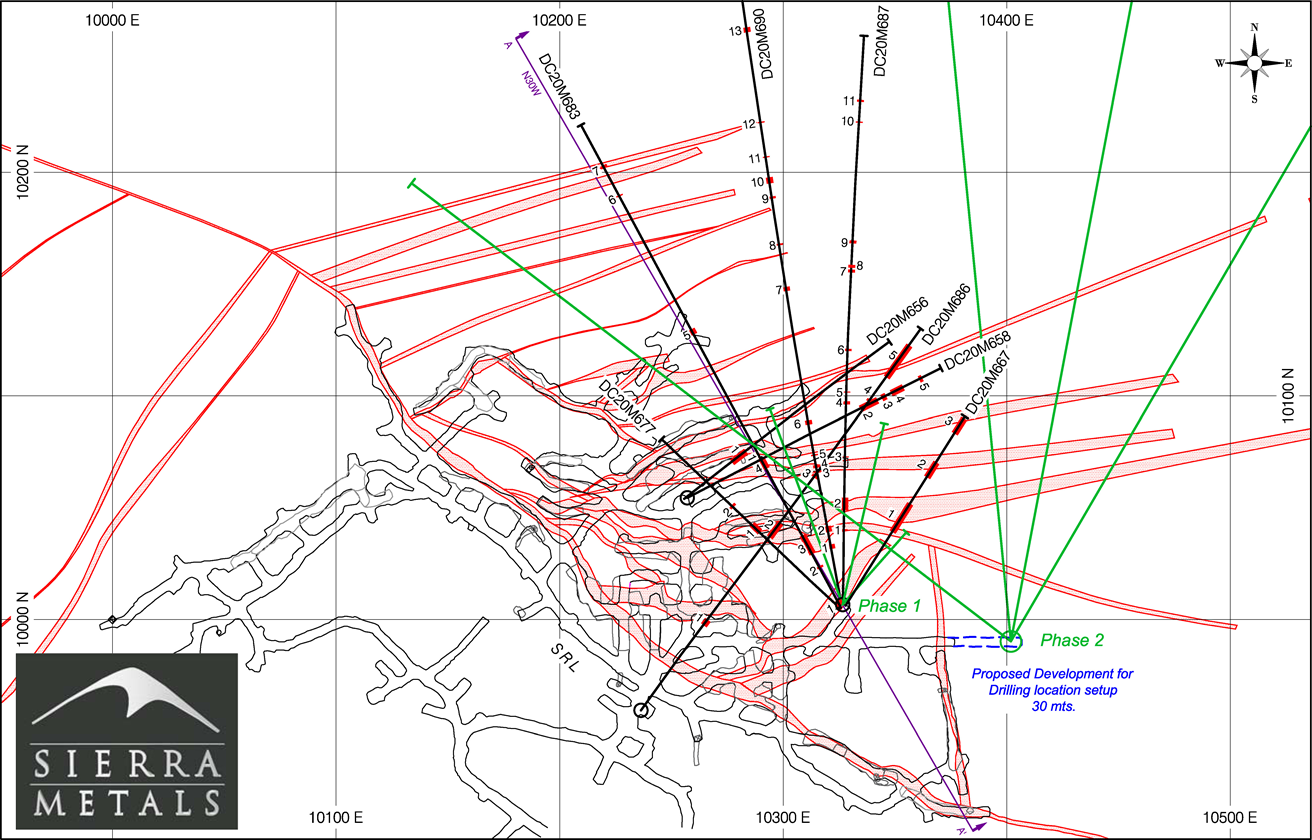

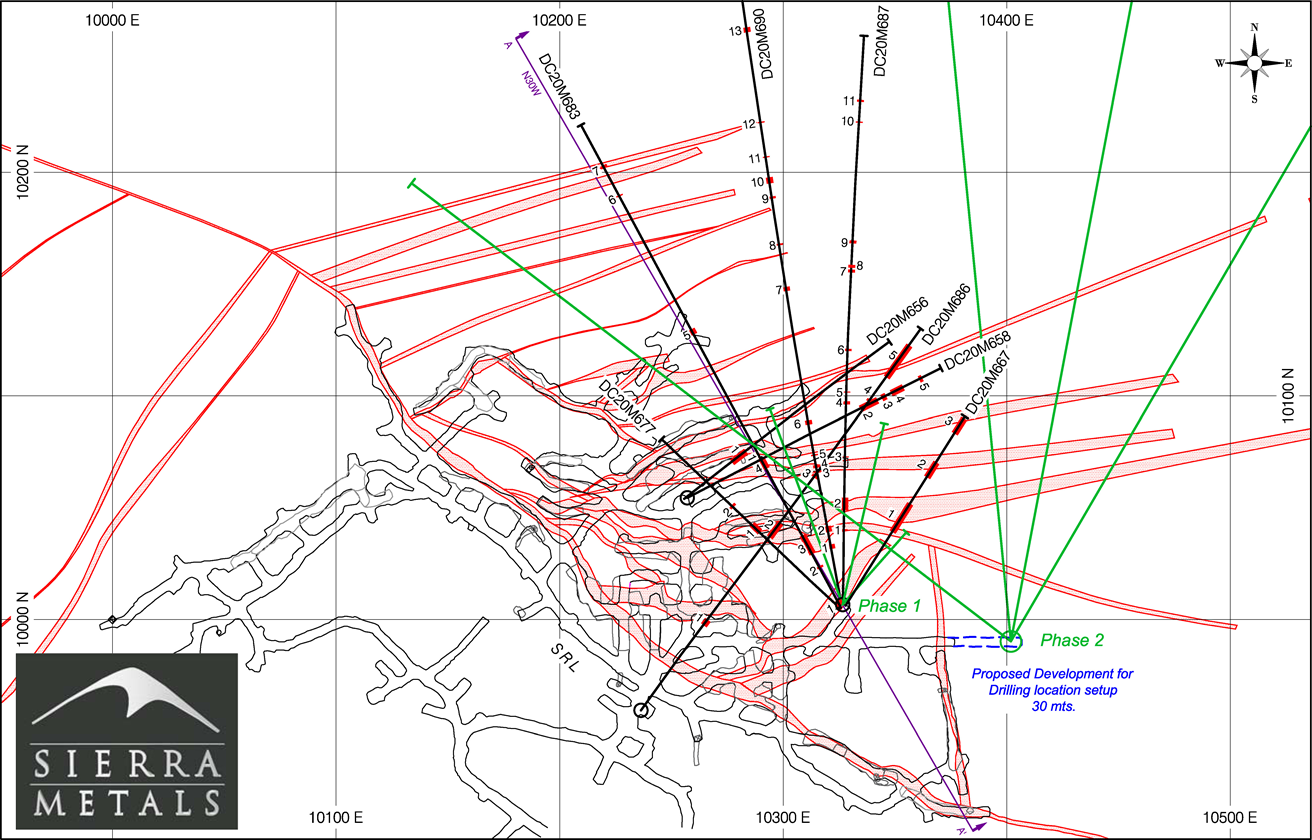

A plan map is shown below of the Cusi area in Figure 1. Figure 2 shows the distribution of the NE – SW System veins.

Figure 1: Cusi Project: NE – SW System Area

Figure 2: NE- SW System Veins – Plan View

Cusi Mine Operation Update

The Cusi Mine remained in care and maintenance during the government-mandated shutdowns due to its proximity to urban centers with large populations. During this period of care and maintenance, the management team has had the time to complete an optimised view of the entire mine operation. Changes on the interpretation of the geological system have been made based on updated information from a stockwork tonnage system to a vein model system, which is expected to help better control and improve head grades, dilution, and make better use of Cusi’s silver mineral resources. The Company plans to use a sublevel stoping method for extraction, which is better suited to the rock/mineral environment. Additionally, the main access ramp has been extended to an opening of four meters by four meters, which will allow for the use of larger 30-ton capacity trucks into the mine and improve the efficiency of ore haulage coming from the mine.

Mine development is currently starting at Cusi in a zone that will bypass the previously announced area of subsidence (see press release dated May 13, 2020) and provide access to higher-grade economic ore to provide feed for the mill. Cusi production is expected to recommence after the mine development work is completed and once a process can be implemented at the mine to mitigate risk to employees at the site through a testing and quarantine methodology similar to the Company’s other operations. Production will include ore from Santa Rosa de Lima zone, the Promontorio zone, as well as from a series of east-west vein systems including the new zone announced today that cross the Cusi fault near Santa Rosa de Lima zone. Management is targeting a ramp-up to 1,200 tonnes per day by the end of the year, at which point the Cusi mine is expected to become self-sustainable and cash flow positive.

Additionally, during the second half of the year, studies will commence on the potential expansion of Cusi. Work will begin on a new tailing dam near the Mal Paso Mill, providing for tails deposition capacity for the foreseeable future. Furthermore, infill drilling will take place at the Santa Rosa de Lima, Promontorio, and San Nicolas zones to improve and build on mineral resources at the mine. Management also believes there is further brownfield potential in areas not previously explored but which are very close to the Santa Rosa de Lima zone such as those announced earlier in this press release.

Quality Control

The quality assurance-quality control (QA-QC) program employed by Sierra Metals has been described in detail in the NI-43-101 report for Cusi dated June, 2018, prepared by SRK Consulting in Denver, which is available for review on Sedar (Sections 10 and 11). The lithologies logged are used in combination with the assay data to identify mineralization for the geologic model. Both geochemistry and assays feature the analyses for the primary elements to be reported at Cusi (Au, Ag, Pb, Zn).

Qualified Persons

All technical data contained in this news release has been reviewed and approved by Americo Zuzunaga, FAusIMM (CP Mining Engineer) and Vice President of Corporate Planning is a Qualified Person and chartered professional qualifying as a Competent Person under the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves.

Augusto Chung, FAusIMM (CP Metallurgist) and Vice President Special Projects and Metallurgy and a chartered professional qualifying as a Competent Person on metallurgical processes.

About Sierra Metals

Sierra Metals is a Canadian based growing polymetallic mining company with production from its Yauricocha Mine in Peru, and it’s Bolivar and Cusi Mines in Mexico. The Company is focused on increasing production volume and growing mineral resources. Sierra Metals has recently had several new discoveries and still has additional brownfield exploration opportunities at all three mines in Peru and Mexico that are within or close proximity to the existing mines. Additionally, the Company has large land packages at all three mines with several prospective regional targets providing longer-term exploration upside and mineral resource growth potential.

The common shares of the Company are listed and posted for trading on the Bolsa de Valores de Lima and on the Toronto Stock Exchange under the symbol “SMT” and on the NYSE American Exchange under the symbol “SMTS”.

For further information regarding Sierra Metals, please visit www.sierrametals.com or contact:

Mike McAllister, CPIR

VP, Investor Relations

+1 (416) 366-7777

info@sierrametals.com

|

J. Alonso Lujan

Vice President, Exploration

+51 630-3100

+52 614-426-0211

|

Luis Marchese

CEO

+1 (416) 366-7777

|

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals | Facebook: SierraMetalsInc | LinkedIn: Sierra Metals

Inc | Instagram:sierrametals

Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of Canadian and U.S. securities laws (collectively, “forward-looking information“). Forward-looking information includes, but is not limited to, statements with respect to the date of the 2020 Shareholders’ Meeting and the anticipated filing of the Compensation Disclosure. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential” or variations thereof, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking information.

Forward-looking information is subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the risks described under the heading “Risk Factors” in the Company’s annual information form dated March 30, 2020 for its fiscal year ended December 31, 2019 and other risks identified in the Company’s filings with Canadian securities regulators and the United States Securities and Exchange Commission, which filings are available at www.sedar.com and www.sec.gov, respectively.

The risk factors referred to above are not an exhaustive list of the factors that may affect any of the Company’s forward-looking information. Forward-looking information includes statements about the future and is inherently uncertain, and the Company’s actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors. The Company’s statements containing forward-looking information are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update such forward-looking information if circumstances or management’s beliefs, expectations or opinions should change, other than as required by applicable law. For the reasons set forth above, one should not place undue reliance on forward-looking information.