Jaguar Mining Reports Updated Mineral Reserves and Mineral Resources for the Pilar Mine, Brazil as at May 31, 2020

Proven and Probable Mineral Reserve Ounces increased 40% year-over-year

(net of mined depletion) including a 12% increase in reserve grade to 4.0 g/t Au

Toronto, Canada, August 18, 2020 – Jaguar Mining Inc. (“Jaguar” or the “Company”) (TSX: JAG) is pleased to report updated Mineral Resources and Mineral Reserves (“MRMR”) estimates as at May 31, 2020 for the Pilar Gold Mine located in Minas Gerais, Brazil.

Highlights

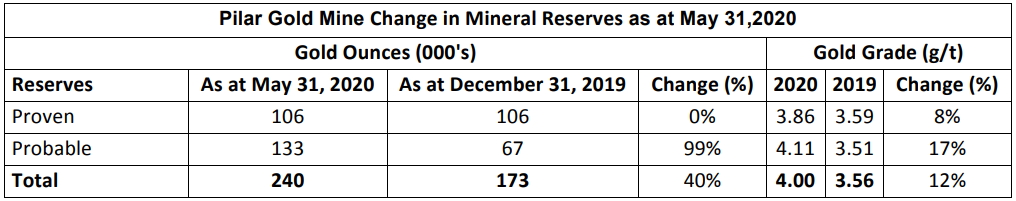

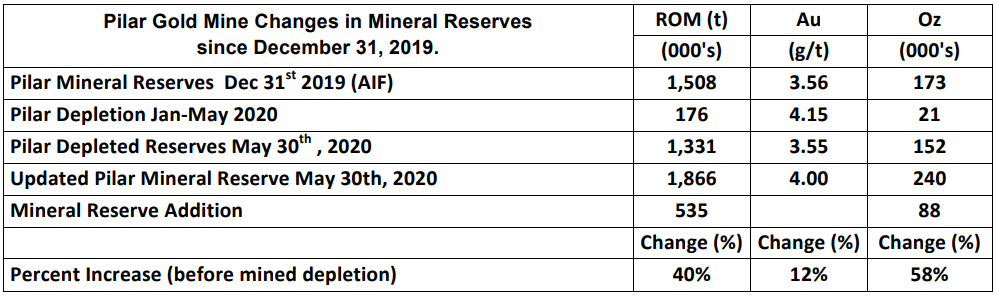

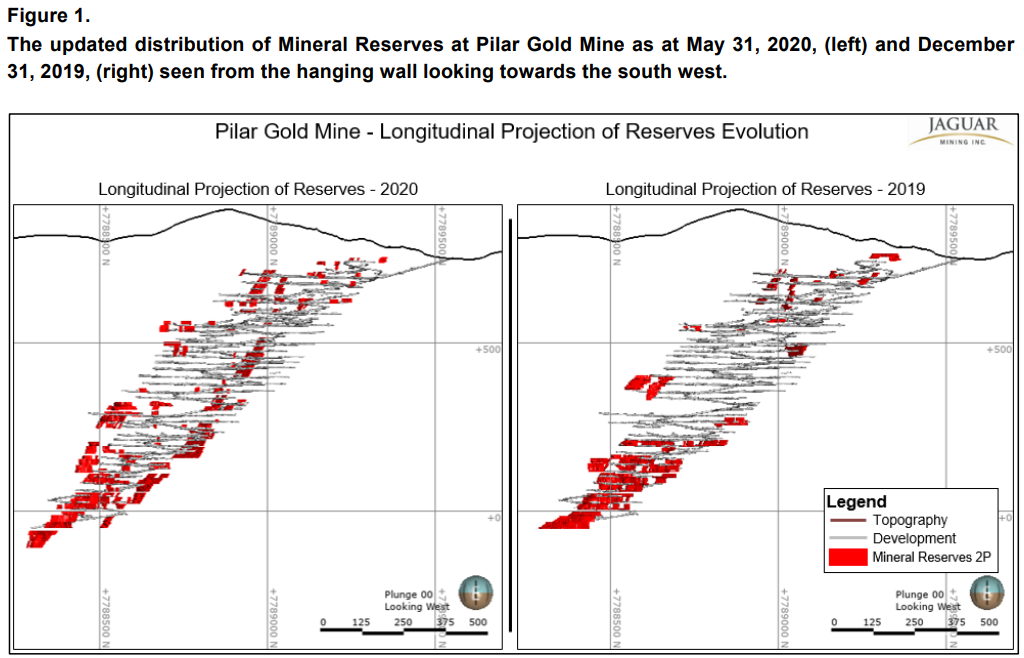

- Pilar Proven and Probable Mineral Reserves (“2P”) as at May 31, 2020 were 240,000 ounces of gold contained within 1.86 Mt at a weighted average grade of 4.0 g/t Au, representing a 12% increase in reserve grade. This reflects an ounce increase of 58% year-over-year before mined depletion, and an increase in 2P Mineral Reserves of 40% year-over-year, net of January-May, 2020 mined depletion (21,000 ounces).

- Probable Mineral Reserves increased 99% to 133,000 ounces of gold at a weighted average grade of 4.11 g/t Au

- Proven Mineral Reserves remained constant at 106,000 ounces of gold at a weighted average grade of 3.86 g/t Au

Pilar Mineral Reserves and Resources are reported as at May 31, 2020 have been prepared in accordance with CIM definitions (2014) as in National Instrument 43-101 (“NI 43-101”) and are reported along with an updated Technical Report dated August 17, 2020 and will be filed shortly.

Vern Baker, CEO of Jaguar Mining stated; “While our Pilar mine has steadily increased production to record levels, the Pilar Geology team has spent the last 18 months focused on increasing our understanding of the complex structures that incorporate our orebodies. Through the utilization of good basic geologic efforts – mapping, sampling, drilling, and modeling – the team has once again replaced and added to our reserves and have demonstrated that the grade our orebodies can deliver is higher than prior reserves indicated. We continue to have a solid resource base under our Reserves, and the work has identified some significant opportunities to add ounces in structures higher up in our mine. Pilar has now added drilling capacity to drive reserves down plunge and to delineate new opportunities. With this additional effort, we look forward to expanding our resource base and reserve inventory and to grow our operation through successful drilling and solid mining practices.

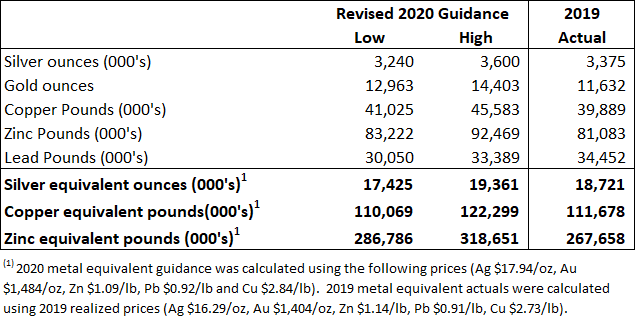

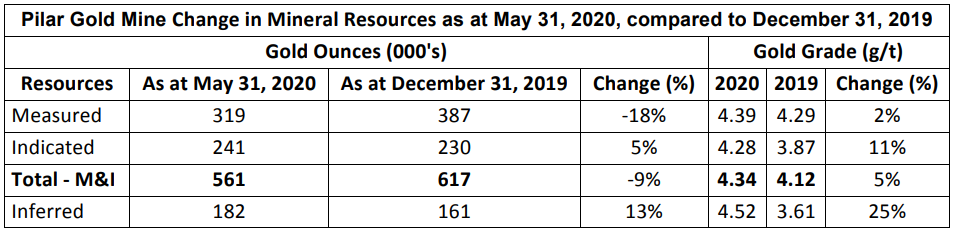

Pilar Gold Mine Mineral Reserves and Mineral Resources summary as at May 31, 2020 compared to December 31, 2019:

Table 1

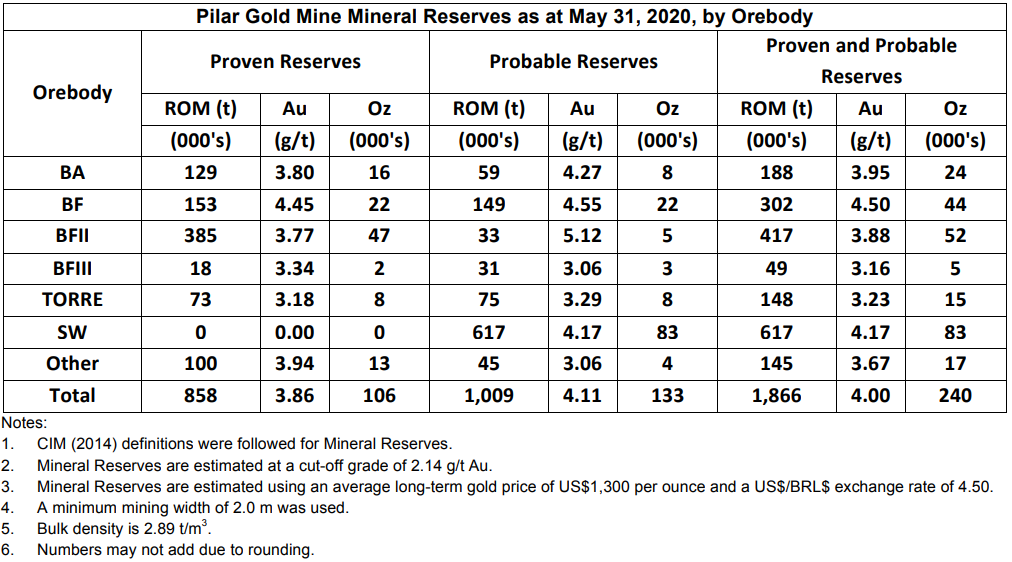

Table 2

Table 3

For the May 31, 2020, Mineral Reserve and Mineral Resource estimates, the Company prepared an updated geological and block model and a supporting Technical Report under the supervision of RPA´s Qualified Persons Mr. Sepp and Mr. Pressacco.

- For comparison purposes, Gold Price and Cut-Off Grade assumptions used in this press release are the same as those previously reported in Jaguar´s 43-101 Technical Report on the Caeté Mining Complex published May 28, 2019 (SEDAR) effective date 5th, April 2019. There is a potential for increases in assumptions due to higher gold prices and/or more favorable BRL exchange rates.

- Infill Drilling and Secondary Development has successfully replaced year to date (January-May) 2020 mined depletion of some 21,000 ounces Au and added significantly to the Mineral Reserves which are now equivalent to more than four years of production at current production rates.

- Total 2P Mineral Reserves are 240,000 ounces of gold (1,866 Mt at a weighted average grade of 4.00 g/t Au) (net of 2020 year to date depletion (January-May) of 21,000 ounces, which are 40% higher compared to 2P Reserves of 173,000 ounces at a weighted grade of 3.56 g/t Au as at December 31, 2019.

- Total Probable Mineral Reserves increased 99% to 133,000 ounces of gold, at a weighted average grade of 4.11 g/t Au which reflects a 17% increase in weighted average grade year on year.

- Total Proven Mineral Reserves remained constant at 106,000 ounces of gold, at an increased weighted average grade of 3.86 g/t Au which reflects an 8% increase in weighted average grade year on year.

- The database used to prepare the estimates, with a cut-off date of April 31, 2020, comprises 1,941 drill holes and 22,716 samples. The estimate was generated from a block model constrained by three-dimensional (3D) wireframe models. Capping values are applied as appropriate for each orebody. The wireframe models of the mineralization, block model, and excavated material for Pilar were constructed by Jaguar and reviewed by RPA. Separate wireframes were built for each mineralized lens for each orebody and were used to constrain the grade estimates into the block model.

- The Mineral Resources and Mineral Reserves for May 31, 2020 Technical Report will be published on SEDAR by the end of August 2020.

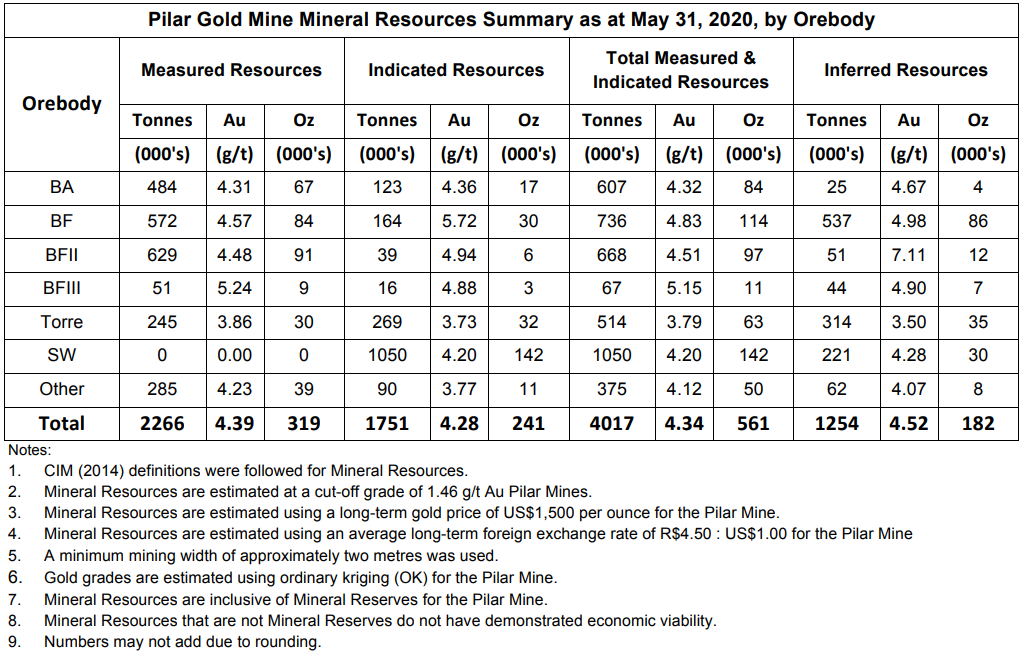

Table 4.

Table 5.

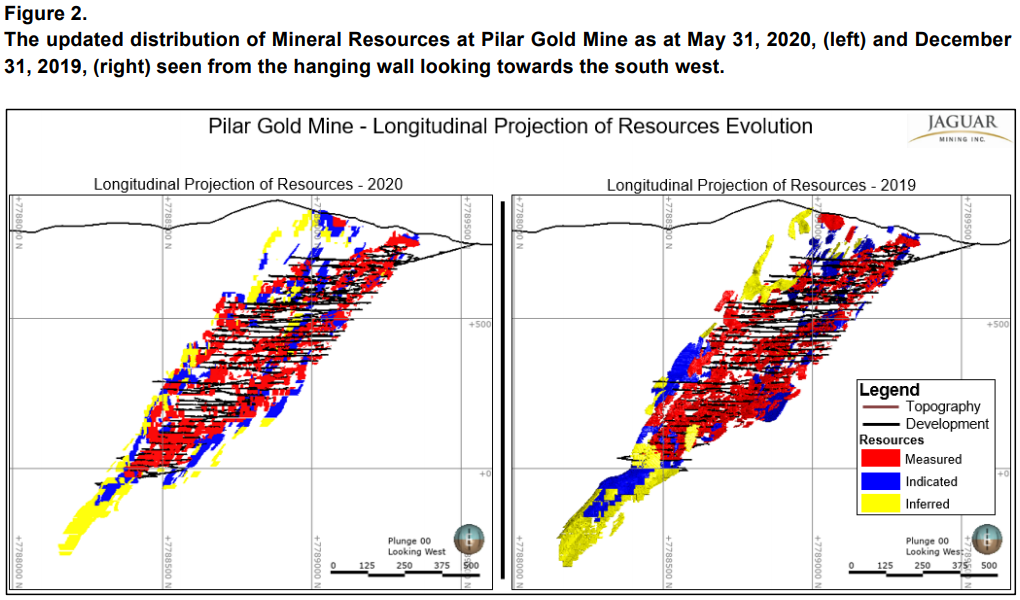

- Measured and Indicated Mineral Resources at Pilar at a cut-off grade of 1.46 g/t Au comprise 4.01 Mt at a weighted average grade of 4.34 g/t Au – containing 561,000 ounces of gold.

- This reflects a decrease of 9% in Measured and Indicated Category gold ounces year-over-year but with 5% higher grades.

- The Inferred Mineral Resource at Pilar is 1.254 Mt at an average grade of 4.52 g/t Au which reflects a grade increase of 25%, containing 182,000 oz. of gold which reflects an overall 13% increase in contained ounces in this category.

Qualified Persons

The scientific and technical information contained in this press release has been reviewed and approved (i) in respect of the estimated Mineral Reserves and the Life of Mine Plan (LOM) by Jeff Sepp, P.Eng., of Roscoe Postle Associates Inc. (“RPA”), and (ii) in respect of the estimated Mineral Resources by Reno Pressacco, P.Geo., of RPA. RPA is an independent mining consultant and Mr. Sepp and Mr. Pressacco are each Qualified Persons within the definition of NI 43-101.

Quality Control

All sampling and samples utilized at Jaguar for Mineral Resource and or Mineral Reserves estimation uses a quality-control program that includes insertion of blanks and commercial standards in order to ensure best practice in sampling and analysis.

HQ, NQ, and BQ size drill core is sawn in half with a diamond saw. Samples are selected for analysis in standard intervals according to geological characteristics such as lithology and hydrothermal alteration. Rock channel sampling of the underground development follows the same standard intervals as for the drill core.

Half of the sawed sample is forwarded to the analytical laboratory for analysis while the remaining half of the core is stored in a secure location. The drill core and rock chip samples for resource-reserve conversion and grade control samples are transported for physical preparation and analysis in securely sealed bags to the Jaguar in-house laboratory located at the company´s Caeté Complex, Caeté, Minas Gerais. Growth exploration samples are sent to the independent ALS Brazil (subsidiary of ALS Global) laboratory located in Vespasiano, Minas Gerais, Brazil. The analysis of these exploration samples is conducted at ALS Global’s respective facilities (fire assay is conducted by ALS Global in Lima, Peru, and multi-elementary analysis is conducted by ALS Global in Vancouver, Canada). ALS has accreditation in a global management system that meets all requirements of international standards ISO/IEC 17025:2005 and ISO 9001:2015. All major ALS geochemistry analytical laboratories are accredited to ISO/IEC 17025:2005 for specific analytical procedures.

For a complete description of Jaguar’s sample preparation, analytical methods and QA/QC procedures, please refer to “Technical Report on the Roça Grande and Pilar Operations, Minas Gerais State, Brazil“, a copy of which is available on the Company’s SEDAR profile at www.sedar.com.

Mineralized material for each orebody was classified into the Measured, Indicated, or Inferred Mineral Resource categories based on the search ellipse ranges obtained from the variography study, the observed continuity of the mineralization, the drill hole and channel sample density, and previous production experience from these orebodies.

The Mineral Resources are inclusive of Mineral Reserves. For those portions of the Mineral Resources that comprise the Mineral Reserve, stope design wireframes were used to constrain the Mineral Resource reports.

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar Mining is the second largest operating gold company tenement holder in the Iron Quadrangle, holding just over 25,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes, and a large land package with significant upside exploration potential from mineral claims covering an area of approximately 64,000 hectares. The Company’s principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex and Caeté Gold Mine Complex. The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. Additional information is available on the Company’s website at www.jaguarmining.com.

For further information, please contact:

|

Vern Baker |

Hashim Ahmed |

Forward-Looking Statements

Certain statements in this news release constitute “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management’s expectations and plans relating to the future. All of the forward-looking information set forth in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as “are expected,” “is forecast,” “is targeted,” “approximately,” “plans,” “anticipates,” “projects,” “continue,” “estimate,” “believe,” or variations of such words and phrases or statements that certain actions, events or results “may,” “could,” “would,” “might,” or “will” be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. This news release contains forward-looking information regarding potential and, among other things, expected future mineral resources, potential mineral production opportunities, geological and mineral exploration statistics, ore grades, current and expected future assay results, and definition/delineation/exploration drilling at the Pilar Gold Mine and the Turmalina Gold Mine in Brazil, as well as forward-looking information regarding costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, capital requirements, project studies, mine life extensions, and continuous improvement initiatives. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the estimated timeline and for the development of the drill program at the Pilar Gold Mine (and its expanded exploration footprint) and the Turmalina Gold Mine; its mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; and political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting its plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including without limitation environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.